Welcome back! Turner here with The Split. I just moved across Ann Arbor with the family yesterday, and I finished setting up my desk as I sat down to write this.

Bloomberg just announced Pinduoduo, one of the largest ecommerce platforms in China, is preparing a US launch this September. Its unclear exactly what this will look like, but I'll break down what I know.

Pinduoduo Readies US Launch

Bloomberg reported yesterday that Pinduoduo (PDD) was preparing to enter the US market. If you're unfamiliar, PDD is the largest ecommerce platform in China by active shoppers (roughly 882 million). It was founded in 2015, IPO'd in 2018, and briefly surpassed a $200 billion market cap in 2021 before pulling back alongside the broader Chinese markets to currently trade at a $60 billion valuation.

Why did Pinduoduo rise so fast? There are many reasons, the main being it flipped the retailing model from supply-driven to demand-driven. This meant cutting out middlemen and predicting the exact amount of a product customers would order, then working with suppliers to fill that demand. This is now done through an advertising platform where merchants bid for demand to fill their excess production capacity. PDD's founder Colin Huang calls this "Consumer to Manufacturer", or C2M. As it plans a US launch, I'd expect Pinduoduo to borrow elements of its C2M model.

Pinduoduo started by selling fruits directly from farmers via WeChat text message groups, and then expanded into other grocery products. Groceries are a frequent retentive purchase, however have lower margins relative to most other ecommerce categories. PDD's initial delivery provider was SF Express, and its rumored to have received favorable terms (Wang Wei the SF Express founder was an angel investor in PDD). Over time PDD went deeper with its food suppliers, building software for them to run their farms more efficiently. PDD also expanded into community group buying, where a "community group leader" runs their own business on the platform. CGLs essentially use their home as a distribution hub and acquire end-customers, performing both the marketing and last mile logistics.

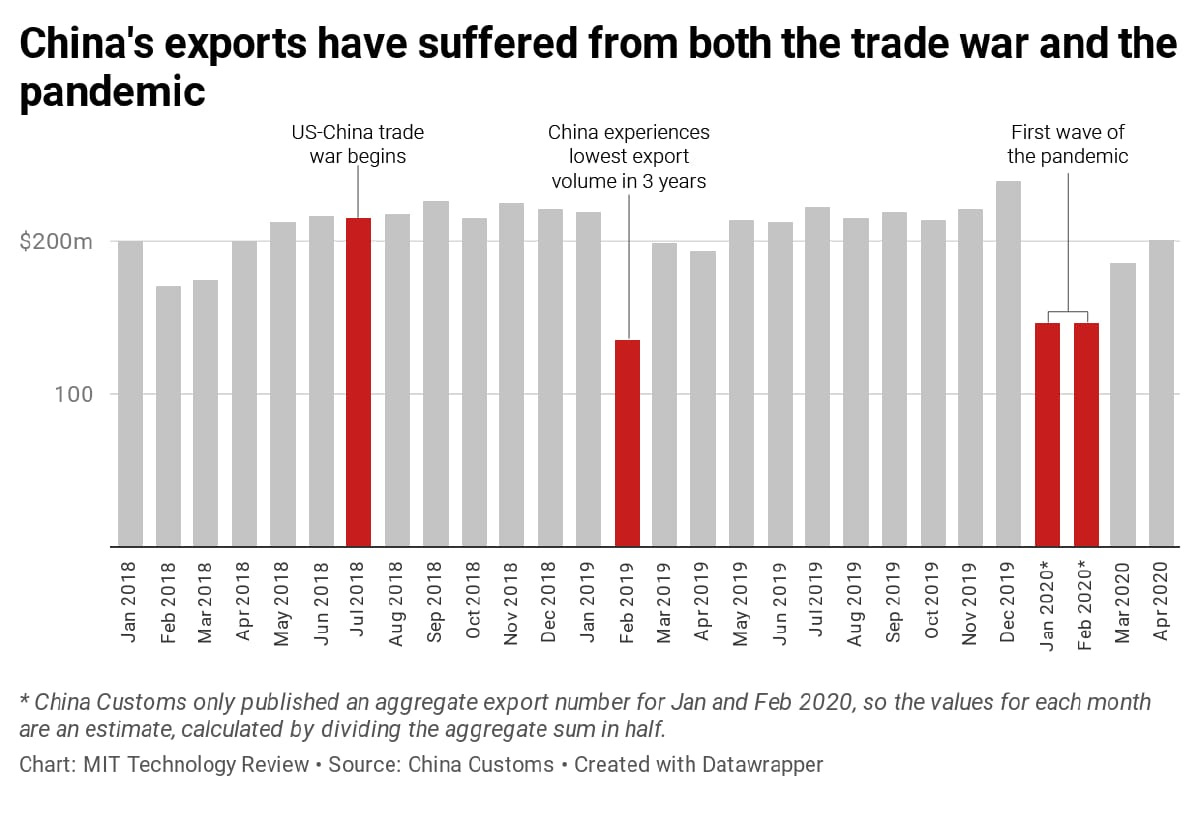

Pinduoduo eventually expanded beyond groceries into other products like clothing, household goods, appliances, and electronics. This was around the time the US-China trade war began, and PDD helped local factories that lost business selling products to overseas brands (who then marked up prices 5-10x) sell domestically. PDD eventually helped some merchants create "manufacturer owned brands".

As the Chinese economy slowed post-COVID, it's not surprising to see Pinduoduo look internationally for growth. Much of its merchant base has sold cross-border, and are likely already utilizing platforms like AliExpress and Wish to sell outside China. If PDD can successfully aggregate demand internationally, it gives its C2M model more leverage and makes it more valuable to its local merchants as it competes against Alibaba (which already sells internationally) and JD in China.

Inspired by SHEIN's success, we may see either a) a similar launch in clothing / beauty, or b) a launch category where Pinduoduo has a strong merchant base, like household goods (appliances, furniture, textiles) or electronics. The top three retailers in the US appliance market (Lowe's, Home Depot, and Best Buy) have ~72% market share. And the US furniture market is worth $227 billion, almost 5x larger than China's $50 billion. SHEIN is in these categories already, however PDD could give its suppliers more volume and pass further savings on to US consumers.

Pinduoduo will need to navigate the long lead-times and expensive delivery costs of North American ecommerce. Appliances or furniture have high Average Order Values (AOVs), which would present an opportunity for PDD's discounting + team purchase model. Beauty, clothing, and textiles would lead to faster repurchase rates that mirror PDD's initial success with grocery in China. PDD's new US offering is reportedly free for merchants, and we may see PDD lean into categories where SHEIN has lower volume. This would allow it to be much more merchant friendly.

Pinduoduo's rise in China coincided with free, uncompetitive traffic as WeChat gained prominence across the country. PDD may look for similar cheap or free traffic in the US. They're late to TikTok as SHEIN took full advantage years ago. But its possible there's still another year or so left of TikTok algorithm arbitrage. They could also leverage recent widespread adoption of Shopify by small brands to quickly onboard products and tap into their excess inventory (a space I've been personally been interested in).

No matter what happens, it will be interesting to watch Pinduoduo, SHEIN, ByteDance, and dark horse Kuaishou fight for US ecommerce market share from China.

Other Stories Worth Reading

Speaking of China, its currently going through an unprecedented 70-day heat wave. "I can't think of anything comparable to this in its blend of intensity, duration, geographic extent [equivalent to California, Colorado, and Texas, combined] and number of people affected [over 100 million].” This could be the first of more large mass-scale, climate-driven events. More from Axios.

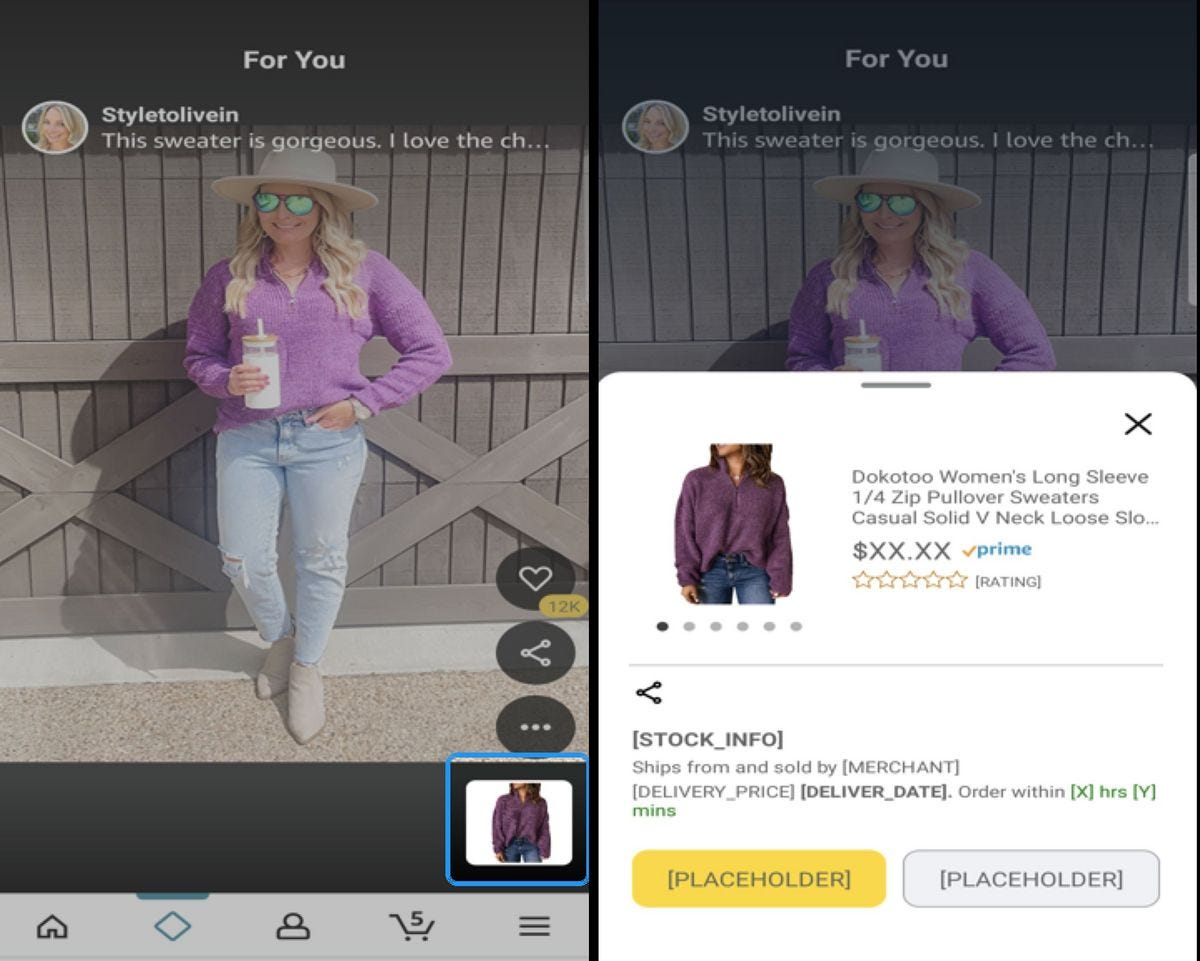

Amazon is testing a TikTok-like photo and video feed of products: Tested under the name "Inspire", it appears as an icon on the Amazon app home page. Amazon has historically not done well with the types of creator partnerships needed to successfully launch this type of content format. More from the WSJ.

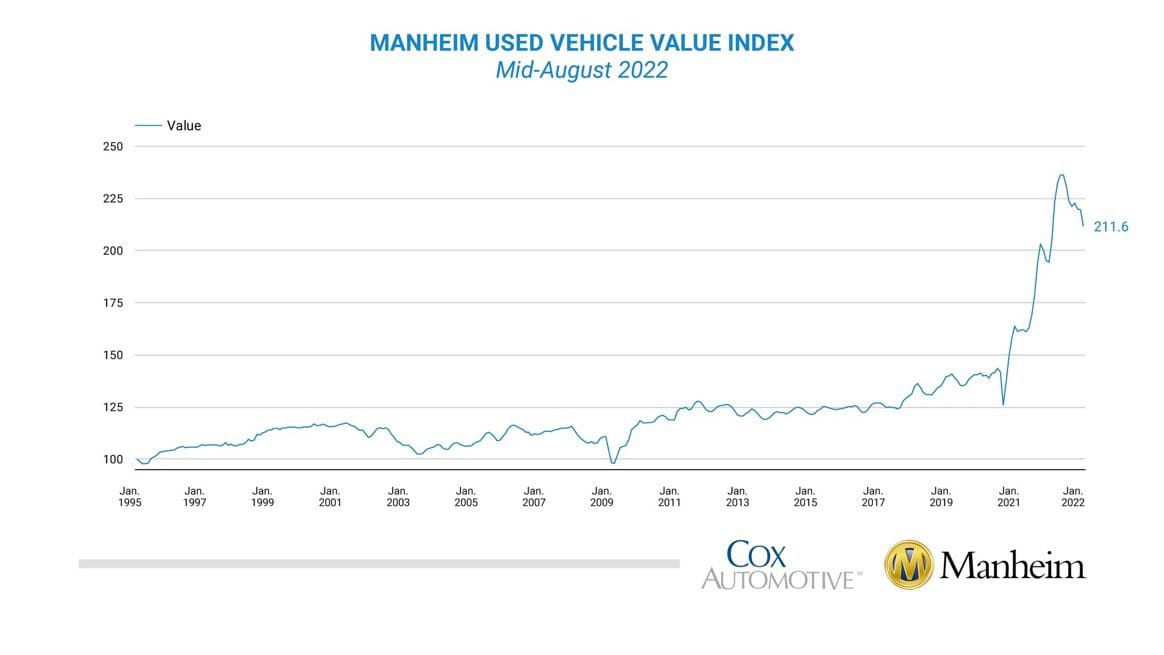

Manheim Used Car Index Down 3.6% in 1H of August: Wholesale prices continue declining, and broader supply-driven inflation increases are likely to continue reversing to the downside as well.

45 of 272 Bored Apes tied to BendDAO loans at risk of being margin called: 3% of the entire Bored Ape NFT collection is at risk of being liquidated as NFT floor prices continue tumbling. As liquidations are triggered across the BAYC and other NFT collections, it could drive prices lower and lead to even further decreases across broader NFT prices. More from Coindesk.

It's time to ⚠️ Get a Job. ⚠️

Banana portfolio company BeReal has been scaling fast - its up to 10 million Daily Active Users (DAUs) since launching in the US earlier this year. Once per day at a random time, the app sends a notification to everyone in the country, who then all have two minutes to take a picture of whatever they're doing.

It creates authentic content that people love, but it presents a unique engineering challenge. BeReal is hiring for multiple senior engineering and product roles:

If you're interested in solving this sort of problem and are looking for something new to work on, its a very attractive time to join the company as they continue scaling.

Three other jobs across the Banana portfolio:

Drivly is hiring a Business Development Leader (Detroit, Miami, or remote)

Snackpass is hiring Full Stack Engineers (SF, LA, NYC or remote)

Secureframe* is hiring Senior Marketing Operations Manager (US, Canada, remote)

We're planning the first talent collective drop this week - the move has slowed me down!