🍌 Adding a Paid Tier to The Split + Launching a Podcast 🎉

Hi 👋 Turner back again with The Split. Welcome to all new subscribers and the 21,500+ people reading each email!

If you missed it, last week I wrote about the surprising connection between Messi coming to the US and Apple’s new Vision Pro mixed reality headset. Or more importantly, Apple’s content and advertising ambitions.

Today, I’m starting a new experiment: a paid version of The Split + a podcast called The Peel going live next week. Keep reading for details, plus new products from WhatsApp, Ramp, Retool, and Airplane, how Apple’s new iOS 17 will make link tracking harder for digital marketers + also help solve the mental health crisis, using generative AI to create beautiful QR codes, and a 2011 interview with the Co-founder and CEO of NVIDA.

A Message From Axios

🥶 Venture Capital in a Cooldown

Funding rounds aren’t stopping, VCs are just getting more selective. In the midst of high inflation, rising interest rates and a global economic pullback, we’re also seeing huge advances in machine learning, decentralized systems, and new forms of interacting with computers like chat, heads-up displays, and voice. The Axios Pro newsroom is here to provide clarity.

Why it matters: Venture firms have record amounts of dry powder and Axios can help you understand where it’s going, why it’s going there, and what insiders are thinking.

Axios Pro reporters are true industry insiders, pairing decades of experience with contacts and connections that other outlets just don’t have.

They weave insights into their reporting, helping you better understand what’s going on today and what to watch for tomorrow.

Download Axios’ free industry report on what this cooldown means for VC, PE, M&A and your own business.

tl;dr: The Split is Adding a Paid Tier 🎉

When I started writing The Split just under a year ago, I wasn’t 100% sure what I was doing.

I’ve used this to share my thinking around the topics I’m exploring, whereas I’ve kept my Twitter much looser. Way more people are consistently reading this than I ever expected, to the point that the one-two punch of Twitter + Newsletter has been able to consistently move the needle for Banana Cap portfolio companies - a recent example, we helped Canvas get to #1 on Product Hunt a few weeks ago!

Beginning next week, paid subscribers will get additional features around the podcast going live next week and more to be announced later this summer.

You can upgrade any time, and early supporters will get 33% off for the next 72 hours only. Early subscribers will also get a free banana cap 🍌🧢 (I don’t know how many of these I have left, so first come, first served).

What to Expect?

What you’ll get as a paid subscriber:

First, additional features enriching the podcast launching next week.

Second, we’re launching a merch store later this summer. I get asked “Can I buy Banana swag” a few times per week. Soon you can!

Third, priority responses in annual Reader Predictions and quarterly Mailbag Q&A columns (first one coming in July!).

Finally, lifetime pricing lock-in: I’ll never increase the price for existing subscribers. When The Split launches a streaming service like Netflix, a wireless plan like Amazon, and a salad subscription like Sweetgreen (all on the 300-year road map), you’ll still pay just $100 per year.

You should also expect more paid features to be added over time. I have a lot of ideas, some of them probably too crazy to ever pull off, but don’t want to share anything publicly yet.

Plus, I’ll be re-investing essentially all the subscription revenue. The more paid subscribers, the more we can re-invest into better content.

What’s Staying the Same?

If you don’t upgrade, nothing about The Split will change. I’ll still send weekly emails diving into topics I’m thinking through + my favorite new products, charts, longer reads, and memes. You’ll still get my inside perspective on all things startups, venture capital, and investing.

My periodic deep dives on Banana and non-Banana portfolio companies will also still be free. And I’m going to experiment with more content formats throughout the year - stay tuned!

Why Should You Upgrade?

You probably shouldn’t, at least not until you want to read something.

If you’ve gotten this far, hopefully you enjoy my writing and content. I wouldn’t be here without your support!

A few people know what’s coming, and I wanted to give an early bird discount to them + everyone else who planned to subscribe anyways once they read the headline.

How Much Does it Cost?

Paid plans will start at $150 annually, or $15 per month.

Subscribing in the next 72 hours will lock-in lifetime pricing of $100 per year + get you a Banana cap (which initially cost me around ~$32 each).

I’d assume you can expense this. If you’re a founder, investor, executive, or individual contributor at a startup or big company, any single email or nugget shared in The Split could make you better at your job and pay for itself (remember when I kept writing about now-dominant Temu before, during, and after the launch?). If you can’t afford it, please let me know and we’ll figure something out.

Thank You!

If you’ve gotten any value out of The Split over the past year, or just want to show your support, consider upgrading your subscription.

You’ll get more nudges as I roll things out, but please take advantage of the early bird discount if you’re intrigued.

If you have ideas, please comment or reply with your thoughts around guests we should have on the podcast (or banana merch you’d wear!). There’s 15 episodes already recorded or lined up, and I’m open to any feedback on how to make them most interesting.

Thank you! 🙏

🚀 Product Launches

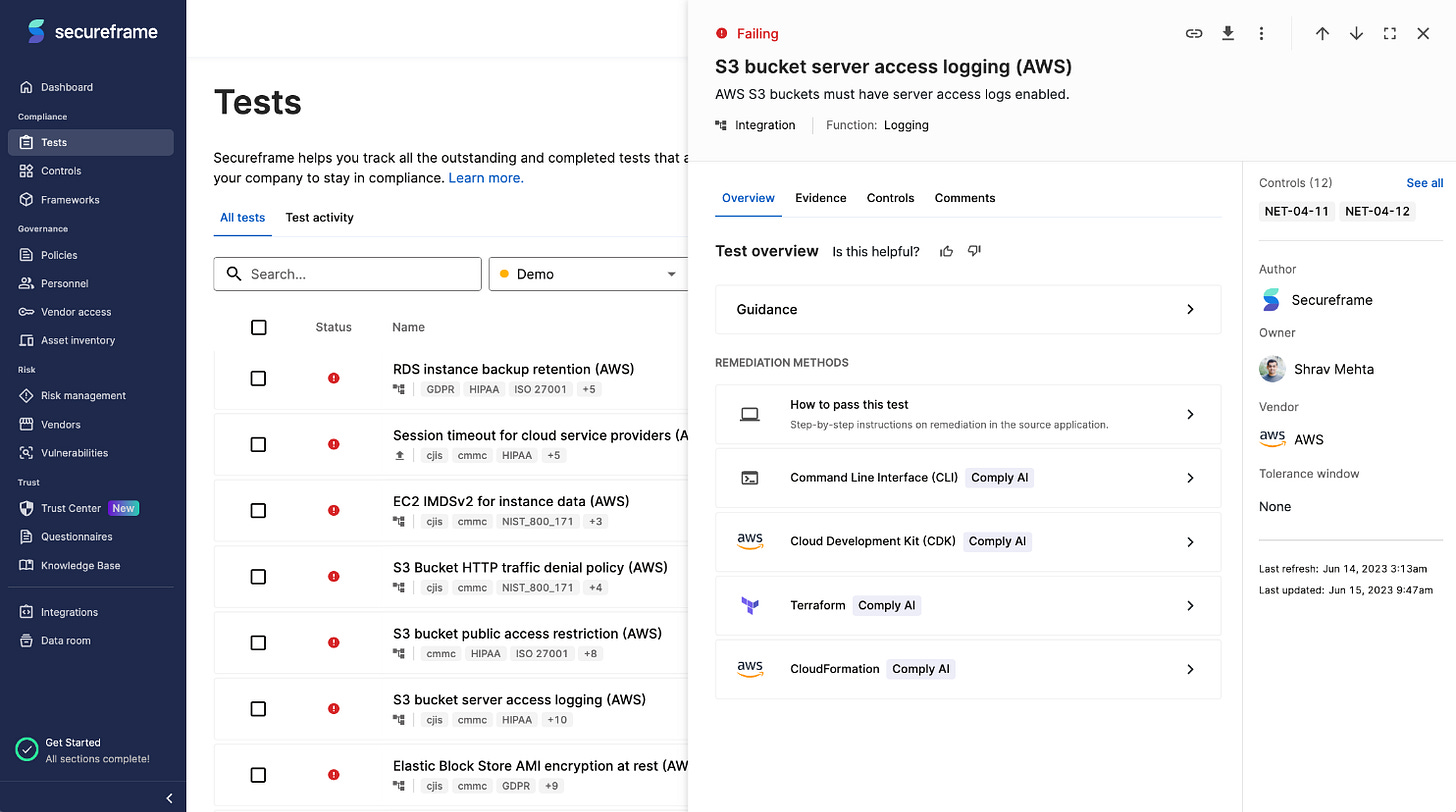

Secureframe’s New Comply AI: The new product from Banana portfolio company Secureframe helps you speed up cloud remediation and time-to-compliance. It integrates directly into Secureframe’s AI-powered compliance questionnaire, Secureframe Trust.

Using infrastructure as code (IaC), Comply AI works in real-time to quickly generate initial remediation guidance as code so you can easily correct underlying configuration or other issues causing the control failure in your cloud environment.

If you’re looking for the best way to automate your security and compliance - from SOC 2, ISO 27001, HIPAA, GDPR, CCPA, and more - dive into the details here.

WhatsApp Channels: The Twitter-like text feed will have no likes, retweets, or replies - at least to start. Based on the images below, its giving me Artifact mixed with Instagram Stories. Many believed WhatsApp would eventually monetize with things like commerce and payments. It still probably will, but this makes its potential as an advertising tool even more interesting. Especially so as its continued steadily growing in the US, up to 62 million US Daily Active Users per Sensor Tower.

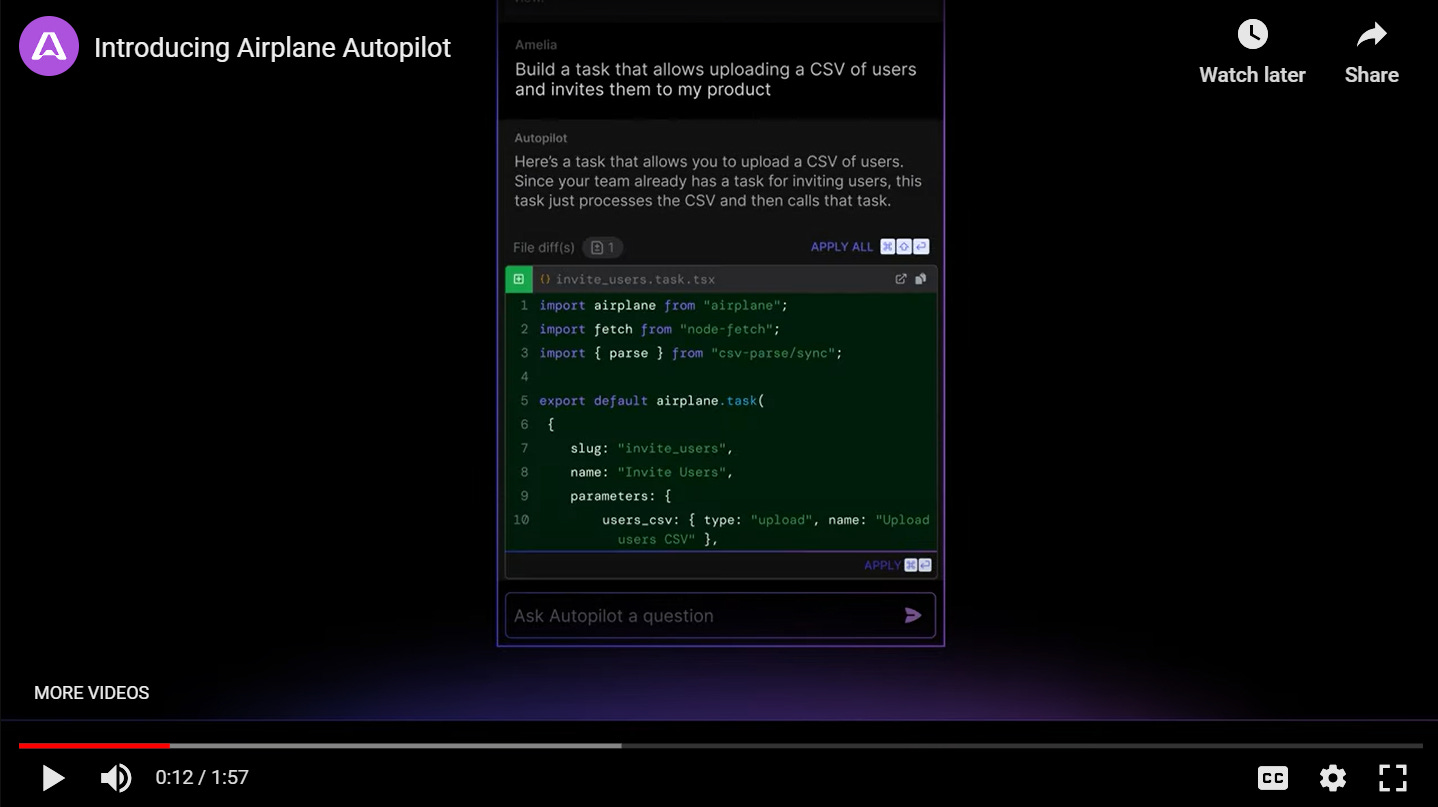

Airplane Autipilot: A new AI-optimized pair programmer that embeds inside the Airplane workspace. It answers questions, explains code, helps debug, provides dynamic suggestions, and overall helps build better software. This is also one of the cleanest product trailers you’ll ever watch.

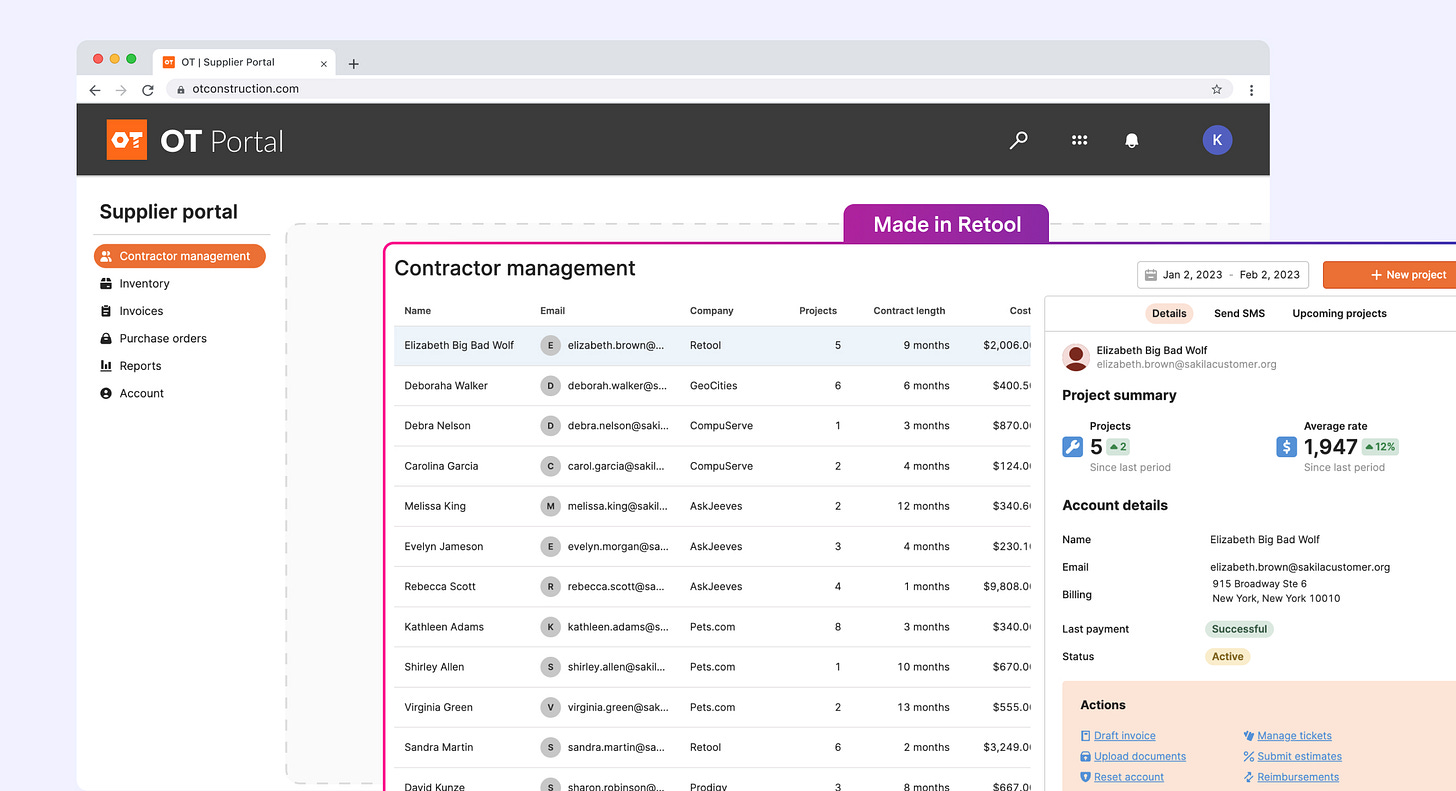

Retool Embed: Meanwhile, Retool, which helps developers build software tools used internally at companies, now allows customers to embed Retool dashboards in customer-facing products. Retool’s product is essentially a flexible, user-friendly database with super powers. This likely doubles its number of potential use cases (probably more than that), and makes it look like a competitor to companies like SAP and Oracle if you squint hard enough.

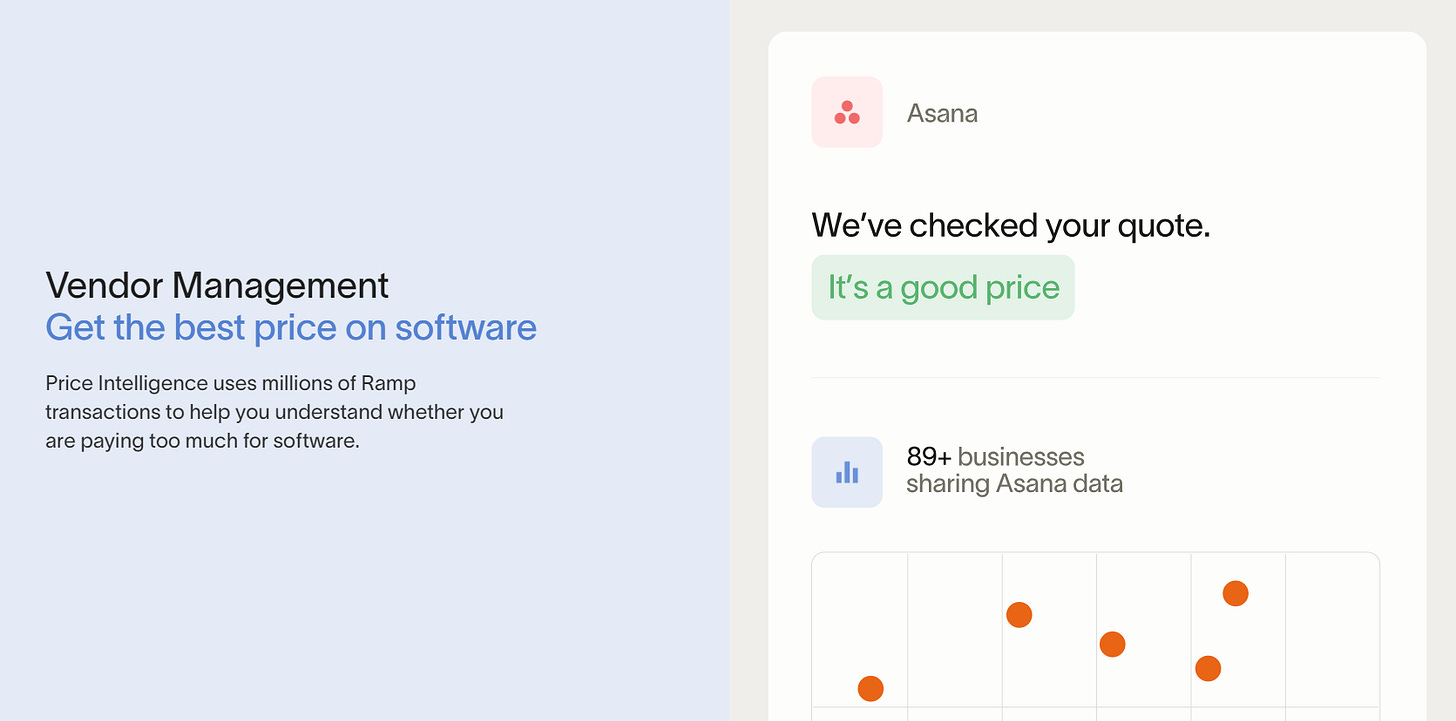

Ramp Intelligence: Corporate charge card startup Ramp has unveiled a suite of new AI-powered finance software. It rolled out automation tools for finance teams in 2021, expanded its credit offerings in 2022, and this recent launch brings things like instant contract benchmarking and comparisons, auto-coding for accounting team’s journal entrys (be thankful if you don’t know what this means), and a “co-pilot for finance teams”.

🔗 News and Charts

iOS 17 Will Automatically Remove Tracking Links: This will go largely unnoticed by most consumers, but is a big deal for marketers. Link tracking has gotten even more important post-Apple’s ATT changes. Making it harder to track links shifts even more power towards Apple’s growing ad platform.

This latest update only affects private browsing in Safari. But at this point, you should assume Apple’s roadmap involves prioritizing its own ad business over all else. I’m assuming private browsing is just the start. After originally significantly discounting the impact ATT would have, I’m expecting this to eventually permeate across the entire iOS or device level.

In terms of downstream effects, a simple one is digital marketing will get more expensive. This is because its another thing making it harder to track individual user behaviors, just like all the ATT changes. This will reduce the information marketers get around their campaigns, making it harder to measure exact ROI.

Using affiliate tracking links will get harder. This is a common business model for blogs and influencers, and I’d expect the math to start flipping in favor of building and selling their own products instead of taking a cut selling them for others. We’ve seen early signs of what this might look like from Mr. Beast’s Feastables and Emma Chamberlain’s Chamberlain Coffee. I’d expect the winners will be those that either a) control the full stack, or b) don’t participate in the stack at all.

Nearly 90% of Consumers No Longer Trust Influencers: A natural response to Apple’s growing advertising ambitions has been for brands to tilt towards influencer marketing. In this survey of 1,000 American consumers, 86% stated they’re more likely to trust a brand that publishes user-generated content vs just 12% that use influencers.

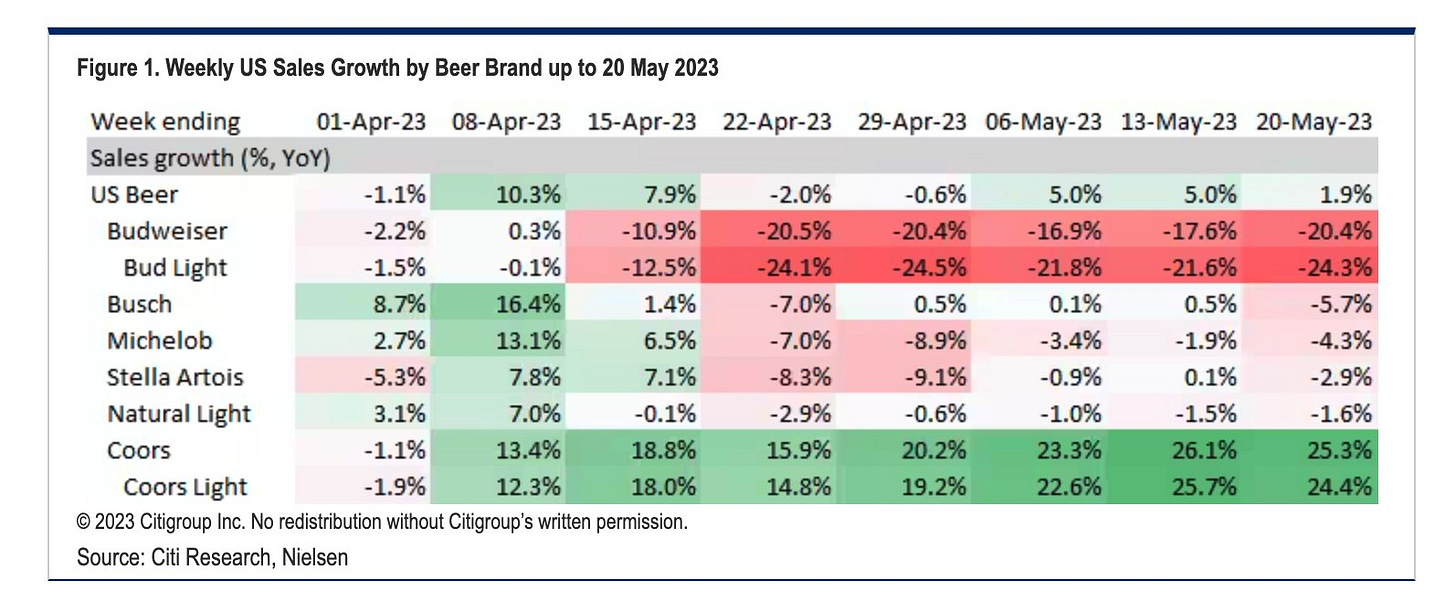

At the same time, sales of Bud Light continue dropping after it’s mishandling of a partnership with a transgender-influencer. There was a small amount of public backlash, but based on what I understand, it looks like the real damage came from Bud Light’s ex-VP of Marketing saying in an interview she wanted to disassociate the brand from its “fratty, out of touch humor”.

Instagram’s Recruiting Celebs Like Oprah for its Twitter Competitor: And the pitch is “it’s a platform that’s sanely run”. What I think is most interesting is it automatically brings over their Instagram follower graph. For the average Instagram power user, this makes it a much better option than starting from scratch on Twitter (so as long as they have followers using it). And for the average consumer, a pre-populated follower graph makes it easier to get started.

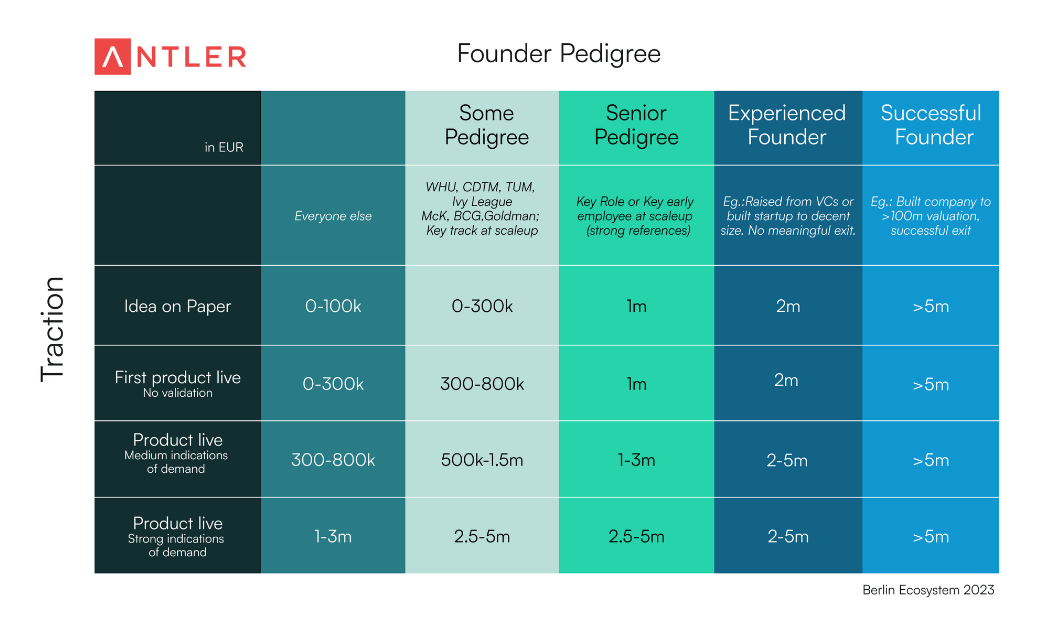

Founder Ability to Raise Cheat Sheet: I don’t 100% agree with all these numbers (looks like its tailored towards Berlin), but this is a useful framework on thinking through how much to raise based on prior founder accomplishments and company traction. h/t Rahat Ahmed for sharing! (Note: all in Euros).

World Trade Has Changed in Ways No One is Expecting: China is now exporting a trillion dollars more than when Trump started his trade war. Despite talk of de-globalization, on most measures China’s economy has actually re-globalized. “Between these expensive sports purchases, air-conditioned stadiums, new cities being built in the desert and the decline in oil prices, the Saudi current account surplus is destined to disappear.”

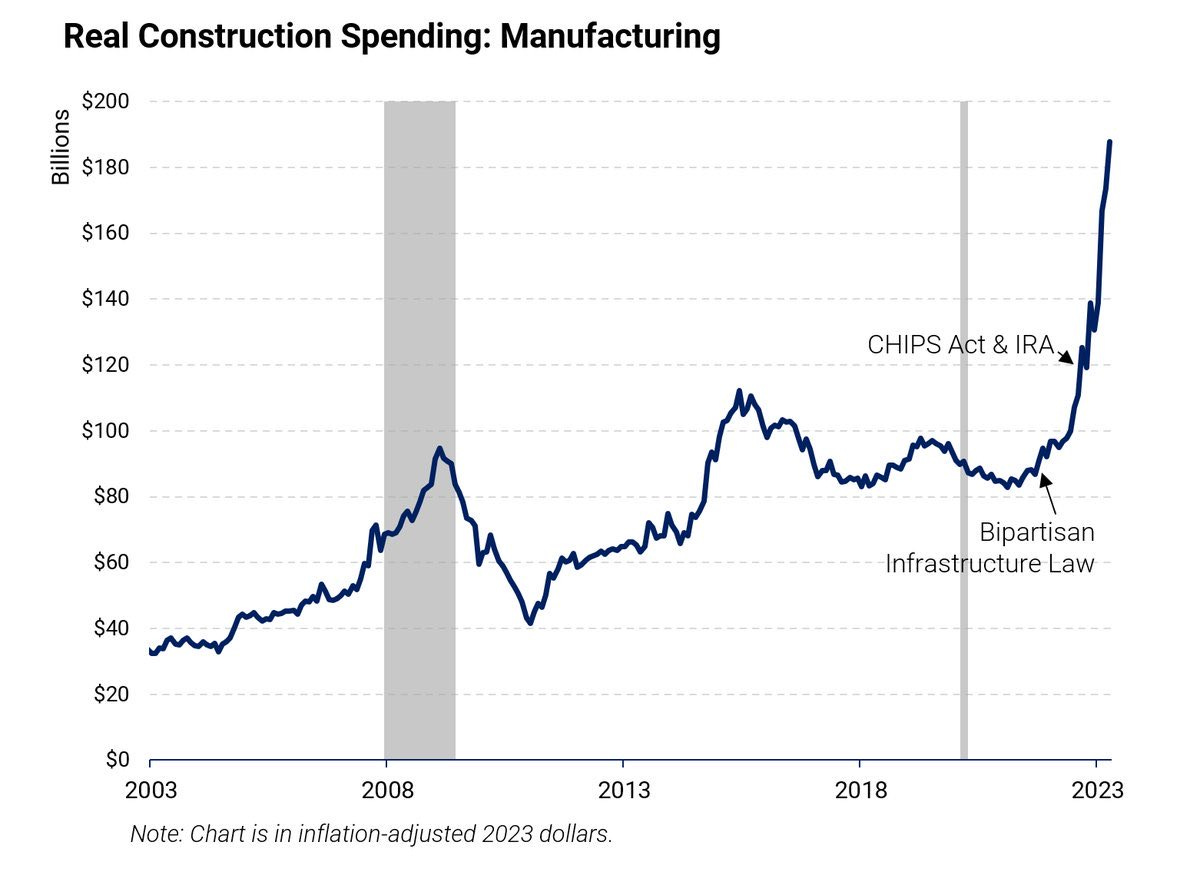

The US is Back! At least in terms of construction spending on domestic manufacturing capabilities.

Meanwhile, while Canadian real estate prices continue going bonkers. This has been long speculated to be due to foreign investment from China, with things like zero interest rates, high levels of immigration, and a lack of new supply contributing to the surge more recently. (h/t Bucco Capital)

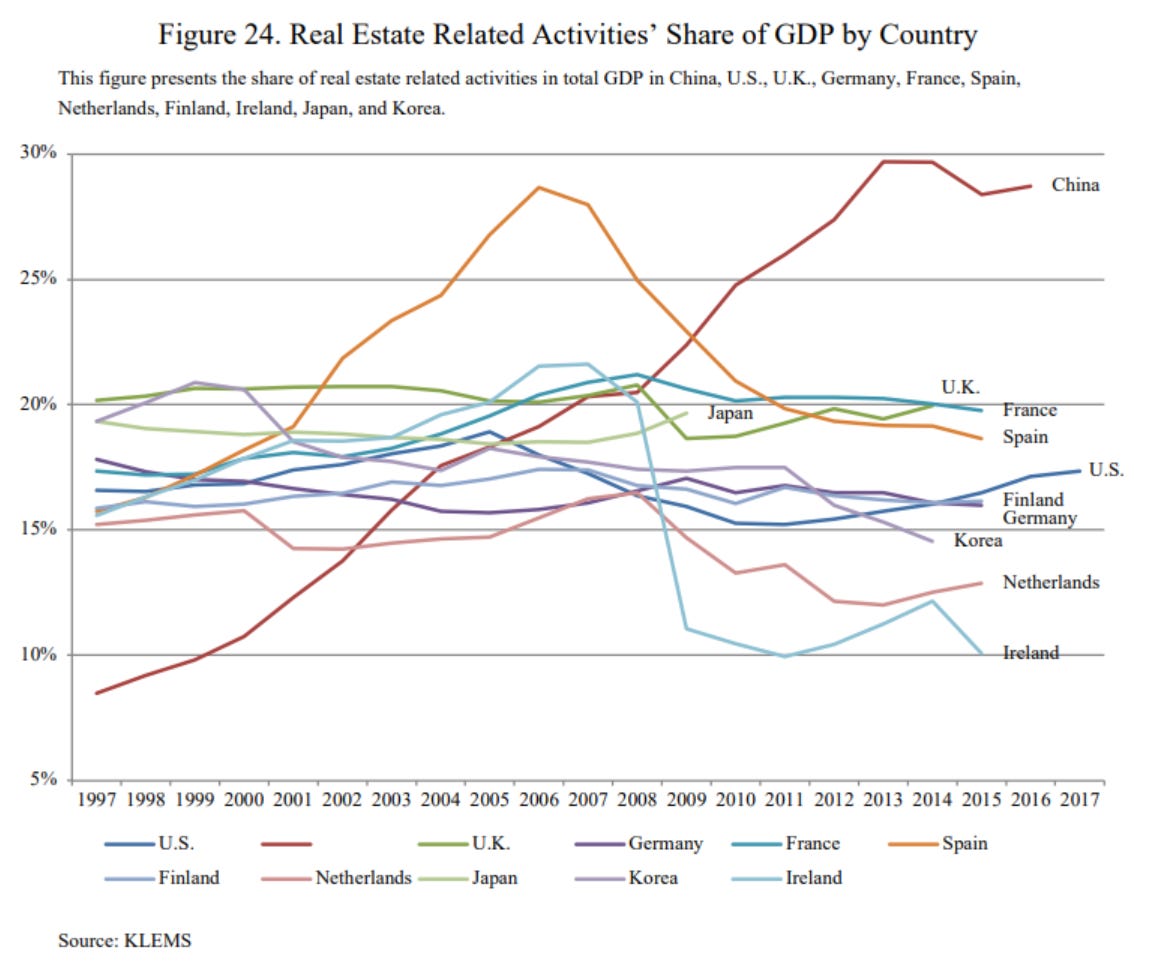

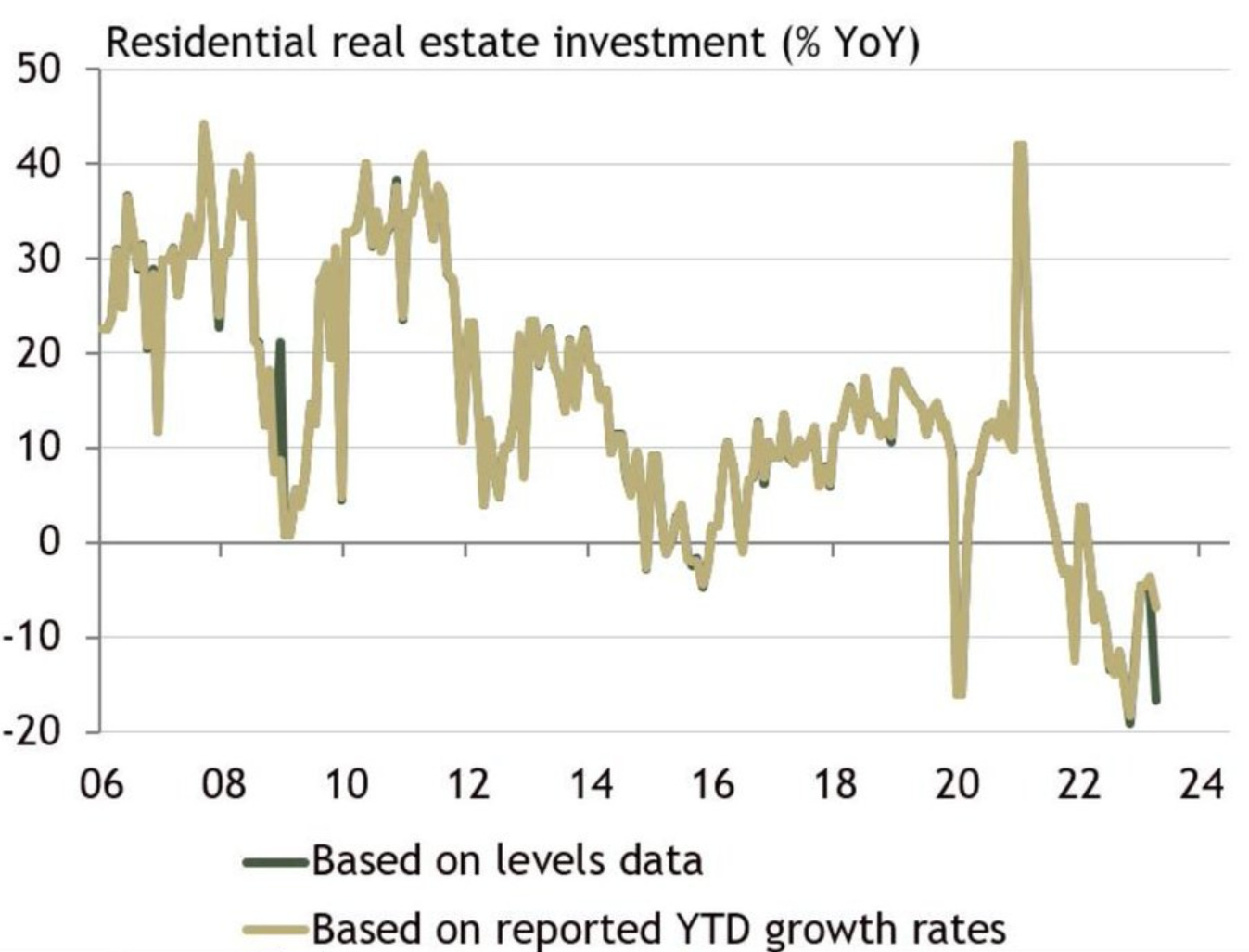

Real Estate is China’s Economic Achilles Heel: Real estate was at one point over 30% of China’s GDP.

And emerging from its Zero COVID lockdowns, investment has slowed considerably. 22% of housing in China is vacant, compared to 28% in Span, 13% in the US, and 3% in the UK. h/t Noah Smith atNoahpinionfor sharing these!

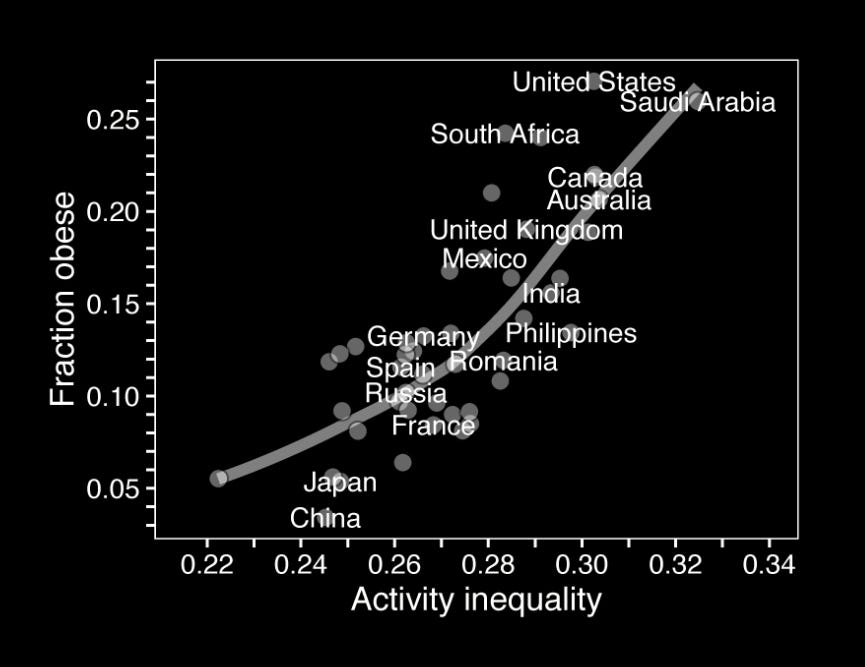

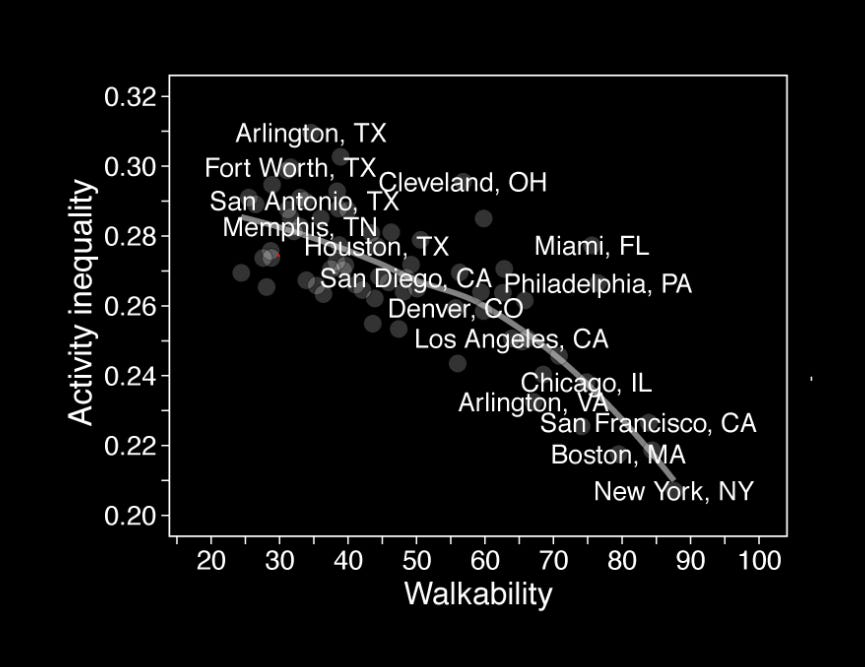

Activity Inequality Predicts Obesity: A Stanford study shows individuals in the five countries with highest activity inequality are 196% more likely to be obese than individuals from the 5 countries with lowest activity inequality.

What impacts “activity inequality”? The built environment, specifically city walkability. This shows up with higher walkability scores associated with lower levels of activity inequality across 69 US cities.

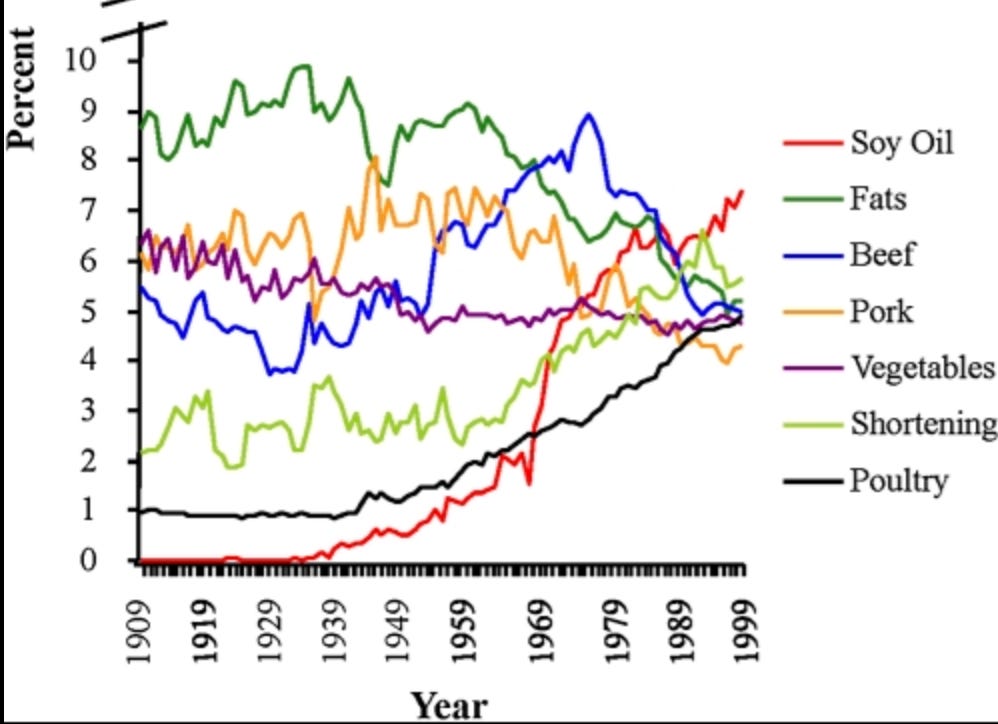

Soy Oil is the Largest Source of Calories in the US: Another under discussed aspect of obesity is the rise of soybeans in the US diet. And it practically didn’t exist 100 years ago.

Tabacco’s High ESG Ratings: Phillip Morris, the maker of Marlboro cigarettes, scored an 84 out of 100 points on S&P Global’s Environmental, Social, and Governance (ESG) ratings. This compared to Tesla, which makes electric vehicles, at 37 points. The cigarette makers high scores came from emphasizing its diverse board, funding minority businesses, promoting transgender women in sports, partnership with African data scientists, setting water reduction targets, empowering female tobacco farmers, and advertising to LGBTQ consumers.

Meanwhile, cigarettes are the leading cause of preventable death in the United States, and kill more people than alcohol, illegal drugs, and car accidents combined. Tabacco farming, mostly in developing countries, causes long-term damage to soil and leads to deforestation, and workers are exposed to toxic chemicals. 🤔🤔

💌 ICYMI

AI Generated QR Codes: Someone figured out how to turn QR codes into beautiful images with Stable Diffusion (try this one 👇). Here’s the original source in Chinese.

📚 Long Reads

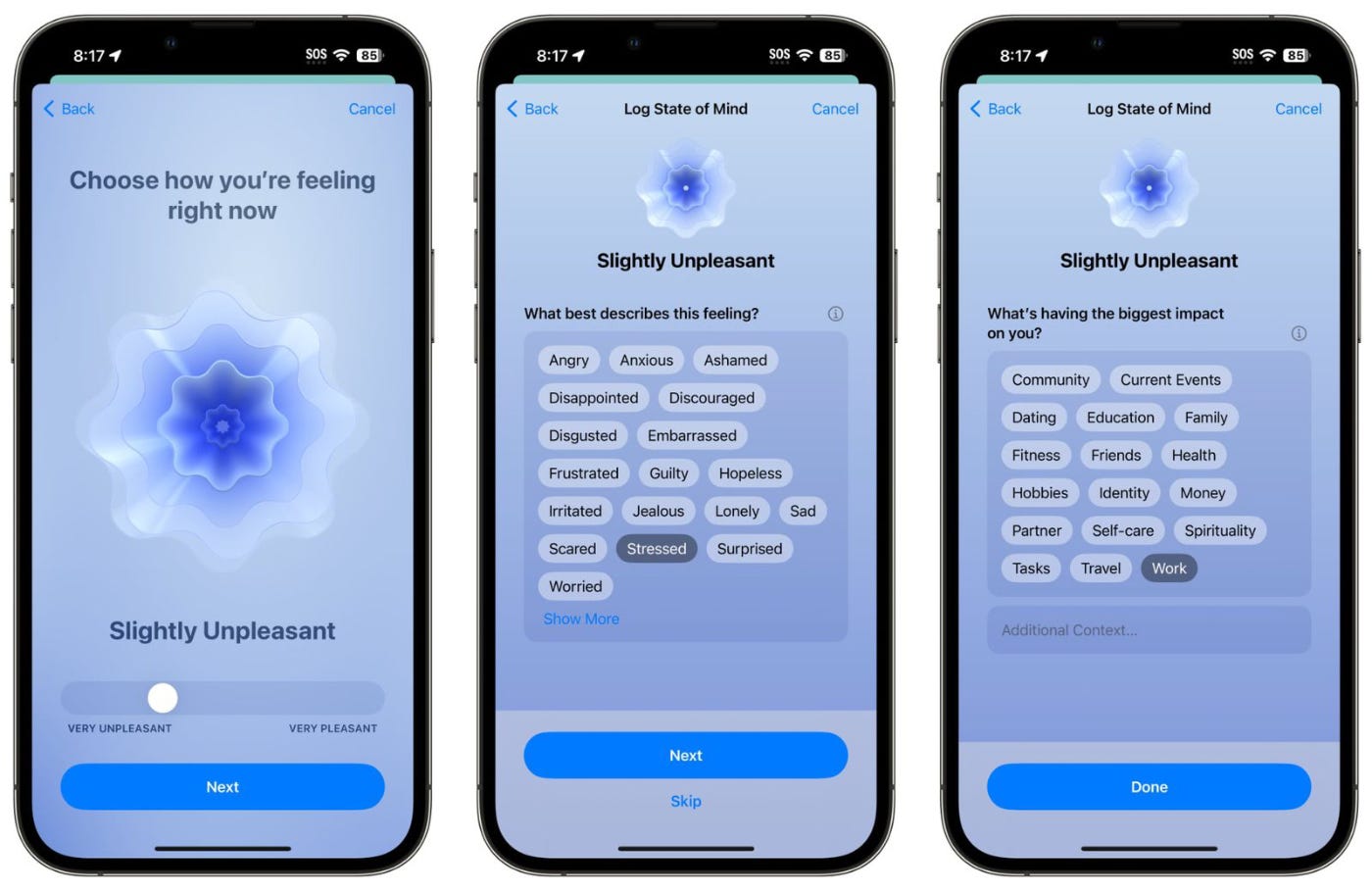

Apple Has a Shot at Solving the Mental Health Crisis: Last year, 19% of American adults (or 50+ million people) experienced some form of mental illness like anxiety or depression. Its estimated to cost the US economy over $1 trillion every year.

Dan Shipper at Every argues that Apple is going after mental health in a big way. They recently announced a mood tracker, mental health trend report, and psychological assessments will ship with new devices. Apple’s hinted it has big plans in health, and its near-constant touchpoint with the majority of US consumers means this is an area it can make a big initial impact.

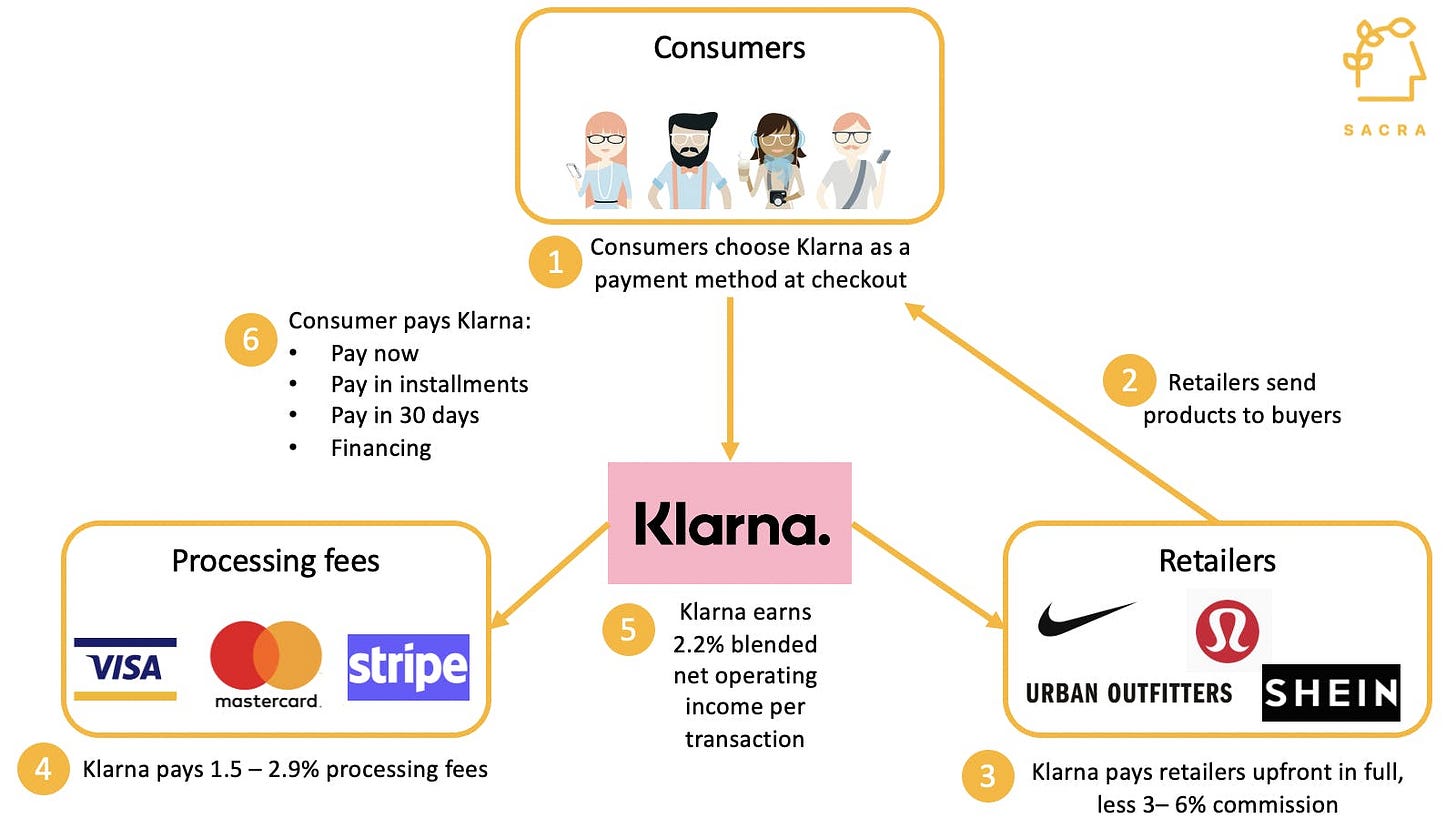

How Klarna’s Building the Shopping Destination of the Future: I’ve always been fascinated by the '“Buy Now, Pay Later —> ecommerce destination” playbook. This is a very long read on how Klarna used credit as a wedge into building the next big ecommerce platform. h/t How They Grow.

How to Create a Masterpiece: An in-depth look from Thomas at Uncharted Territories at what it takes to create something unique (hint: consistency). For example, Mr. Beast published a video an average of every 11 days for ten years. He’s arguably the largest online content creator in the world, and it took him almost five years to see consistent traction.

🔊 Must Watch Interview with NVIDIA Founder

Semiconductor company NVIDIA just passed a $1 trillion market cap, making it only the seventh US-based company to do so. I enjoyed this 2011 interview with NVIDIA’s Co-founder and CEO, Jen-Hsun "Jensen" Huang. The company was worth $12.3 billion at the time, a casual 86x less than when I typed this.

🍌 Monkey Business

I’ve been busy on Twitter this week:

👇 please hit the ❤️ button below if you liked this post

Congrats on the two new launches! That’s awesome 👏 And thanks for the shoutout 🙏

Congrats on the launches!