Instagram Founders Launch 'TikTok for Text'

Plus a new internal update tool from Broadcast, 2023 predictions from Pinterest, and how MadHappy became the next Supreme

Hi everyone, Turner back again with The Split.

Two cool new products to put on your radar: one from my friend Varadh, another from the Instagram founders. I'm also digging in to some predictions for 2023 from Pinterest. Apparently 80% of these Pinterest predictions have come true over the past three years, so I'm absorbing as much as I can!

I'm also trying something new. Until Friday, Feb 3rd at 11:59pm ET, I'm decreasing the referrals needed to get a Banana Cap from 10 to 5. This means I'll send a cap to anyone with 5 or more referrals by the end of the week (even if you've already crossed it). If you're a subscriber, grab your unique link at the bottom of this email. We're going to completely revamp the referral system in February, and this may be the last chance to grab the cap before we refresh things!

Before jumping in, quick reminder on our event in SF on Wednesday, Feb 8th from 6-8pm at AngelList's office. Join us for light snacks, refreshments, and conversations. You'll meet other founders, investors, and genuinely curious people who read The Split!

Sign-up here.

A Message From Morning Brew

☕ Learn Something New Every Day

Start your day off right with Morning Brew - the daily email that makes reading the news actually enjoyable.

Every morning, Morning Brew summarizes the top news stories and delivers them straight to your inbox so you can quickly get caught up on the way to work or over your morning coffee.

Unlike traditional news which can be boring and dense, Morning Brew is fun to read and easy to understand.

The best part? It’s completely free and only takes 5 minutes to read so you can get all the most relevant updates and move on with your day.

It’s no wonder over 4 million people read Morning Brew. Try it for free.

📱 Instagram Founders Launch New Company

Instagram co-founders Kevin Systrom and Mike Krieger just announced they're starting a new company. Their first product Artifact appears to be similar to Toutiao, which was TikTok-owner ByteDance's initial breakout product in China.

Artifact is a personalized newsfeed that uses machine learning to learn your interests. Soon, they'll add a friend graph component that involves sharing, commenting, and private messaging. In some ways, Artifact borrows some elements from Substack's new app, however appears to be partnering with premium publishers compared to Substack's bottoms-up, independent creator approach.

One way to think about Artifact is its TikTok for text. It appears very similar to China's Toutiao, and you could make the case there's a lot of similarities with Twitter too, especially as Twitter has expanded content in the timeline outside of who you follow.

Toutiao is an interesting case study. Here's a lightly edited excerpt from a longer piece on ByteDance that I wrote in 2020 that should get you up to speed and set the stage for the opportunity here in the US:

When Toutiao launched in 2012, China’s mobile news market was dominated by censored state controlled media and web portals like Sina and Sohu that served lengthy, boring text that was written and optimized for desktop. Toutiao’s initial product scraped content from the long-tail of Chinese web-based media and reformatted it for mobile. For a time, it went as far as removing the original ads and replacing them with its own.

Toutiao initially seeded the app through Weibo influencers (the Twitter of China). It used aggressive push notifications and frequently nudged users to share content (more later), which helped it grow to 10 million users within 90 days. New users logged in with their Sina or Weibo account, which Toutiao scraped for initial interests and friends. It then used each user's individual usage data (how they tapped, swiped, or paused, time spent per article, their comments, location, time of day, and much more) to serve each user the most relevant content. It changed the titles, cover images, and even shortened most articles. This got users to an 80% read rate on each article in less than one day, which contributed to the 45% lifetime user retention it boasted early on. This was all instant and free compared to human editors and gave Toutiao a 10x better product at a 10x lower cost.

Traditional media companies of course hated all of this and Toutiao was in constant legal disputes. It claimed it was hard to attribute original sources of any particular story and that many sites crashed the app due to bad formatting on mobile. Toutiao eventually let users bounce to outside sites, and Toutiao often made up the majority of publishers' traffic. In 2014 Weibo’s traffic started declining, and it invested in Toutiao’s $100m Series C round in exchange for guaranteed traffic.

Toutiao soon convinced publishers and curators to create content directly in the app in exchange for a revenue share. A majority of the read-time on Toutiao quickly shifted to partner contributed content. Toutiao’s targeting gave its contributors a larger, more relevant audience, much faster than any other platform. This further incentivized contributors - and it had 1.2 million by 2017. State-controlled entities embraced Toutiao because, unlike any other services like Weibo or WeChat, they did not need followers to distribute public statements or updates on health epidemics. Tencent, Alibaba, Baidu and many startups eventually launched similar news products, but Toutiao’s high-margin business model helped partners monetize their content and kept most contributing directly to Toutiao (its core business was reportedly profitable in 2015 with $220 million in revenue).

Over time Toutiao added relevant comments from friends (made on other platforms) to articles, the ability to share pictures to a feed, job listings, buttons to launch into separate fitness, music, and podcast apps; and live streamed shows, interactive Q&A channels, and a platform for full-length movies (Xigua). It followed other Chinese tech giants and introduced mini programs in 2018, which allowed developers to build app-like experiences within Toutiao. This introduced third-party delivery for restaurants, groceries, and pharmacies. Last, Toutiao had a culture of quickly shipping new apps with names like "good-looking pictures", "connotation comics", “funny embarrassment”, “must-see videos tonight”, and "getting pregnant when you laugh too much" and shutting them down within two months if they didn’t take off.

Most importantly, Toutiao incorporated video all over the app. Similar to Facebook, this allowed it to start inserting video feed ads. Toutiao initially went after big brands just starting to invest in mobile ads. Despite being much smaller than competitors Baidu and Tencent, brands were convinced to try Toutiao’s hyper-targeted ad product that reached its wealthy user base in Tier 1 and 2 cities. The targeting worked so well that data-driven marketing companies like Meituan were spending 85% of their ad budgets on ByteDance properties by July of 2019.

Toutiao’s reach with Chinese consumers and ability to hyper target video ads propelled ByteDance to an estimated $16-20 billion in revenue by 2019. This was nearly 3x larger than Google in its eighth year of existence (2005), and 4x its ninth year. There is of course, a lot of nuance, like timing of broader technology adoption.

In September of 2016, ByteDance used its core recommendation algorithm and the distribution it had built up with Chinese users and advertisers to launch short-video app Douyin in China (originally called A.me), and TikTok to the rest of the world in 2017 (important to note these are two completely separate products). Not only did this expand Toutiao’s video ad inventory, but also created an avenue for introducing commerce and expanded outside its largely-male user base. Most importantly, it became evident by 2018 that Toutiao had reached maturity and ByteDance’s future growth would need to come from new products.

You can read the rest of this deep dive on ByteDance from 2020 here.

I do think Artifact's core concept is a smart idea. The space appears crowded, and they won't have any of the same tailwinds as Toutiao. To start, they'll need to find a core content format that no one else has nailed yet alongside an early distribution hack to quickly get readers on board.

🚀 Product Launches

Broadcast Launches AI-Driven Weekly Updates: My friend Varadh just launched his new product, Broadcast.

If you work at a startup, you probably write weekly updates that are shared with your team or company more broadly. These probably first started on Slack, and a wiki was added at some point. As you scaled these simple updates relied on more data, from multiple tools, and took more and more time and resources to put together.

A study from Asana found that 62% of manager time is spent massaging and directing information flow, not solving problems or building products. Broadcast integrates with all your tools (including Notion, Linear, Asana, Github, Gmail, Slack, and more) and uses AI to automatically compile better updates, faster.

They've been working on this for awhile now, and it's exciting to see them get it out in the wild. They just opened up the closed beta. If you want to try it out, request access here.

🔗 Links and Charts

How to Build an Organic LinkedIn Marketing Strategy: This was a great post from my friend Julian. LinkedIn is generally a great place to find B2B customers, and also suffers from a content deficit problem: there's a lack of good content, so everything has very large reach. Personally, I've been telling founders that LinkedIn and YouTube Shorts feel like they're in a similar spot as TikTok was in 2020. There's a mismatch between supply of quality content and time spent by viewers, so any marginally good content gets more views than it would otherwise.

New Podcast Creation Down 80%: This drop surprised me when it probably shouldn't have, especially how 2022 saw fewer new podcasts than 2019. I was also surprised that Brazil and Indonesia were the second and third largest markets for podcast creation behind the US.

Amazon Smile Was Created to Fight Google: Smile was a destination that donated a small % of each purchase to a charity of the customer's choice. Amazon discontinued the program two weeks ago, but I just learned it was originally created by Amazon's Traffic Optimization team to train customers to visit smile.amazon.com directly instead of first searching on Google. Amazon pays Google for all converted traffic, and this ultimately saved just as much as, if not more than, what Amazon donated to charity through Smile.

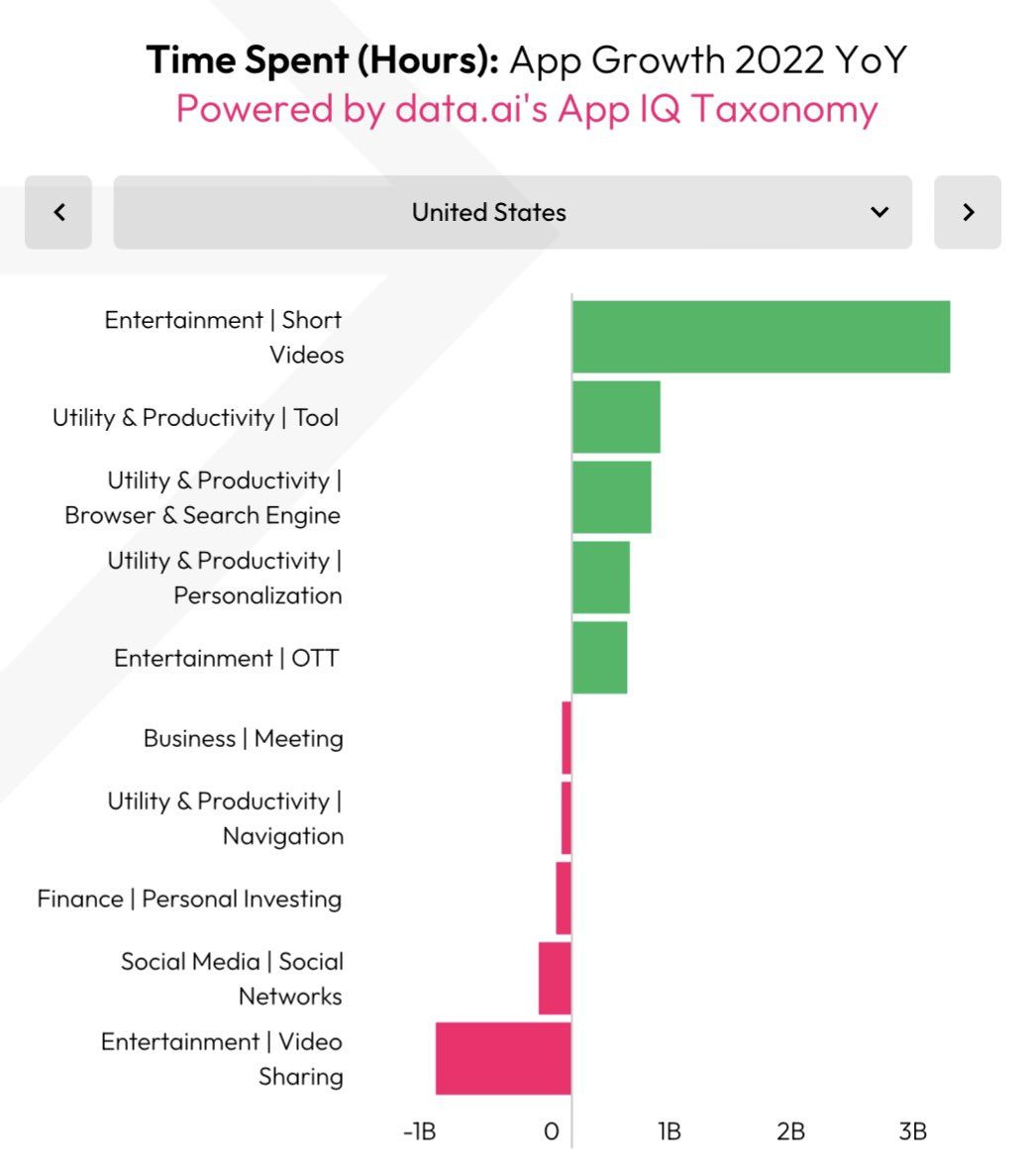

Short-video saw the biggest gain in mobile time spent in 2022. Alongside stealing time from traditional social media and video streaming, it created nearly 3 billion net new minutes! h/t Olivia Moore for sha

American Households with Children Continues Declining: Attributable to everything from later marriages and longer life expectancy, I assume the most likely culprit of this decline is an equally inverse cost of raising children. I wonder what this chart looks like over centuries and different historical societies? h/t @GoodsCapital for sharing.

NFL Franchise Growth vs the S&P 500: Since the 50s, every single year would have been a good year to invest in an NFL team (this chart showing size of the NFLs media deals goes back further).

Logan Paul Buys a Super Bowl Commercial: I don't follow Logan Paul very closely, but I believe this might be the first YouTuber, or social media influencer more broadly, to buy a Super Bowl commercial? Please correct me if I'm wrong!

A Streamer Bought the Rights to the World Cup in December, which is arguably an even bigger deal than a Super Bowl commercial. Casimiro's stream where he commentated on World Cup games also broke YouTube's peak concurrent viewers record with 6.5 million (the previous record was 4 million).

📚 Long Reads

How MadHappy Became the New Supreme: Everyone knows MadHappy focused on mental health. But more importantly, they were completely counter-positioned to Supreme, which leveraged hype, exclusivity, brand collabs, celeb endorsements, and social signaling. Meanwhile, Madhappy promoted optimism and an inclusive lifestyle. Supreme stayed a fashion brand, and Madhappy transcended into a community and its customers' personal lives.

Is Amex any different from Mastercard and Visa?: The secret is Amex is both a card network AND a bank. This means that even though they scale slower, their business model enables them to push for higher volume customers (more transaction fees) who also carry a credit balance (of which they generate interest income on). This stat blew my mind: "Delta co-branded cards account for 9% of global Amex volume and 21% of its loan portfolio".

Pinterest Predicts 2023: This annual post from Pinterest is new to me, it predicts the top 27 emerging trends for 2023. And apparently, 80% of Pinterest's predictions over the last thee years have come true. Here's some for this year:

The YOLO years: Baby boomers will throw more extravagant parties. 50-year anniversary parties are trending up 370%.

Gemini hair: Dual hair colors will spike, as related searches are up 345%.

All aboard: Trains make a comeback due to quicker boarding, extra legroom, scenic views, and a lower carbon footprint than flying. Related searches are up 205%.

Free spirits: Low/no alcohol drinks continue taking market share, with searches for fancy nonalcoholic drinks up 220% and creative cocktails presentations up 555%. This trend is also applicable to products like Liquid Death, which I wrote about a few months ago here!

Check out the full report from Pinterest here.

🔊 Podcasts

The Complete History & Strategy of the NFL: This was an excellent breakdown from Ben and David at Acquired on how the NFL

Kept its teams competitive to maximize entertainment value

Created storylines around the game

Outsourced (and commoditized) distribution to the TV networks

Sacrificed short-term pain for long-term benefits to reach almost $20 billion in revenue last year.

This all seems obvious in retrospect, but they walk through the entire history of the National Football League, starting all the way back at the first American football game in 1869. They narrate and analyze how the NFL clearly capitalized on the rise of TV across America, but struggled to capitalize on the social media age (especially compared to the NBA).

Listen to the full episode here.

💼 Career Services

This week we did Banana Talent Drop #10! It featured 10 new candidates with an average of 9 years of experience. This latest drop included engineers from Twilio and CrowdStrike, PMs from Stripe and Uber, and other candidates with product and engineering experience across some of your favorite startups.

(I admit this graphic is getting messy, need to figure out a cleaner format!)

I also know at least one candidate was hired last week! I've been sharing feedback with Pallet around ideas that will help us manage this on our end, and hopefully I'll be able to share more detailed hiring stories soon!

As a candidate, the collective is a passive way to get interest from hiring managers at nearly 50 companies. As a hiring manager, it gets you access to the entire collective in addition to new drops every two weeks. (As always, if you're at a Banana portfolio company, reach out for access).

If you're starting to explore a new role or hiring and want a feed of pre-vetted candidates, get started here.

🍌 Monkey Business

Follow me on TikTok for more dumb memes like this.

🍌 The Split is brought to you by the team at Banana Capital. Read more about what we're up to and the latest on our Fund 2 here.

🤝 Interested in a sponsor partnership with The Split? Inquire here.