🍌 Emerging Managers are Not OK

Exploring the Q1 '23 emerging manager report, plus free TV's, Instagram's text-based app, the largest fast food chains in the US, and fake GitHub stars

Hi everyone 👋 Turner back again with The Split. Welcome to the 500+ new subscribers since last week’s piece on how Google’s products are evolving.

Signature Block just published a fascinating report on the state of emerging managers in venture capital. It paints a grim but hopeful picture, and I’m digging into the results below.

Keep reading for a new, free smart TV brought to you by the founders of Pluto TV, Instagram’s new text-based app, a visual of the largest fast food chains in the US, and exploring the dark market of fake GitHub stars.

A Message From Create

💪 The World’s First Creatine Gummies

Over the past few months I’ve watched my friend Dan McCormick (of Not Boring fame) launch and scale his creatine gummy brand, Create.

Creatine is scientifically proven to increase strength, improve muscle recovery, reduce fatigue, and enhance athletic performance. Used correctly and in moderation, it can boost muscle mass. It works, and it’s safe and recognized as such by the FDA.

Creatine isn’t for everyone, and I personally haven’t used it since it was a small part of a pre-workout I used in college. But I remember how chalky and gross some of the mixes I tried were. And Dan’s created a tasty gummy now used by 8,000+ customers. Plus, he’s tweeting publicly about building the company.

Tap the button below for 20% off your first order with the code intro20

Exploring The Q1 ‘23 Emerging Manager Report

Signature Block just published its inaugural Q1 ‘23 report on the state of emerging managers, which are venture capital firms investing their first or second fund. The survey of 215 investors had lots of data around their experience, fundraising, investment strategy, and market observations.

If you’re into this, I recommend reading the full report here. Now on to the points that jumped out to me.

91% of emerging managers are finding fundraising difficult or very difficult

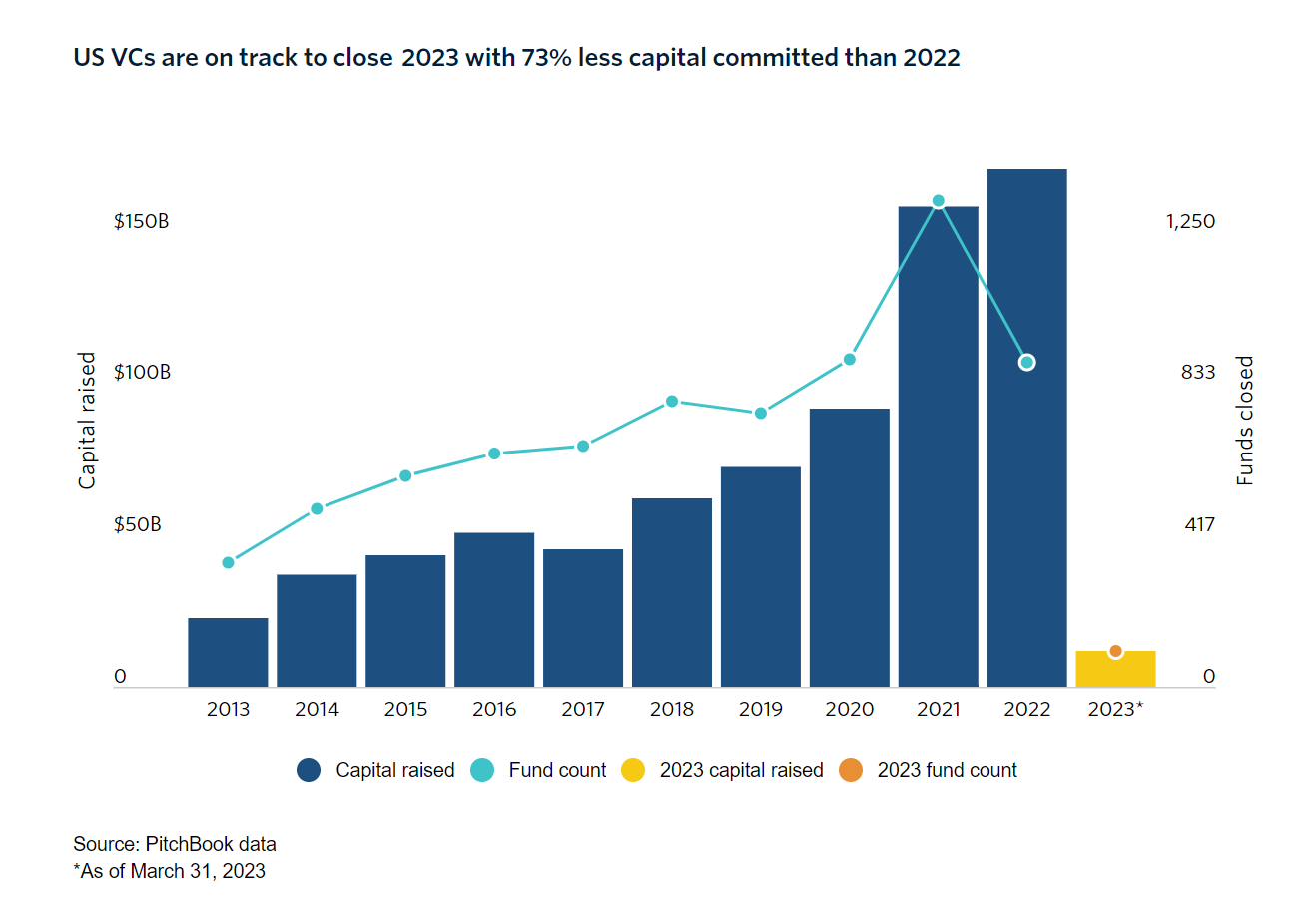

This tracks with what I’m seeing anecdotally. I shared this chart a few weeks ago on the current pace of fund closings based on Pitchbook data, which I think is deceptive:

A majority of the funds Pitchbook reports were closed in 2022 were mostly committed in 2021 and Q1 of 2022. Since then, the market has been almost completely frozen amongst some large institutional LP’s. Many of the new funds being announced recently (and showing up in the 2022 and 2023 data) were technically raised quite awhile ago. In fact, a common strategy for anyone raising capital is to announce the prior fundraising event when you start the next one…

If you look at startup exits (liquidity events), they’ve been practically non-existent for the past six quarters. These startups exiting and returning capital to VCs and their investors (LPs) is typically what funds the majority of capital being invested into the venture capital asset class. But who can blame them? Valuations are down significantly since 2021. It also means valuations are down in other asset classes, which institutional LPs will likely need to sell in to make new venture investments.

None of this bodes well for emerging managers. It’s the riskiest sub-asset class within venture capital, of which is one of the riskiest asset classes. This makes it very impacted during funding pullbacks.

There is good news though, as three private venture-backed companies (ByteDance, Stripe, and SpaceX) alone are probably worth somewhere between $300 to $500 billion in total today. If even 20% of that value is re-invested into venture, that represents at least $60 billion in capital waiting to be redeployed. This could get us to back to 2014-2017 levels.

32% of emerging managers have decreased their target fund size

Anecdotally, this seems very low. Part of it may be the sheer will and determination to stick with it through tough times. But it may also reflect responses from managers who haven’t fundraised within the past year.

One thing I saw very frequently was emerging managers that just stopped fundraising entirely last year. I know many that had sizeable commitments by Q1 of 2022 and simply closed the fund when the market dried up. This could match with the 59% that aren’t currently raising and don’t plan to within the next 12 months in the report.

Only 26% of the survey respondents were or plan to remain solo GPs

This goes against what many believe to be a large, underlying trend in venture. The reality is, raising a fund is hard (let alone also investing, managing, and exiting a fund), and it’s generally easier to do it with other partners that are equally as committed and experienced.

One reason solo GPs might seem more prevalent than they are is due to the nature of how it works. As an extreme example, there might 20 investors at one firm and 20 solo. It’s 40 investors total, the world sees 21 unique venture firms, and 20 of them are solo GP’s.

67% saw valuations decrease in Q1, while 78% saw more or the same deal flow

This aligns with what I’ve seen in AngelList’s public data. Valuations in the top 10% of companies came down throughout Q1. They proceeded to bounce back in Q2.

Similar story at Seed, valuations on the highest valued rounds came down noticeably throughout Q1 (before also trending back up again).

I wonder how much of this was SVB related?

Biggest Challenges: Fundraising and Deal Flow

61% of respondents said fundraising was their biggest challenge, and 67% said introductions to potential LPs are most helpful to them right now. This shouldn’t be surprising based on some of the other data above.

39% said their biggest challenge was not seeing enough high quality startups, and 15% said more deal flow would be helpful. In aggregate, emerging managers feel like they’re seeing good opportunities.

AI is Overhyped, Longevity is Underhyped

49% said AI and ML is the most overhyped space currently. This is within good reason: artificial intelligence can help companies generate more revenue and cut costs. Web3 and climate tech were seen as the next most overhyped, which anecdotally matches what I’m seeing as early stage valuations in both areas don’t seem to have come down much.

Opinions on the most underhyped areas were more diverse. Longevity took the lead with 8%, and I personally could believe this as I don’t think I’ve ever heard anyone talk my ear off about extending my life expectancy. I’d be curious to know how exactly everyone voted on this one.

All said, it’s fascinating to see how emerging venture managers are thinking. I’m crossing my fingers they keep publishing these quarterly.

The full report has 10x more data than I highlighted - check it out here.

🚀 Product Launches

OpenAI Launches Official ChatGPT App: With dozens of copycats using their tech already in the app store, I’m fascinated to see how well this does. It feels like a very big step in how powerful its consumer product can be.

Photoshop Launches Generative Fill: The feature beautifully incorporates generative AI throughout the product. I’d recommend watching the example video below, which shows how easy it is to select a portion of an image and edit it with a simple prompt.

Telly Launches a Free Smart TV: The catch? You have to watch their ads. The TV comes with a screen below that gives extra context (scores when watching sports), but most importantly for Telly, can show ads. I’m not sure how many impressions they can show, and they’re only releasing 500,000 to start. The CEO and co-founder Ilya Pozin previously founded the ad-based streaming service Pluto TV, which sold to Viacom for $340 million in 2019. I’d assume he knows something about TV ads.

iMessage is Now Available on Windows 11: Something I’ve been needing for years, this will save me so much time.

SpaceX Starlink Launches Mobility: The new service essentially turns Starlink’s satellite home internet product into a cell phone data provider. I haven’t used it personally so can’t comment on the quality. $250/month for 220 mpbs download speed is a hefty price, but it claims 100% coverage in every country it operates, and seems to target groups like emergency responders to start. It’s an interesting time to be competing against telecom operators like Comcast as the cable bundle finally starts to unravel!

🔗 Charts and News

NYC Passes SF in Startup Count: Between Q1 ‘22 and Q1 ‘23, 543 NYC-based startups closed a

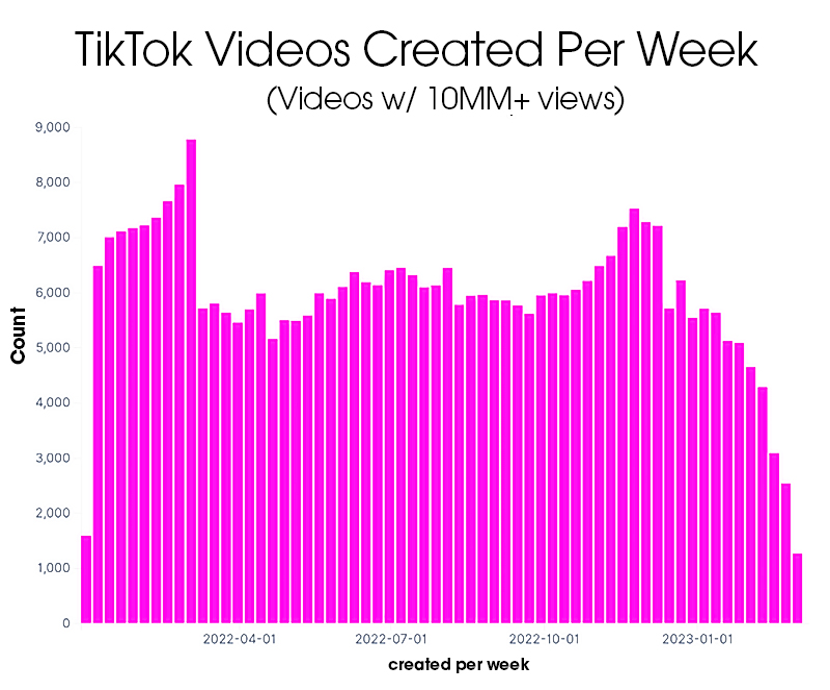

Views of Viral TikTok’s are Declining: This headline and chart might be alarming, but based on other numbers AdWeek provides, it seems clear to me that TikTok has started focusing on the long-tail of videos. This would line-up with it’s long-term ambitions to get into commerce. (IE, how many Amazon listings ever get 10+ million views?)

Instagram is Launching a Text-Based App: The app will be built on top of Instagram, and will actually sync your existing Instagram followers. I think this will be huge for kickstarting initial adoption, and was a strategy used by ByteDance in its early days. It’s also interesting that Instagram’s co-founders just launched a text-based product. h/t Lia Haberman at ICYMI by Lia Haberman for finding this.

The Battle for Gen Z’s Texts: iMessage is still king, but according to this WSJ article, it’s only used for serious conversations. They use Snapchat for everything else.

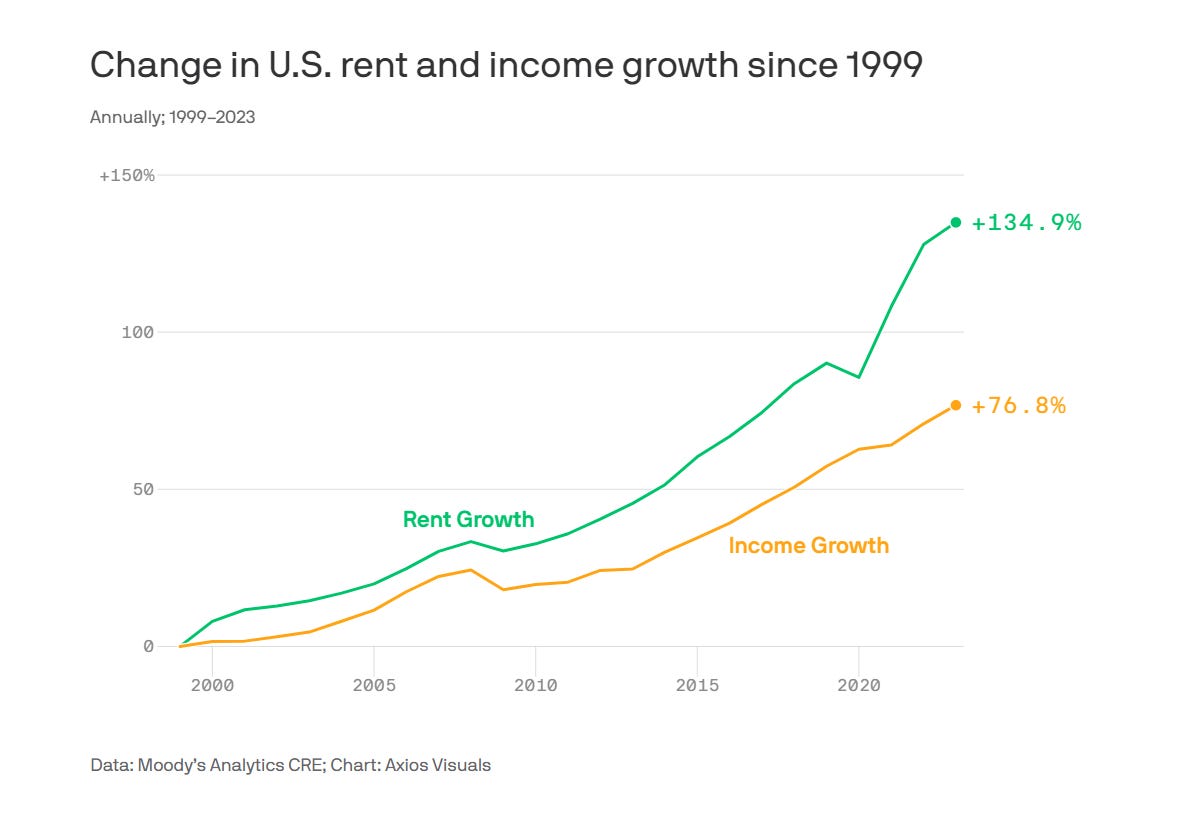

America’s Growing Rent Burden: Rent is now nearly 30% of the average consumers income. And obviously, a lot higher amongst lower income levels. This gap has only accelerated over the past three years.

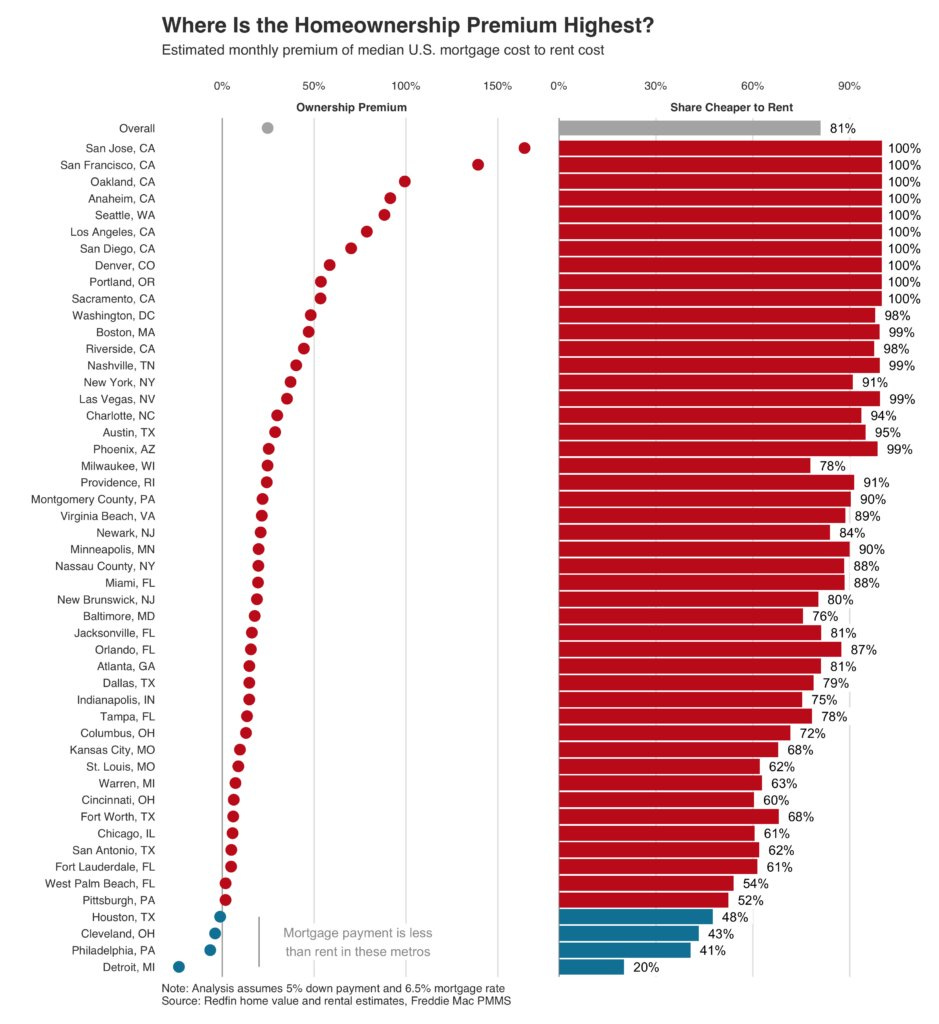

It’s Cheaper to Buy Than Rent in Only Four Major US Metros: The greater Bay Area claims the top three spots on the list. And happy to report that Detroit, the closest to me, is the best place to buy a home according to this chart. h/t Taylor Marr.

Amazon is Building Conversational Experience for Search: No announcements have been made, but someone found a (now deleted) job listing for a role leading the team. Amazon’s $40 billion advertising business is primarily in Search, and it has a lot to lose if it doesn’t adapt to how generative AI is changing the way consumers search for products and services online.

Largest US Fast Food Chains: My friend Sheel Mohnot first pointed this out - who knew Hunt Brothers pizza was the third largest restaurant chain in the US? The majority of their locations are franchised to convenience stores alongside highways.

📚 Long Reads

Michael Lewis SBF Profile Is Out October 3rd: You can pre-order Going Infinite: The Rise and Fall of a New Tycoon here.

How Duolingo Grew its TikTok to 6.6 Million Followers: The strategy was initially rooted in irony. “A cartoon mascot could never be an internet creator”. Its since evolved into a cultural phenomenon and cemented the Duolingo owl as the unofficial mascot of TikTok.

Tracking the Fake GitHub Star Black Market: An interesting analysis from the Dagster team on how easy it is to buy fake GitHub stars, which has a large influence on how most developer tools are funded and purchased. h/t Trisha Pan for sharing.

Cal Student Lives in LA and Commutes to SF by Plane: I’m not convinced this is true. But a crazy story of someone “saving money” by avoiding paying rent in SF.

📺 Video

How I Designed Fruit Ninja: A 23-minute behind the scenes look at one of the first hit iPhone apps, Fruit Ninja.