Why Does Instacart's IPO Filing Mention Food Stamps 25 Times?

Plus new products from Mercury and BeReal, why small angel checks are the backbone of Silicon Valley, and why smart people walk fast.

Hi everyone 👋

Last week, Instacart filed its S-1 to go public. I’m sure your favorite VC has already given you a detailed breakdown, but what was most interesting to me is that it mentioned EBT SNAP, aka food stamps, 25 times - almost as much as it mentioned AI (34 times).

Keep reading and we’ll explore why food stamps have been so important to Instacart, plus dig into new products from Mercury and BeReal, why small angel checks are the backbone of Silicon Valley, and why smart people walk fast.

Before jumping in, Banana Cap is hosting an event in SF on Wednesday, Sept 20th from 6-8pm at AngelList's office. Join us for light snacks, refreshments, and conversations. You'll meet other founders, investors, and genuinely curious people who read The Split!

Sign-up here.

What’s the deal with food stamps?

Instacart just filed its S-1 to go public. There’s lots to unpack, and the team at Meritech wrote a great high-level here. All you need to know to understand Instacart’s business model is that its an advertising network that shifts retail trade spend from the store to your phone (where it can be measured), all powered by a logistics / delivery network that runs at near break-even. This is coincidentally also Amazon’s business model.

Two things that strengthen both Instacart and Amazon’s businesses: more eyeballs (higher revenue) and more customer density within its logistics network (lower cost per order).

This is why I was intrigued to see Instacart’s S-1 mention EBT SNAP so many times, which is essentially government subsidized food assistance for low income Americans. Over 42 million Americans rely on $200 billion in annual government benefits to buy groceries, and before Instacart built capabilities to handle EBT payments, a total of roughly 38,000 consumers were using it online as of March 2020.

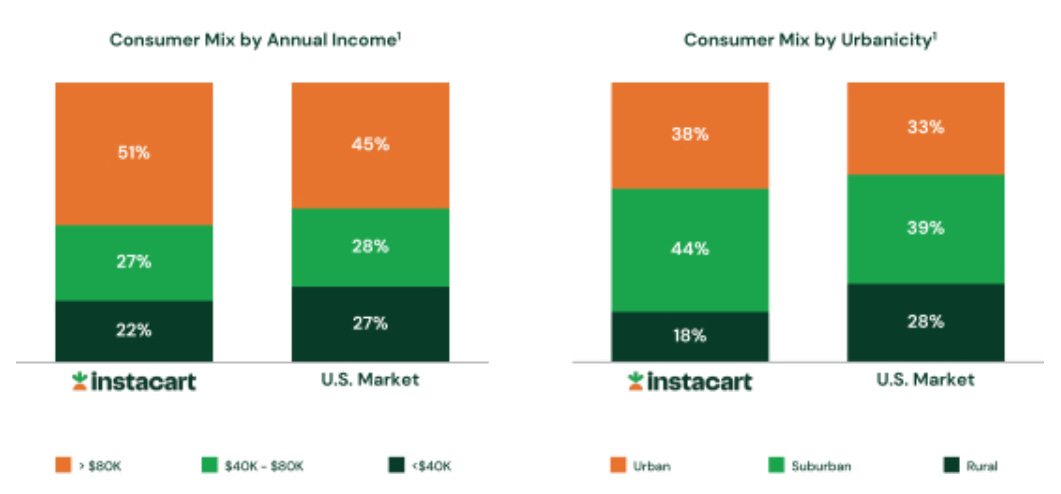

According to Instacart’s S-1, its userbase skews higher income than the rest of the $1 trillion US grocery market. A simple explanation for this is that the delivery costs attached to most online orders generally deter smaller purchases, or those more likely from lower income consumers.

Intacart mentioned it started investing heavily in marketing in 2021, which is coincidentally also when its own advertising business started ramping up. In a sense, its essentially re-investing its ad revenue into growing its customer base, which generates even more ad revenue to re-invest in more marketing.

Allowing customers to pay with EBT makes Instacart’s marketing even more effective. Roughly 1 in 10 households rely on food stamps for their grocery spend, which meant before it accepted EBT, 10% of Instacart’s ads were worthless. Now, nearly every customer can convert. And while EBT beneficiaries are likely concentrated in certain neighborhoods, it still likely adds density to Instacart’s delivery and customer networks, lowering its cost per order.

EBT also has the benefit of capturing a customer’s non-food spend. Delivery costs make traditional ecommerce uneconomical for the average EBT beneficiary. Instacart allows customers to split orders between EBT and non-EBT spend, which attaches non-grocery spend to an EBT-eligible basket, introducing 10% of households to ecommerce for every day purchases for the first time.

I’d expect nearly every retailer to eventually adopt the same capabilities as its found money. Historically, this was enabled by KKR-owned Fiserv (founded in 1984). Coincidentally, after implementing it at Instacart, the PM Ofek Lavian who led Instacart’s EBT program left to work on Forage, a payment processor that makes it simple for any merchant to accept EBT SNAP payments online. We invested in Forage’s Seed round at Banana two years ago, and it’s been exciting to see how many other retailers have been able to quickly tap into the same benefits.

Tieing this all back to Amazon, Instacart sits in a very interesting spot. Amazon has never been able to figure out grocery delivery, despite acquiring Whole Foods in 2017. By first building a logistics network that supports grocery delivery, and then starting to capture some of its high-margin ad dollars, Instacart has positioned itself to be one of the first true challengers to Amazon’s ecommerce dominance.

🚀 Product Launches

Mercury Launches SAFEs for Fundraising: Chasing down signatures and matching them up with wires hitting the bank is one of the most time consuming aspects for early stage founders when fundraising. Mercury just incorporated the entire SAFE process into an easy-to-use workflow. Mercury already had (in my opinion) the best banking product for startups, and this new feature makes it even more of a no brainer for any new founder starting a company.

Open AI Launches Enterprise: The launch includes features like unlimited GPT-4 usage, 2x speed, extended context windows, and free credits to its APIs. More importantly, it has an admin console that allows business customers to control exactly how employees use ChatGPT and what it has access to (this has been a popular new startup categories of the past year). It does not give OpenAI access to your internal data, which has been a breaking point for many large customers who want to protect theirs.

Netflix Starts Streaming Video Games: These two new games can be controlled with a phone or mouse and keyboard if on web. They adds to its library of 70+ mobile games, and could be the tipping point for a big new product line for Netflix. If its able to find games that really hit, it could give Netflix a significant advantage over competitors who are purely focused on video streaming.

BeReal Launches ‘Friends of Friends’ Feature: The new feed replaces the “Discovery” one, which showed posts from anyone. The update also gives more customization, allows you to pin up to three past BeReal’s to your profile, and adds @ mentions to comments.

🔗 News and Charts

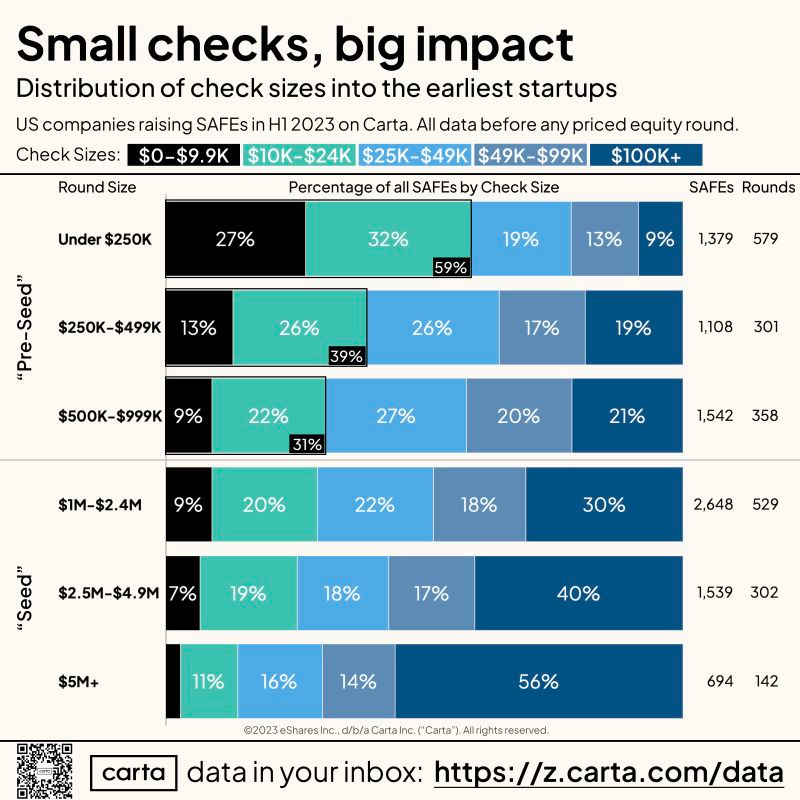

All Hail The Small Angel Check: Data form Carta shows just how impactful small check angel investors are to the very earliest and smallest of funding rounds. I haven’t seen data on this recently, but anecdotally the velocity of these checks shrunk significantly throughout most of 2022 and part of 2023. They’re typically some of the very first checks in a startup, and this slowdown has had a significant effect on how founders have raised their first round of capital over the past 18 months.

You probably see me share these charts from Carta often, you can sign-up for “The Data Minute” newsletter yourself here.

Zepto Becomes India’s First Unicorn of 2023: The news follows similar publicly traded companies like Uber, Coupang, and Delivery Hero hitting cash flow break-even, plus investors realizing that its primarily advertising revenue that’s driving Amazon’s free cash flow. It will be interesting to see how this changes investor sentiment on ecommerce platforms!

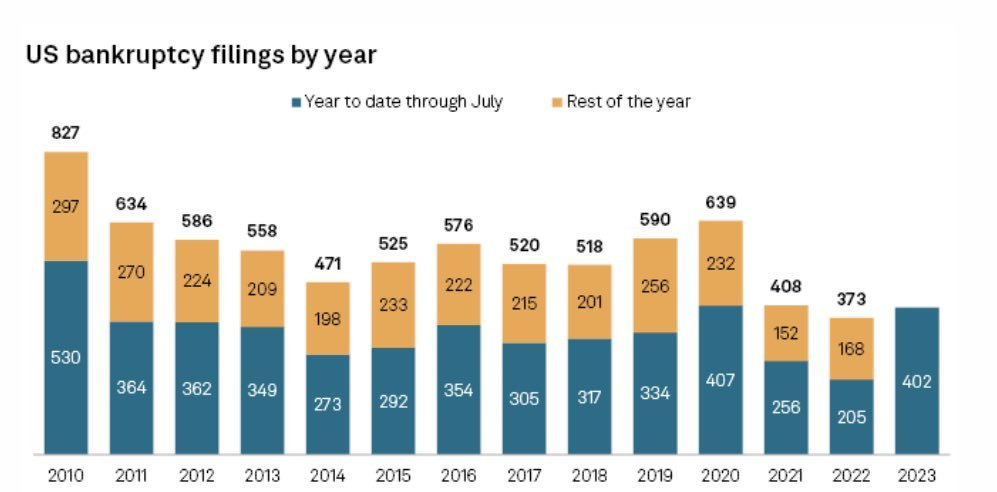

US Corporate Bankruptcies in 2023 Already Exceed 2022 Levels: They’re on-track to hit the highest point since 2010. We’re starting to see the effects of higher costs of capital.

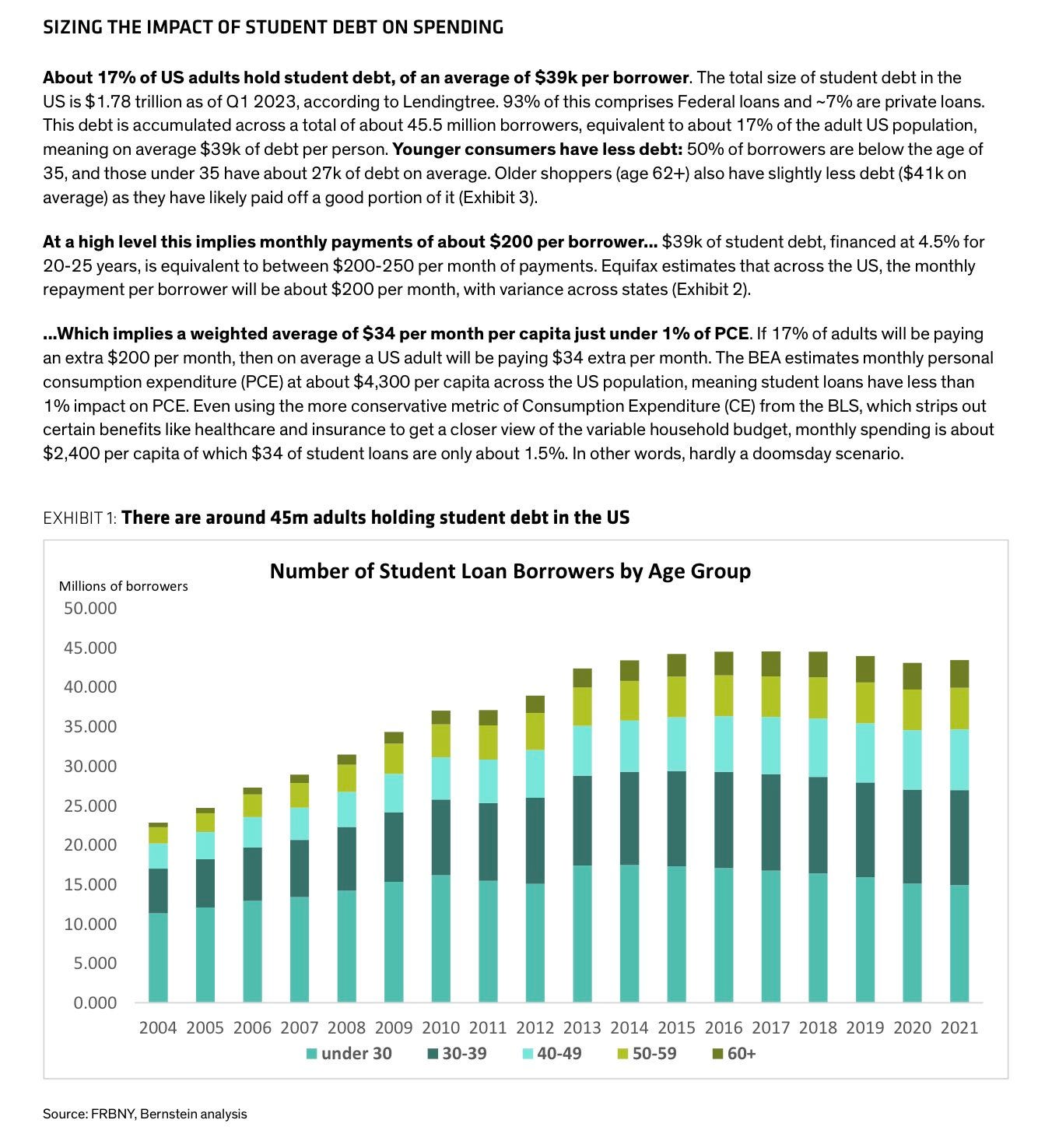

Student Loan Payments Makeup 1% of US Consumer Spending: I’ve asked if anyone knows the answer to this on Twitter before, and Cory Wang shared this research from Bernstein a few weeks ago.

17% of US adults hold student debt, at an average of $39,000 per borrower. This skews mostly towards 30-59 year old borrowers. All-said, average monthly payments per borrower are $200, or $34 per month per capita, or just under 1% of personal consumption expenditures.

This is a smaller number than I expected, but will likely have a big impact on specific industries that get cut when someone suddenly has $200 less discretionary income (travel, clothing, pets, entertainment, etc).

Celebrities Increase Willingness to Pay Up to 29%: This 9,000+ respondent survey found that a celebrity/influencer-aligned product can increase willingness to pay by up to 29% depending on the celebrity, for an average of 22%.

Americans Increasingly View Moderate Drinking as Unhealthy: I don’t think this is a new data point for regular readers of The Split, but it’s interesting to see how much faster this sentiment is growing amongst Gen Z and Young Millennials, especially compared to the 55+ age demographic.

Florida State’s Wild Athletic Department Budget: I’m not sure what surprised me the most:

“Donations” as the largest revenue line, more than TV rights

“Miscellaneous” as the largest expense, at 42% of the entire budget

How much men’s football (and NCAA TV deals) subsidize collegiate sports - especially true if that’s where most “donation” revenue comes from

How much admin and coaches get paid (30% of the budget) when no money goes to the students

And finally, could they even afford to pay the students in the first place? It makes NIL look like a great solution.

Is The UK As Poor as Mississippi? Removing London’s economic output drops the UK’s GDP per capita by 14%. In comparison, removing San Francisco and Munich drop US and German GDP per capita by 4% and 1%, respectively (the highest in each country). France has a similar effect, where Paris drives an outsized impact on its economic activity. Important to remember this doesn’t incorporate individual income, spending, or living standards, but its more a reflection of general economic activity.

Where Are Americans Born?: Fascinating analysis of US Census data form 1850 - 2020. That link has another chart (at the top of the page) that shows immigration was at an all-time low in 1970 (53 years ago), with only 5% of Americans being born outside the country.

And TIL, the 1890 US census records were destroyed in a fire.

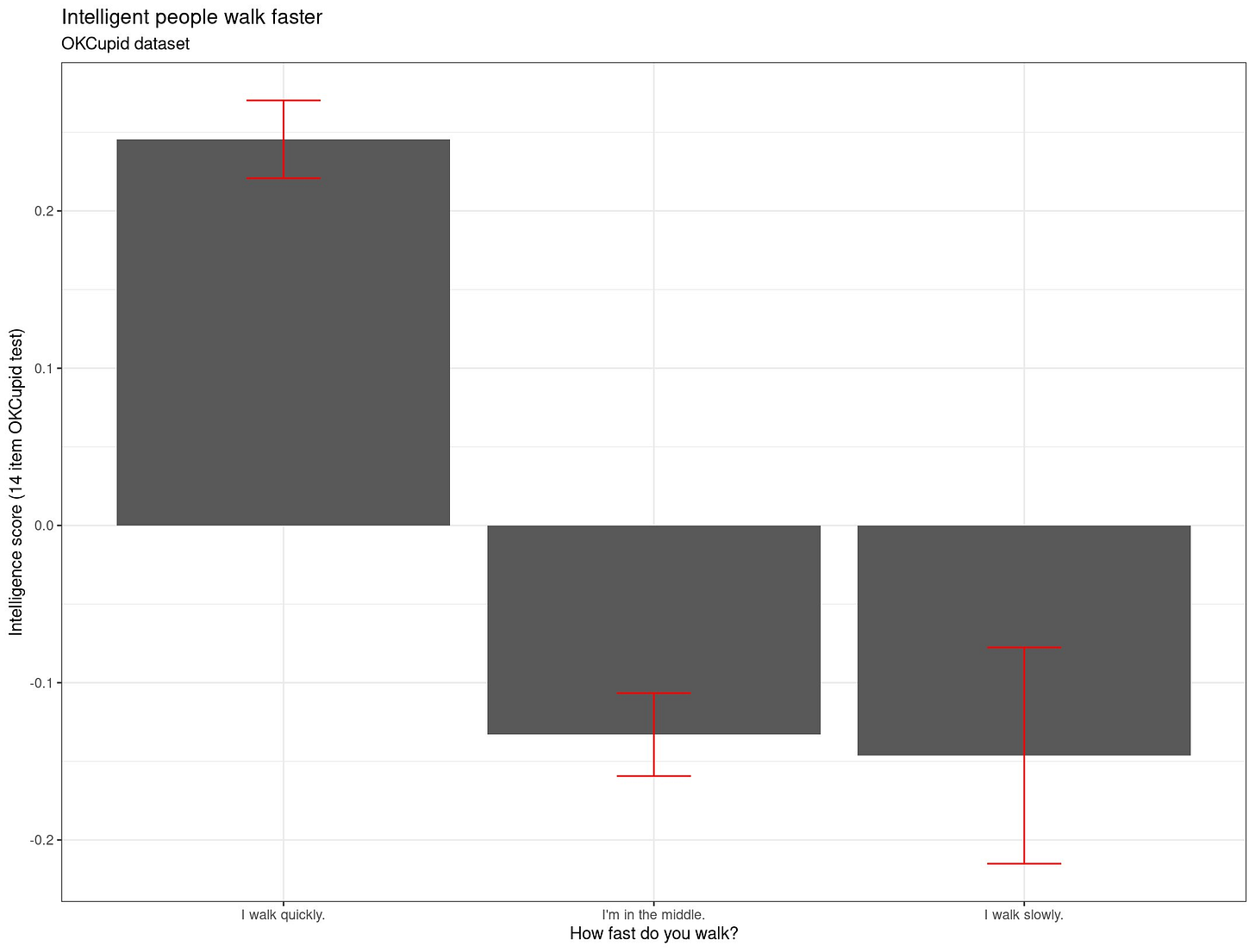

Per OKCupid, Smarter People Walk Faster: May we all pick up the pace this week. ⚡

US Teens More Likely to Believe Online Conspiracy’s Than Adults: 49% of adults surveyed agreed with four or more “harmful conspiracy statements”, compared with 60% of teens between 13-17 and 69% amongst those who spent 4+ hours per day on social media.

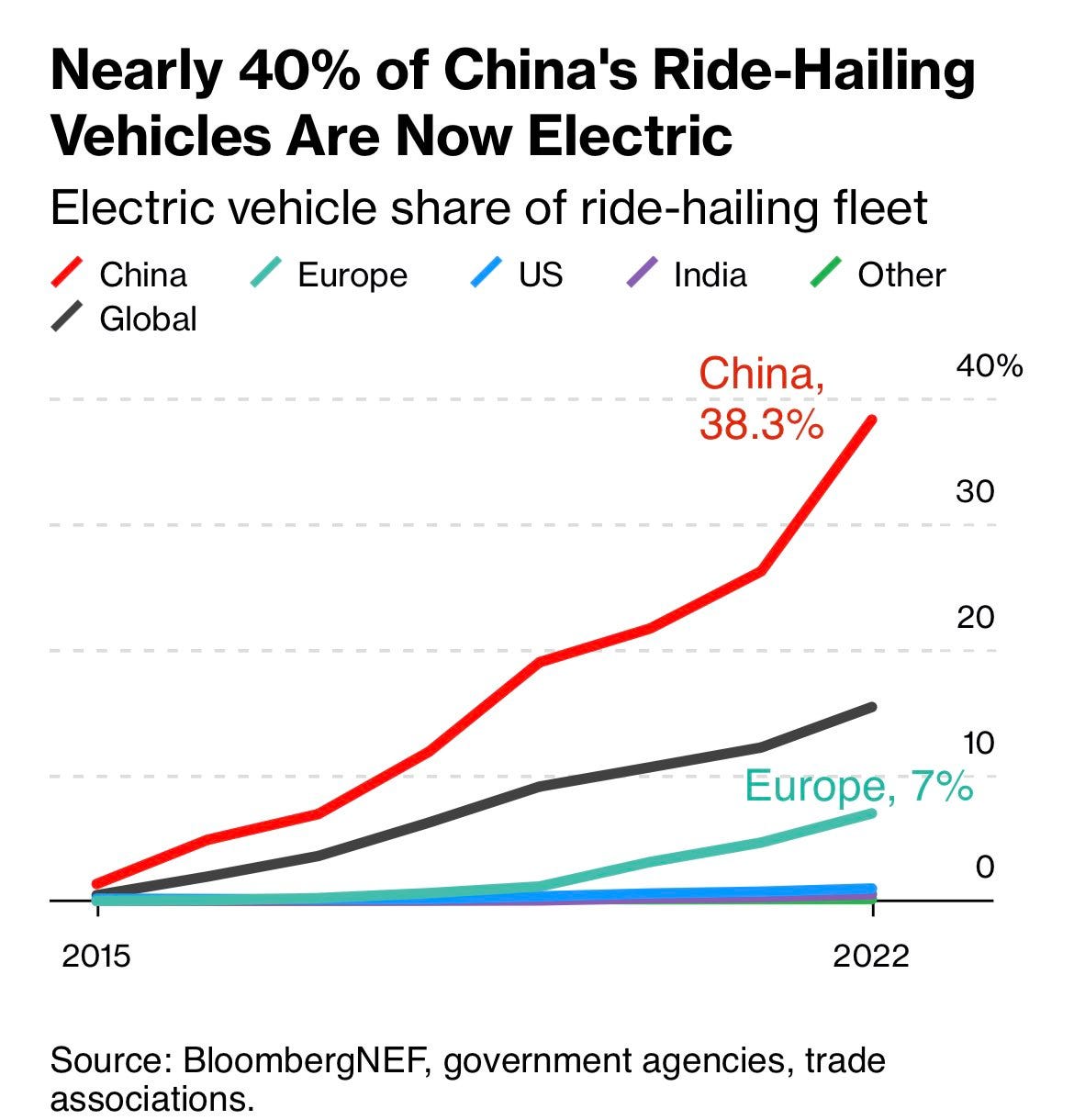

China’s Ride Hailing Fleet Almost Majority EV’s: It’s interesting that the US has been so far behind here, especially considering its driver labor costs are likely much higher than the rest of the world.

💌 ICYMI

Quick headlines in case you missed them:

This Guy Bought 2,000+ Bottles of Wine From SVBs Asset Auction

China Now Sells Fewer Goods to the US Than Mexico or Canada Do

📚 Long Reads

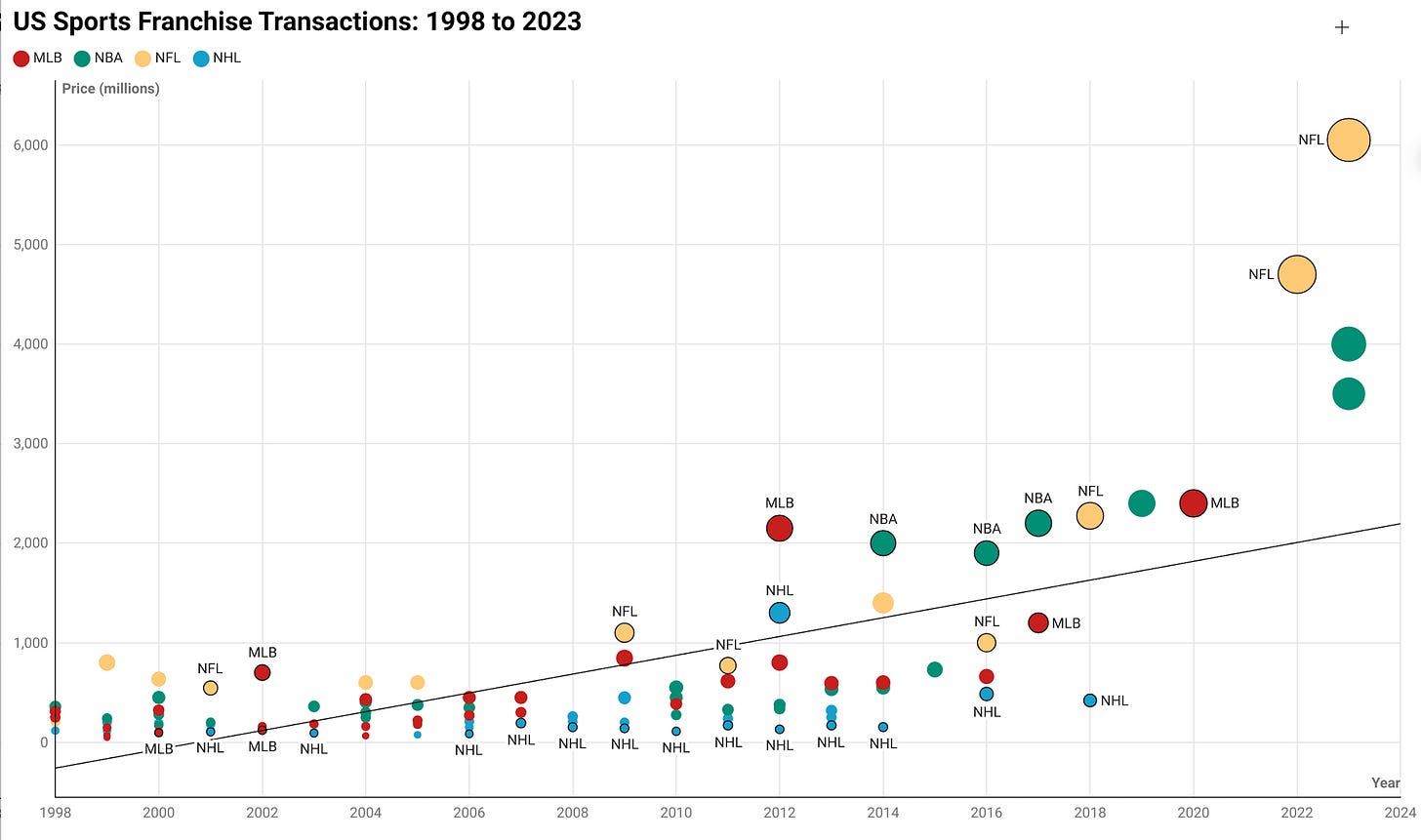

Toys for Billionaires: Sports Franchises as Trophy Assets: A deep dive from NYU Stern professor Aswath Damodaran on what drives the valuation of professional sports franchises.

I think his take is directionally correct, but if I had to take it a step further, I’d propose that he’s missing how the collapse of the cable bundle and globalization of media rights could significantly change the cash flow for some sports teams. For example, no ESPN means the NFL and underlying teams lose the media rights revenue, but it also means that leagues and teams can, will, and already have built their own media distribution.

The Phoenix Suns made press earlier this year for cancelling their local cable deal and broadcasting their games for free over-the-air. It’s estimated they’ll lose tens of millions in guaranteed media rights revenue, but the team thinks it will boost their local distribution from 800,000 to 2.8 million households.

Radish - The baby-friendly communal neighborhood: I recently met Phil Levin, who just launched a cool new product called Live Near Friends to help friends live near each other. He’s no stranger to this lifestyle, and he recently wrote about his current unique living situation with a bunch of friends.

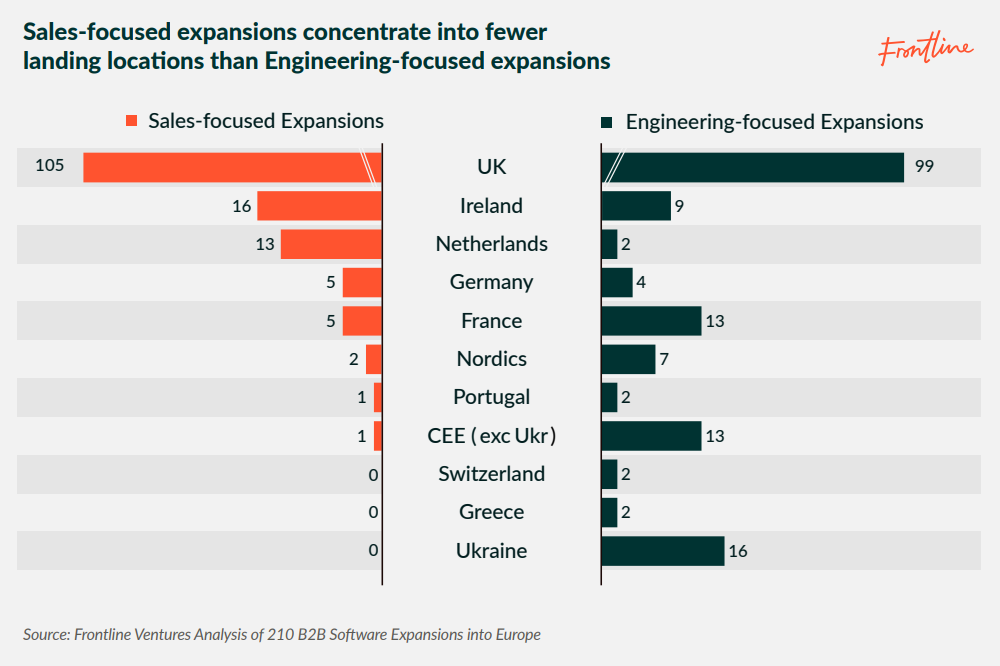

The European Expansion Report: A great resource for US companies expanding to Europe. Highlights:

Europe is 40% of global revenue for top US companies at IPO

93% of first European offices are in London, Dublin, or Amsterdam

Engineering-focused expansions are have a broader office footprint

New cohorts are scaling headcount + offices faster than ever

On Population Density by Thesis Driven: Why its so misunderstood, and a guide for better understanding it.

🔊 Podcast / Video

The 40-year History of MTV: A deep dive on the business of MTV from Dan Runcie at Trapital.

Fun fact: MTV launched as a joint-venture between Warner Bros and American Express.

🐵 Monkey Business

❤️ Reader Love

If you missed it, check out the latest podcast episode with Sean Frank at Ridge here.

Compared to internal combustion engine (ICE) vehicles, I'd estimate that the average price of an EV in China is about 30 percent lower. https://scratchgames.io

Re: China EVs. Don't quote me on this but I believe the average price of an EV in China is around 30% cheaper than ICE cars.