Deel Goes Free + 2023 Reader Predictions

Plus The Split passes 15k subscribers, some charts on US home buyers, and reads on the venture market

Welcome back to The Split!

A cool milestone: The Split just passed 15,000 subscribers over the weekend. This was the "minimum viable newsletter" number I had in my head when I started writing consistently over the summer. It looks like we need a new goal now...

Keep reading and I'll recap some of the predictions you had for the year, one of them being related to The Split. I'll also dig into Deel's new suite of free HR products that could save founders a lot of HR-related headaches, plus some charts and reads on the venture market.

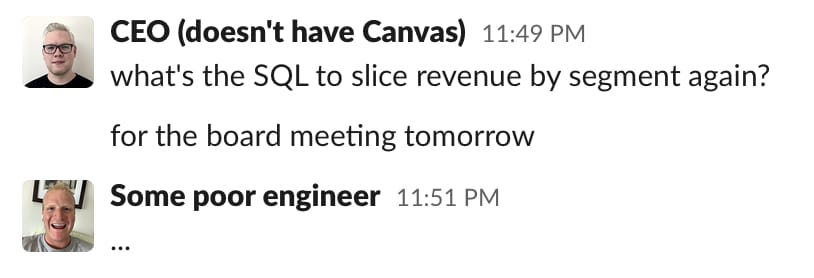

First, a quick message from Banana portfolio company Canvas:

📈 Do you truly understand your startup?

Why does it take distracting an engineer and waiting days to answer a simple question about your business? And worse, all you get back is a CSV that raises more questions than it answers.

There’s a better way.

With Canvas, you can combine data from your database, Segment, Stripe, Quickbooks, Hubspot, your database, and >150 other SaaS tools and analyze it without writing any SQL.

They have easy-to-use templates for startup staples like ARR cohorts, net 💰 retention, user churn, sales rep efficiency, LTV/CAC, and return on ad spend.

It’s the first data tool you'll love. And the last one you'll ever need. No more SQL favors!

Funding round coming up and need to get metrics together? Just raised and need a board deck? 🍌 Split readers get a free consult with our experts – ask us anything data. Find out why CTOs call Canvas a no-brainer.

🚀 Product Launches

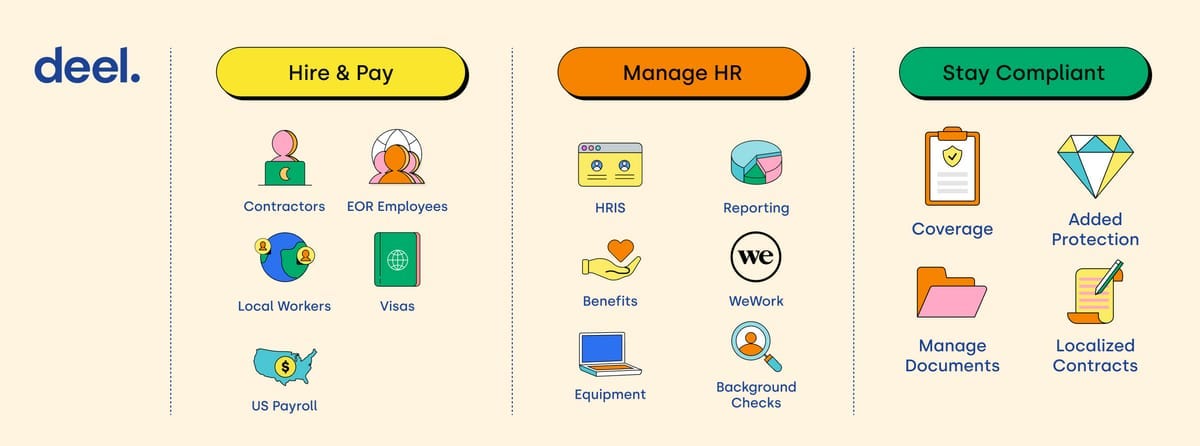

Deel Launches Suite of Free HR Software: You might be familiar with Deel for its remote payroll software. Yesterday, it announced a new suite of HR software that it's giving away for free.

Giving away software for free is always an interesting strategy. And of course, it's not actually free since customers pay for Deel's payroll product. It disclosed it crossed $295 million in ARR to end 2022, up from $4m in 2020. It has 85% gross margins and positive monthly EBITDA since September. Needless to say, Deel can experiment with free.

It looks like Deel is betting that payroll is the winning platform in HR. I could see the rationale. Trying to pay your first employee is probably one of the first things you'd think about when hiring them. And it's customer base ranges from one-day-old startups to publicly traded companies. It's focus on international payroll for remote teams also means it can initially slot in alongside existing payroll solutions instead of forcing new customers to switch completely.

I'd assume payroll has sneaky high ACV's for an HR product because it gets to borrow from every other function of the business. HR tools seem to cost anywhere from $10 to $100 per employee per year (an extreme generalization). Running payroll means Deel is positioned to take a % of all compensation-related spend, which for the average company makes up a high % of revenue.

Having payroll as an initial wedge, especially Deel's tools to hire and pay a remote team that can slot alongside other payroll products, gives it a wide point of entry and an unfair CAC advantage since its customer LTV is much higher. It adds some context to the "multi-product portfolio" language we're seeing across the market.

🔮 2023 Reader Predictions

As promised last week, here are my favorite 2023 reader predictions that rolled in.

From Anne Lee Skates at a16z:

AI and other productivity software will start giving everyday individuals and SMBs superpowers they could never afford or access before (previously reserved for executives or large corporates).

Grammarly is a great example, previously you needed to hire an editor, assistant or chief of staff, but few can afford to do this.

Speechify is another example. It’s expensive for humans to turn written text into audio format, but crucial for special needs learners. Tech levels the playing field for those previously underserved by publishers and text-based websites.

I like the framing as "AI giving super powers". It's how I've been thinking about it, just worded much more eloquently.

From Bradley Mullen at Vye Ventures:

A technology that I predict will grow significantly in popularity in 2023 is touchless palm vein recognition for customer identification and purchasing. This will become much more widely used throughout the year at banks, retailers, and in other settings requiring secure ID such as hospitals and governmental secure locations.

Not only is there the wow factor, it can't be spoofed and it will be convenient and useful to leave one's ID and credit card at home, especially as the networks grow.

I'm sure we've all seen the eye scanners in Minority Report. Palm-reading could make sense as a less privacy-invasive form of bio-ID. But I wonder if Apple is better positioned to roll something out with its built-in Face ID features? Tune in at the end of the year to see if Bradley's right!

From Shomik Ghosh at Boldstart Ventures:

2023 will be a new refresh cycle for B2B software. Companies that have been around 10 years + and are now public companies moving further upmarket with "heavier" products are going to be disrupted by leaner startups who focus on solving end user pain points quicker and optimize architectures for the infrastructure that has become ubiquitous since then (K8s, container adoption, eBPF, open telemetry, modern data stack, JAMstack, etc).

Maybe this is just because I'm not in the enterprise SaaS trenches with Shomik, but I thought the popular narrative was the largest players would steal share as customers cut costs this year. There's probably just as compelling of a pitch being made maximizing the value of your tools, which would represent a perfect opportunity this refresh cycle for startups solving problems 10x or 100x better than incumbents.

From Sam Fargo, who writes Money Buff:

An AI-generated song tops the charts and The Split reaches 50k readers.

I could see this happening, especially if "tops the charts" is Top 40 and not just #1 overall. On The Split reaching 50k readers, sounds like good to me!

From Arda Capital, who just started writing Tidal Wave:

Winners: The FOMC will achieve a soft landing, Facebook (see losers), AI/ML founders

Losers: TikTok will be banned in the US, Figma deal gets blocked and won't reach the $20 billion mark for awhile

I always love a good TikTok ban prediction to get the people going. And a soft landing from the FOMC seems to be non-consensus if you spend much time on FinTwit!

From Michael Girdley, Co-founder of Girdley Enterprises:

Michelin grants stars to every Chili's in North America.

I don't think I can see this one, but Chili's does seem to be crushing it lately. Maybe Gridley's right...

🔗 Links and Charts

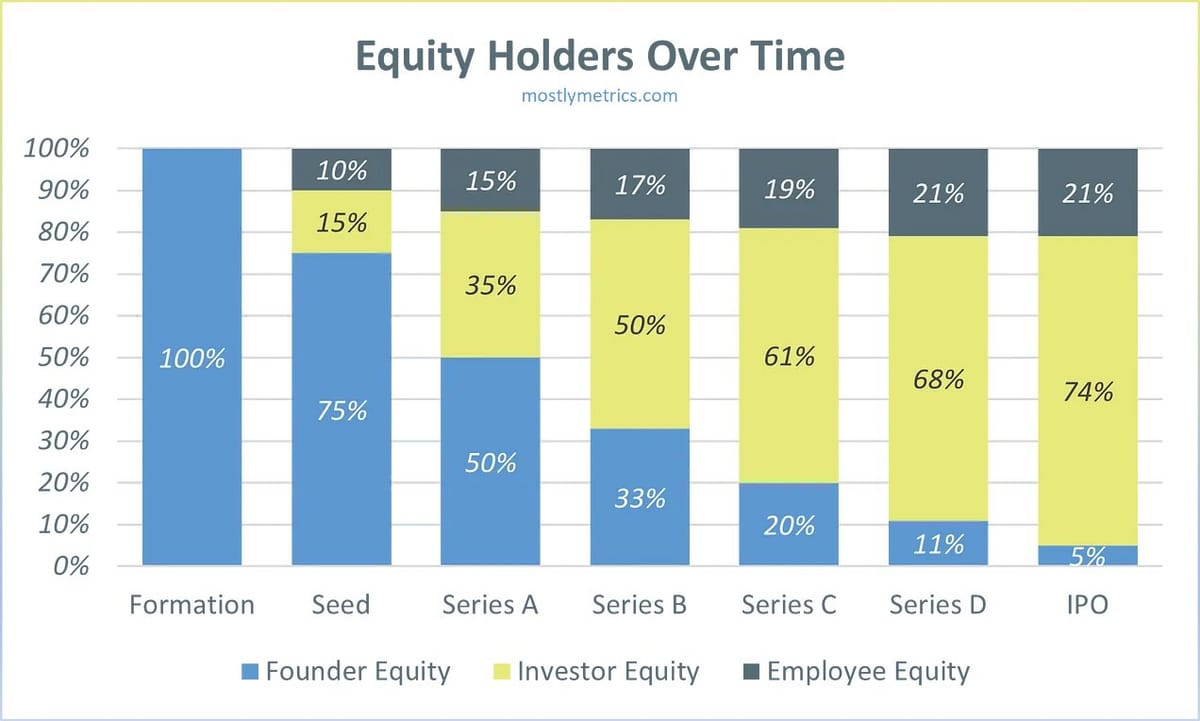

How Much Dilution is Normal? If you've never modeled out the scenarios of raising venture capital before, this will likely be eye-opening chart and read.

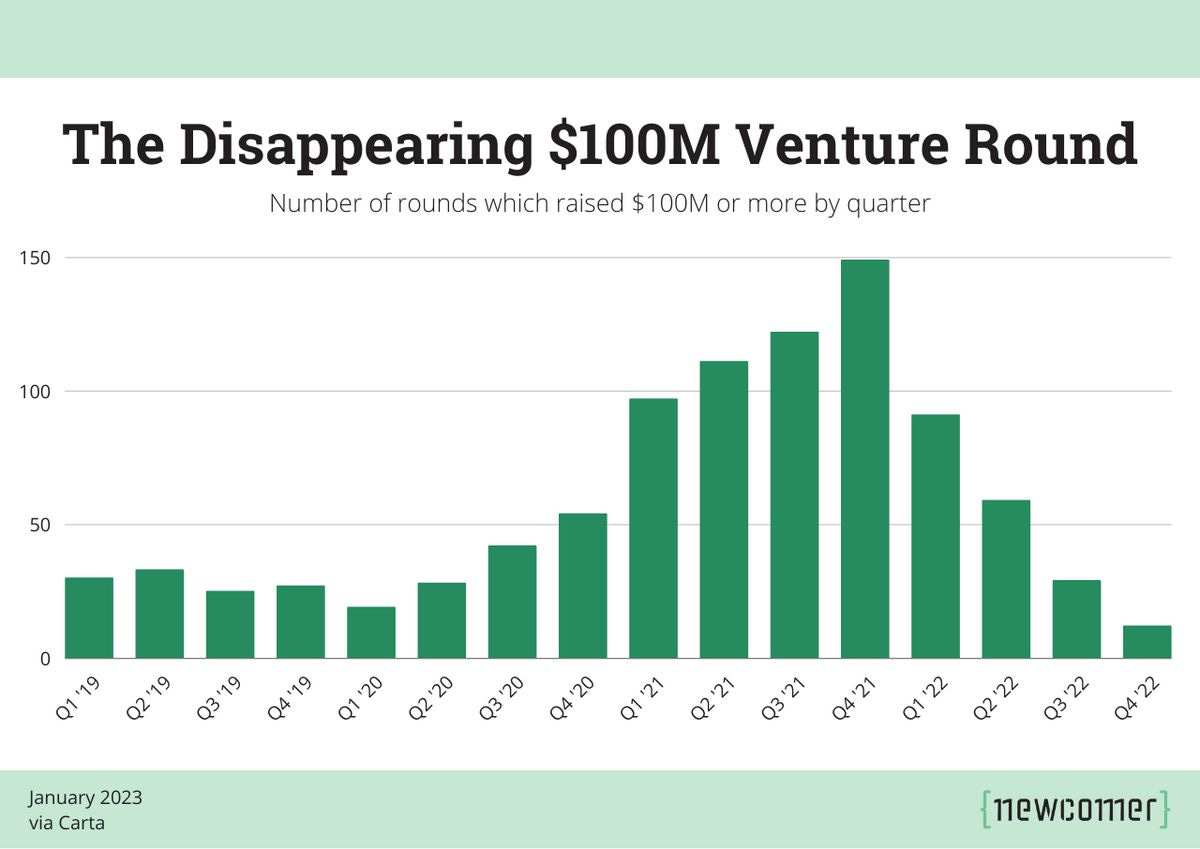

$100m Venture Rounds Down 90% From 2022: A good "state of the market" piece supported with lots of interesting data from Eric Newcomer. Most relevant to Banana and our early stage portfolio companies, the number of $100 million venture rounds, which was artificially high to begin with, shrunk drastically last year.

TikTok is Testing a Podcast Feature: If you've read any of my longer pieces on ByteDance, I've always thought it would use TikTok as a top of funnel to acquire creators and consumers that it will further monetize with other products. TikTok is just as much an audio app as it is video, and many creators launch podcasts to monetize their brands. We know ByteDance is experimenting with a music app Resso in India (where TikTok is banned), Indonesia, and Brazil. And we know "TikTok Music" is probably launching soon too.

TikTok Has a Secret "Heat" Button That Makes Anyone Go Viral: If you're a Turner stan, you probably remember how I was once viscously attacked on Twitter for claiming there was more human influence on on the For You Page than TikTok admitted. And I don't really think it's that controversial. Every media company makes editorial decisions, and even the ones with algorithmic feeds can decide to elevate or suppress certain content.

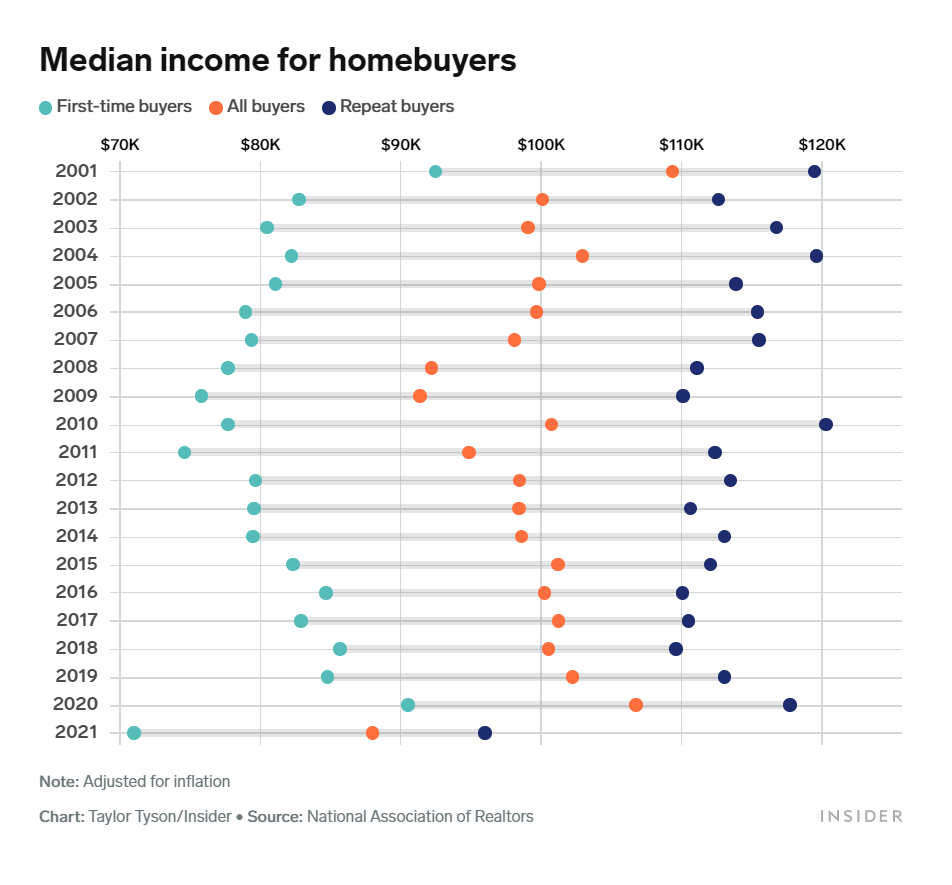

First-time Homebuyers are 'Royally Screwed': Interesting charts in this Business Insider piece. 2022 saw the poorest and oldest first-time homebuyers on record. They may be right that the 2023 buyer is royally screwed, but low rates, stimulus checks, and work from home made 2021 a generational time to buy a home for many US consumers.

Pet Prices Down From Pandemic Highs: Dog prices in the UK are down 20% year-over-year as post-pandemic demand cools off. In Q2 of 2020, there were over 400 buyers per advertised pet. By November of 2022, that number was 80.

There's also signs of financial strain for pet owners. 25% can't afford to take them to the vet, and 18% of owners reportedly went into debt to pay for their pet's care. Nearly 10% are considering giving up their pet, and UK rescue centers at full capacity increased from 22% to 42% between 2019 and 2022. Still, almost 70% of UK households own a pet. And 80% would cut back on non-pet expenses to provide for them.

Amazon Prime Members Convert 74% of the Time: This stat is from June of 2015 and probably outdated, but this still blew my mind. “When a Prime member visits Amazon.com, there’s a 74% chance they end up buying something”.

Talk about conversion rates, Kim Kardashian averages a 0.004% conversion rate on each Instagram post. At 341 million followers, that's 13,640 purchases per post.

Quick tech layoff analysis from Inquisitive Investor on Twitter showed what % of job growth since the start of the pandemic was laid-off last week. Amazon's is hard to compare since a lot of its job growth was in warehousing and logistics. But it goes to show just how small some of these layoffs were.

Microsoft Lays off Entire VR and XR Teams: This includes AltspaceVR, its VR-based social platform, and MRTK, its mixed reality toolkit for Unity. HoloLens is also reportedly struggling to renew its military contract.

📚 Long Reads

What does the rest of the world not get about India?: This is the first time I've ever throw a full-blown Twitter thread in this section, but this one from my friend Romeen was good. The craziest stat in my opinion, and there were a lot, was that the Indian consumer will often spend 10-20x their annual income on their wedding.

Declining Returns in Software & Defensibility: A thought-provoking take with data on the declining returns investing in "Vanilla SaaS" models.

Where Fraud Lives and Why: A deeper dive on the "How Pervasive is Corporate Fraud" paper I linked to last week. Byrne Hobart argues that Sarbanes Oxley made it harder to commit fraud in the public markets, and a higher aggregate dollar amount being invested in short positions means investors are incentivized to find it.

The private markets remain a better place to commit fraud, with one sentences capturing it well: "The more impressive a company looks, the more embarrassing the basic due diligence questions are." Byrne suggests the down market and recent series of high-profile failures could give private markets a similar jolt that Arthur Andersen's failure did for public markets.

Q&A with Netflix's New Co-CEOs: Broad-ranging interview, it hints India and Indonesia are big growth markets. Live content also seems to be a focus area. And Netflix's advertising business will be "mid-single digit billions in three years".

💼 Career Services

Banana Talent Drop #10 goes out this Sunday! We're on track to pass 200 candidates, with new ones dropping this weekend from the companies below + more.

If you're starting to explore a new role or are hiring and want a steady stream of pre-vetted candidates, start applying below!

(As always, if you're at a Banana portfolio company and aren't on it yet, make sure to reach out for free access).

🍌 Monkey Business

❤️ Reader Love

🍌 The Split is brought to you by the team at Banana Capital. Read more about what we're up to and the latest on our Fund 2 here.

🤝 Interested in a sponsor partnership with The Split? Inquire here.