VINN: Redesigning the Car Buying Experience

The Vancouver Island-based startup changing the way consumers shop for cars

Hi 👋 Turner here, welcome back to all 13,000+ readers of The Split.

Last summer at Banana Capital we made one of our largest investments ever, into a fast growing startup on a small island in Western Canada, VINN. I've wanted to write and publish this since then, and today I'm sharing their story and what all they've been up to. This is a long post - if you're reading in your email, you can always tap "Read Online" in the top right to open in your browser.

VINN: Redesigning the Car Shopping Experience

In 2018, Caleb Bernabe, Tom Avant, and Chet Flanagan started building VINN, an online new and used car marketplace based in Victoria, British Columbia, Canada.

By the summer of 2022, its capital-efficient model had propelled it to become one of the largest online car marketplaces in Canada, with over 150,000 vehicles listed. Here’s a behind the scenes look at how VINN is making car shopping fun.

From Vancouver Island

Born and raised on Vancouver Island as the oldest of two brothers, Caleb always had a passion for cars. Growing up, he spent his time on the weekends rebuilding, driving, breaking, and fixing all kinds of classic cars and motorcycles. In high school, he started running digital marketing campaigns for local dealership groups, making serious money for a high schooler. He had saved most of it, as he always planned to go to med school to become a doctor.

Less than half way through undergrad, Caleb kept finding himself searching for more entrepreneurial outlets. Ultimately, his enthusiasm for cars pulled him back, and he dropped out to run business development initiatives for one of the largest dealer groups in Western Canada.

Caleb’s first responsibility was all things marketing. He spent his time organizing the spending strategies and brand awareness efforts across 6 different OEM’s. Over time, his scope expanded to optimizing the entire customer journey: from the first point of contact online to the final in-store delivery. At the same dealer group, Tom Avant had developed a love for building software getting his degree from the University of Calgary, and was looking for opportunities after graduation while working in the dealers back office. Caleb and Tom started working on projects together, and had a shared realization that there was an immediate opportunity to do things drastically differently in the auto space.

Stacking Insurance Papers: The Birth of VINN

The more problems they solved together, the more aspects of the dealer business model they realized were not optimized to take full advantage of the internet. To start, online inventory never matched what was actually on the lot. And the dealer’s business model often meant the car being sold wasn’t even what a customer actually wanted. Caleb found he was always incentivized to sell specific vehicles that had sat on the lot for too long, not what a customer actually needed or wanted. He grew frustrated that his love of cars and car shopping was not shared by the vast majority of consumers. Few buyers actually enjoyed interacting with car dealerships!

Caleb and Tom knew there had to be a better model. They wanted to design the best possible customer experience from the ground up, while making dealerships more efficient by enabling them to focus on their strengths of managing inventory and facilitating transactions. There was one specific time where Tom worked through a stack of hundreds of insurance and vehicle registration forms, manually entering them into a spreadsheet. It took hours of reading off and double checking vehicle identification numbers, aka the VIN. This was the moment they had their name.

The World’s Most Valuable Typeform

In the summer of 2018, Tom built a system to scrape and clean public data from dealership websites across Canada. It wasn’t pretty, but they spun up a listing site and used SEO and SEM arbitrage to experiment with acquiring customers at a different part of the funnel than Caleb had been doing at the dealership.

As Caleb knew too well, dealers carrying inventory had specific vehicles to move, and acquiring customers higher up the funnel offered better economics. It would allow them to provide a seamless customer experience, qualifying each customer and matching them with the perfect vehicle. And after many long days and nights of tests and iterations, they finally had something that worked.

VINN officially launched in 2020. Initially, the entire customer-facing product was “What’s the best car for me?” quizzes ran entirely on Typeform. They moved into an office in downtown Victoria, and would all reach out to each customer individually to qualify every lead and figure out exactly what each one needed. When I first tried the product, I got a text, call, and another text within an hour.

Within a year, things hit an inflection point. The business was processing hundreds of customers per month, with a similar UI and still running entirely on Typeform. The team had essentially reproduced the car dealership sales force, but online and remotely from Vancouver Island in Victoria, British Columbia. And since VINN carried none of their own inventory, there was no pressure to get customers into any particular vehicle. Sales reps could give each shopper the perfect experience getting them into the best vehicle for their individual needs.

But this inflection wasn’t quite obvious to many investors yet. Fundraising was slow and difficult for the first-time founders based on an island off the west coast of Canada. Internet car listings was a small, mature market. And online car retailers were seen as capital intensive with a limited line of sight to profitability. Here’s Caleb giving one of his first ever pitches to a group in Victoria.

Eventually, the team's intuition and the size of the opportunity caught the attention of local angel investor Andrew Wilkinson and Varadh Jain (who subsequently connected Caleb to most further additions to the cap table). Other early support came from friends like Sam Archibald, Tom’s childhood friend working in private equity at Apollo, who later joined as CFO.

VINN’s traction continued to accelerate, and this was around the time I met Caleb (thanks Daniel Dubois!). Like everyone else, I was skeptical but intrigued before our first call. The mix of efficient customer acquisition and high per unit GMV offered too interesting an opportunity to not get involved. We quickly invested from Banana Capital and soon after the largest venture firm in Canada, Inovia Capital, joined as well.

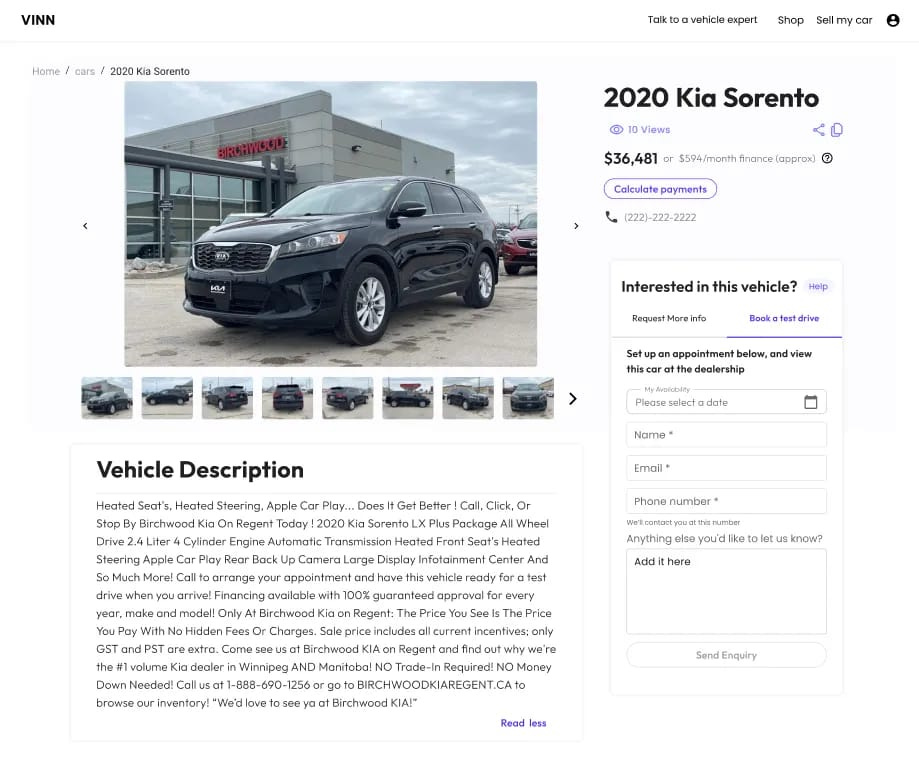

The team continued iterating on the product, which soon evolved into a managed marketplace much easier to navigate than outdated classifieds sites that historically dominate the online car search. And they finally moved off Typeform, building a team of metrics-driven developers, data engineers, and designers. The team constantly looks for creative ways to automate the customer research process, improve customer happiness, increase conversion rates and set a foundation to efficiently scale the business over time.

Fast forward to 2022, VINN’s business is a lightweight front-end powered by a well-oiled sales machine run on a custom in-house CRM that sits on top of its new data warehouse. VINN’s Customer Success reps communicate with buyers via email, text, phone, etc, which all flow through the CRM.

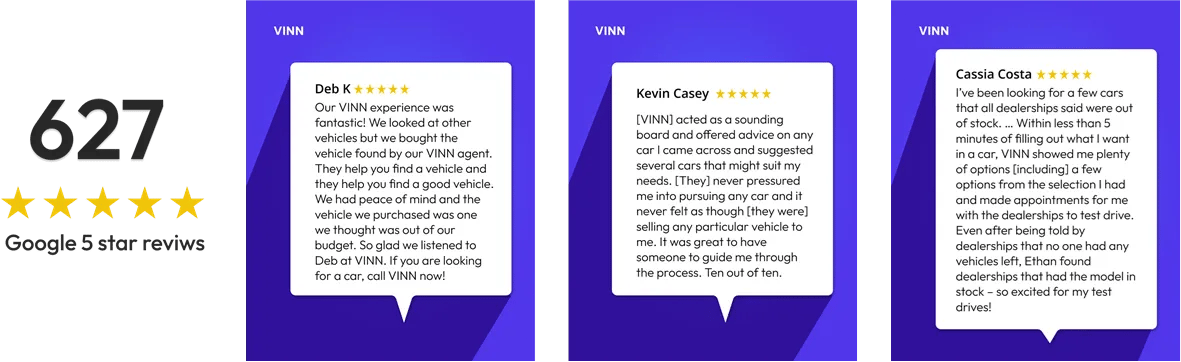

VINN’s marketing approach focuses on a warm brand and engaging social content. Backed by machine learning, the team strives for a "human-in-the-loop" approach, automating most tasks with the customer success team and engaging content creating a unique customer experience. This is all shows up in VINN’s customer reviews.

Auto: The Largest Consumer Retail Market

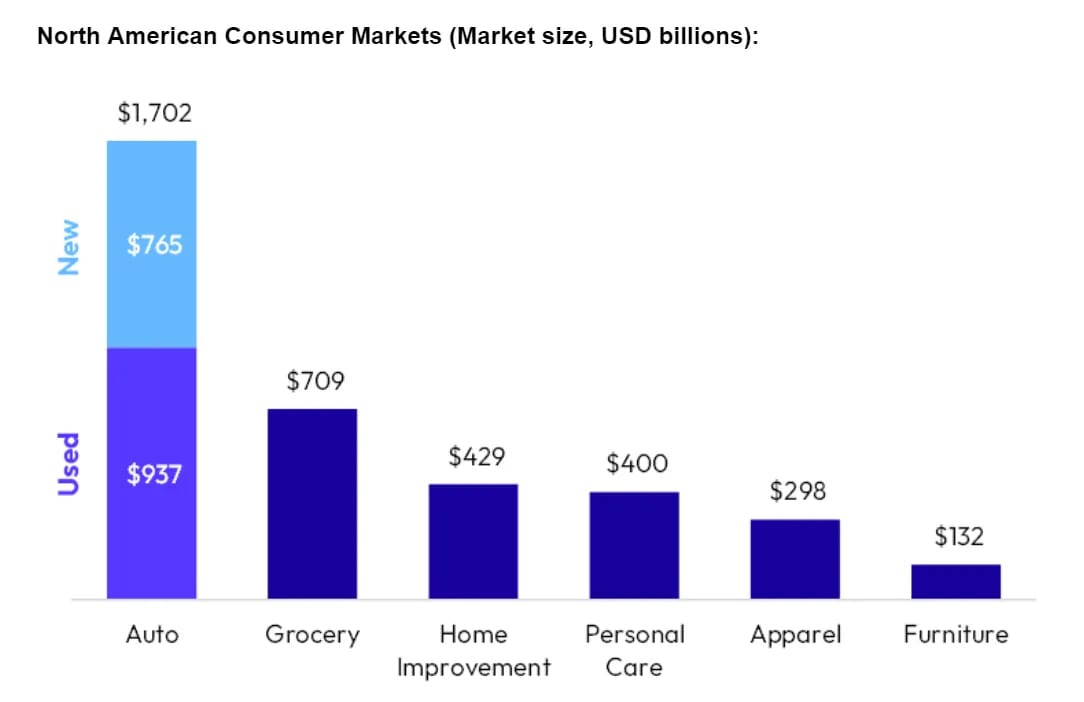

The consumer auto market is massive. It represents ~20% of North American consumer retail spending, worth ~$1.5 trillion and $180 billion in the US and Canada, respectively. And yet, the largest US dealership groups have less than 5% market share.

The US and Canadian auto markets have averaged near 16 million and 1.8 million in new vehicle sales per year, respectively, for the past 40 years. And by facilitating both new and used sales, VINN has more than double the addressable market compared to online-only used car retailers.

Source: Vroom, as of 2019 for US, scaled to total North American population

One of the biggest problems Caleb faced getting customers into the right car was that, broadly speaking, customers did not enjoy interacting with dealerships. VINN focused on the research and discovery phase of the customer journey as it is very time-intensive for shoppers, as a vehicle is one of the largest purchases most consumers make in their life.

Source: (1) Autotrader survey, 2017, (2) Dealersocket, 2016

Running a dealership and selling vehicles also requires significant working capital investment, doesn’t lend to much economies of scale past a certain point, and can be a challenge to differentiate as customers typically shop within close proximity to their home. There are some benefits to scale, but market dynamics have led the industry to remain fragmented. This meant lots of repetitive, non-value additive work being performed by dealerships across North America.

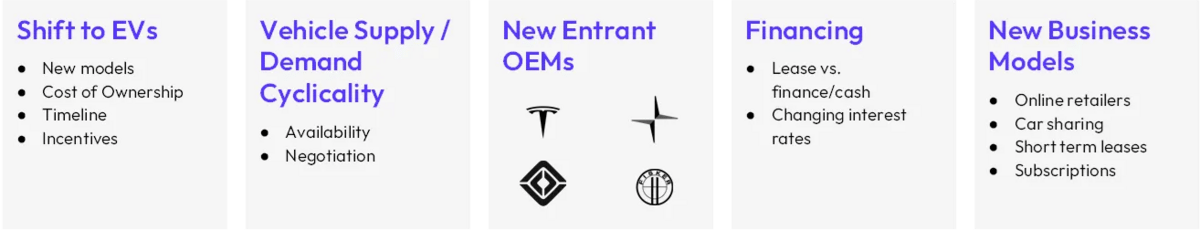

Further, there are several industry trends making things even more difficult for consumers: the shift to EVs, supply constraints, new OEMs, a rapidly changing financing environment, and new types of ownership models. Being agnostic to every category and business model, VINN creates an extremely wide customer funnel for an expanding suite of its own products.

The margins selling vehicles are typically low, but owning the point of sale unlocks the opportunity to upsell financing, insurance, and warranties (F&I), which have very high margins and make up a large portion of industry profitability (alongside things like maintenance and repairs).

The internet offered an opportunity to redesign the dealer business model. “Internet-first” dealers like Carvana could avoid opening public-facing dealerships and deliver vehicles directly to customers. Facilities were still needed in each market, but the delivery radius for each warehouse was massive, requiring much less capital invested per addressable customer. Instead of serving the hundred thousand customers close enough to visit the lot, one warehouse could serve the tens of millions of potential customers within a reasonable delivery distance. At the end of the day however, they were still capital intensive businesses that bought and sold vehicles and generated most cash flow from F&I.

VINN's position at the research and discovery point of the buyer journey provides for drastically cheaper customer acquisition costs than retailers that must overcome additional hurdles to ensure a customer is ready to purchase a car online, often site-unseen. By providing much of the research and discovery phase in a no-pressure sales environment, VINN allows customers to experience the best of both the online and physical models, as the majority of customers still prefer to see and test drive a vehicle before making a purchase decision.

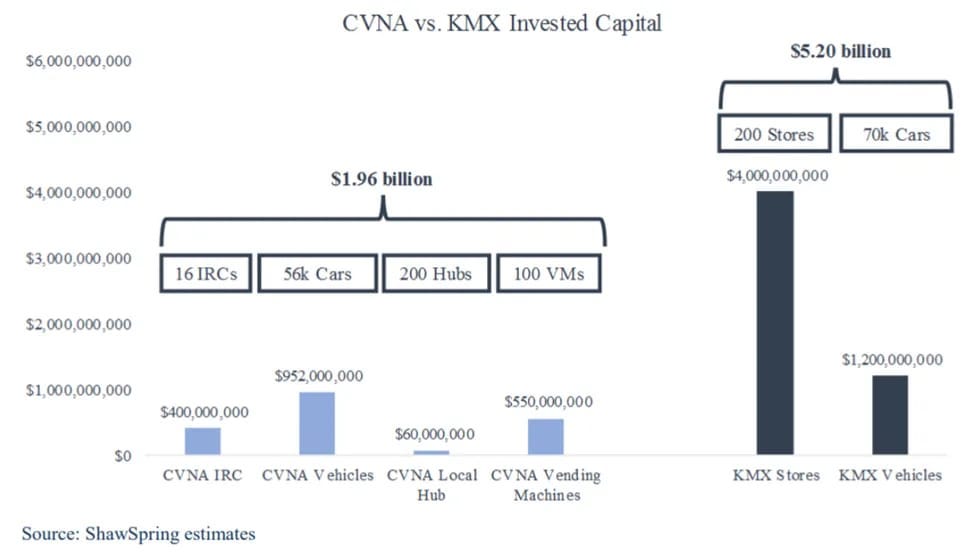

As a marketplace, VINN’s business model is very capital efficient, since it requires zero inventory, capex, or fulfillment and storefront buildout to enter new markets. Scaled national dealership groups like CarMax still require multiple acres of expensive real estate, facilities buildout and inventory investment (200+ vehicles for sale). An estimate from ShawSpring partners in 2020 (below) estimates that for each new location, CarMax spends a total of roughly $15m-$36m ($10m-$30m in CapEx, $4m-$5m in working capital, and $1m in salaries).

Direct to consumer models like Carvana and Vroom do have more capital efficiency than CarMax. However, VINN is able to add an incremental unit of inventory for virtually zero incremental investment, making it infinitely more capital efficient.

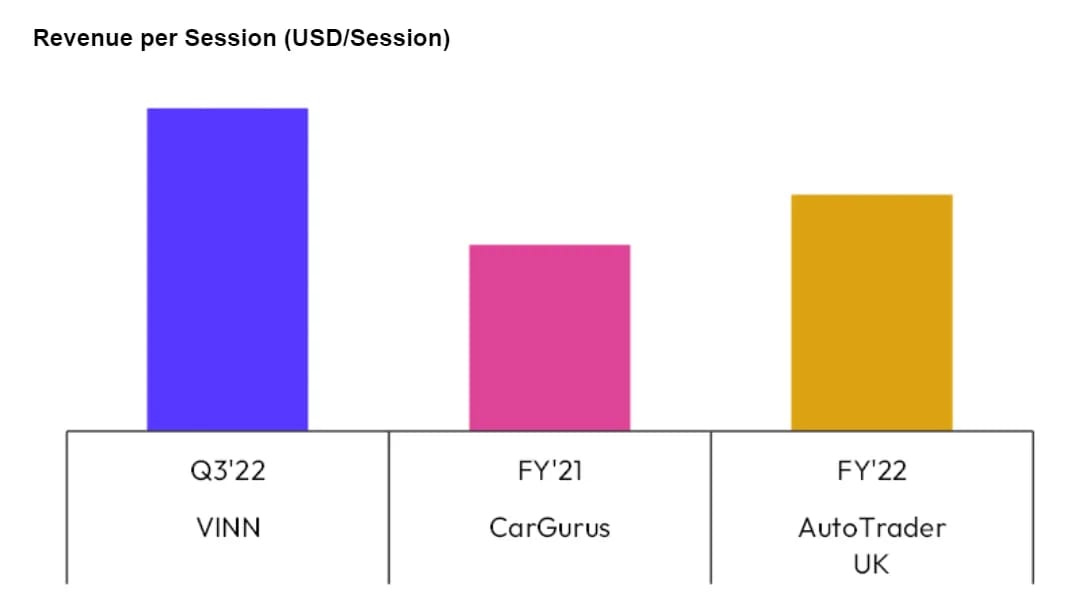

Finally, by focusing on high-quality shoppers, VINN is able to monetize its traffic very effectively. Whereas classifieds websites like CarGurus and Autotrader leverage a large traffic base to charge high subscription fees to retailers, VINN is able to generate much higher monetization at a fraction of the scale. Similar to classifieds websites, VINN will attract a larger audience over time; but its entire product and business is optimized for conversions, not impression-based marketing. By focusing on high-quality customers, vehicle retailers are willing to pay a premium for VINN’s shoppers since the high conversion rate reduce its dealer partners sales resources per transaction.

Another stark difference between the two models shows up in Carvana’s market penetration. Within the first eight years, Carvana achieved 2.34% market share in its 2013 cohort of markets. After a mid-2020 launch, VINN has nearly 6% market share across all franchised dealerships in Canada, showing how fast its model scales. (It's also worth noting that Carvana appears to have stopped disclosing this chart publicly in 2022.)

State of the Business

It would be irresponsible to write anything about the auto industry without talking about its current state. Throughout the pandemic, the price of both new and used cars saw record price increases.

Driven by supply chain constraints and fueled by low interest rates combined with high personal savings rates, dealership groups rode this all the way up. And now, they're riding it all the way down. Carvana just reported Q3 2022 earnings yesterday, and total retail units sold declined 8% year-over-year (and 13% quarter-over-quarter) compared to a 31% decrease in gross profit. Its stock is down 97% from August, 2021 highs.

Dealers entered 2022 in an environment where vehicle prices could rise 5-10% in any given month. Interest rates were low, and consumers had record levels of personal savings. Vehicles were in short supply, so teams bought new inventory at any price, knowing they would make money on the sale. Dealers are leaving 2022 with interest rates twice as high and prices sliding just as fast as they rose. This has made product discovery even more important for consumers and fast inventory turnover top of mind for every dealer.

Improving product discovery for consumers and high-quality demand for its dealer customers has driven VINN to rapid growth since launching. Revenue grew 9x year-over-year in Q2 2021 and another 6x year-over-year in Q3 2022.

New product initiatives focus on improving the customer experience, increasing internal efficiencies, building an organic traffic flywheel, and adding to its machine learning and data collection capabilities. The road map includes speech-to-text for automatic customer data entry into VINN’s CRM, ML data cleaning for enhanced search and analytics, enhanced data extraction from user input and interaction, and improved recommendation systems. They’ll also layer in more video, written, social content, and other product features to improve SEO and top of funnel over the next year.

What’s Next for VINN

At the end of the day, VINN acquires customers 10x cheaper than the average online vehicle retailer while investing zero per unit of available inventory and monetizing its traffic above the rates of leading classified sites. This results in a business that is very capital efficient, reinforced by exceptionally positive shopper reviews and strong relationships with its dealer partners.

Marketing hundreds of millions in vehicle volume on an annual basis, VINN recently opened up inventory advertisements on its platform for dealers to pay for premium listings. It's also experimenting with acting as an outsourced internal sales and support team for select dealer partners. This expands its product portfolio from just top of funnel demand to helping auto dealerships redefine their cost structures. While similar business models historically have leveraged dealerships for their own gain, VINN is outsourcing its dealer partners non-core functions to make them more effective.

If you want to join the team, VINN is always looking for smart people. They’re specifically hiring a VP Marketing to lead the team building an engaged organic audience.

And if you’re in the market for a vehicle in Canada, click here to give VINN a try!