🍌 Snap Partner Summit 2023 Recap

Snapchat goes enterprise, Spotlight hits 350 million MAUs, Bitmoji is bigger than anyone realized

Hi everyone 👋 Turner here, and thanks as always for reading The Split.

Snap hosted their 2023 Partner Summit on Wednesday. Historically, this has centered around all things Snapchat and Spectacles, its Augmented Reality glasses. This year there was a surprising focus on Snap’s B2B products. Its TikTok-like video feature Spotlight just passed 350 million Monthly Active Users (MAUs), and it’s ChatGPT-like MyAI is now available to all 750 million Snapchat MAUs.

Keep reading for more on US office occupancy sitting at half of pre-COVID levels, ChatGPT’s impact on migration back to San Francisco, building a house in less than three hours, and how Lego sets were one of the best investments of the past 35 years.

And for some housekeeping, I’ll be moving The Split to Substack starting with next weeks email. If you missed it last week, I alluded to why I’m making the move. I have a few longer posts lined up in April and May, please let me know if you miss them as I transfer things over!

A Message From Failory

😱 Learn From Failed Startup Founders

Over 90% of startups fail, and every failure has lessons for other entrepreneurs.

This is why Failory is one of my favorite newsletters. Written by Nico Cerdeira, he sends a weekly case study detailing the lessons learned from failed startups.

These include founder interviews, blog posts, and even a graveyard of 200+ sunset products from Google and Amazon.

Join 30,000+ other readers and subscribe for free here.

Snap Partner Summit 2023 Recap

Yesterday Snap hosted its 5th annual Partner Summit. The event centered around AI, AR, Creators, Snapchat+, and Ares, it’s new enterprise AR Product. I’ll summarize what I thought was important, and you can re-watch the event here.

Spotlight is Used by Half of Snapchat Users

To start, Snapcaht’s TikTok-like vertical video feed Spotlight just crossed 350 million MAUs. It sits to the far right of the app, one swipe past Discover, its premium content hub. Sitting at 750 million globally, this means nearly half the userbase is using Spotlight with some form of consistency. Snap also mentioned the time spent watching Spotlight in Q1 was up 170% from last year.

I personally haven’t put much weight into an outright TikTok ban in the US. If it does happen, Spotlight has been positioning itself to fill the void. We know TikTok sees commerce as a big piece of its monetization strategy, and more news from today hints at the same for Snap.

Snapchat’s “Insane” Creator Monetization

Spotlight directly ties into Snap’s progress in creator monetization. It mentioned that in Q1 time spent watching content from creators in its revenue share program doubled over last year. And a recent Fortune piece has constant praise from creators mentioning Snapchat’s “insane monetization”.

Snap is rolling out this revenue share more broadly, making Spotlight a TikTok-like feed with a YouTube-like revenue share. And creators can now make money on Snapchat in five different ways: creating AR filters, ad revenue share on Spotlight, sponsored brand posts found through its creator marketplace, virtual gifts in story replies, and commerce via a Shopify integration.

Snapchat+ Hits 3 Million Subs

Snapchat+, its subscription product, just passed 3 million subscribers and $100 million in annualized revenue. Six months after launch, it represents 2% of Snap’s total revenue.

Snapchat+ includes 20+ features like ability to change the Snapchat app icon, pinning friends in chat, custom sound notifications for each friend, boosting stories in the feed, and custom camera features and group chat backgrounds. Verizon is also giving its customers three free months of Snapchat+ via +Play, its subscription hub to manage and save on various content subscriptions.

I still think there’s a path to 100 million Snapchat+ subscribers if it leans into paywalled content in Discover. “You can only watch this Snapchat Show that everyone at school is talking about if you pay $10/month for Snapchat+”. Snap probably wants a large enough base of paying subs to seed initial demand, so we might not see this for awhile.

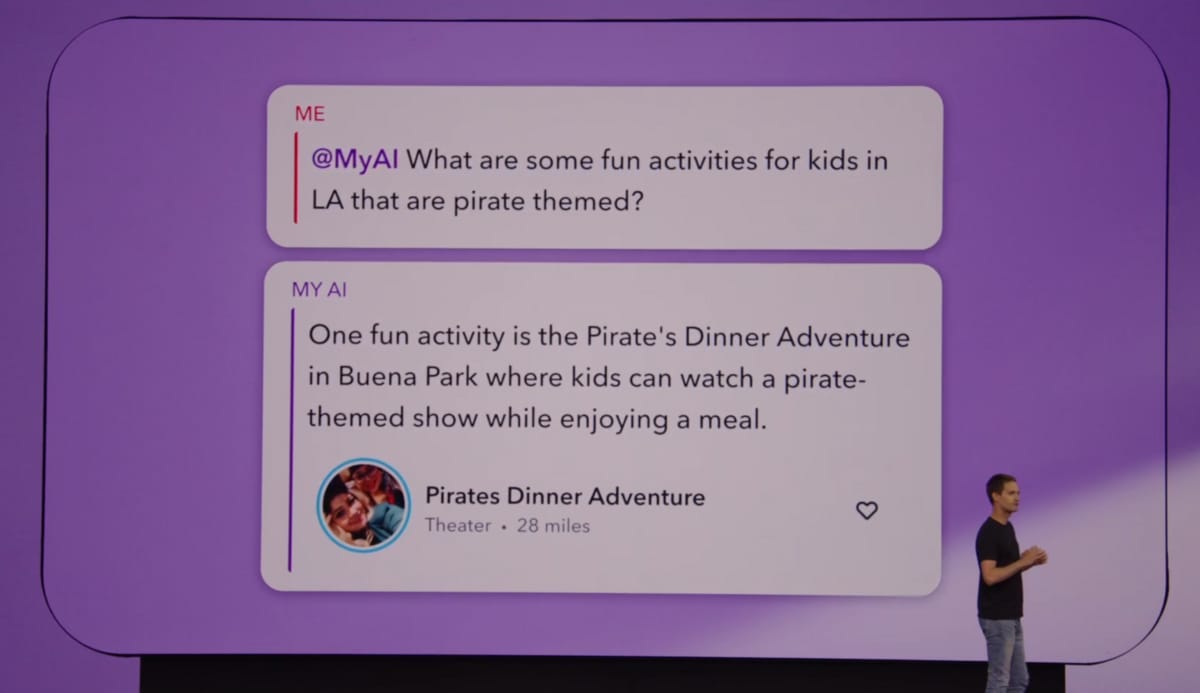

MyAI Now Open to all 750 Million Snapchat MAUs

Snap announced MyAI, its ChatGPT-like bot, is now free. It was previously only available in Snapchat+. This opens it to all 750 million MAUs, nearly 7x more than ChatGPT’s last public number of 100 million.

It will be interesting to see if MyAI remains free forever and if Snap is able to weave it into its advertising business. This also creates an opportunity for chat plugins, which could give new life to Snap Minis, its “app within an app” concept. The presentation on Wednesday hints at how this could be possible.

MyAI can also now respond with pictures. If you send it a snap, it uses generative AI to snap one back. This would probably make it feel much more real than just text, and you could argue Snap is one of the best positioned to win the “AI friend” land grab.

Augmented Reality Goes Enterprise

On the Augmented Reality side, Snapchat’s AR platform is now integrated in the native Samsung, Microsoft Teams, and Microsoft Flip cameras. It’s “find my friends” Snap Map feature will start highlighting places friends have visited historically, and will tie in to the Snapchat camera with explorable 3D features like this map of the grounds at Coachella…

… and this one to locate a friend through the camera based on their position on the map.

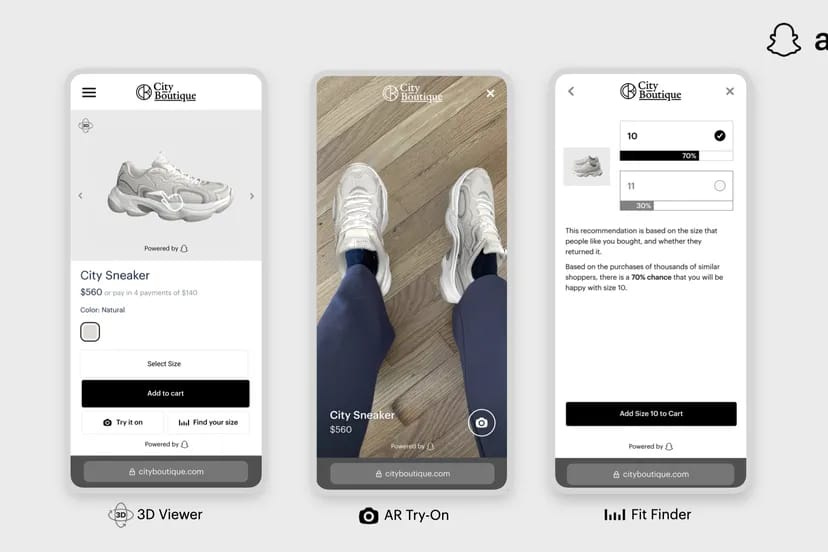

Snap is also leaning heavily into enterprise AR products. It announced ARES, its AR Enterprise Shopping software suite. This puts its AR tech into retailers ecommerce products and stores (more on this second part below). It adds native 3D viewing in the checkout experience, enable’s AR try-on, and fit and size recommendations. If it works, this would increase conversion rates (more revenue) and reduce returns rates (fewer costs). 300 customers are actively using Ares, some seeing as much as a 59% increase in revenue per customer.

This also gives Snap more first party data. Considering Apple’s ATT changes two years ago, more touch points with consumers makes it in-app and third party ad products more effective. If a brand like Levi’s uses Snap’s checkout on Levi.com, it probably helps conversion rates within Snapchat.

Snap also launched an AR Mirror for retailers. From a single image, it enables instant AR try-on. For consumers, its a new way to discover products (no more taking 20+ shirts into the dressing room). For retailers, it unlocks new data on how customers interact with inventory in the store. The mirrors could be used to drive loyalty program sign-ups, or even turn into a self-serve checkout.

For Snap, the mirror is great marketing for their other enterprise software. It probably drives Snapchat downloads, and it most importantly integrates with the rest of its product, including its ad network.

Bitmoji is Bigger Than Anyone Thought

Lastly, Snap disclosed that a total of 1.7 billion Bitmoji’s have been created in the lifetime of the app, it’s digital avatar product. This is up from 1 billion a year ago. Assuming they’re all unique accounts, it almost 22% of the global population has their own virtual character on Bitmoji.

Snap is also expanding Bitmoji Drops. This will look similar to its December partnership with Adidas, which gave access to exclusive products for a short-time. You can start to see how this ties in with other products Snap is building in AR, digital and physical commerce, and advertising.

Summary

Stepping back, it’s good to remember that Snap’s advertising business was significantly impacted by Apple over the past two years. We knew Snap had long-term plans in AR, and many of these initiatives bring commerce closer to Snapchat’s ecosystem.

Last week, if I would have told you that Snap was going to spend the entire hour talking about creator monetization and enterprise software, you wouldn’t believe me. But that’s exactly what happened. If anything, it feels like a material shift in how it approaches its business.

💰️ Free Stuff

Facebook Settles $725 Million Class Action Lawsuit: Anyone in the US who’s had a Facebook account at any time since May 24th, 2007 can apply for their share.

🚀 Product Launches

a16z Launches Tech Week 2023: This year Tech Week will span SF (May 30-June 4th), LA (June 5-11th), and NYC (Oct 16-22). Check out the initial lineup, and be on the look out for Banana-organized events over the next few months.

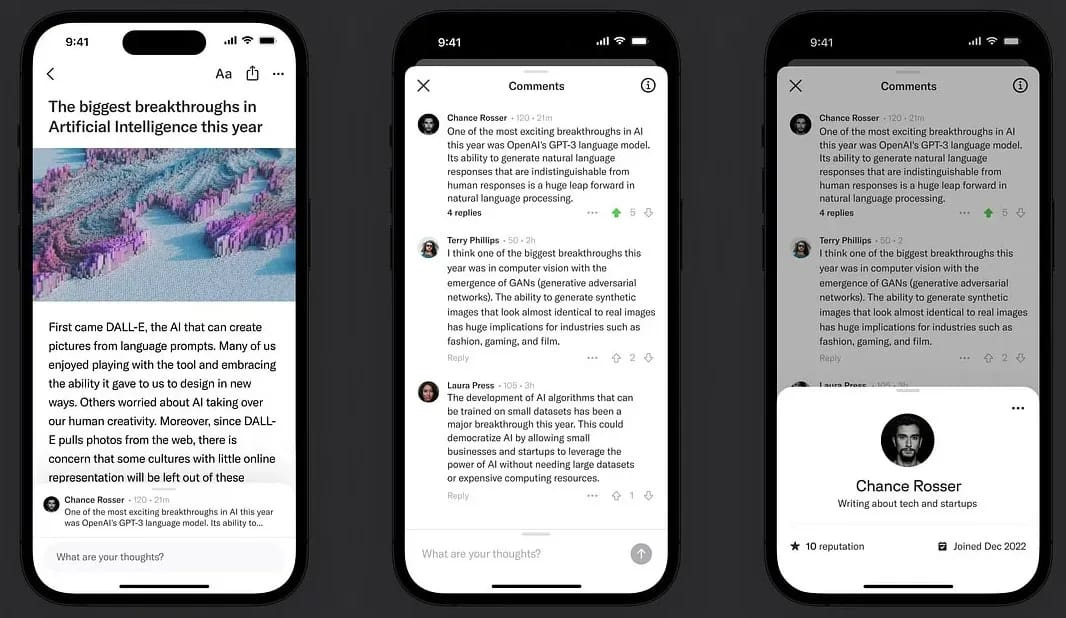

Artifact Adds Comments and Friend Features: I missed exactly when this happened, but Artifact is getting more social. When I wrote about the initial launch in January, the app felt like a slick RSS reader. It now has comments and the early signs of user profiles.

Amazon Releases ARMBench: It’s now the largest public data set for training “pick and place” robots. It features more than 190,000 objects, nearly 1,900x greater than the prior largesat. This dataset allows identification of:

Boundaries of each individual object

Specific products or SKUs

Defect and error detection

Amazon hasn’t mentioned it’s long-term plans with ARMBench. On one hand, more efficient warehouse robots cut costs internally. If they follow their playbook of turning cost centers into new businesses, we may see them look for ways to sell this to other warehouses just like they sell compute with AWS. Or maybe it just makes Fulfilled by Amazon even better, its third party logistics business.

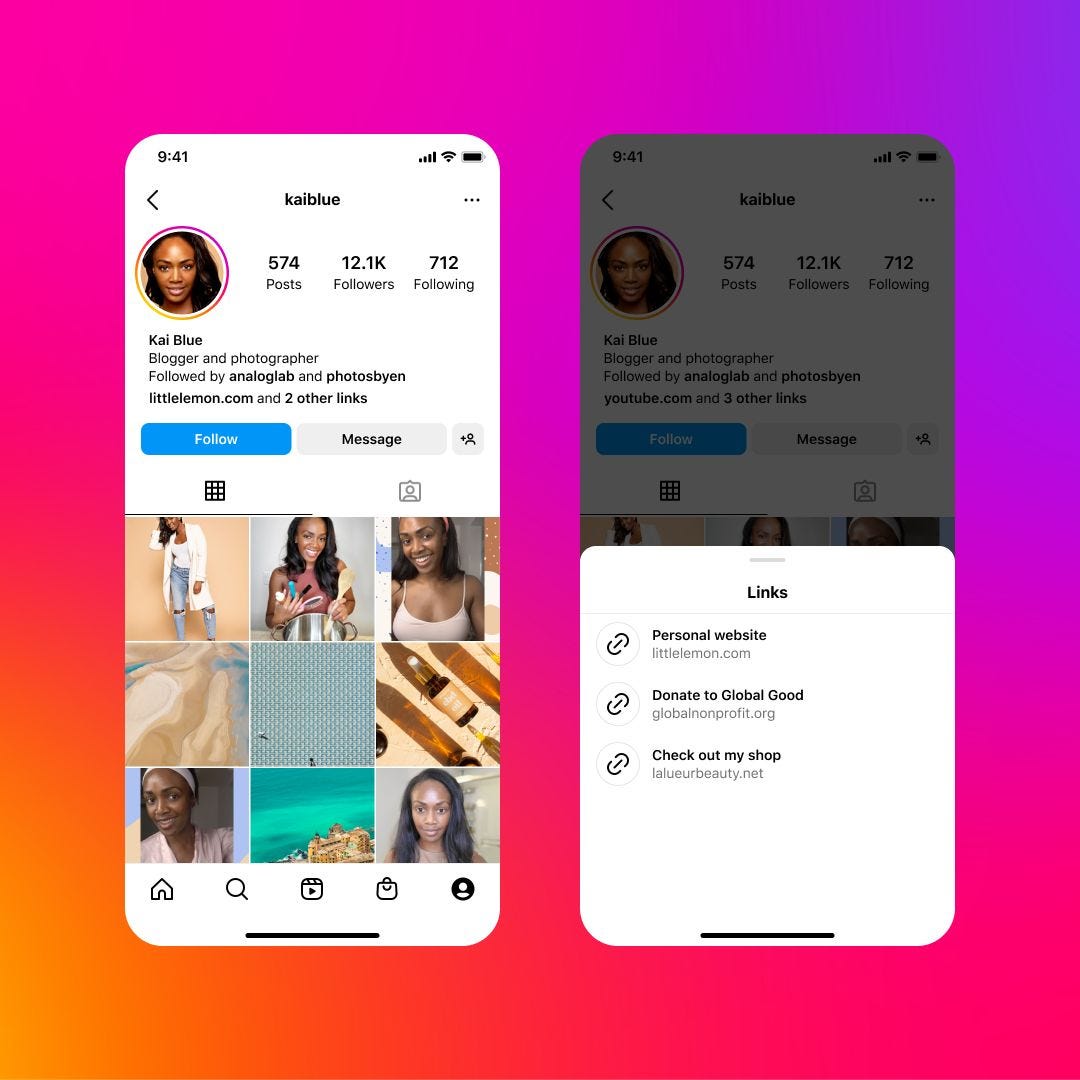

Instagram Expands Links in Bio to Five Links: The narrative has been that this kills the Link in Bio products like Linktree and Beacons, but every power creator wants one central tool they can update across platforms. They’re essentially mobile-first websites, and Facebook left a lot to be improved on in this first iteration.

🔗 Links and Charts

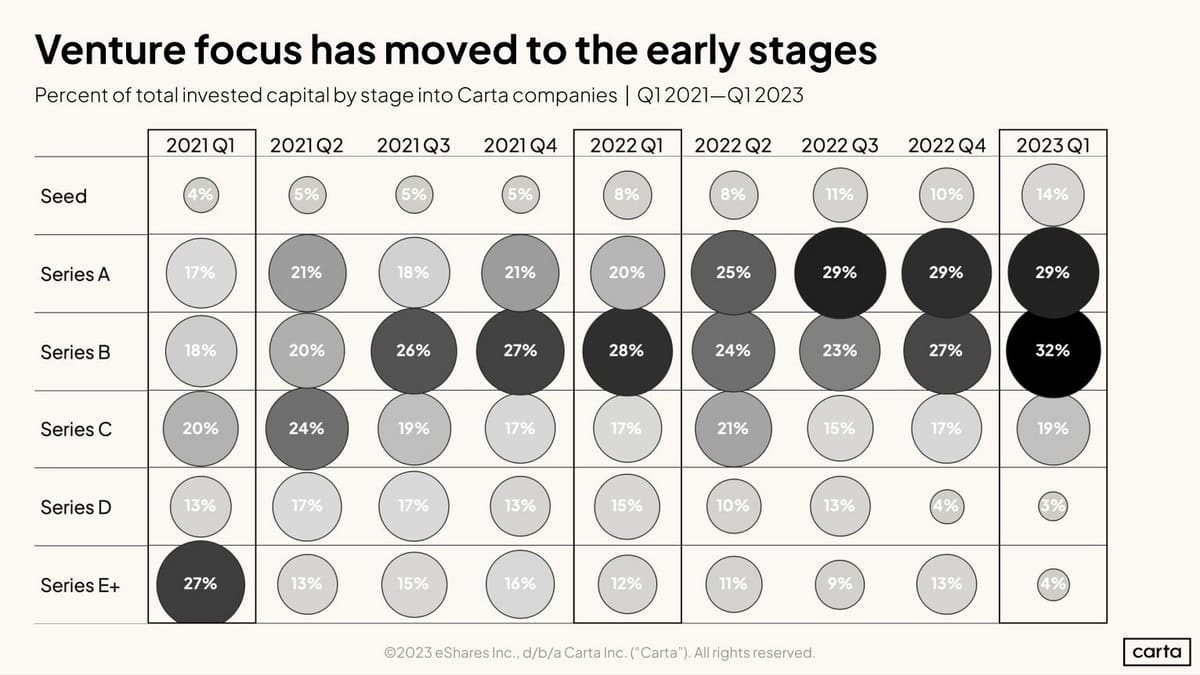

Private Market Venture Dollars Are Moving Earlier: While not new for regular readers of the Split, data from Carta shows how Seed has grown its share of total invested venture dollars by 3.5x while late stage remains near non-existent.

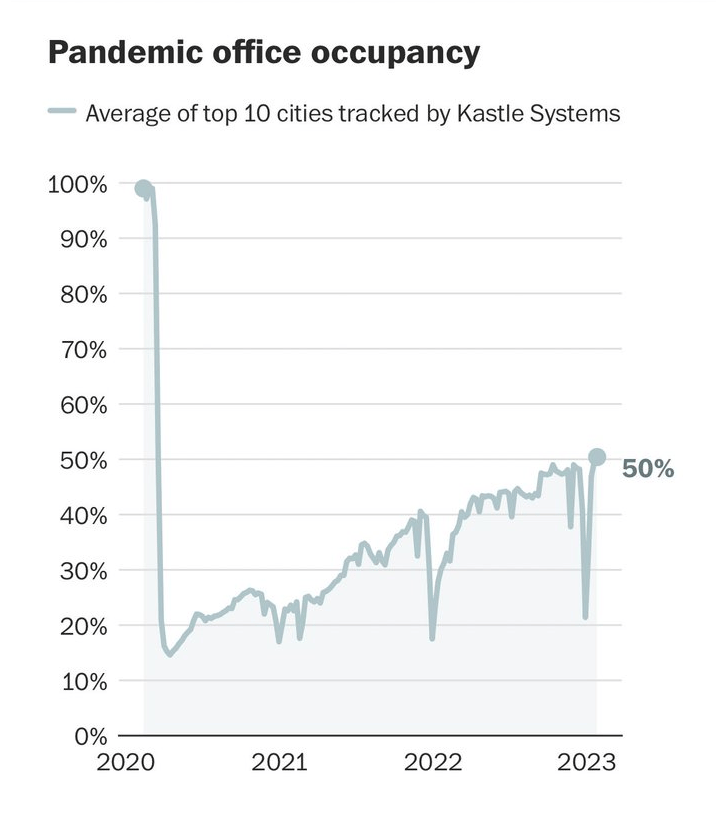

US Office Occupancy Back to 50% of Pre-COVID Levels: This measures actual bodies in the office. San Francisco is at the very low-end, finally crossing 40% of pre-COVID occupancy in January of 2023.

While its slowly recovered over the past three years, experts don’t predict the number to go much higher. More than half of US jobs that can be done remotely were already hybrid in November of 2022, up from 32% in January of 2019.

San Francisco Office Vacancy at 25-Year High: Over 10% is sublease space, also higher than post-Dot Com Crash and the Great Financial Crisis.

SF is Back: Well, sort of. Someone mapped OpenAI product launches on top of San Francisco’s net migration rate. I can definitely buy what this narrative is selling me.

Skyscraper Proposed for SF’s West Side: In what might fix some of SF’s housing issues, the completely out of place tower has a legitimate shot of happening.

“The City will need to approve the project, and they know it. The proposed project at 2700 Sloat is 100% Code compliant (both city and state), including the base density calculation. The city needs to supply the Outer Sunset area with 11,000 new housing units in just over 7.5 years, and approval of hundreds of small projects is not going to get them anywhere near that state requirement.”

Netflix’s Second Live Stream Special Was a Disaster: It’s Love is Blind Live Reunion Special was a highly anticipated follow-up to the live Chris Rock event I mentioned a few weeks ago. And for reasons we’ll hopefully learn soon, it couldn’t get the broadcast to work.

GM to NOT Support Apple or Android in New Models: GM’s upcoming electric vehicles will not support Apple CarPlay and Android Auto. This is despite industry surveys indicating there’s very high consumer demand for native Apple and Android support. This hints at how GM is thinking about its Ultifi vehicle operating system: software updates and in-vehicle personalization and upgrades.

Introducing Ultifi | GM Ultium Effect

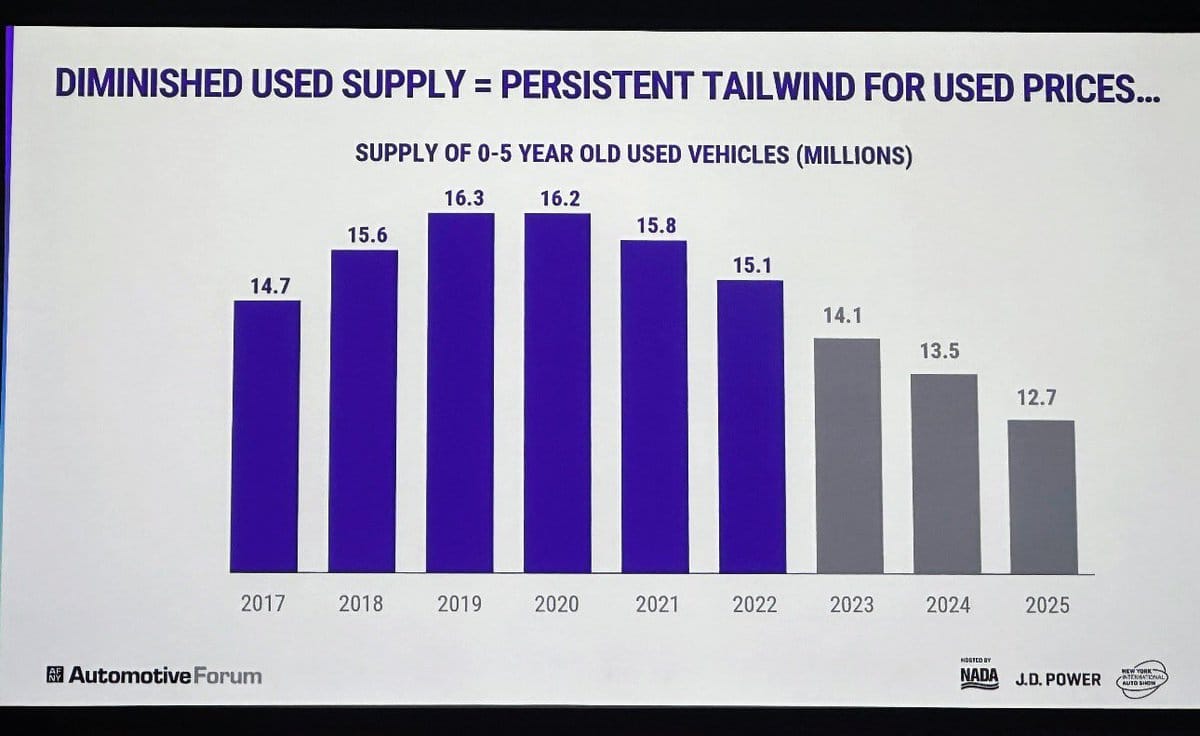

Speaking of cars, the auto industry is anticipating a significant decline in used car supply over the next three years. If it plays out like housing, this will keep prices elevated despite higher interest rates. We may even see automakers lean into this to support the value of vehicles in their leasing businesses. h/t Brian Kramer at Cars.com

Montana Lawmakers Approve Statewide TikTok Ban: The ban moves to the governor to sign (he has 10 days to act on it before automatically becoming law), after which legal challenges are expected. It would prohibit TikTok, owned by Beijing-based ByteDance Ltd, from operating within the state and bar app stores from offering TikTok within the state.

Apple’s Growing India Footprint: Apple now produces over 7% of iPhones in India, up from 1% in 2021. Analysts think this could reach 25% by 2025. Its Indian suppliers now have over 60,000 employees, and its opening its first two Apple Stores in India this April.

The video game market over time: h/t Ben Gilbert for sharing.

Blockbuster Drove HBO’s Original Original Content Push: While today we know HBO as the destination for premium content, it launched in 1972 as a paid cable channel with commercial-free movies. It wasn’t until Blockbuster provided consumers thousands of on-demand choices in its stores by the early 90’s that HBO started aggressively investing in original content. By 2001 it allowed subscribers to catch-up on previous seasons and episodes, which made it well-positioned for streaming when it launched HBO Go in 2010.

America’s Changing Values: The importance of patriotism, religion, and having children have decreased over the past 25 years. And the drop has accelerated over the last five.

327 People Were Responsible for 6,000+ of NYCs Shoplifting Arrests: 18 department stores and seven chain pharmacy locations accounted for 20% of all shoplifting complaints in NYC. Theft of items valued at less than $1,000 have increased 53% since 2019, and the number of shoplifting complaints in NYC has nearly doubled since 2018.

📚 Long Reads

Oracle’s Financial Engineering is Paying Off: Oracle founder and CEO Larry Ellison has quietly become the fourth wealthiest person in the world, per Forbes. This has happened mostly under the radar over the past decade, as his stake in Oracle has grown 3x to more than $100 billion.

The craziest part of this story is that he hasn’t actually bought any shares. Oracle has bought back over $150 billion in stock since 2011, and Larry hasn’t sold a single share. This has increased his personal stake in the company to 43%, which is projected to pass 50% by 2026. It begs the question of what happens then? And does this become a trend across other tech companies?

How to Build a House in One Day: A thought provoking piece from Austin Vernon. He starts by sharing the below video where, as part of a competition in the early 1980s, a group of workers built a standard code-compliant home in 2 hours and 45 minutes. He then expands on how robotics and adapting the supply chain could speed the pace of construction today.

How I Changed My Mind on Social Media and Teen Depression: You’ve probably seen the charts showing how increase dsocial media usage has impacted teenage mental health. This post goes into detail on why it’s probably not attributable to social media alone, but to smartphone usage more broadly.

I Saw the Face of God in a Semiconductor Factory: A long story from Wired on TSMC, the mysterious Taiwanese company at the center of the global semiconductor industry. Favorite quote: “The semiconductor industry churns out more objects in a year than have ever been produced in all the other factories in all the other industries in the history of the world.”

Letter From Neal - YouTube’s 2023 Priorities: Its big initiatives this year include expanding on-platform creator monetization, increasing market share in TV and podcasting, and leaning further into Shorts.

LEGO: The Toy of Smart Investors: Investing in Lego sets as an asset class between 1987-2015 would have outperformed large cap, bonds, gold, and other alternative investments. Its returns are not exposed to market, value, momentum, and volatility risk factors, making it an “attractive alternative asset with good diversification potential”. h/t Arda Capital for sharing.

📺 Videos

Crypto: The World’s Biggest Scam: A well-done documentary from one of my new favorite YouTube accounts going inside the rise and fall of the crypto market.

💼 Career Services

Banana Talent Drop #13 went live on Monday (I forgot to press submit on the drop last week 🤦♂️). Candidates with experience at Meta, Cameo, Zynga, Instawork, Riot Games, Zuora, Qualcomm, and a long-tail of startups were sent to 68 hiring managers.

The Banana Talent Collective now has 230 candidates hailing from the companies below + more (if you're at a Banana portfolio company, reach out for access).

If you're hiring and want a feed of high quality pre-vetted candidates, join the collective to get in front of potential hires that are both actively searching for and passively considering their next role.

🍌 Monkey Business

❤️ Reader Love

🍌 The Split is brought to you by the team at Banana Capital. We invest $250k to $750k in Pre-Seed and Seed rounds globally. Read more about what we're up to and the latest on our Fund 2 here.

🤝 Interested in a sponsor partnership with The Split? Inquire here.