Happy Tuesday 👋 Turner back again with The Split. If you're in the US, remember to VOTE today!

Before jumping in, if you have a minute, please fill out this quick survey 🙏 I'd love to get a better idea of who all is reading and what everyone is interested in. I'll share the results (anonymized, of course) next week.

Two months ago, Pinduoduo's Temu launched in the US. As I'm hitting send, Temu is currently #3 overall in the iOS App Store. The product feels like, in Olivia on my team's words, "if SHEIN and Wish had a baby".

Assuming you read what I wrote back when Temu launched in September, I ended with:

My biggest outstanding questions are around Temu's go-to-market strategy. There's early indications of leveraging messaging for customer acquisition like Pinduoduo. Personally, I'm not sure how well this will work outside of China. There's also no hints yet around what a Temu influencer marketing strategy could look like, which I think makes even more sense in the current environment after Apple's ATT changes. Its also possible giving things away for one cent is all Temu needs to do to go viral. ¯\_(ツ)_/¯

We're starting to get an early indication of how it's building its US user base.

There doesn't seem to be much influencer activity yet, but I've seen screenshots of Instagram ads. This is straight forward and makes sense as it had $17.8 billion in cash (excluding restricted cash) and short-term investments on its balance sheet at the end of Q2. Just like ByteDance with TikTok, Pinduoduo could brute force Temu into the market with a heavy ad blitz. It's also sending aggressive discount emails, highlighting up to 93% off. Must see, must have, must shop!

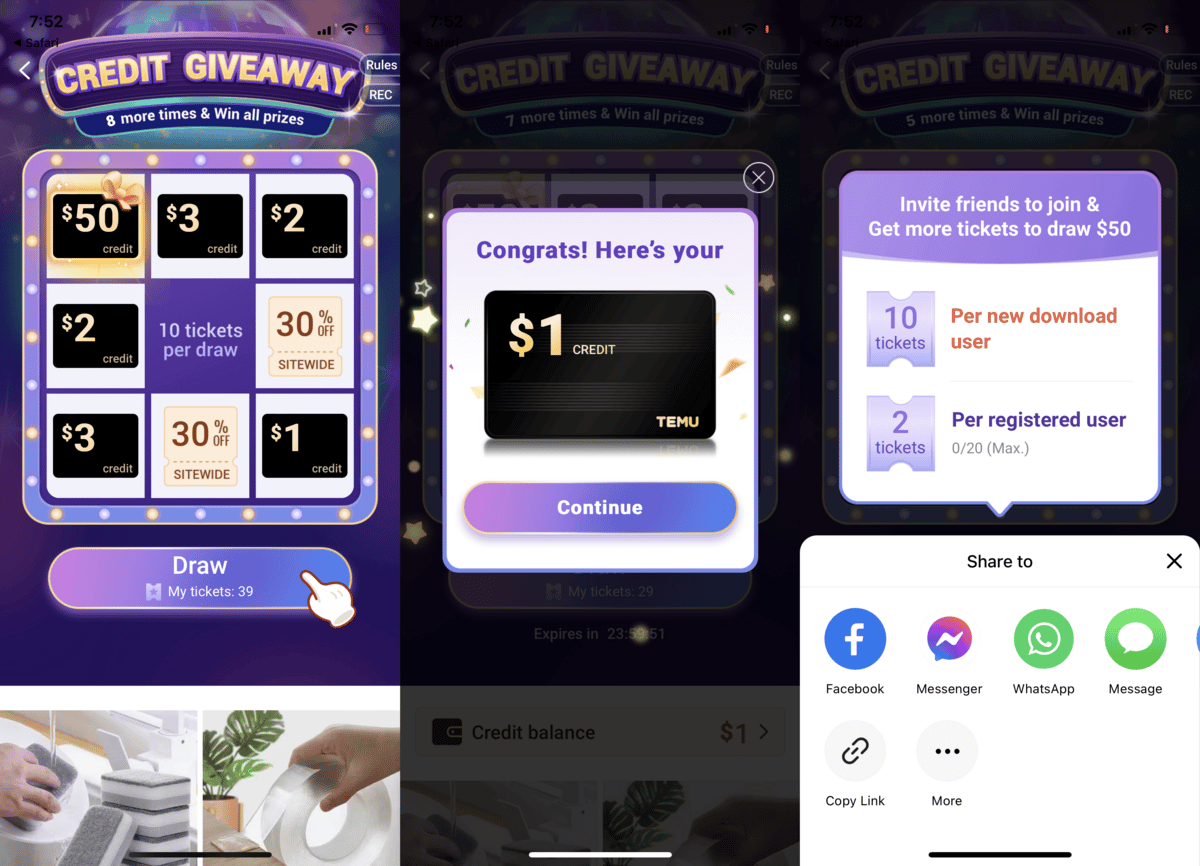

Temu is also giving aggressive credit and invite promotions within the app. Unlike Pinduoduo, which originally incentivized users to share the link to a product page, Temu leverages a referral link where both parties receive credits towards future purchases. I have not pushed this all the way to the end, but they essentially get 6 new app downloads in exchange for $50 in credit, an all-in cost of $61, or $12.20 per app install (if I remembering correctly, you get three draws for free to start). It also heavily incentivizes app downloads over everything else. I think we'll see Temu turn on feed advertising sooner rather than later.

If you remember from a few months ago, I'm in a WhatsApp group with what I think are some suppliers and Pinduoduo employees. There's not much activity anymore, just sharing of referral links every few days. I'm still convinced this is just employees trying to kickstart organic sharing.

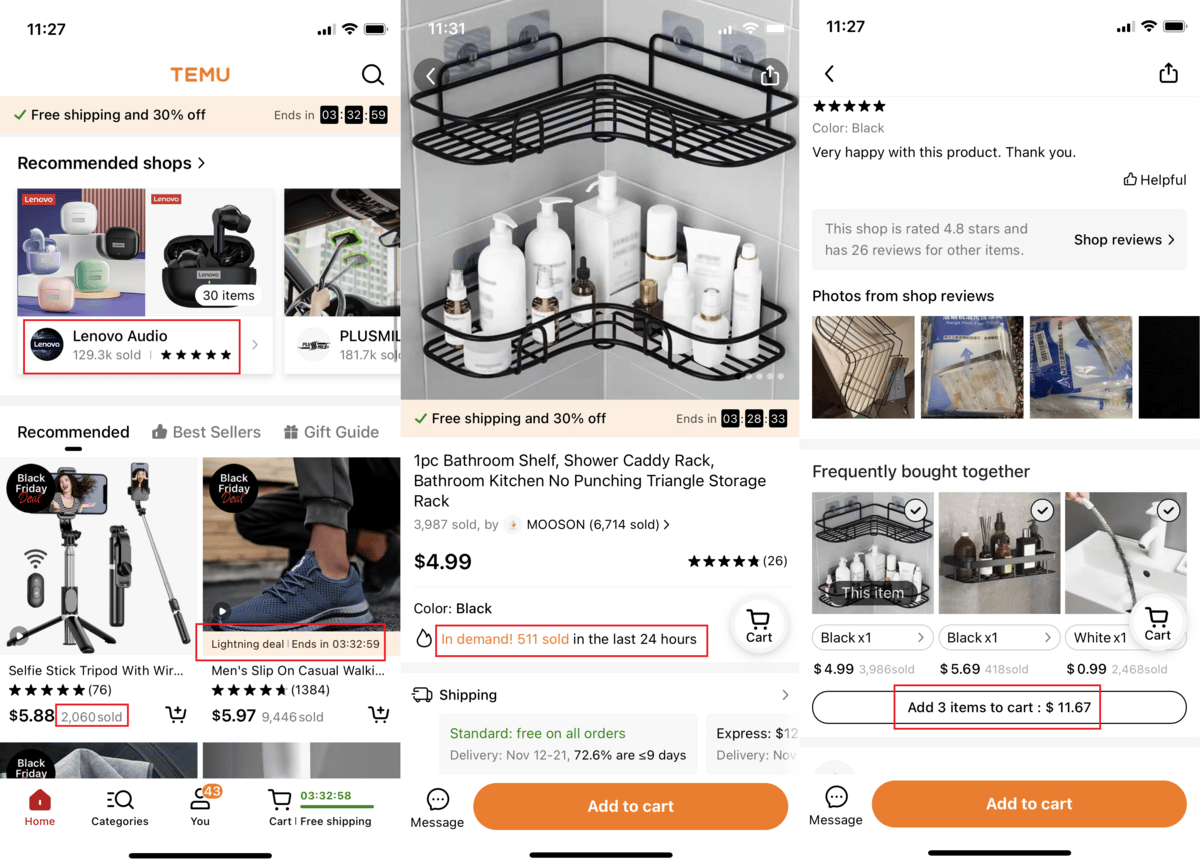

Temu's product categories also seem to have expanded significantly. Product assortment still feels random, but I'd expect more SKUs and improving product quality over time.

Another high-level takeaway is there's lots of social proof built into the app. Nearly every feed thumbnail and product listing page mentions how many items have been sold, though its hard to know how real these numbers are. There's urgency built around various SKU-level sales, and similar to Wish, it has "brand shops".

Temu's product listing pages are not very long, and quickly turn into a scrollable feed of more product thumbnails. It also nudges you to add the entire "frequently bought together".

Call me crazy, but I think Temu is going to catch on in the US. The app is simply more fun to use than Amazon. Profitability is still an open question considering the extremely low price points, but I don't think it's a concern considering Pinduoduo's cash position. Its more important to get scale quickly, especially considering price points are so low.

It will be a long journey and Temu will have to continue expanding product assortment quickly to catch up with other scaled ecommerce platforms. Its not well documented, but a large part of Pinduoduo's initial success in China was attributable to ramping its supplier base very fast through founder Colin Huang's existing relationships running an ecommerce marketing business. As I mentioned last time, Temu is likely tapping into Pinduoduo's existing Chinese merchant base that views Temu as easy incremental revenue. There are certainly product quality concerns. But many of the products Americans buy online are coming from Chinese merchants anyways...

🤝 Want to Partner With The Split?

Over the past few weeks I've been discussing sponsorship opportunities in The Split. If you want to reach 13,000+ startup founders, public company CEO's, and early, late stage, and public market investors, fill out this form and I'll be in touch. Startups at Series B and beyond have seemed to be the best fit.

🚀 Product Launches

Snapchat and Amazon launch AR shopping partnership: Amazon will run a store inside Snapchat where consumers can try on products in augmented reality, starting with sunglasses. It's unclear if the checkout will happen inside Snapchat or Amazon's ecosystem, but nevertheless indicates AR shopping is coming to Snapchat. Snap could certainly use the new revenue stream right now. More from TechCrunch.

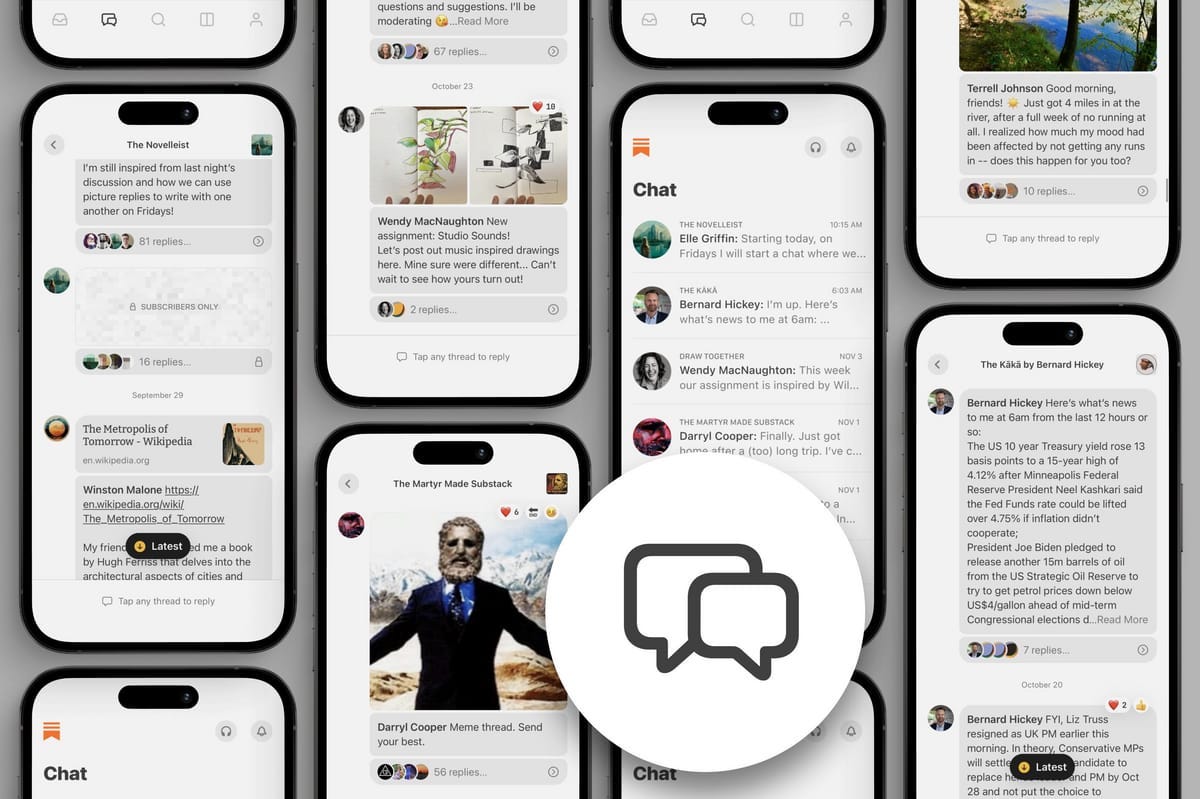

Substack launches Chat: One of the cooler new products I've seen lately, it's a clever way Substack is slowly evolving into a social network. The team solved the initial content / supply cold start problem by starting with email and blog content that now populates an RSS-like feed. More from Substack.

WhatsApp launches Communities: This also seems like a significant move in the direction of WhatsApp becoming more of a social network. More from WhatsApp.

AMC announces partnership with... Zoom? You read that right. In what seems absolutely insane, Zoom and AMC are partnering up to allow teams to rent AMC theater rooms for large, multi-city group meetings. It remains to be seen if anyone will actually use this, but it allows AMC to rent out unused theater locations during week days when no one is watching movies anyways. I actually think it makes a very, very, very small amount of sense. Very small. More from Variety.

🔗 Links and Charts

Twitter users hit all-time highs: In a leaked deck used by its sales team, Twitter has added 15 million Daily Active Users (DAUs) since Q2. That's up 20% year-over-year, more than the 17% in Q2. The US, its largest market, is reportedly growing even faster than 20%. More from Alex Heath at The Verge.

Elon also tweeted a user chart here.

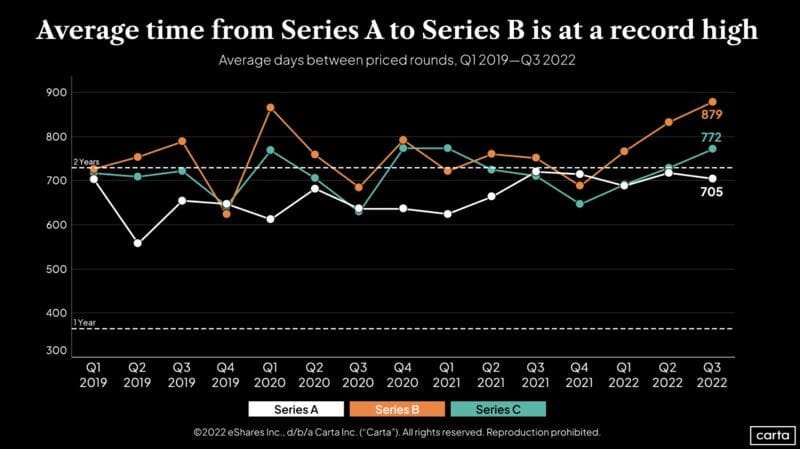

Average time from Series A to Series B at record high: Looks like Series C as well. Data from Carta. h/t Taylor Schaude.

Did AI crash the economy? Brad Slingerlend argues the software used by most apartment operators to price apartment rent caused the rent bubble that is now driving Fed interest policy (rent is 40% of CPI). More from Brad at NZS Capital.

37% of US small businesses were unable to pay full rent in October: This is up from 30% in September. More from Bloomberg.

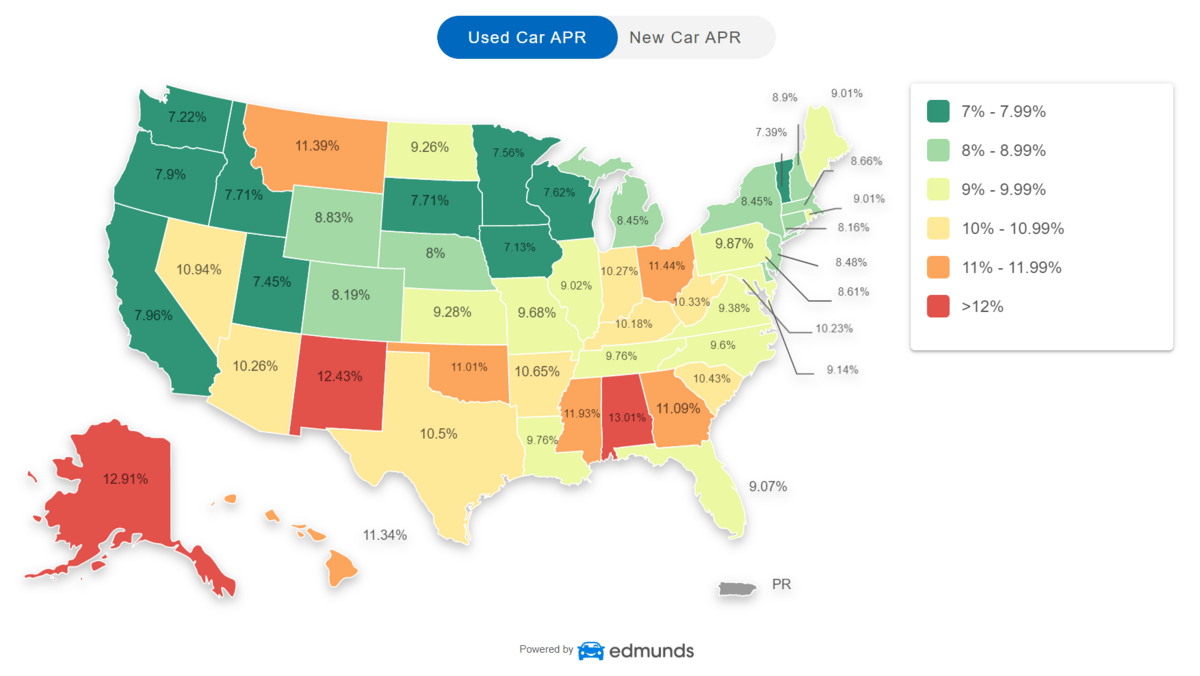

Average rates on used car loans cross 10%: More from Edmonds.

Wells Fargo retail mortgage application volume down 90% year-over-year: Auto originations are also down 40%. More form CNBC.

In an almost unbelievable chart, the median distance moved from their previous residence by new US home buyers between June of 2021 and 2022 was 50 miles, up from 15 miles in each of the previous five years. This is the highest number since the data started being tracked since 2005. More from the WSJ.

Logistics companies cut 20k jobs in October, the 4th consecutive month of declines: More from the WSJ.

If you want to feel depressed, Elliott Management's 28-page Q3 LP letter leaked, with a pretty bleak outlook on markets as a whole. Check it out here.

💼 Career Services

Yesterday we did Banana Talent Drop #6. The Banana Talent Collective now has 136 candidates with an average of nine years of work experience. And more than two thirds of intro requests were accepted last week 🤯

If you're considering a new role (or want to start hiring), join candidates with experience from all the companies below here (and don't worry if you have less than nine years 😅).

Two Chief of Staff roles at Seed stage venture capital firms in my network that might be up someone's alley:

Chief of Staff at Spacecadet Ventures (Remote)

Chief of Staff at Eniac Ventures (NYC, in-person)