🎧🍌 Pricing Lessons from the Fastest Growing Companies with Kevin Liu, Co-founder and CEO of Metronome

Why Metronome sacrificed its early margins to scale with OpenAI, the most common pricing mistakes, Kevin's framework for iterating on startup ideas, and the dangers of over-building a product

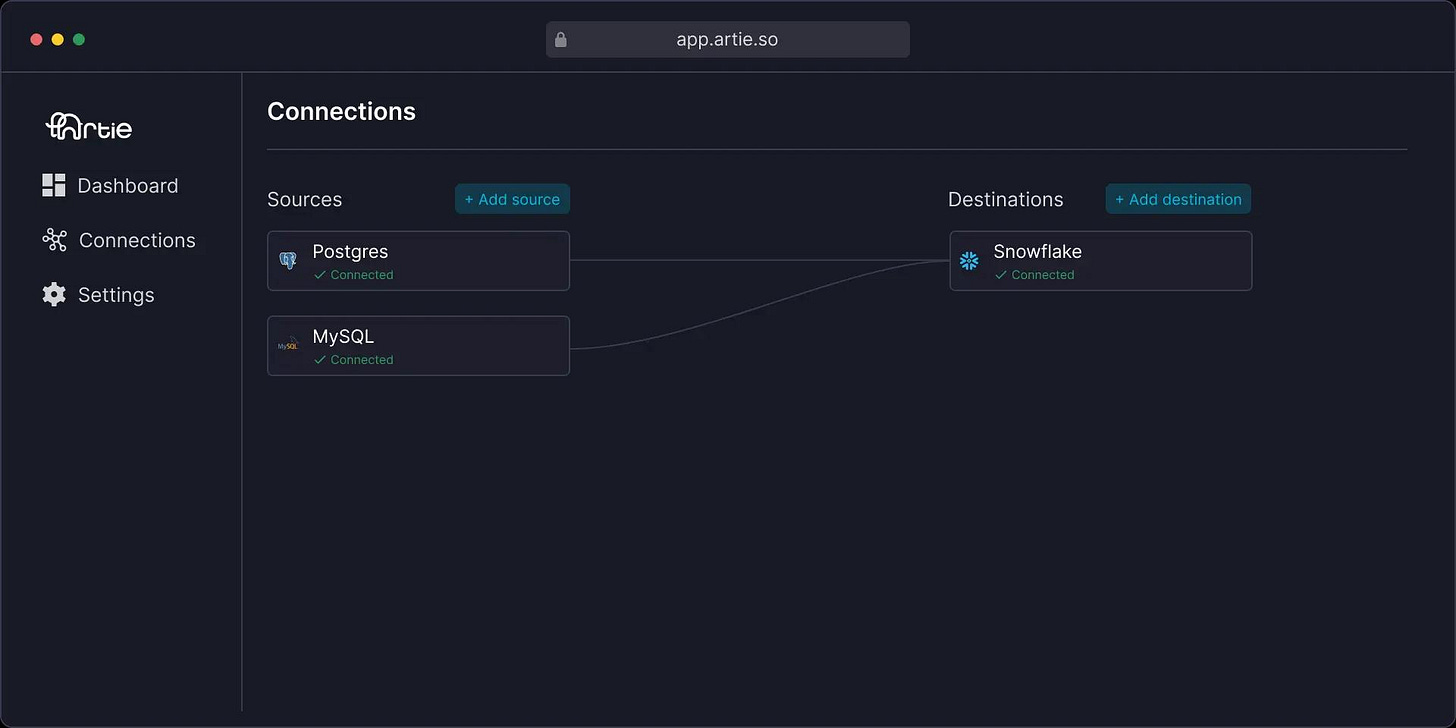

The episode is brought to you by Artie

Artie is the real-time database replication solution that sets up in minutes and requires zero day-to-day maintenance.

Artie is one of my latest investments at Banana, and I’ve been recommending it to every team I meet.

Artie uses streaming technology and change data capture to sync your databases and data warehouse in real-time. The product abstracts away all the complexity of setting up and managing streaming architecture, and enables you to operationalize your live production data. Its all wrapped in an Analytics Portal giving insight into system level infrastructure, helping you monitor database and pipeline health.

To go deeper, check out their latest case study with Substack.

Internal sentiment is extremely positive. Our A/B testing framework measures much faster and we have higher data integrity now. This means the whole company can move faster and make decisions quicker. Artie is business critical and our day to day would be significantly tougher without it.

Artie is open source, and you can book a demo for a two week free trial.

To inquire about sponsoring future episodes, click here.

Kevin Liu is the Co-founder and CEO of Metronome, which enables software companies to launch, iterate, and scale their business models with billing infrastructure that works at any size and stage.

Kevin and his co-founder Scott Woody started Metronome in 2019 after selling their respective companies to and meeting at Dropbox. They have since raised over $30 million from investors like a16z, General Catalyst, Nat Turner, Zach Weinberg, Jean-Denis Greze, Elad Gil, Lachy Groom, and dozens of other angels and founders in the revenue and billing space.

Topics discussed include:

The history and evolution of software business models

A crash course on all things software pricing

Kevin’s framework for iterating on new startup ideas

His 2-days on, 1-day off strategy for early customer need-finding

How he leveraged angels to raise Metronome’s Seed and Series A rounds

The dangers of over-building a product

Why Metronome sacrificed its own margins to scale with OpenAI and chatGPT

How Kevin thinks founders should prioritize their time

Frameworks for building a pricing model

The biggest pricing mistakes companies make

Explore Metronome’s products here

Find Kevin on LinkedIn

🙏 Thanks to Zac and Xavier at Supermix for help with production and distribution.

Transcript

Find transcripts of all prior episodes here.

Turner Novak:

Kevin, how's it going?

Kevin Liu:

Good. Good to meet you finally.

Turner Novak:

Yeah, good to meet you too. Thanks for coming on. So the first question, could you just explain to us really quick what is Metronome the product?

Kevin Liu:

Really quick is the hard part of this honestly. There are a lot of components to the product because we're pretty broadly spread out across a lot of different use cases within a company. But I think that the short version I would think about is that Metronome is the leading billing platform for modern software companies. So our mission is really to help companies operationalize and accelerate the revenue.

Kevin Liu:

And I think it's worth noting, because I don't think accelerating revenue is really something you'd typically associate with a billing system of all things. Maybe something I think typically more akin to automation, but we try to think about everything we build through the lens of how we can actually help companies move faster and grow their business.

Kevin Liu:

To get more specific with it, our initial insight was really focused on helping customers with the transition to usage-based pricing models first by building this billing platform that was real time and data first. So that's still very much the case today, although we've broadened out. Most of our customers also have subscription and one-time fees as a part of their pricing and packaging.

Kevin Liu:

But the product today actually really has three different areas of focus, I would say. So there's data, there's billing, and there's revenue. On the data side of things, we look more akin to an infrastructure company. So if you think about how a company will do billing, especially when they have more complex pricing models, there's this data component that requires you to understand what the customer is doing inside of your product.

Kevin Liu:

And so we integrate directly with your event streams to actually ingest that information and to calculate metrics in real time. And we make sure that that data, along with the billing data that's in Metronome gets to other use cases within your company. Unlike most billing systems, which are these batch based architectures, we're built on modern data streaming technology. So your customers and your teams always know what's happening with how customers are using your product and how that's turning into dollars. You don't have to wait until end of month to understand consumption or to make decisions.

Kevin Liu:

The billing part of it is really this incredibly complex business logic platform. So you can think of it as first component, the usage data streams in. We're performing all of these aggregations on top of it. It hits the billing side of things, and now our job is to encode all of the terms of the financial agreement between you and your customers. So maybe that's a fully automated self-serve motion, where a customer can just swipe a credit card. But beyond just the typical pricing you want to offer, you also want to experiment. So there's a bunch of variants of that. Maybe there's a large enterprise customer that's negotiated custom discounts, and strange rollover terms in a bespoke commit or some kind of weird minimum structure. Whatever it is, we have to be able to model that and we have to keep it organized and consistent inside of Metronome. We need to be 100% accurate. There's no tolerance for error. You don't misspell customers. You really don't want that to happen.

Turner Novak:

Especially when that's your revenue. This is how you're making money. If you're not billing correctly, that's your business model.

Kevin Liu:

That's really the thing that's a little bit different. I think even on the data component, we look almost similar I think in some respects to an observability company in that we have this massive data pipeline, data streaming through it. We're calculating metrics. People will oftentimes look at that and be like, "That looks like observability or it looks like analytics." But the difference is you can drop some number of analytics events or observability events on the floor, and it's a little bit, no harm, no foul. It's obviously not good. Nobody wants a data pipeline that's lossy. But if you drop some percentage of your billing data on the floor, that's a real problem, right? That's a P0 for us, a major incident. And so there's really just no tolerance for error when it comes to billing.

Kevin Liu:

So if you think about a billing platform, you're calculating how much a customer owes on an invoice. That's kind of the core billing piece of it, but we actually have these two other parts that we really, really need to make great for customers.

Kevin Liu:

On the data side, we look more akin to an infrastructure company. We integrate directly with your event streams to calculate all of your metrics in real time so you don't have to. On the revenue side, we have this very, very complex set of integrations that we have to run through to complete that end-to-end story for customers, post billing through collections, through reconciliation, through revenue recognition. And that's oftentimes especially complex, because you have to jump from the constraints of all these different systems to get to a working end-to-end financial workflow.

Kevin Liu:

That kind of covers the whole end-to-end suite of things for us. We go through data, we go through billing, and then we're getting that data out to other systems so that you can use it for your business.

Turner Novak:

So then in terms of just the history of the software market, obviously we didn't start with usage-based billing, being able to measure every single detail of how a customer used the product. It was licenses, subscription, and now we've got to usage base. Can you kind of talk us through just the history of how this has all played out?

Kevin Liu:

Yeah. I think the way to think about it today is that we're really seeing in SaaS pricing today, what happens inevitably when any industry matures. If you look at how people have charged for video games or how cell phone providers have charged for their fees, as industries mature, the context changes, and you really converge around new pricing and packaging.

Kevin Liu:

In the early days of SaaS pricing, I don't think the pricing back then was particularly nuanced. It was just flat rate subscriptions, although that in and of itself was already this leap forward from paying for a perpetual license, basically like you pay once and you own the software forever, and you literally deploy it on a server. This on-prem deployed software.

Kevin Liu:

So that early SaaS pricing, that flat rate subscription really I think was the first step in unlocking the ability for a company and a customer to maintain a long-term financial relationship with a much smoother upgrade model. Software's just deployed in the cloud, you get all the upgrades as they come, but that was really step one. Pricing doesn't live in a vacuum, and over time, it evolves in response to the market. What companies and customers trying to solve for, as well as whatever competitive dynamics are out there.

Kevin Liu:

So companies and customers both kind of push the bounds of pricing to solve for things that either party needs. Better value capture for the company, fairer pricing models for customers.

Kevin Liu:

And I think for usage in particular, that's being driven by a number of things. I think the first is there's just always this instinct to get to better alignment, like fairer pricing models that's being driven by the customer. Vendors have to respond to that.

Kevin Liu:

And when you look at early SaaS pricing, or even I would actually call seats, kind of like the first instantiation of a usage-based model. People don't necessarily think of them that way, but they're really just a very coarse-grained metric for how companies are using your product.

Turner Novak:

It's like the most simple form of usage base, like one person is using it, 10 people are using it. That's how many seats you have.

Kevin Liu:

And if you look at what happened with seats, you'll see that you started with really, really coarse grained, "I'll agree to buy 1,000 seats of Salesforce," or 1,000 seats of whatever company it is that you're committing to, and it kind of doesn't matter how many you actually use. And people responded to that and were like, "Well, why am I paying for all of these seats when I'm not using them?"

Kevin Liu:

And so then you kind of evolve to these more dynamic models where people can kind of upsell and downsell throughout the month, depending on how many people are actually using the product. You go all the way to Slack's kind of fair billing where there are different classes of seats and there's more complex [inaudible 00:10:19]. It gets really complex.

Kevin Liu:

But that's really a good example of how that spectrum plays out over time and how the customer really pushes companies to align to more "fair" pricing models. Even if you're not selling a direct competitor to Slack, a customer that's familiar with Slack's pricing model might come to you and be like, "Well, Slack charges this way, so why don't you?" I would say the second thing is as customers shift their software into the cloud, their COGS model just completely changes.

Turner Novak:

Can you explain COGS really quickly for somebody who's never heard that word before?

Kevin Liu:

Yeah. COGS is just cost of good sold. You can think of it in very brief as the cost that you pay to run your product. When you were deploying software on-prem, the customer would literally take on all of the COGS, all of the cost for running your product. It's running on their servers. You're not incurring any additional costs to manage that product.

Kevin Liu:

But once it's in the cloud, that's shared infrastructure across all of your customers. So when a customer, let's say, sends a bunch of data into your product, makes a bunch of API requests, spins up a cluster, that costs you money now when you have cloud software. That's broadly speaking true. And what happens is companies have to, in the long run, be able to predict and hold a consistent good margin. The cost can't be more expensive than the money that you're taking in, especially when it comes to just baseline infrastructure costs.

Kevin Liu:

And so what happens is when you've built on top of a cloud provider or another platform, all of these platforms are using consumption-based pricing models, right? Amazon charges you based off of how much of AWS you use. If your cost in the background is going like this, it's jumping up and down, it's going up and down, then you can't hold a flat pricing structure if suddenly the cost spikes, and the amount you're making is actually no longer tied to the cost of your product.

Kevin Liu:

And so that's when consumption-based models that really are maybe one or two layers abstracted away from Amazon's pricing come into play. You see a lot of infrastructure companies doing this, where they're really just kind of value add repackaging Amazon's pricing in different ways. And they're providing a lot of value on top of Amazon's infrastructure, but ultimately it's all running in Amazon's services, and they're getting charged for however much you're using of their product. So that's another, I think really, really significant reason that we're seeing that happen.

Kevin Liu:

I would say the third is really product-led growth. So the macro trend we're seeing play out now is that the average company is seeing their pricing get a lot more complex over time, right? SaaS companies in the past would be either maybe self-serve or enterprise, but not both. You would be one or the other.

Kevin Liu:

But now you have these product-led growth companies that try to connect both motions in a continuous funnel. You can sign up, self-serve as a small account inside of a large organization. And then over time, you actually get to the point where you've grown enough that you now are talking to a salesperson and upselling going into this enterprise motion.

Turner Novak:

So an example of that would be an engineer from Walmart signs up and you say, "Oh, Walmart, they have a lot more needs than just this one person." That's your way to get in the door at one of these larger customers, that before you'd have to go to the CTO, try to convince them to take a meeting, sell it top down.

Kevin Liu:

That's exactly right. So you may have heard the term land and expand. That's really highly applicable to companies that have this kind of product-led growth motion, right? And if you look at historical companies that have done a really great job of this, I think Figma is really well understood to run a really good PLG motion, Segment is another one. There are a lot more.

Kevin Liu:

But basically, you're talking about situations where you're actually running two totally different go-to-market motions at the same time. It's literally double the complexity, and then you add in the complexity of trying to connect the two.

Kevin Liu:

What happens then is product-led growth actually incentivizes you to make it really easy for people to adopt at the beginning of the funnel. So consumption is a really great fit for that because if all you have to pay for is one seat, or you only have to pay for the number of API calls that you use, it's much easier for an individual developer to actually sign up and start right away. And then as the account scales up over time, it actually just winds up naturally expanding because of the way that consumption-based pricing models work.

Kevin Liu:

But yeah, I mean that complexity is just hard for companies to manage. It used to be that you would just charge someone a million dollars, they would take your software, and deploy it on a server. And now we have the subscription fees, and then we'll charge you for implementation. And then there are these add-ons, and then this bit is consumption based. This part is a quarterly subscription. This part has a minimum. So it makes for a very complex mix for companies to manage and operationalize.

Turner Novak:

And I think you've kind of mentioned a couple other things in the past. It impacts how you do your accounting, how you compensate your salespeople. There's a lot of downstream from just even the revenue perspective of changing from SaaS or subscription to usage base introduces a bunch more complexities. Can you kind of hit on how those all change or what all changes?

Kevin Liu:

Yeah, for sure. In this more complex world where you have product-led growth motions or self-serve and enterprise, you have hybrid pricing models or you have pricing models with five or six different components, it's just more complex to operationalize.

Kevin Liu:

So inherently, subscription only, which is the world that we were in not long ago, is actually just quite a bit more simplistic. Let's say you're a customer success person working on an account for a company that does a subscription. I mean obviously, you care about how customers are using the product, but you can probably wait until six months before it's time to renew, and then go and reach out and see what's going on.

Kevin Liu:

That's just not an option when it comes to a consumption-based pricing model, because you're not going to get paid unless the customer is actively getting value. As a customer success person, you have to know exactly what's going on in the account at all times. And if it's trending below where you expected them to be consuming, you have to reach out and kind of actually work on that. Which I think is a better... I think that's just a better outcome for both the company and its customers. It makes for a much more accurate model with respect to the value trade between companies.

Kevin Liu:

I would also say it changes. You mentioned a couple of things there. It changes your accounting, changes your forecasting, it changes your sales motion, it changes how important post-sales is. It changes sales compensation. When you're looking at accounting, now all of a sudden as opposed to just being able to recognize the revenue in these kinds of straightforward chunks, maybe you're selling a commit model, and you have to recognize your revenue as you burn down against the commit. So you literally need to know what the exact fine grain usage is to be able to recognize revenue properly in a month or in a quarter.

Turner Novak:

And then the unused that you haven't spent yet or burned down of those commitments, those are probably going to show up as deferred revenue on your balance sheet somewhere.

Kevin Liu:

Yeah, exactly. And that's just like, most systems are not set up for that. They don't have the data source for it. They don't capture data in that way. If you look at something like forecasting, in a subscription-based model, you really only need Salesforce opportunities to understand where your revenue forecasting is going to be, because a rep will just call out like, "Okay, I think this account is going to close for this much or is going to renew for this much."

Turner Novak:

That's your pipeline. Yeah.

Kevin Liu:

Exactly. If you can get that [inaudible 00:17:41] pipeline right, then you're probably in reasonable shape. Now, there's the second order problem of how do you make sure that this is actually forecastable and accurate. But in a consumption-based model, that's not the only variable anymore. Your revenue is directly tied to how much customers are consuming day in and day out. If it's a good quarter for them and their business grows a lot, you might see it go up like this. If it's not so great, then maybe it's a little bit flatter. And so you need access to that information all the time to be able to forecast.

Kevin Liu:

If you look at, I think this was Mike Scarpelli from Snowflake. He wrote a blog post about this. He's the CFO. He mentioned that at Snowflake, they more or less forecast continuously, because you're constantly updating your forecast based off of what's happening.

Kevin Liu:

You look into that forecast and you can just see up-to-date exactly where you think you're going to hit for the month or for the quarter based off of up-to-date, real-time consumption data, which is what we offer. Small shout out there.

Turner Novak:

Small plug. Yeah.

Kevin Liu:

Small plug. Yeah. And then when you think about the sales motion and sales compensation, most salespeople who haven't sold in a consumption-based model before are used to actually going out there and selling really large commitments upfront. They're trying to maximize the size of that initial expand, but that may not be the right motion in a consumption-based model.

Kevin Liu:

Oftentimes, it's more correct to go in there and to sell maybe a small account first, as you mentioned. Maybe it's that first couple of working groups at Microsoft, and then you connect them over time, and you build that momentum in the account.

Kevin Liu:

So if you're not careful with how you do your sales compensation... Let's say for instance, you primarily compensate folks on the initial commit size, so just the bookings as opposed to having any attachment to what happens later on, you can get some really awkward incentives, where a customer or a salesperson is really incented to oversell a customer, which is not what you want. That may be net harmful for your business. So you have to adjust your sales comp, you have to change your entire sales motion to match how you're going to do that.

Kevin Liu:

And then finally, I mentioned the post-sales thing before, but I would say post-sales becomes roughly three times more important when you're in a consumption-based pricing model. It's just totally different. It's no longer just about whether or not the customer renews. But as an example, time to value, time to deploy is directly related to the consumption curve of a company. If you get six months of extra consumption because you deployed six months faster, you're really drastically pulling your revenue forward. They're not just paying you the subscription regardless of what happens or not.

Kevin Liu:

So then there are things you can do from a pricing and packaging point of view to really solve for some of these things. Let's say you're a product that has really complex product to deploy. Maybe in year one, you charge a services or platform fee. The point is that all of these things really are different between the prior model. And when someone is thinking about how to change their pricing and packaging, they really need to be thinking about how they account for not just like, "How am I going to change the spreadsheet, the calculations on the pricing and packaging model?" But actually how every single part of their business changes.

Turner Novak:

Why was this an interesting startup for you to build in the first place?

Kevin Liu:

I think it's interesting for a couple of reasons. The first is that it's tremendously impactful to companies, which is something you'll hear about when I go through the founding story. It's actually one of the most important levers a company has to be able to change their market position.

Turner Novak:

Really, change their market position?

Kevin Liu:

I'll give you a kind of story from the old days of telco pricing, which is, do you remember family plans where it's like if you and three other members of your family are on the same plan, then when you text each other, when you call each other, the phone minutes or the text messages are free. This is probably drastically dating myself.

Turner Novak:

Yeah. I mean, I swear I remember this.

Kevin Liu:

This is back in the dark ages when it cost money to call someone for some number of minutes and to text someone. Now we just get rate limited based off data because that's the new layer of abstraction. It's still consumption based, but it's all data.

Kevin Liu:

Back in the day, you were getting charged for the number of minutes or the number of text messages that you were spending. And I forget who it was, don't quote me necessarily precisely on this one. But I believe it was T-Mobile that came out with the first ever family plan. It was this concept that if you brought other members of your family onto your phone plan, you could kind of text and call each other for free. That's really valuable. The people that you probably call and text the most are your other family members. When you look at the kind of net effect, that basically gave T-Mobile some built-in virality and network effect into how customers were actually adopting their phone plans.

Kevin Liu:

I believe at the time it was Cingular that had the majority of the market share at the time. They're now part of AT&T. But when T-Mobile did this, they literally couldn't respond because their billing system didn't have the capacity to be able to make all of these family plan texts and phone calls free.

Kevin Liu:

And so T-Mobile just had this period of time where it was able to have unfettered access, unfettered competitive advantage in the market, and why wouldn't people just kind of go and sign up for that product? And so that wound up actually really costing market share for Cingular.

Kevin Liu:

Setting that story aside for a second, you kind of understand what I mean, which is if a company goes and decides to do something from a pricing point of view and the competitors can't respond either because of the underlying product, let's say Snowflake, and the fact that you could elastically expand or contract the size of your instance. Or if you can't respond because your billing system is literally incapable of doing so, that gives a massive competitive advantage to the company that's more flexible there. And there are other examples of this as well that I'll get into a little bit later, but I think that was really the first.

Kevin Liu:

I would say also, if I were to think about what personally is interesting to me as a big nerd around billing, it's really this extraordinarily complex, like this instantiation of a company's business model.

Kevin Liu:

So imagine trying to write software that can understand the breadth of what two people, two organizations can negotiate in human language. It's insane. And then you add on the data component of what we do, which is also this incredibly challenging infra and data problem as well. Huge volumes of data. It has to always be correct. It actually ends up being this world-class product design and technical problem. And this was really important to my co-founder, Scott and I. It felt like an area where you really get rewarded for good execution. So we like complex problems and we like places where we can kind of affect the outcome. And this really felt like one of those.

Kevin Liu:

And then finally, the opportunity is actually just really, really significant. If you look at some of the biggest companies in SaaS software, they were built in the revenue stack, so adjacent to or touching revenue in some way. You have Salesforce, which is sitting kind of at the front end of that with all of the opportunities. You have Stripe as an infrastructure layer. Underneath, at the end points, you have SAP with its ERP and Ledger. You have NetSuite and Oracle. These are some pretty sizable companies. Even companies that are slightly smaller but still very valuable like bill.com. It's just a part of the stack that because it's so directly tied to how companies survive and thrive, it gets a lot of attention.

Kevin Liu:

What was really strange from my point of view is you kind of look at the middle of that, which is I would say the billing system, the system that's responsible for calculating all of that. And there wasn't some gigantic obvious world beating company in the middle, which is obviously the most central and most important part. And so that really felt like an opportunity for us.

Kevin Liu:

And I think the reason frankly is because billing is really hard for all the reasons that I talked about above. But again, we were looking for something where if we executed well, that reward was really, really great.

Turner Novak:

It's kind of like you solve this, I don't know, contract legal problem. You need to solve the problem of very accurate data to understand what's going on and how to measure the contract. And then you're like a payment product also, all these different things all kind of tied in one.

Kevin Liu:

Yeah. Well, you have to at least integrate with the payment product. So Metronome doesn't force you to use Metronome payments, but it's actually... And this gets into a lot of the reasons why we built the product the way we did. But it does interface with that very, very important kind of flow of money. And what I would say, when you look at broadly the amount of value that can be created in there, that really gets into the story of why my co-founder and I actually decided to start the company.

Turner Novak:

You and Scott, your co-founder, you both sold your first companies to Dropbox, totally different companies. And actually, you mentioned you said you started this in college, and I think you said you didn't know what you were doing. So I guess question really quick, what were some of the things you learned that first time around, things you didn't know you were doing?

Kevin Liu:

I think it would've been easier to come up with a list of what I knew, because it was very short. I mean, just to contextualize this, right? Again, this is maybe dating me a little bit, but you're right. I started my first company when I was still in college. Truly had no idea what I was doing. I mean, I'd never even really worked in a professional environment aside from a handful of internships. So shout out to my co-founders from my first company, Steven and Marty, for putting up with me. It's just wild in retrospect how little we knew about starting companies, and we still figured it was kind of worth a shot anyway.

Kevin Liu:

And again, just to contextualize, back then seed rounds were very small. They were probably on the order of 500K. The understanding of SaaS as a space was near zero, and the understanding of even startups as a space was near zero.

Kevin Liu:

I mean, to give you some context, I don't think product-market fit was even a phrase back when I started my first company. No, it was all Ramen profitable. Steve Blank Four Steps to the Epiphany. It was a very different set of knowledge and wisdom at the time. YC was like 10 companies. It was just getting started.

Kevin Liu:

And so it was really a totally different frame of reference. You really only started companies if you felt like you could do nothing else or if you could literally do nothing else, you just had no other options basically-

Turner Novak:

No one would hire you.

Kevin Liu:

Yeah, exactly. And so we had gotten into this great summer fellowship program that was put on by Lightspeed Venture Partners. I think it was called the Lightspeed Summer Fellowship. And the requirement for the program was that you had at least one person that was still in school. All three of us were still in school, so that's what made us eligible.

Kevin Liu:

And we were kind of very relieved that we were going to be able to focus full-time on starting a company instead of going and trying to find an internship at Goldman Sachs or whatever it was that would've been the alternative.

Kevin Liu:

And so the thing I remember, just to give you a sense of how little we knew, my co-founder on that first company, he had worked briefly at Amazon. And the idea was that Amazon had had all of these really, really exciting and interesting data science tools to help with their analytics, pricing and packaging.

Kevin Liu:

He came with this idea, along with myself and our third co-founder, that we should try and develop that tooling and sell it to other businesses, primarily e-commerce companies, because they were going to need it in order to be able to compete with Amazon.

Kevin Liu:

And I remember sitting down with Steven and Marty, and we were kind of going full steam ahead on this idea. And then I was like, "Whoa, whoa, whoa, whoa. Guys, hold on a second. We haven't really done our diligence. We haven't thought about other things that we might build. We're going to work on this for the summer, but maybe this turns into something quite a bit bigger, so we should think a little bit harder. Let's step aside for 15 minutes and then come back and see if we think of anything else."

Kevin Liu:

So we all stepped out, we came back. 15 minutes later, no new ideas. "Okay, great. Let's do it." That was the entire process. That was the diligence. That was the entire process. We really did not know even the basic building blocks of how to do customer research, understanding the buying process and budgeting for purchasing software. We didn't know very much at all, again, because none of us had ever worked in those environments. And so with Metronome, that diligence process was much deeper, both on the idea and on each other.

Turner Novak:

Yeah. How many ideas did you guys come up with?

Kevin Liu:

It was probably on the order of dozen or so that we seriously considered, and we really went deep on a handful. There were a lot of spaces that we explored. So the context here, Scott Woody, my now co-founder and the CTO of Metronome, we became really good friends because we both had started companies and sold them to Dropbox. A mutual friend who is now our head of finance at Metronome connected the two of us and said, "You're both huge nerds. You're both recently acquired founders at Dropbox. You're going to get along great." And he was right.

Kevin Liu:

And so Scott and I became friends almost immediately after I got to Dropbox. He had been there just a little bit longer than I had, and so he kind of knew a little bit more about what was going on.

Kevin Liu:

We knew that we wanted to start a company together, but we didn't know when. And then eventually, I left the company, left Dropbox. And we came back and started looking into ideas together over a period of I want to say well over a year.

Turner Novak:

What was the timeframe between meeting and then deciding or starting a company?

Kevin Liu:

It was a long time. So we met in 2014. I left Dropbox in 2016. I was doing some advising and stuff on the side. I wanted to get a little bit more context on other companies. Basically, I'd only ever worked at two. It was just my own startup and Dropbox. And so Dropbox definitely taught a lot with respect to how companies functioned and how to hold a high quality talent bar. But we started Metronome I think about three years after I left Dropbox. So 2019.

Turner Novak:

So you hadn't known each other for about five years?

Kevin Liu:

Yeah, about five years. But for many of those years in between, we'd kind of just come together, sneak into the Dropbox offices somewhere, and go and kind of whiteboard out ideas or something after hours. Or we'd go and kind of grab lunch outside of work, and talk about different things that we could potentially work on together.

Kevin Liu:

And so there was definitely a lot of interest, but it was part timing and part finding the set of things that we were really excited to work on together. And also, because we'd started our first companies already, we really wanted to do that diligence on each other. We knew how intense of an experience it was, and that just because you were friends with someone, that didn't necessarily mean that you were going to be able to work well together.

Kevin Liu:

So actually, I remember one very memorable time, we were thinking about doing some sort of idea related to small businesses. I don't even remember what it was at this point. We were just like small businesses seem like an interesting area, they're underserved, but we don't know anything about small businesses. How do we learn?

Kevin Liu:

And I remember this was the moment when I was like, "I really think we can work well together." Because we decided that to learn about small businesses, we would drive to Milpitas, which is kind of this more suburban area in the San Francisco Bay Area. And we bought a box of Krispy Kreme donuts, and we decided to go around door to door knocking on doors pretending to be Stanford grad students, working on some sort of project related to small businesses. And we'd offer people donuts in exchange for doing a user research interview with us.

Kevin Liu:

The goal that we set, and this was the thing that I thought was really important, our goal was to get rejected 50 times. So we weren't stopping until people had said no and shut the door in our face 50 times.

Turner Novak:

Okay, that's actually probably a good idea. Because you're probably going to hit that eventually.

Kevin Liu:

100%.

Turner Novak:

You're going to hit that eventually.

Kevin Liu:

And we got some bites. But I think the important thing in that process was you can kind of go through this pretty uncomfortable, not always the best experience with someone. And to know that you're going to really enjoy it, you're going to get a lot out of it, and that you're aligned on always doing what's best regardless of how fun or not fun it was. It wasn't fun to get rejected 50 times, although we kind of tried to make it fun.

Kevin Liu:

We did a bunch of values diligence on each other. This is something that I always try to advise other founders on when they ask about how to think about figuring out whether or not the person that they're working with is the right one. Understand what it is about each other that makes you want to work with each other, and see if that aligns you to a core set of values that you can both get behind, that are representative of the type of company that you want to build.

Kevin Liu:

Among other things. You have to have all the hard discussions, who owns what, what is your role as the company evolves. But being able to have those hard conversations and being able to then, when you disagree, figure out a way to work through it, I think was actually pretty critically important. We kind of took our time. It was a better part of the year doing all this diligence on each other.

Kevin Liu:

And then we finally ended up on Metronome. Sorry, this was very roundabout. But we got to Metronome because we had looked at all these different spaces that were kind of far afield. And I think it was an important part of the search process. We were just trying to convince ourselves, look, we've both been in SaaS our entire careers. Are we just doing that by default, or do we actually believe that that's really the type of company that we want to build?

Kevin Liu:

And so we started from what we knew, and that was kind of the point that unlocked everything. I think we found that when you were trying to get up to speed on new things, it was really hard to just build up the level of conviction that was necessary to go all in on a new idea, especially when you're a second time founder.

Kevin Liu:

I call it the second time founder syndrome, but I'm curious if you've ever seen this with the other folks that you've interviewed. But oftentimes when you start a first company and then you go and start a second company, you're in the diligence process for the second company trying to solve for every single thing that you were worried about or that you didn't like from the first company, even if it's not possible.

Kevin Liu:

And then what you eventually realize is that that's not feasible. All good ideas have warts. They all look really bad in some kind of way. Who the hell is going to get into a stranger's car and pay money for it? Is kind the classic example. Why would-

Turner Novak:

Stay a stranger's house, Airbnb.

Kevin Liu:

Yeah, yeah, yeah. And those are the classic examples, but even every SaaS company, you can come up with probably close to a dozen reasons why it won't work. I'm curious if you've seen other founders fall into that trap as well, but definitely it felt like that for me, because at that point, I was almost three years on from my first company. And I was just finding all these reasons to rule out every single idea that I came across, because it didn't quite fit.

Turner Novak:

I've definitely seen it. And I see it a lot, is investing in startups. What have I seen people struggle with and fail, selling to a certain kind of customer, or these sales cycles are really long, or the contracts are never big enough in this certain industry. And it's usually, you learn firsthand from some big mistake like it's hard to sell to hospitals or something, or the contract, the ACVs and selling to small businesses, they're never big enough, so you need to make sure your CAC, and payback period, and sales velocity is very quick, otherwise it's not going to work.

Turner Novak:

I mean, I think it makes sense though as a second time founder. It's like where did you fail the first time, and you're trying to solve for those risks and de-risk it the second time around.

Kevin Liu:

But the secret is there is no way to de-risk everything. And this is actually, I think the superpower of first time founders is that they don't have that baggage. I won't go so far as to say as this is the right solution for everyone, but to me it was really getting back to fundamentals. Getting back to something that we understood really, really well, and that being the thing that kind of put us over the edge. Even though there were a dozen objections as to why Metronome wouldn't be successful as a company, we knew that space well enough to be able to find the through line, the thing that would convince us that this was going to succeed.

Kevin Liu:

And so what happened there was really, I think a lot of credit goes to Scott. He had built the growth and modernization engineering team at Dropbox. I'd done some stuff that was kind tangentially related. The first company was in analytics and pricing, and so I had some familiarity with it, but I wouldn't have called myself a billing expert to begin with.

Turner Novak:

Is anyone a billing expert? I don't know, maybe you are now.

Kevin Liu:

Yeah, I think it kind of requires you to live and marinate in the context for many, many years. Again, it's so complex. But Scott had kind of built this team. It was this really important piece in Dropbox's growth from about 200 million to I think 1.6 billion in ARR. He found over and over again, and I kind of had seen much of the same, but so many strategic decisions were just gated on the billing system.

Kevin Liu:

So everything from new product launches, to acquiring another company, to changing our pricing and packaging, our go-to-market motion, to expanding internationally.

Kevin Liu:

I remember one very memorable example. We wanted to expand into Japan, and that was the largest free user base for Dropbox outside of North America. So it made a lot of sense to get a Japanese, let's call it language website, and portal, and pricing out into the world. And we found that all of the pricing in our billing system was hard coded, and so there was no way to change the pricing for the Japanese launch, which then actually ended up delaying the Japanese launch until we had time to refactor the billing code. And that's a hugely impactful thing to delay, because of some sort of internal systems limitation.

Turner Novak:

It's the third-largest economy in the world, right? Something like that.

Kevin Liu:

Yes. I mean, it's really, really significant. It was a big opportunity, and it was something that was important to all the people there at the time. So I think if you look at that set of problems, it was, why in the world could you make a decision to go and launch in a new locale or to go and acquire another company, and then have that depend on an internal system, and then you have to wait to make that level of strategic decision? It was honestly through no fault of Dropbox. Dropbox had built all of this stuff during a time when a lot of it was not well understood. Again, this is the early days of SaaS. Not even clear that people back then would've categorized Dropbox as a SaaS company as opposed to a consumer company. They had to build their own payment gateway, because Stripe didn't exist at that point.

Kevin Liu:

I think this is really consistent thematically with what we hear when we talk to companies, but under no circumstances are you ever resourcing something like your billing system to the extent where it really needs to be resourced. If you're building this internally, you're telling folks, "Hey, I want you to go and just make this work for the pricing that we need to release, and you can't be the blocker for it. This has to get out the door by X date." You're never going and being like, "Here, let's put all of our most senior engineers and architects on this project, and have them design a system that can handle all of the pricing and packaging that our company might pivot into over the course of the next 10 years." That's a non goal.

Kevin Liu:

But in designing it in this very rigid, let's solve for the now kind of way, that means every time you pivot or every time you change something, you now have to go back and spend another sprint, another five sprints in order to get things to a place where you can actually unblock this new set of things. It becomes this constant drag on the system.

Kevin Liu:

And those engineers, they're fantastic engineers. There are a lot of stuff they can work on internally on the platform or on the product besides billing. We actually really, I think started with that and that feeling that this goes back to why our mission is to operationalize and accelerate. It's because we were looking at all these decisions and be like, "They need to happen faster." They need to happen more quickly, and then they need to come into being more quickly. You have to be able to operationalize these decisions fast. If you decide to change your pricing and packaging or if you decide to launch a new product, billing should just never be the long haul. And in fact, billing should try and that system of record should actually make that decision easier for you. It should expose all the data necessary or help you calculate what pricing and packaging might be, so you don't have to waste time trying to figure that out. We should be speeding up those decisions whenever possible, and helping you operationalize them more quickly.

Turner Novak:

You want your best people actually building the products, not at the end like, "How do we accept the payment? How do we charge people?"

Kevin Liu:

Not because that's not a hard problem or it's not a valuable problem, but because it's the same problem that dozens of other companies have. So why just rebuild the same thing that two dozen other companies have already built? What is the value in that?

Turner Novak:

And so I guess that comes back to one of the questions I had. I think you talked to 60 companies in the course of six weeks was when you first kind of... I guess the sprint you did when you were kind of first doing your diligence and figuring this all. Can you kind of explain that process?

Kevin Liu:

Yeah, absolutely. So this was probably one of the biggest learnings. If you compare what we did for need finding for Metronome, and frankly all the other stuff that we did before it, but it was really focused and really, really careful relative to the 15 minutes we spent thinking about other ideas for the first company that I had worked on.

Kevin Liu:

And so it was this really, really methodical process where the goal was to hit a certain level of volume, but to also keep time, to synthesize our learnings each time, and to constantly evolve what we were trying to understand. We talked about 60 companies in six weeks. This was really heavily leaning on our network. A big thank you to all the friends who were kind enough to make introductions there. And we had this two days on, one day off structure where we would interview companies for two days along a certain set of dimensions that we were trying to understand about the space.

Turner Novak:

Was it all billing? Had you guys decided billing was the space?

Kevin Liu:

At that point, we were like, we want to do the need finding process for billing specifically. We hadn't decided we are definitely going to work in billing. I think we were trying to understand the billing space more broadly. But those 60 companies spanned a pretty broad range of sizes and types, all SaaS companies. But we did this... Actually, not all SaaS companies, some of them were in consumer software as well. They were use cases for sure.

Kevin Liu:

But it was was two days on, one day off. And I think that's actually really important. Too many people get into a rhythm where it's like five days on, no days off, where you're just interviewing companies constantly. But you have to take that additional space to take a step back, and to think about what it is that you've actually learned in two days of talking to companies, and what explicit adjustments you want to make to your need finding process. That makes the next two days drastically more efficient. It makes it much more valuable.

Kevin Liu:

And so what got to, what Scott and I like to refer to it as was really kind a private glimpse of the future. And that's a super important feeling to have for a founder. That's your advantage relative to the market. You put in all that work to get to that.

Kevin Liu:

So we kind of felt two things. The first is we were getting dragged kicking and screaming in the direction of billing, almost regardless of whether or not we wanted to. People were kind of urging us like, "Okay, when are you going to build this thing that you're talking about?"

Kevin Liu:

The other thing was, at the time, consumption-based billing was not really a thing. I mean, there were companies that were on those early consumption models. You had Snowflake, and Datadog, and Twilio, but it wasn't a broadly adopted set of paradigms for software. And I remember at the time-

Turner Novak:

It was pretty easy too. It's just like Twilio, it's like an API poll, really easy to track.

Kevin Liu:

Well, I don't think the Twilio team would call it easy. I think at the time, we had gotten feedback that Twilio had something like 100 billing engineers. And this might be apocryphal, but I had heard that at some point that grew to 200. So it's not a simple problem, what Twilio is dealing with. The pricing and packaging gets very complex, even if the base metric is simplistic.

Turner Novak:

Even two though, you're talking about 200 engineers building this in a company Twilio's size. You can definitely see the value of just have someone else solve that problem for us.

Kevin Liu:

Dropbox had a team of 70 working on billing, in addition to the team of 70 working on growth and monetization that Scott was working on. That entire monetization team was massive.

Turner Novak:

And it still took them a long time to open the market, to open Japan.

Kevin Liu:

These were really complicated systems. They required a lot of work, and that grew over time. You had to hire the right people. But I think when you look at those first 60 companies, we really felt like looking at that set... I mean, I'll just give you the numbers, probably 10 or 15% of them, so call it six to eight companies had a consumption-based pricing model. But I want to say something like 85%, 90% of them had something coming. They were like, "I have this product in pipeline that is going to really drastically change how the system functions, and we have no idea how we're going to solve for it." Or, "We really need to make this pricing and packaging change, we need to sell this add-on." If you look outwardly, you're like this is just 10 to 15% of the market that is seeing their pricing and packaging get complex. And then it wasn't until you dove into it, you actually talked to everyone when you're like, everyone is actually going to have some version of this problem at some point.

Kevin Liu:

Even if the base pricing model was subscription, there was going to be some kind of add-on or something that they were experimenting with, some change to product-led growth. Something was kind of encouraging their pricing to get more complex, and they weren't sure that the existing systems that they built or that they bought were going to be a good fit for that. So that actually was really, I think for us, the learning that we took that eventually led to the seed round.

Turner Novak:

From what I saw, I think it was like a $5 million seed round from General Catalyst.

Kevin Liu:

And a lot of angels.

Turner Novak:

A lot of angels. Can you just talk us through that?

Kevin Liu:

Yeah. Our seed round was honestly a bit of a tough process initially. So what we thought was really obvious after talking to those 60 companies, I think was not obvious to everyone else. I think a lot of folks were broadly skeptical. They weren't sure whether or not Metronome was going to be a feature, or whether it was really a kind of paradigm shift for how SaaS companies were doing their pricing.

Kevin Liu:

And so we had really two components to the seed round. We had a large group of angels, and then we had Quentin from General Catalyst who led the round. Shout out to him for believing in us early.

Kevin Liu:

But the angels, I remember really trying to focus on being methodical about the angel investors that we brought on. And we actually try to make angels every single round at Metronome. I found them to be incredibly useful. This is a lot of the same advice that I give to some of the founders that I advise, but trying to find, for example, founders that are one or two rounds ahead of you who are going to give you really tactical advice.

Kevin Liu:

The truth is, in the early days, the advice that you need is probably less like, how do I tackle this big strategic question? It's more like, which HRIS do I use? Or how do I find a legal counsel that's not going to cost me an arm and a leg who's going to help me get my first customer MSAs done? So having some really tactical on the ground advice from folks is really helpful.

Turner Novak:

Did you do minimum check size or are you just like, "Hey, if you want to give me one grand, that's totally fine."

Kevin Liu:

We had an interesting strategy. Basically, we talked to the angels first. We asked them what their maximum would be. We didn't have a minimum defined at the time. And we just kind of asked them to sign off on whether or not we were interesting as a company. And then that gave us the momentum that we needed to go in and talk to the lead, and to get that lead investment figured out, after which point we kind of knew how much allocation we had, and then we right-sized all the checks. And we tried to take care of the folks who really committed early in the process.

Kevin Liu:

But I think the other thing we tried to do was we really wanted to bring on angel investors, founders, and operators who had a lot of credibility just broadly with the problem space. So folks who were founders or executives at early usage-based companies.

Kevin Liu:

So this would be like William and Zach from Plaid, Calvin French-Owen from Segment. There were a lot of folks like that who really... And later on, Armon from HashiCorp, Reynold and Ion from Databricks, really kind of bringing on founders who could tell us their story around what was painful about their experience, trying to stand all of this up from scratch. That was super helpful for us.

Kevin Liu:

And so being kind of careful and thoughtful about what areas you might help in, and thinking tactically is just advice I give to a lot of founders. If you think you are going to need help dealing with people issues because it's not an area that you're experienced in, but you don't have the capital to bring on a full-time people person early on, then maybe it's a good idea to bring in an angel investor who's familiar with that, who you can rely on for tactical advice. And just make that agreement clear and explicit upfront around what it is that you expect them to help with.

Kevin Liu:

But we eventually kind of went through that process, got to a bunch of term sheets, and ended up picking Quentin from General Catalyst who was CTO at Dropbox. Prior to that, CTO at SAP, which was another company in the revenue stack. We felt like that insight would be really broadly useful.

Kevin Liu:

And he actually hadn't even started at GC yet. He was kind of on his way over. It had been announced, but he hadn't officially hit a start date.

Turner Novak:

You didn't know if it was going to happen.

Kevin Liu:

Yeah, it was happening in the background to make it work, but big shout out to him and for all of those early angels for really making it happen, and for believing in us early.

Turner Novak:

Who were some of the very first people?

Kevin Liu:

I remember the very first check that we got, or the very first commitment we got was from a couple of people. So there was Jean-Denis, CTO over at Plaid. He was prior to that, someone we knew from Dropbox. A lot of folks from the Dropbox network. Nat Turner and Zach Weinberg who were investors in my very, very first company.

Turner Novak:

Wow. They came back.

Kevin Liu:

They came back. Despite having invested in someone who literally had no idea what they were doing the first time around, they were somehow convinced to come back. So big thank you to Nat and Zach for being amenable to that.

Kevin Liu:

But yeah, I mean it's something you learned throughout your career is a lot of the people who help you along the way are the folks that you've built up relationships with over time. Silicon Valley is not a very big place, and even the broader tech ecosystem's not a very big place. And so if you take care of people, if you do right by them, they'll come back to back you a second time or a third time when you go and take that next risk.

Turner Novak:

So raise the seed round. I think you had mentioned something about you were signing deals with customers before you had a product. How should I think about that as a startup founder?

Kevin Liu:

A surprising number of founders do that. The first thing is to take a step back and to realize that people buy software because of trust. This is broadly true regardless of what stage you're in. And all of the other process things that companies do are just exercises to help establish that trust. So RFPs, POCs, customer references, all of those are just a means to the same end, which is, "I trust you and I'm going to buy your software."

Kevin Liu:

The bad news is when you're an early stage startup with no customers, trust is in very short supply. So you don't have customers that can vouch for your product working or how good your team is, and you may not even have a product that you can demo, which is the case with us.

Kevin Liu:

The good news is that when someone's pain is acute enough, they're more willing to take a bet. They're more willing to take more risk in order to solve their pain. And that's why for me at least, early stage sales is really an exercise in just two things.

Kevin Liu:

One, it's finding the pain. So that's figuring out who is feeling the most pain around your market and your problem space. This is basically the search process for getting to product-market fit. And I mentioned this before, but you'll know it when you feel it. When the pain is strong enough, it almost is like a gravitational pull.

Turner Novak:

People want to pay you.

Kevin Liu:

Exactly. Whether or not you like it, you're going to get dragged along. And then I think the second thing is establishing trust, and you don't have much on which to establish trust in the beginning. You have to think about what you do have. So maybe it's expertise in the problem space, maybe it's a set of great design mocks, or maybe it's early funding from a top tier set of investors. You need something, like a seed that you can germinate into that trust with the customer.

Kevin Liu:

And so at Metronome, we really early on sold on just two things, our own expertise and some white papers, basically like a set of architecture diagrams and design principles. We didn't even have a demo for the very first set of customers, because we hadn't built the product yet. And we just were fortunate to have found a space where customers were feeling real pain, and to have worked with early customers that believed in us enough and were willing to take a bet.

Kevin Liu:

And so the thing that I would... This is again, very common advice that I give to founders. But I really, really urge founders to take a step back and to consider whether or not the right thing to do is actually to go and build, if that makes sense.

Kevin Liu:

I would say it's typically very common for folks to overbuild, right? It's very common for a founder to think, "Hey, if I just build this out a little bit more, it'll resonate more in the demo and that'll get us to product-market fit." And in reality, there are a lot of ways for you to figure that out or to get to that first set of customers that don't involve building the product. You can go and iterate on this thing and design. You can bring those design mocks to folks. That's much faster, and it gives you a much quicker kind of iteration cycle than trying to go and actually build and rebuild the product seven times as you're trying to find product-market fit.

Kevin Liu:

And so figuring out the ways in which you can speed up that cycle and getting to that first set of customers that says, "I care about this enough, this makes sense," I think is really helpful.

Kevin Liu:

Now, that doesn't mean that it's not a good thing to build a demo. Some things really have to be felt or seen to really kind of rock. That doesn't mean that it's necessarily the first thing that you should reach for, in my opinion.

Turner Novak:

You've said something interesting related to customer trust. You mentioned as OpenAI was scaling, I think they're one of your public customers. I think that's on the website. You mentioned not caring what your costs were to serve, and just giving them a good experience. Why did you do that? I mean, maybe it's straightforward, but that's pretty bold to just not care about yourself.

Kevin Liu:

As you might imagine, when OpenAI started really hitting their insane product-market fit, the just sheer data volumes that they were sending to us started increasing drastically. And so obviously, that cost us a lot.

Kevin Liu:

I made it super clear, and we talked about this as a company, that our effort and energy was not going to go towards going and distracting them at such a critical time with, "Now you need to go and pay us more." And instead to focus on doing everything we could to scale with them, and to keep up, and to make sure they had continuity of business, and they weren't suffering.

Kevin Liu:

I think it really goes back to one of our core values, which is being customer obsessed. I think in the long run, you build up trust with customers by repeatedly and consistently delivering with those customers over, and over, and over again. And sure enough, later on, when we went and retroed all of this with them, they told us how appreciative they were and the fact that they kind of noticed that we were one of the few vendors that didn't come out to them with arms outstretched being like, "Hey, where's the additional money?" And they saw that when other vendors were hitting major scaling problems... We certainly hit scaling problems too. I think everybody did. But how focused we were on working through it with them, and that ultimately led to a much better, stronger, long-term relationship.

Kevin Liu:

I think again, Silicon Valley, the tech ecosystem, very small place. You want to do right by customers whenever you can. And of course you have to have that level of trust established. You don't want to just give things away for free forever. But if you have that trust established and you have that right level of partnership, I think in the long run it's better for everyone.

Turner Novak:

And then what time period was that? Just curious.

Kevin Liu:

I can't remember the exact months, but it coincided with the release of ChatGPT as you might expect. Literally the data that was being sent over to Metronome increased by multiple orders of magnitude in just the span of two months. The OpenAI side of things just drastically increased. And that obviously was also just a huge amount of data net. And so there's some stuff out there, I think stories of what other vendors were feeling at the time. And I think it was really, really hard to keep up for... Anyway, it was the fastest scaling SaaS business of all time

Turner Novak:

Yeah. Or consumer business also, just zero to 100 million, whatever, I don't know, it was like a month or something, whatever their official records say. And then I think you were probably in a position to absorb. You had just sort of, I don't know, a couple months or a year before that, raised a series A, right? So you had a little bit of a balance sheet to kind of shock absorb the costs. And that was a $30 million series A from a16z?

Kevin Liu:

Martin Casado at Andreessen. Yeah, he is their GP who leads their infrastructure team. We wanted that context, because for us, the data volumes were increasing and Metronome's architecture was getting kind of increasingly complex.

Kevin Liu:

So yeah, the series A was a really interesting process for us. I would say in contrast to the seed round, people kind of got it much more quickly. We had the metrics to back up the story. It wasn't just two guys with a slide deck and nothing else.

Turner Novak:

A hypothesis from some customer conversations.

Kevin Liu:

Exactly. And so the series A was a hugely competitive and frankly stressful process for-

Turner Novak:

Stress?

Kevin Liu:

Oh yeah. I mean, I think if you talk to any founder about what fundraising is like, even the ones who do it all the time and are good at it, they'll tell you that it's stressful. I mean, it's emotionally taxing. It's a really consequential decision. And at the series A, we were thinking about bringing on a board member for the first time in the history of the company. And the way I think about board members is they're like executives, except you can't fire them. So you better do everything you can to make sure that you pick the right person. And so we had looked at a whole set of criteria. I'm not going to go all the way into it.

Turner Novak:

So what were the biggest ones?

Kevin Liu:

I think specifically for the partner, we cared a lot about partner quality. I think we probably did something like 30 reference calls on Martin and Andreessen Horowitz.

Turner Novak:

Wow, okay. That's more than I've ever heard.

Kevin Liu:

We probably did over 20 on each other firm that we were thinking about working with. Yeah, I mean, it's like what is more consequential than this decision when you're at the series A? I think of it as a really important long-term partnership. And I'm very happy about the outcome. Martin has been a wonderful partner to us, and I think it's in part because we had that level of conviction, even though it was a fast moving process. But we were looking at everything from what did the firm bring to the table, to the partner standing within the firm, to a specific type of expertise, that infra expertise was really, really important to the customers that they could bring to the table, to how they reacted with founders when maybe the going wasn't so great. Really, really important. If you just talk to someone's references and they bring you a bunch of success stories, you're probably not hearing the whole story of what it's like working with them. So we were very, very careful to kind of go through that entire process.

Kevin Liu:

I would say that was the big takeaway and the big difference for us with that series A was really thinking about who we were bringing onto the board, and what it is, what type of board it was that we wanted to build.

Turner Novak:

And then you have a really interesting, I guess philosophy with hiring... And it's not really that controversial. It's just you've said you just spend a ton of time and you put a ton of resources into finding the right and the best people. Can you just talk about your philosophy and process for doing that?

Kevin Liu:

Yeah. And so this goes back to one of the things that I'm actively doing very differently with Metronome now than with my first startup. Again, back then, we had no idea what good hiring practices were. We just kind of derived it from first principles and crossed our fingers. So I had no idea, you're just making stuff up.

Kevin Liu:

And so I think this is broadly true oftentimes of first time founders, but you're probably overly focused on doing everything yourself. And there is a lot that you have to do yourself, absolutely no question. There's stuff that you just absolutely have to do and you don't have an option.

Kevin Liu:

But with Metronome, we've always placed as much energy as possible since the beginning towards finding and hiring who we thought were the right people. And that started with the values alignment with Scott at the very beginning, and identifying the company values early, because that I think is a really, really important part of it. Incorporating that in the interview process and being explicit about how they instantiate, figuring out the bar that we wanted, figuring out what trade-offs we wanted to make.

Kevin Liu:

Oftentimes, you might be able to get that person who was really, really experienced at a large company, but maybe they lose out on a little bit of the small startup scrappiness. Oftentimes, you might be able to get that person who comes with a great deal of experience, but maybe they're not as aligned on the compensation. Maybe they need or want more compensation, or maybe they don't value the equity as much. So ultimately, every decision tells you what it is that you're filtering for and what you care about. So it's very, very consequential.

Kevin Liu:

My favorite question, or the thing that I like to do for every single person that we hired today, I'm not going to give away everything that we filter for, but I like to go through the resume and ask questions about why they took which roles, which places they felt they were the most and least successful, and why they decided to make changes in their career when they did.

Kevin Liu:

It's intentionally open-ended, but it tells you a lot about someone's intentionality. How much are they just making knee-jerk decisions versus doing things intentionally or making career decisions intentionally? What they're solving for in their career, their level of self-awareness.

Kevin Liu:

Ultimately, every person at every company is pretty different. And so just because someone was successful at one company, doesn't mean that they're going to be successful at Metronome. And just because someone wasn't successful at one company, doesn't mean they're not going to be successful at Metronome. And so I want to make sure that Metronome is a great fit for anyone we bring on board. So I try to understand them and their decision-making, what they are trying to solve for as deeply as possible. So that's been a really, really helpful addition to the interview process.

Turner Novak:

How do you think broadly about managing your time as a startup founder? And this is a question from Dimitri Dadiomov at Modern Treasury. I had to fit his question in, because he introduced us, and thank you to Dmitri for connecting us-

Kevin Liu:

Thanks, Dmitri.

Turner Novak:

Yeah.

Kevin Liu:

Honestly, that's something I'm still working at. It's probably not the thing that I'm best at. What I would say is for better or for worse, I am a highly urgent individual, and so when I see something that needs fixing or if I see something that I want to get better, the urgency level for me is very, very high, almost to a fault. It's not always distinguished.

Kevin Liu:

But what has helped is taking a step back with Scott and always aligning on what we think the most important. Being brutally honest about if we strip away every single other thing that we're doing and we're left with only accomplishing one thing in this next period of time, next month, next quarter, whatever it is, what is that one thing? And trying to focus as much of that urgency and intensity towards that one thing as possible.

Kevin Liu:

So that might be finding your first set of customers. That might be figuring out how to make sure that your first set of customers deploys really well. That might be figuring out how you want to make drastic changes to your product and your data model for this new segment that you're going into. Right?

Kevin Liu:

We recently, I would say about a year ago, started really seeing success selling into the enterprise. We recently announced Nvidia as a measure room customer. That requires a lot of intensity and focus on the product. We have a lot of mid-market and startup customers as well. And luckily, we've raised quite a lot of capital. We've been able to grow the company quite a bit, and so it's not as much of a problem to make sure that we can support them. But that's really, really important for us to find that side of things that we need to focus on at any even point.

Turner Novak:

If I'm a founder trying to figure out my pricing model, what's usually the journey look like? What do you usually tell founders to explore?

Kevin Liu:

Yeah, so I think one thing that's really important to understand is your initial pricing and packaging model is likely to change a lot. Very, very frequently. It's going to change a ton, and it's going to change often. Because when you first start out, you have very little of the customer feedback that's going to help shape the pricing model later on.

Kevin Liu:

And so I broadly have three points of advice for folks. I find that most commonly, if someone is screwing something up, it falls into one of these categories. So I try to give this set of advice and make sure that they're doing at least the base set of this.

Kevin Liu:

I think the first is looking at your comps. So pricing and packaging is contextual. You're always going to be compared to something, right? Direct competitors, better established companies in adjacent industries. How much comparison is usually dependent on industry maturity and what other products your buyer is familiar with. But your packaging and your pricing has to be compelling given that comparison. And it can't be too divergent from market norms, or else a customer is going to look at that and get this weird feeling that it doesn't align with what everyone else is doing.

Kevin Liu:

The second is building for change. I think this is actually a really common mistake. Folks will oftentimes overbuild when they're really, really early stage, or they'll build on something that's really rigid. They might custom engineer their first billing system. But because you're frequently iterating on pricing and packaging, it takes time and effort to converge on the right mix.

Kevin Liu:

So custom or bad billing setups actually inhibit your iteration, which is actually the most important thing you have, being able to iterate quickly on your pricing and packaging. Because you're actually having to put in more engineering work every time you make a pricing change or every time an enterprise customer comes to you and is like, "Hey, I'll sign and I'll give you that seven figure contract, but I don't like your metrics and I don't like how your pricing structure works. And we're going to rewrite the entire thing." And you're like, "Oh shoot. How do I do that? I guess we're going to use a spreadsheet."

Kevin Liu:

So making sure that you know that change is going to happen, that you build for that in advance is really important. And then finally, just making it understandable. So it's really easy to come up with a list of 100 things you want your pricing and packaging to optimize for. I need it to be a smooth on-ramp into my product, and I want to make sure that it encourages an upsell at this point, and all that kind of stuff. But it's much harder to pair that down to the handful that you actually need.

Kevin Liu: