🍌 Could TikTok Kill Amazon?

Exploring how TikTok's gained ecommerce market share in China and South East Asia, plus how humans almost went extinct 1 million years ago, and too many alien memes

Hi everyone 👋 Turner back again with The Split.

My brother’s getting married this weekend, so slightly shorter email today.

If you missed it, we’re hosting an event in SF next week with AngelList. Join us on Wednesday, September 20th from 6-8pm at AngelList’s office for light snacks, drinks, and conversations. You’ll meet other founders, investors, and readers of The Split!

Sign-up here - looking forward to seeing everyone there!

A Message From Mercury

📈 These metrics are now center-stage for startup investors

Speaking of investors, VCs are still investing - even in today’s challenging market. Investors haven’t stopped looking for opportunities, they’ve just shifted what they’re looking for.

By understanding the key metrics investors have their sights set on, early-stage startups can laser-focus their pitch to investors to land the funding necessary to realize their ambitions.

Read more from Mercury to learn what investors are thinking and how to lean into these numbers today. It aligns with how we think at Banana.

Could TikTok Kill Amazon?

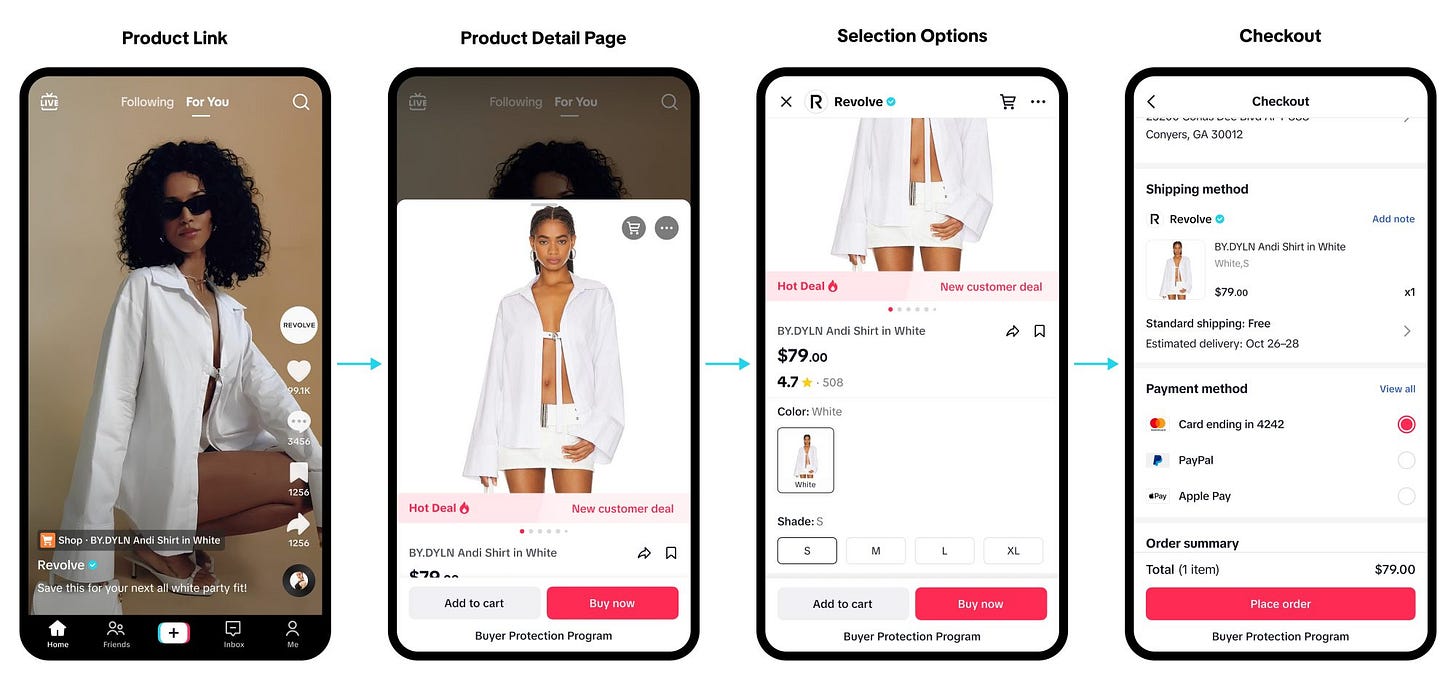

Earlier this week, TikTok officially launched TikTok Shop in the US. This follows a few months of testing in the US and a few years operating in South East Asia and China. It brings a dedicated Shop tab, live video shopping, shoppable ads, and affiliate programs for creators, all inside of TikTok’s US product.

In other words, TikTok is taking on Amazon by letting you buy products directly in its app.

If you don’t spend much time on TikTok, a short-form video app competing with Amazon sounds crazy. But Chinese consumers spent $208 billion buying things on Douyin in 2022, Bytedance’s separate, identical app to TikTok that operates in China. This compares to Amazon’s roughly $367 billion in gross merchandise volume in the US (according to the extremely reliable source, Statista).

This chart on the right shared by Freda Duan at Altimeter shows how Douyin and Kuaishou (China’s second largest short-form video app) have stolen market share from Alibaba and JD over the past five years, which are essentially the closest companies that China has to Amazon. The left shows how TikTok Shop has already taken share from SEA’s equivalents to Amazon, Shopee (owned by Sea Limited), Lazada (owned by Alibaba), and Tokopedia.

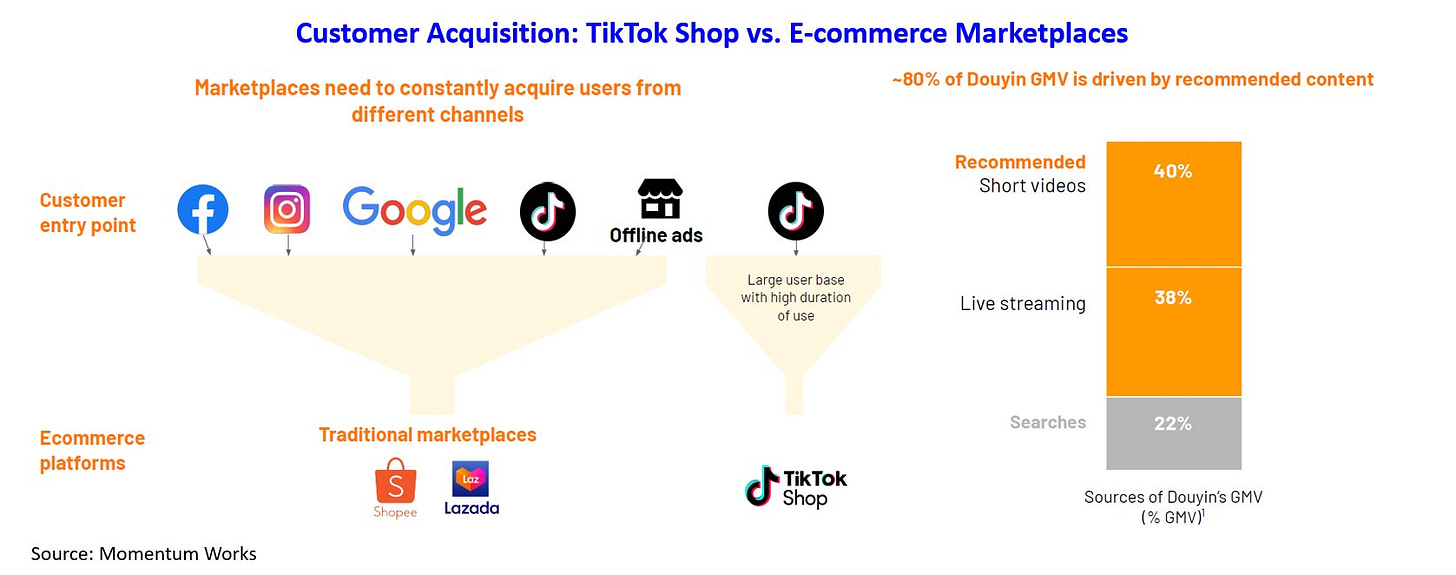

This is another excellent chart shared by Freda outlining the typical ecommerce purchase journey. Most ecommerce marketplaces have to acquire users on other platforms, like TikTok. TikTok benefits from already controlling the consumer demand and time spent, meaning its customer acquisition costs will (in theory) be much lower.

TikTok is already driving large amounts of consumer purchase behavior in the US. I’d assume a very small % of readers remember the viral TikTok leggings from two years ago. But it drove an insane amount of commerce that happened outside of TikTok. Note the 17,098 reviews on this one of many Amazon listings.

In China, Douyin started its ecommerce business by first partnering with Alibaba for fulfillment. Once it had enough adoption in 2020, it forced sellers to use its in-house tools. I’ve assumed TikTok will use the same strategy in the US, and its rumored to be doing so.

TechCrunch recently reported TikTok’s US business is on pace to lose $500 million this year. This is largely related to the network of fulfillment centers its building, which is absolutely necessary to provide a good customer experience and control its margins.

TikTok is also expected to offer discounts and free commissions to merchants, which would line up with its strategy in Asia. It takes a lower % of sales from merchants, and combined with fast shipping due to owning its own fulfillment centers, could make it a compelling option for certain types of products that sell well on TikTok.

If you’ve paid attention to Amazon, you know it makes most of its revenue from its advertising product that allows sellers to boost their posts in the search results. TikTok similarly has an advertising platform, and as TikTok Shop evolves I’m sure we’ll see it start allowing merchants to boost their products as well.

Another key piece of this is TikTok’s creator marketplace. It connects brands with influencers, and allows influencers to earn money creating videos featuring a brands products. This will all likely be tied into TikTok Shop. Combined with all the existing user behaviors of TikTok, it gives it a very strategic advantage over Amazon and any other ecommerce platform that doesn’t have the same content network.

It’s setting up to be a very interesting next few years!

🚀 Product Launches

WeeCare is Now Upwards! If you’re a long-time reader of The Split, you might remember me writing about WeeCare three years ago during the height of the pandemic. Over the past six years, its grown from building software for LA-based child care providers to run their in-home daycare businesses into a nationwide network supporting families, providers, employers, and governments.

This week, the team rebranded to Upwards! Whether you're a startup or large enterprise, Upwards provides companies flexible care solutions for their teams without having to build onsite childcare centers. Their scale has increased significantly over the years, but you can read more in my post from three years ago.

🔗 News and Charts

Speaking of child care…

The US Government Spends a Fraction of Other Countries on Child Care: I will always be confused as to how little the US supports young families.

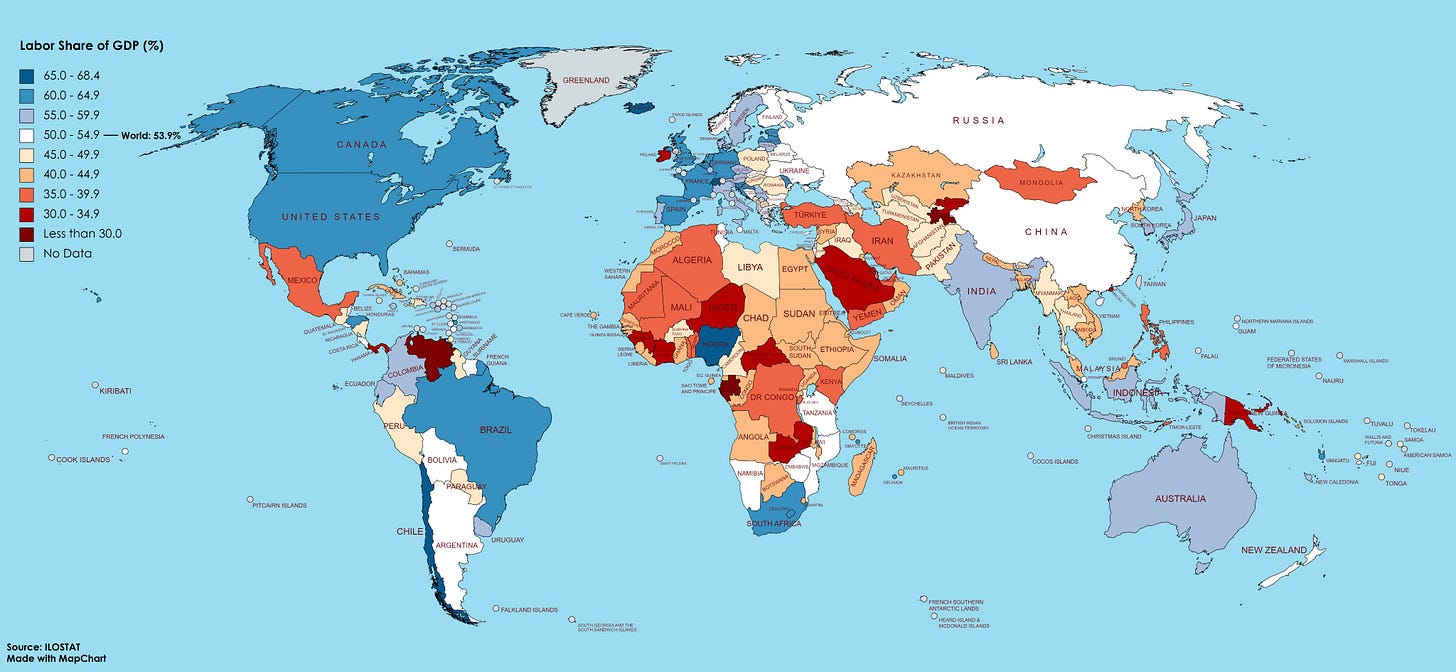

% of GDP Going to Workers by Country: Fascinating how this can differ so drastically between adjacent countries.

% of Population That Uses Public Transit to Commute to Work: Living in Ann Arbor, MI I was extremely surprised to see (what I think is?) us showing up with a 5-10% participation rate. We do have a very good bus system here! h/t Mitchell Nagy for sharing.

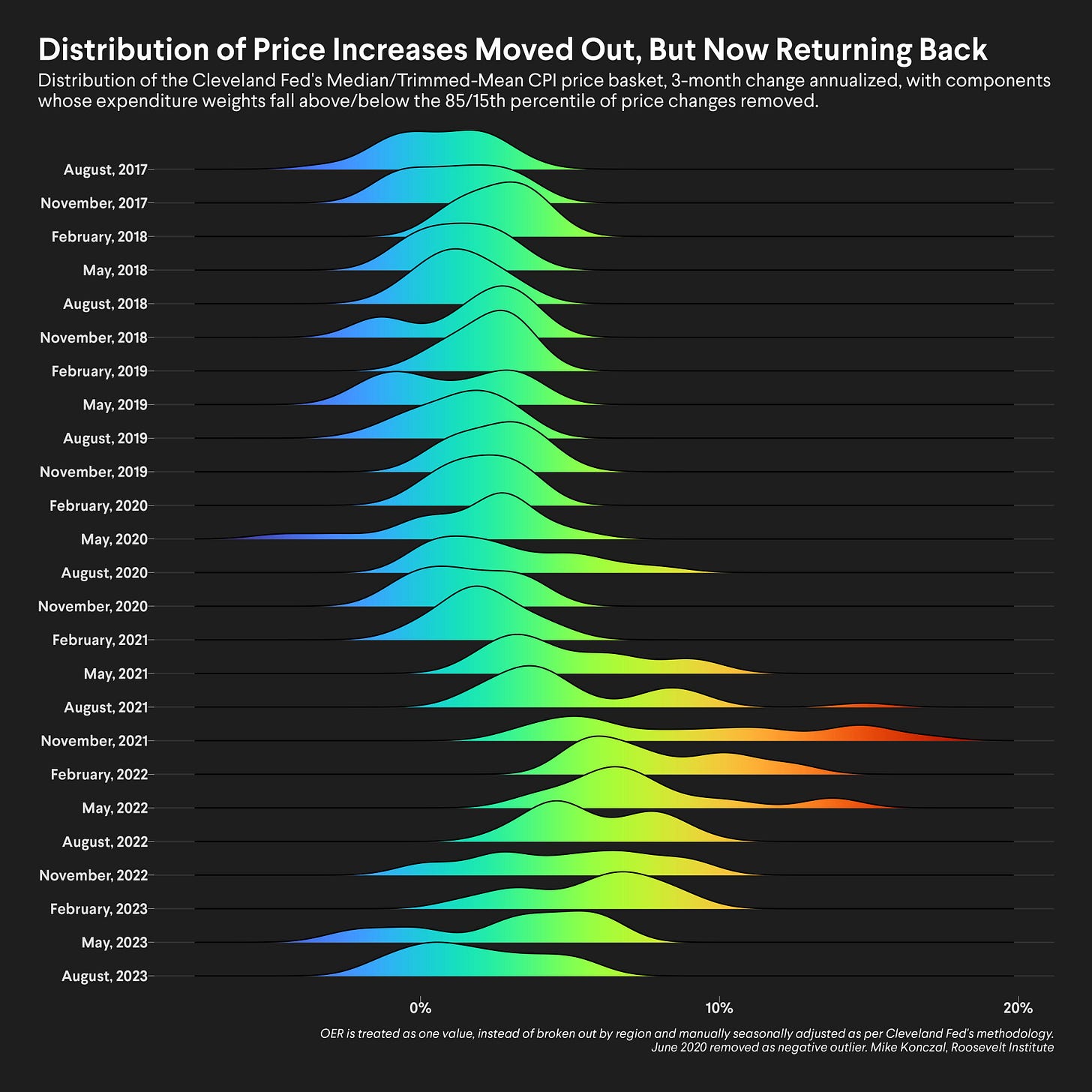

Distribution of Inflation Over Time: I’ve never seen inflation graphed this way, but it shows how entire segments of the input prices were blown way outside of typical ranges throughout 2021 and 2022. h/t Mike Konczal for putting together.

📚 Long Reads

911 in RealTime: Not a read, but this website that shows what it was like to watch live news coverage of the September 11th terror attacks.

Humans Almost Went Extinct a Million Years Ago: A new study shows the human population dropped from 100,000 to around 1,300 almost a million years ago. The research suggests the human population hovered around that level for nearly 100,000 years, and the crash coincided with severe global temperature cooling and long droughts across Africa, Europe, and Asia.

🔊 Two Newest Podcast Episodes

In case you missed them, the two latest episodes of The Peel have been the fastest viewed episodes released so far. They’re both very different, covering Semil Shah’s 10+ year journey building a venture fund from scratch + all Sean Frank’s lessons learned building a $100+ million revenue consumer brand with no outside funding.

How Semil Shah Built Haystack - Stream on Apple, Spotify, YouTube, or read the transcript here.

Bootstrapping Ridge to 9-Figures in Revenue - Stream on Apple, Spotify, YouTube, or read the transcript here.

🐵 Monkey Business

Some serial fraudsters recently convinced the Mexican government (and the internet) they’d discovered aliens in a mine in Peru. It was fake, but the memes were plentiful. I may have had too much fun with them this week…