🍌 Threads, The Fastest Growing Product Since ChatGPT

The Empire strikes back. Can Meta's new app live up to the early hype?

Hi everyone 👋 Turner back again with The Split. Welcome to all new subscribers and the 22,500+ people reading each email!

Meta just launched its text-based Twitter clone, Threads. Keep reading and I’ll tell you how I’m thinking through the launch and what I’m looking for next.

(And if you missed the last piece, I wrote about Twitch’s new competitor Kick. The stakes are lower, but its equally as amusing.)

A Message From Pirate Wires

🏴☠️ A Different Kind of Media

My friend Mike Solana’s Pirate Wires is an independent media company reporting at the intersection of technology, culture, and politics.

They publish multiple pieces each week on the status of the information ecosystem, mind-bending new developments in tech, media distortion, government regulation, and a healthy dose of Twitter drama. There’s already a juicy article on Twitter and Threads waiting on the other side.

And its all free. Subscribe now and get it in your inbox.

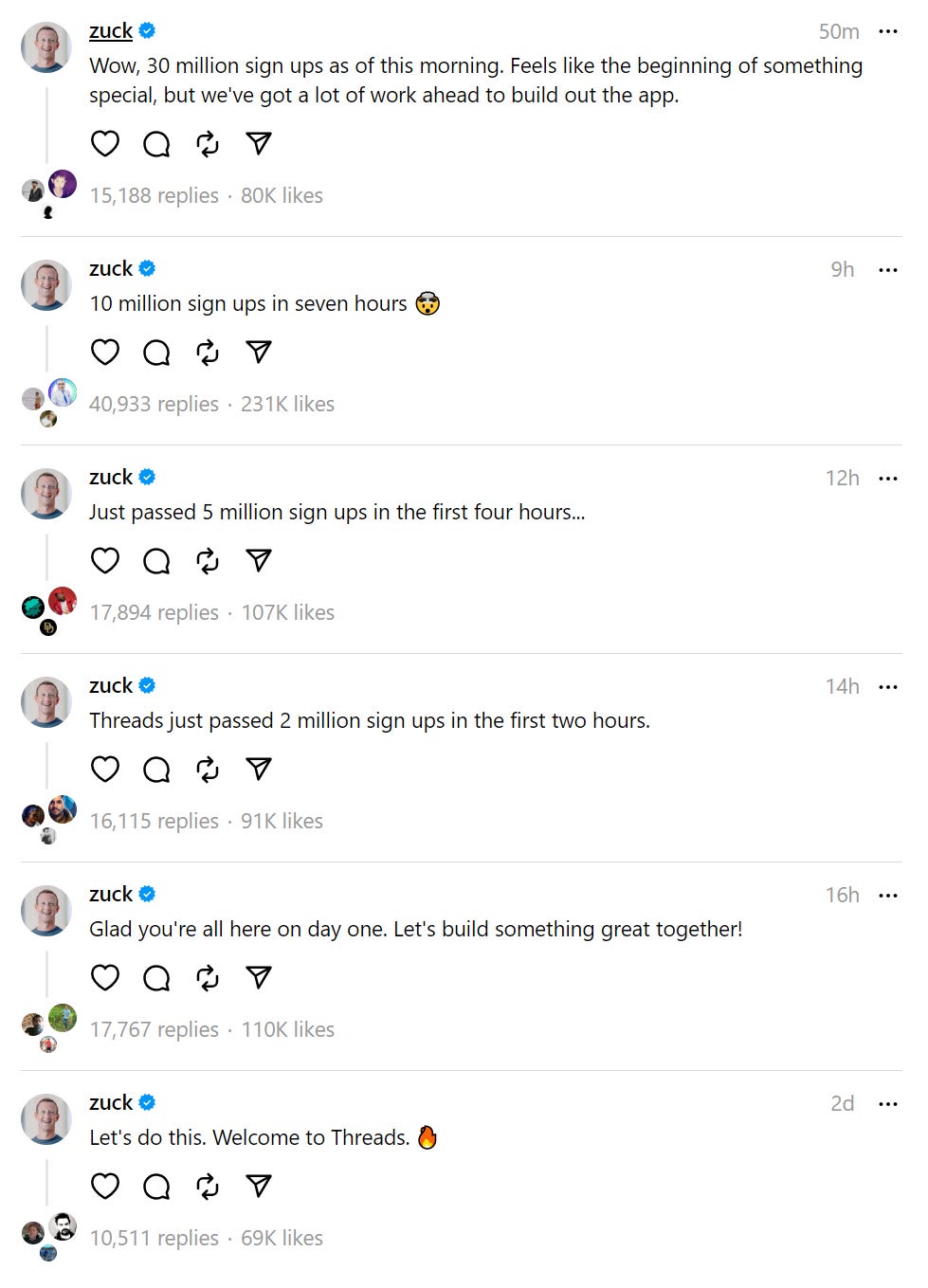

The Empire Strikes Back

Meta, Facebook and Instagram’s parent company, just launched Threads, a text-based Twitter clone. According to Zuck’s profile on Threads, it hit 30 million sign-ups in less than 24 hours, which would be 60x faster than the 60 days it took ChatGPT to hit 30 million (as I hit send, I’m seeing rumors its passed 50 million, but nothing’s been confirmed yet).

I don’t expect this to slow down anytime soon. 30 million sign-ups is a drop in the bucket for Meta at 1-2% of its multi-billion userbase. And it hasn’t even leveraged its largest product yet, Facebook

The Perfect Launch

Threads launched last night on top of Instagram’s social graph. This meant you needed an IG account to sign-up, and it pre-populated the Threads feed with every account you followed on IG.

We know Elon has been pushing celebrities who left Twitter to get back on. The problem has always been that most of them already have large followings on Instagram, and Twitter was too much work, and not to mention a completely different content format and meta game.

Now, if they do want to experiment with text, Threads gives them all their followers immediately. It was one of the smartest things Meta did with this launch, as I mentioned a few weeks ago:

What I think is most interesting is Threads automatically brings over their Instagram follower graph. For the average IG power user, this makes Threads a much better option than starting from scratch on Twitter so as long as they have followers using it. And for the average consumer, a pre-populated follower graph also makes it easier to get started.

But it wasn’t even the smartest thing they did. They also made the feed like TikTok, where the follower graph doesn’t matter, and anyone (follower or not) can potentially see any piece of content. It’s the reason TikTok was successful. Twitter started borrowing this algorithmic feed years ago, and its gotten more aggressive under Elon’s ownership.

Three years ago I wrote about how and why TikTok did this:

It went after each market's biggest social influencers, and quickly built them social capital on the app. In the early days, everyone on its operations teams was tasked with roping in influencers (and long-rumored to have found ways to pay them to post)…

Deliberate product decisions compounded this process. Extremely short videos, algorithmic discovery on the FYP, the muted importance of a follower graph, and constant traffic into the app via heavy marketing, cross-platform posting, promotion by influencers, and (eventually) habit allowed TikTok to deliberately control the allocation of social capital across the network to its most talented creators, both new or old, as new users poured into the app. Alex Zhu, Musical.ly founder and now Head of Product at TikTok, likens the process to creating a new country and giving a greenfield of opportunities to a new class of creators. Hyper fast user onboarding and no friend graph let it use the entirety of time spent in-app allocating this social capital. Casey Newton described this perfectly:

"In previous eras, most of the spoils went to the platform’s earliest adopters - mining value gets harder as the platform ages. TikTok, on the other hand, promotes all content regardless of who made it or how many followers [social capital] they have."

In business, superior distribution (reach with customers, users, etc) usually wins in the long run. A common way to beat a competitor with a distribution advantage is to build a better product that eventually surpasses their distribution. Despite fewer users, the product decisions above gave new TikTok creators instant distribution advantages over existing platforms. This was similar to when Instagram added Stories and gave creators instant distribution advantages over Snapchat. Creators with ~100k followers on Snapchat eventually switched to posting the same content for their ~1 million followers on Instagram. On TikTok, the best videos could instantly reach the entire user base.

The hardest part about building any new network is getting started - this concept called “network effects” exists for a reason. Meta strategically seeded Threads with hundreds of “Threads is coming” articles over the past two weeks. Everyone who reads the news, one of Twitter’s primary use cases, knew Threads was coming. And people could pre-install the app, meaning they’d get a push notification when it hit the app store. It also launched a day earlier than planned, creating a mad scramble to get on.

This sequence of events made the app extremely active when it launched (or at least appear to be so). And now Meta can start leveraging its superior distribution - to my knowledge, Facebook’s family of apps is the largest scaled product in the world.

Who Controls The Memes Controls the Universe

One thing to keep in mind is the Twitter and Instagram social graphs are very different. This was the primary thing I was initially skeptical of two weeks ago. I think this point is still really important, but it won’t matter soon.

Anyone who’s deep into social media strategy knows memes drive engagement across all the social platforms. This stat is a few years old now, but still fascinates me: meme content gets shared seven times more than non-meme content on Instagram. This is because memes are the universal language of the internet. They convey emotion, they cross borders and demographics, and they make complex topics more consumable for a mass audience.

There are countless Instagram meme accounts that are essentially just screenshots of tweets. thetinderblog is one of them. Here’s its six most recent posts:

Other accounts that use tweets as a popular format are HouseofHighlights (sports) and Pubity (memes). I spent about 15 seconds finding these in my own feed, there are tens of thousands of similar large accounts on Instagram. Surprisingly, both of these two already have more followers on Threads (HH and P) than they do on Twitter (HH and P). You probably see where I’m going with this.

Within a three hour span during the course of writing this, House of Highlights gained 150,000 followers on Threads compared to the 300 it added on Twitter (a few hours later before publishing, it has 764,000 on Threads). And Pubity has already passed 1 million followers on Threads compared to the 195,000 total it has on Twitter since joining in September of 2017.

As someone with over 200,000 followers and subscribers across the internet, its hard to convey just:

How big of a dopamine hit this is for a content creator, and

How impactful it is telling advertisers and partners you doubled your reach in a few months (assuming Threads continues scaling and reaches a few hundred million DAUs by the end of the year). If Threads sticks, you can bet Pubity easily doubles its revenue this year.

Threads has positioned itself to seize the memes of production. “Share to Story” and “Post to Feed” is built directly into the share button. The posts below look different than the classic tweet screenshot (Meta needs to figure this out), but its easier than creating a screenshot from a tweet.

House of Highlights is already starting to use Threads for its “Tweet screenshot” Instagram content, which by the way also advertises Threads to all its 44.1 million followers. And TheTinderBlog is starting to experiment with the same content on Threads that goes viral as a Twitter screenshot.

Building the best tool to create a specific content medium is exactly what TikTok did with video, largely to the detriment of Instagram:

Initially, many creators used TikTok to create videos to post on other platforms. TikTok forces videos to be posted in order to export them, and also inserts a watermark on every exported video. Influencers on Weibo, Instagram, YouTube, and Twitter all drove traffic back to Douyin and TikTok, whether they realized it or not. Many creators who initially used it as an editing tool would deliberately start posting more when they noticed fans started following and interacting with them on the app.

If Instagram can get its largest accounts to create content on Threads that’s easy to cross-post on Instagram, it seeds the network with content as Meta pours in new users.

Don’t Bet Against Zuck

The savviest move in all of this is how Meta’s rewarding existing Instagram power users while also creating opportunity for new ones to rise. Earning social capital (as explained in Eugene Wei’s Status as a Service) is the reason users join and contribute to new networks. Not only will accounts create content to cross-post on Instagram, they’ll create it to build social capital on Threads. And with an algorithmic feed, it doesn’t take many accounts doing this to fill the network with interesting content.

Making the follower graph instantly portable further raises the already-high bar for an Instagram account to clear in order to start on Twitter. The two apps also cross-promote each other, meaning Instagram accounts out to “stake their claim in the new country” and grab attention on Threads are also benefiting back on Instagram too. There’s no reason for them not to be using Threads.

It was also smart to hide how many accounts someone follows on Threads. Followers have historically been the universal currency of the internet, with most people aware of their “ratio”, or how many people follow them compared to how many they follow. By hiding who someone is following, there’s no focus on that ratio, and everyone is more willing to dish out follows, distributing even more social capital (and dopamine).

Threads isn’t perfect. It needs a desktop product, as nothing beats a keyboard for creating text-based content (except for maybe generative AI?). The algorithmic feed is going to suck for live news and sports, however multiple major US sports league’s did just wrap up playoffs a few weeks ago. And there’s a clear lack of other basic functionality like Direct Messages. But ultimately, Zuck controls a firehose of traffic. And it can unleash that firehouse on Threads, essentially whenever it wants, dishing out social capital to whoever and whatever is necessary to build and scale this new product.

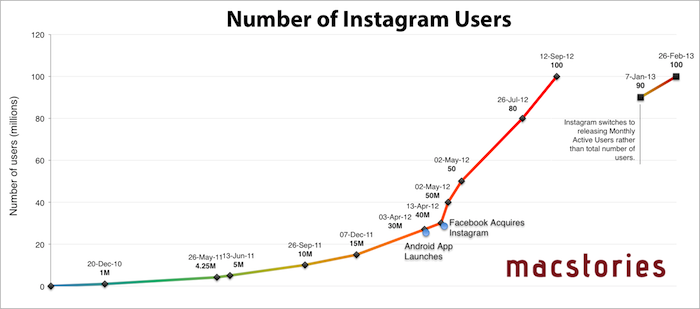

Meta is very familiar with this strategy. Back when it acquired Instagram in 2012, it favored Instagram content in the Facebook feed, helping it quickly convert new users. As seen below, it's evident that 50-75% of Instagram downloads ultimately came from Facebook in the years following the acquisition. And this was at a much smaller scale, when mobile usage was just ramping up, and Facebook itself was still converting its userbase from desktop to mobile.

If this new text-first product catches on, it also gives Meta the room to go full-TikTok with Instagram. People who don’t like it can move to Threads. And it allows Meta to not only compete with Twitter, but also Reddit, the two remaining largest text-first social networks.

Don’t Bet Against Elon

Finally, if Threads fails and we all collectively only take away one thing from this saga, make it this. The fact that Zuck is doing a full-court press with a Twitter clone means one thing: Twitter is working.

Contrary to the discourse, people are still using Twitter. And it’s growing. Elon’s making quick progress overhauling the culture from a big, publicly traded tech company to something that looks and operates more like a startup. The longer Meta lets Twitter continue getting stronger, the harder it will be to beat.

Twitter still needs to figure out what its business model will look like. Meta has over 10 million advertisers, which take a long time to acquire and that it can very easily layer on top of Threads whenever it wants to. It puts Elon in a very challenging position. He needs to decide if he wants to go head-on in advertising or figure out something else, like subscriptions. He doesn’t have a lot of time, but he’s also the richest person in the world - that’s worth something in this.

Zuck is ruthless to defend the mighty ad dollar. Specifically, US ad dollars. It’s easy to forget, but the “Ban TikTok” rhetoric popped up the day TikTok launched it’s self-serve ad platform in the US. That’s not a coincidence. After losing to Facebook a decade ago, Twitter was essentially run like a non-profit for years. Even its Stories clone, Fleets, was doing well (according to friends close to the product inside Twitter) before it was shut down in August of 2021. Now that Twitter appears to be a threat again, Zuck is back on the offensive.

Needless to say, it feels like this cage match is just getting started. I’m excited to see how big Threads get, how fast it gets there, and what happens next. 🍿

🙏 Special thank you to Josh Elman and Sasha Kaletsky for proof-reading an early version of this.

🚀 Product Launches

Inngest Launches Advanced Middleware: Inngest is a sort of “Zapier for developers”, or “IFTT for code”. It lets you set up serverless queues, background jobs, and workflows inside your current codebase without any new infrastructure. Its new Middleware feature allows you to run functions inside of other Inngest functions.

Dropbox Launches AI Search: The new Dropbox Dash extracts and summarizes data across all your files. And not just your Dropbox files - it includes Google Docs, Sheets, Airtable, Slack, Figma, Salesforce, and more. It also hinted at a new “generative AI” search tool. Neither have launched yet, continuing the trend a large companies announcing new AI features ahead of an official launch.

Shopify Releases Slew of Updates:

Collabs: Creators can search for products to earn affiliate revenue from Shopify merchants. If Shopify can make this work, it will compound the network effects that exist around all its various platform features.

Shopify Ventures: Officially announced its new venture capital fund. It highlights Shopify’s 100-year time horizon, merchant obsession, and “infinite impact”.

1-Page Checkout: Not to be confused with one-click, this simplifies checkouts for consumers and increases conversions for brands.

Shopify Marketing Tools: It brings a suite of powerful tools in-house, like automation, customer support, emails, forms, and audience segmentation. It’s essentially 10+ separate tools all brought inside of Shopify.

Canva’s New Developer Platform: This seemed to fly under the radar, but Canva just opened its developer platform to its 135 million MAUs. This is a way for Canva users to access capabilities that don’t quite fall into Canva’s product roadmap but already exist elsewhere, like 3D asset design or generative music with AI.

🔗 Stats and Charts

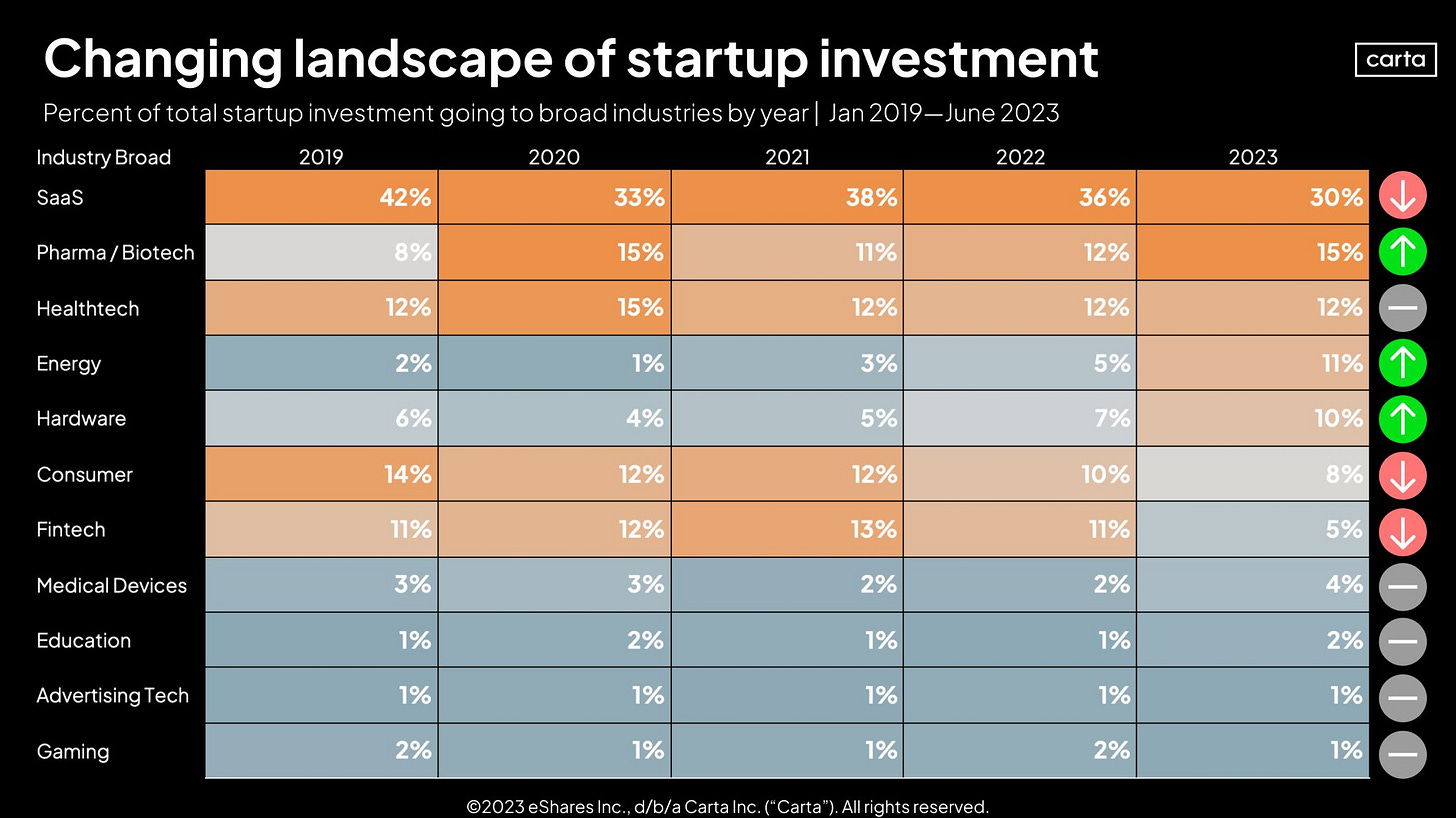

Startup Fundraising Heatmap: It feels like a crime to not include AI in this chart. I’m also wondering why crypto didn’t make it - I assume it’s fallen below the 1% cut-off?

VCs Are Buying Secondary Shares: As the market settles, investors are doubling down on their best companies. And at probably a good time - according to Forge, the median secondary transaction in May had a 61% discount to prior funding rounds.

Doom & Gloom in Commercial Real Estate: One broker estimates that only 10% of office buildings in NYC are not distressed. “In NYC, buildings are selling for less than the value of the land they sit on… we’re seeing prices lower than they’ve been in 20 years in absolute dollar terms.” Meanwhile, Blackstone says US office is now only 2% of its global portfolio, down from over 60% in 2007.

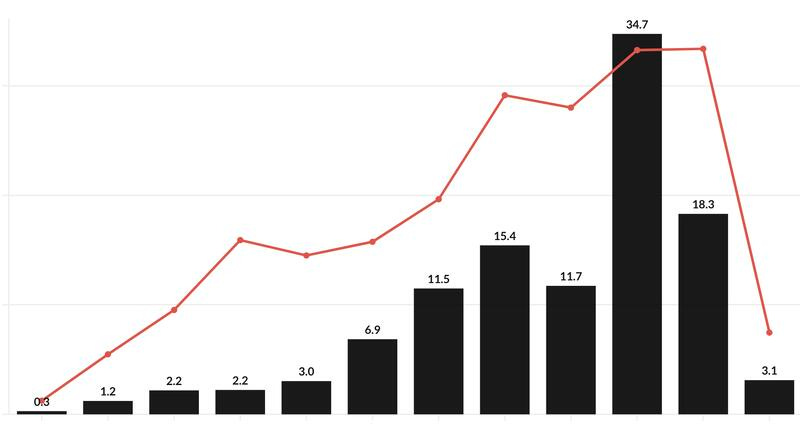

Southeast Asia Tech Has Worst Funding Year Since 2016: Following the trend we’re seeing across the rest of the world, SE Asia is no exception to a scarcity of capital (the last year is 2023 up through July 2nd).

A Pill Form of Ozempic Coming Soon: A pill is easier to consume than an injectable version, not to mention its likely cheaper to produce, ship, and store. I’m not personally aware of all the side effects, but there’s many that have been suggested. Making it more accessible is going to have a lot of second and third order effects (good and bad!).

Amazon Enlists SMBs to Deliver Packages: The move is targeted at businesses from florists to plumbers, who will deliver 20 to 50 packages per day. It appears to be targeting areas Amazon has less fulfillment coverage and currently relies on third parties like the USPS and UPS.

Amazon Adds Grubhub Perks: Prime members will receive one-year of free GrubHub membership. Amazon also acquired a 2% stake in GrubHub, while its parent company JustEat continues to explore a sale. I think I might know where this is headed…

Media’s Shrinking Profits: Over the past decade, profits are down at every media company that isn’t Netflix.

Sony’s PlayStation Relies Heavily on Call of Duty: According to leaked court documents:

14 million PlayStation devices spent 30% or more of time playing CoD

6 million spent more than 70% of time, and

1 million spent 100% of their time playing CoD

It leaked CoD generated $800 million in US revenue and $1.5 billion globally in 2021. And CoD players averaged $13.9 or $15.9 billion in total PlayStation-related spend between 2019 and 2021. Why is this important? Microsoft is trying to close an acquisition Call of Duty publisher Activision Blizzard, and there’s rumors it will make Call of Duty exclusive to Xbox, PlayStation’s biggest competitor.

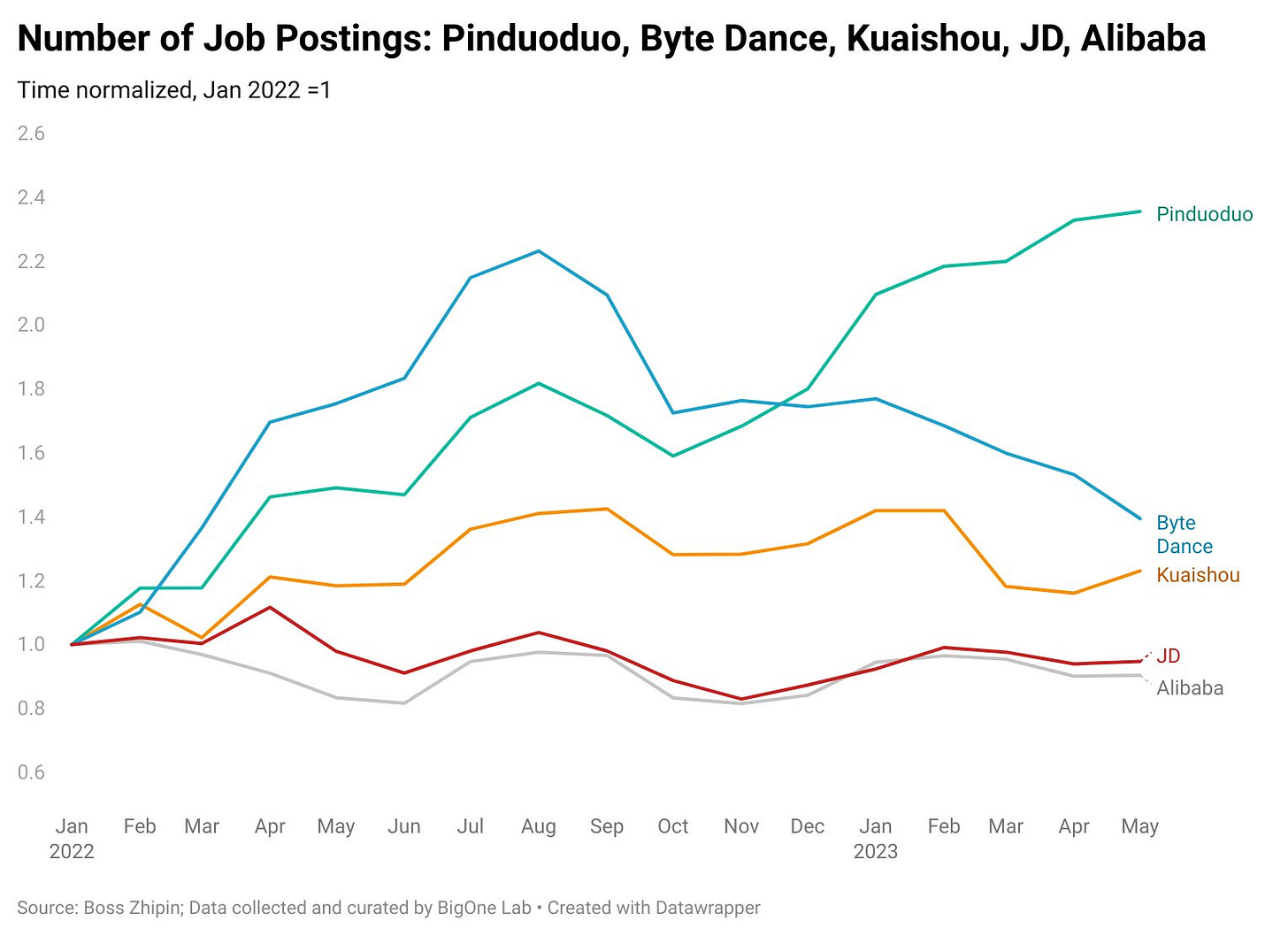

Pinduoduo Significantly Ramps Up Hiring in 2023: The increased hiring has almost perfect correlation with Temu's breakout success starting in November, with US GMV supposedly passing Shein in Q2. Temu has nearly doubled its average order values since launching, but it’s still lower than Shein and most experts are certain Pinduoduo is burnings lot of cash growing Temu in the US.

Instagram Shopping Hit $400 Million GMV in 2022 Before Shutting Down: In some bad news for Meta - despite its success, promoting Shopping it was taking too much space away from content that generated ad revenue. The in-house promotions for Shopping ultimately had poor conversions, which was because it couldn’t use Facebook’s ads data to personalize anything. Instagram also didn’t monetize from any of the commerce, and it would have if the same product was simply an ad unit in the feed.

In better news for Meta, Instagram ads now direct traffic to the sellers Facebook shop where checkout happens. This wasn’t the case pre-Apple’s ATT changes, and the material decline in ad performance after these changes gave Meta the leverage to move sellers from their own checkout experience onto Facebook’s. I think this is very smart for Facebook the platform long-term, as it gives much more data around shopper behaviors. It can also eventually use this to seed its own marketplace or ecommerce platform.

This is ultimately why I think TikTok has a chance to gain real market share in ecommerce. It has no material US or European advertising business to cannibalize compared to Instagram and YouTube, meaning it has more runway to figure out how to make people buy things from videos.

50% of Gen Z Does Most Research AFTER Buying: 79% say they interact directly with brands post-purchase to “evaluate beyond the product, to save money through discounts, to gather information, and to learn things.”

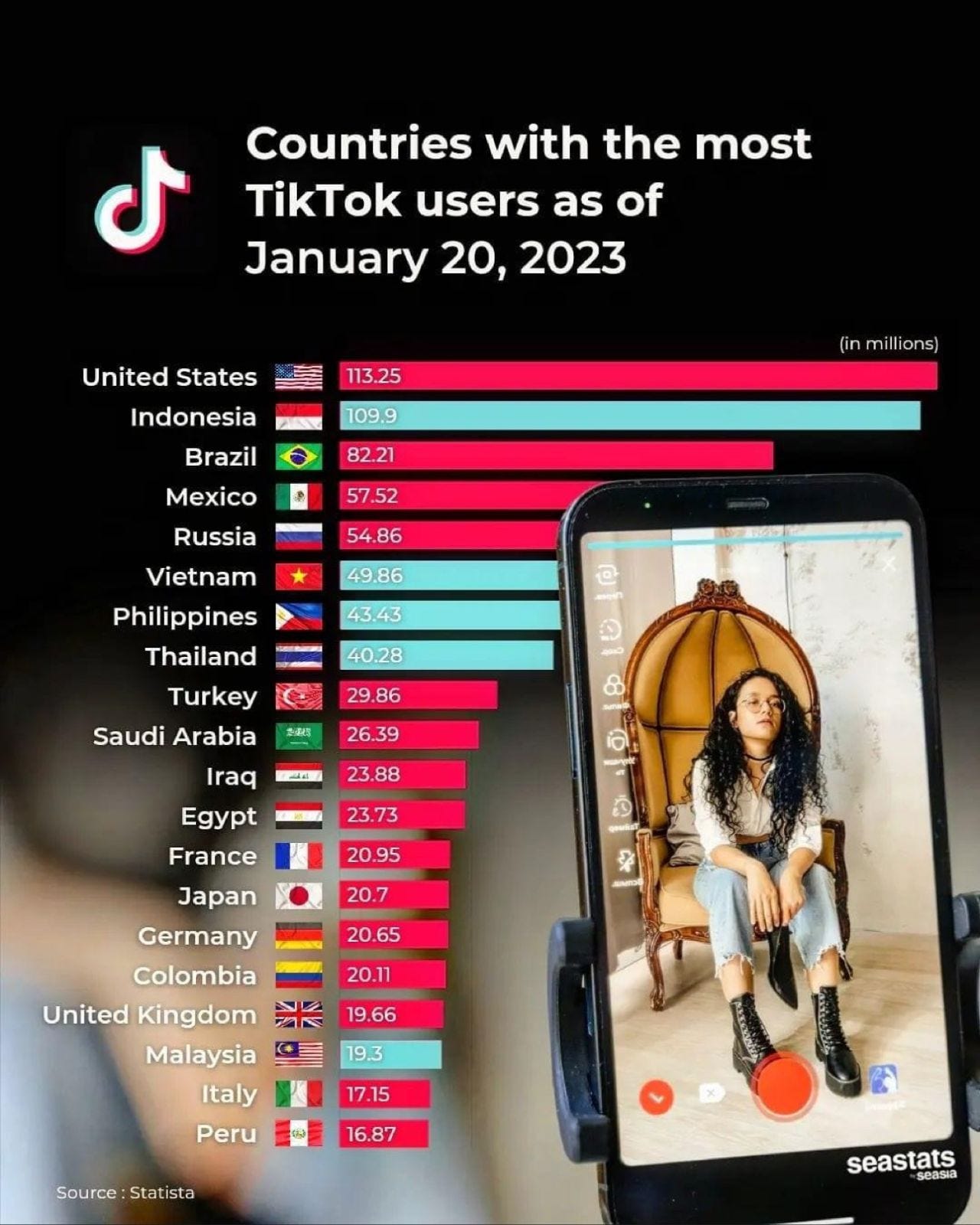

TikTok Users by Country: Indonesia is TikTok’s second largest market, and has been leading the way in ecommerce GMV. It passed $4.4 billion last year, and has projects to hit $12 billion by the end of 2023.

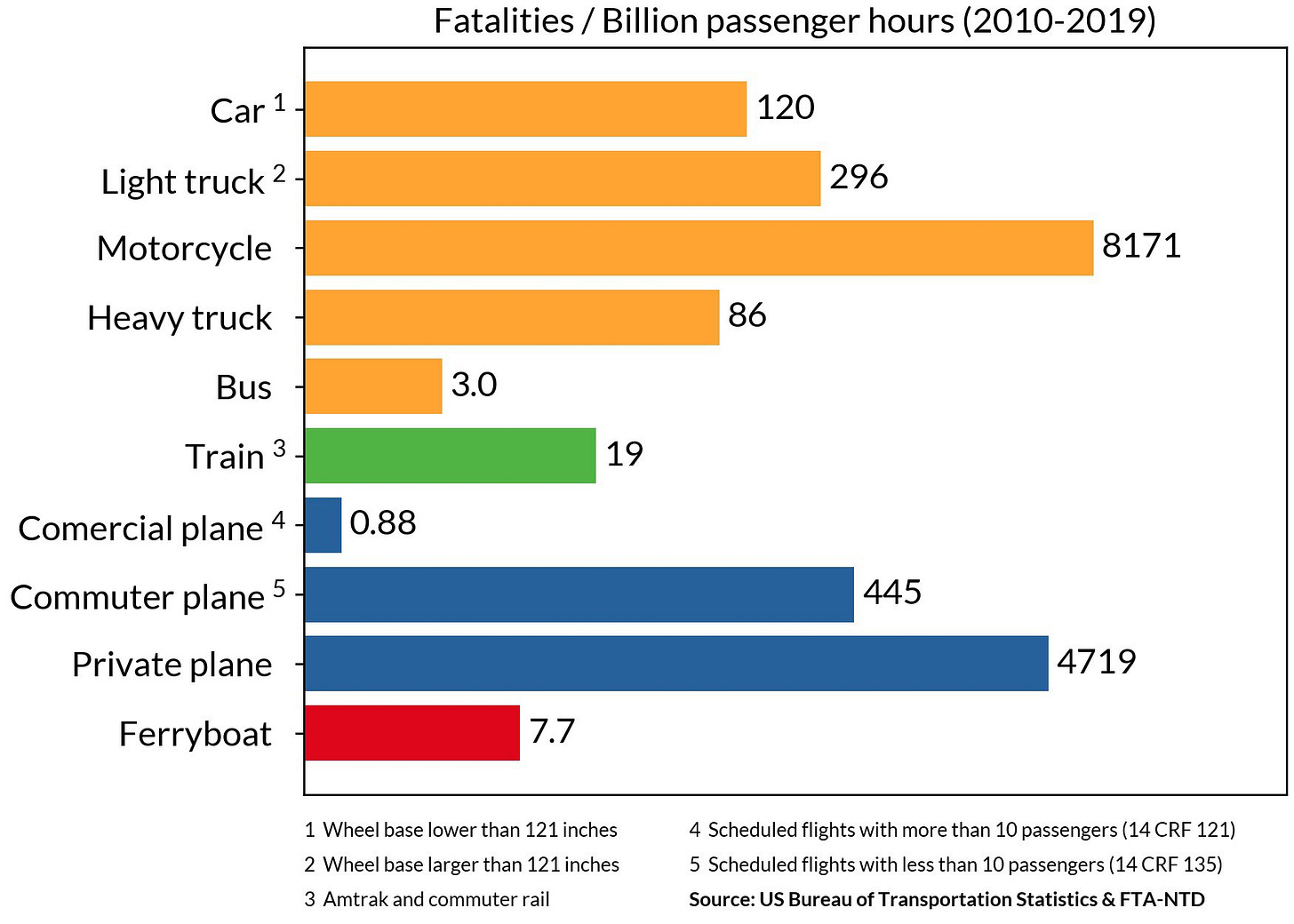

Flying Private is 5,363x More Deadly Than Commercial: Its 39x more deadly than driving a car, and riding a motorcycle is 68x more deadly than a car.

Scottish Children Don’t Like School: The drastic drop in 2022 of “pupils who like school a lot” may have something to do with the pandemic, but still a very concerning drop.

The drop also coincides with an increase in Scottish school-aged children feeling increased pressure by school work, with the number of girls feeling pressured nearly doubling between 2006 and 2022.

🔊 Podcast / Video

If you missed it, last week on The Peel I talked all things education with Ryan Delk, Co-founder and CEO of Primer.

💌 ICYMI

Other headlines in case you missed them:

UBS Says Pickelball Costs Americans $400 Million in Injuries

80% of Google’s Third-Party Video-Ads Violate its Ad Standards

📚 Long Reads

How Duolingo Grew Its TikTok to 6.6 Million: This is a great behind the scenes interview in

with the woman behind Duolingo’s social media strategy, Zaria Parvez.Temu - From $0 to $3 Billion in Ten Months: A data-driven piece on new ecommerce upstart, Temu. Some highlights:

Since its US launch in September, Temu is now in 20 countries

It’s raised its 2023 GMV target from $3 billion to $5 billion

It’s doubled its year-1 marketing budget from $1 billion to $2 billion

30-day repurchase rates were 10% in 2022 (compared to Shein’s ~30%), and have since climbed to 20-35% depending on who you ask

Average Order Value has increased substantially as its expanded into household and personal care products, from $20-25 at launch to $35-40 currently

Half of suppliers are manufacturers, half are retail liquidators. 20% of Temu manufacturers are also selling on Pinduoduo (a much lower number than I would have thought).

Temu buys inventory from global suppliers, receives it in a domestic warehouse, and then sells it (at a markup or loss) to consumers

It has high gross margins, but still has profit margins of negative 60% due to high supply chain and marketing costs

Ali Express is no longer focusing on the US due to Temu’s rise

Temu’s current product category most resembles Amazon and Shein

The Air Jordan Drop So Hot It Blew Up a $85 Million Ponzi Scheme: If you’ve only learned one thing from this newsletter over the past year, I hope it’s that I love a good ponzi scheme. This one is no different!

Over the past four years, Michael Malekzadeh’s Zadeh Kicks took “pre-sale orders” for rare sneakers at below market prices - whether he could actually procure the sneakers or not - and then would scramble to actually buy and deliver them when the shoe launched. When he couldn’t, he’d refund customers at a premium using money from new customers pre-orders.

The Man Who’s Flown 23 Million Miles: In 1990, Tom Stuker bought a United lifetime pass for $290,000. In 2019 alone, he took 373 flights that covered 1.46 million miles - which would have cost him $2.44 million if he paid cash.

His advice for travelers? “Tell the flight attendant’s you remember them from last time, switch your seat from the app as you board, and never check a bag.”

Are Car Seats Holding Back Birth Rates?: A September, 2020 paper found car seat laws saved 57 kids in 2017. It also found the laws reduced new births by 8,000, as families held off having more than two kids due to space limitations in their car.

🍌 Monkey Business

Tap this first one for the full video

❤️ Reader Love

Early reviews on The Peel are in - Trung approves!

👇 please hit the ❤️ button below if you liked this post