Snap Partner Summit 2021 Recap

Snap opens more of its platform to developers, growth of core Snapchat still accelerating

Snap hosted its 2021 Partner Summit (replay) last week. Here’s my recap and key takeaways, as is tradition.

Snapchat Growth Continues Accelerating

Possibly the biggest metric disclosed was Snapchat now reaches 500 million Monthly Active Users (MAU’s). With 280m Daily Active Users (DAU’s), ~56% of users check the app daily. The most successful messaging products like Snapchat are typically higher (Messenger’s DAU/MAU is ~69% in the US), however this lower number may reflect incremental MAU’s coming from Discover, Snapchat’s content product that reaches more US viewers than Netflix, and newly acquired international users (which skews lower). These folks may not be messaging daily, but their usage is highly monetizable. They’re also captive to be pulled into Snapchat’s messaging network over time.

Snapchat’s DAU’s increased 22.3% year-over-year (YoY) in Q1 ‘21, the fastest since its Q1 ‘17 IPO. This was despite dropping hints on earnings calls throughout 2020 that COVID-imposed lockdowns were holding back user growth. Half of all US smartphone users are now on Snapchat, and DAU’s are still opening the app 30x per day. India DAU’s are up 100% YoY for the fifth quarter in a row. Snap also mentioned that 40% of its users are now outside North America and Europe - a trend kickstarted in 2019 by the redesigned Android app.

Snap still has the challenge of monetizing these non-developed market users, something Facebook struggles with as well. Things like AR, premium Discover content, and commerce will likely help with this over time.

The Snapchat Camera & Augmented Reality: Powering Snap’s Business Model

Snap kicked off the summit explaining how cameras typically struggle to accurately capture darker skin tones. It’s commitment to fixing this may seem trivial at first, however considering most of Snap’s future user growth will come in markets with darker skin toned populations, it’s very relevant as explained here:

Snap’s camera usage is still strong, as 5 billion Snaps are created per day, or 18 per DAU. Over 200 million of Snapchat’s 280 million DAU’s (71%) engage with augmented reality (AR) daily. A recent Deloitte study found the pandemic made AR experiences more important to more than half of consumers, and over 75% expect their use of AR to increase over the next five years. In the past Snap has disclosed numbers suggesting users spend ~3 minutes per day in the camera; important considering Snap shared Scan, its camera search feature, now has 170 million MAU’s.

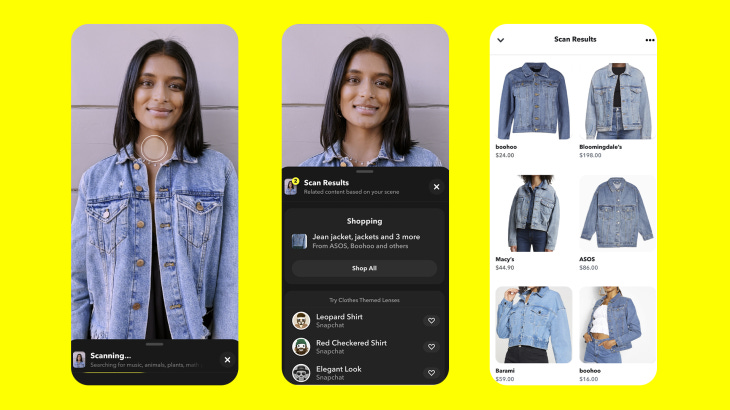

A big Scan capability unveiled last week was “Screenshop”. Point the camera at a friend and scans their outfit to see similar looks to be purchased. This also works with saved pictures in Memories, Snapchat’s cloud photo and video storage feature.

Scan is also getting camera shortcuts, which auto suggests pre-edits to save time when creating a snap, and the ability to recommend recipes based on food in a picture. These rolled out last week, with hints at many more Scan integrations to come. If I had to guess, placement in these visual search tools will be biddable in the future.

Snapchatters share content within the camera 600+ million times per month, and Snap hinted any piece of outside content will soon be shareable inside the camera (this can already be done with Games, Minis, etc). This should increase Snapchat camera usage and opens a new distribution channel for outside apps.

We also saw the next iteration of Local Lenses called Connected Lenses. These allow friends to share the same AR experience at the same time - across the room or across the world. This capability was also opened to lens creators in Lens Studio.

Lens Studio 4.0: Creators, Developers, and Partners

One announcement that seemed to sneak under the radar was Visual Classification in Lens Studio (Snap’s AR development platform), which brings the capabilities of Scan to all developers. I think of Snap’s AR lenses as very early iterations of AR-based apps, and Scan will be how many of these are accessed.

Lens Studio now has multi-person 3D Body Mesh and Cloth Simulation, as well as some new, no-code visual effects. This allows for more realistic, tighter than ever AR. Snap hinted at clothing as big use case, specifically in no code.

Snap also launched API-enabled lenses to pipe in digital assets and product inventory with no integrations needed. Browsable, public profiles for catalogs of AR lenses are also coming to Snapchat (storefronts??). In an AR try-on beta with 30 brands, Snapchatters tried products on 250+ million times, and were 2x more likely to purchase than in other campaigns. American Eagle’s virtual pop-up store generated $2m in incremental sales and one Gucci lens saw 19 million try-ons. All said, Snap continues dropping hints commerce will be a big driver of AR monetization.

Snap unveiled its Lens Creator Marketplace last week, a self-serve portal for creators and Snap’s ad partners. More analytics capabilities are coming to lenses (user demo insights, play time) that mirror its ad tools. This hints at a convergence, and will allow those creators to earn money (200k creators have created 2 million lenses that have been viewed 2 trillion times) while helping brands create AR experiences to be used throughout Snap.

In its try-on beta, Farfetch notably incorporated Lens Studio’s 40 voice commands into its catalog browsing. Snap ML, which allows for Machine Learning models within created lenses, now incorporates sound and audio to recognize phrases, transcribe speech, and make music. This evolution of Lens Studio’s voice capabilities is important as voice will be a key interaction layer in Snap’s AR glasses, Spectacles.

Spectacles 4: the First Built-in AR Displays

This years “one more thing” was Spectacles 4, Snap’s first pair of AR Glasses with a built-in AR display.

The new Specs are 134 grams, 7x lighter than the third generation and ~3x heavier than the average pair of sunglasses. 3D waveguide displays and 15 millisecond latency promise the most realistic AR overlays yet that should work seamlessly in and outdoors. The displays adjust automatically and auto-recommend lenses based on context (hello Scan!). The new Specs link directly to Lens Studio and can render projects in real-time. In addition to bringing back touchpad controls, they have two speakers and four microphones, again hinting how important voice and hands-free will be in AR.

Snap’s biggest advantage in an AR race that includes Apple, Facebook, Google, Microsoft (and many others) is its existing AR usage and friend graph within Snapchat. The new Specs allow you to send snaps directly from the glasses. And if Connected Lenses are any indicator, these will likely work cross platform powering cross-platform, co-located AR experiences.

Alex Heath at The Verge reported Snap acquired WaveOptics, the glass display supplier in Spectacles, for ~$500 million. This is Snap’s largest acquisition to date. Snap has been building Spectacles for seven years, and despite being roughly 10 years away from mass market, Snap is investing aggressively to own this next platform.

Extending the 30 minute battery life, bone conduction, and chip miniaturization (Snap will acquire or ultimately be acquired for this) will eventually increase the use cases and open up wider scale consumer adoption of AR glasses over time. And unlike VR, AR overlays on top of real life. Instead of isolating us from the world, AR promises to immerse us. And similar to Apple’s approach to mobile, the initial consumer use cases more likely translates to enterprise than vice versa.

Snap Kit: Snap’s Developer Platform

A platform that’s starting to see immediate results, Snap revealed its 2.5 year old developer platform Snap Kit now has 250k+ developers. Last week it released Sticker Kit, which opened 34+ million Bitmojis, Snap-made stickers, and GIFs to developers. Snap disclosed its creator tools are used 1+ billion times per day, or 3.6x daily per DAU. More importantly, it adds more features to Snap Kit, making it more compelling for developers to adopt. Pieces of Snap’s platform now help with initial conversion on installs, increasing engagement and retention, and monetization. And for Snap, it gets developers building on a platform that all appears to be converging and increasing in utility.

A few partnerships were highlighted, including a new sticker integration with existing Camera Kit partner, Bumble. This puts Snap’s products in Bumble’s camera and chat.

We also learned about what looks to be the beginning of many Disney partnerships. First are location-based AR lenses in Disneyland, including fixed permanence on iconic physical objects around Disney Parks.

Last year, Bitmoji was integrated into all Samsung phone keyboards. This year, Snap mentioned it’s Camera Kit product was coming to the native camera of all Samsung phones. This brings (all?) features of Snapchat’s camera (and ability to send snaps?) to 20% of all smartphones sold globally on an Android operating system it historicvally struggled on.

Bitmoji: Snapchat’s Decentralized Social Network

Snap casually mentioned Bitmoji now has 200 million DAU’s, another very under reported stat coming out of SPS. Aqcuired for $64 millioni in 2016, Bitmoji is a digital avatar tied to each Snapchat account. Snap has hinted at social features coming to Bitmoji, and we shouldn’t be surprised to see more parts of Bitmoji interlink between all the places its starting to show up. Bitmoji saw over 5 billion digital try-ons over the past year, hinting at what a decentralized advertising and virtual economy might look like.

Bitmoji for Games is also coming to Unity. After announcing the Snap Audience Network would plug into Unity’s supply in December 2020, this further proves how strategic of an asset Bitmoji has become. It’s a portable digital character that can be used across Snapchat, various consumer apps, and in mobile, PC, and console game environments, setting the stage for a decentralized Snap metaverse.

Games and Minis: Snap’s Ecosystem

Over 200 million Snapchatters have played with Games and Minis, up from 100 million one year ago. Snap Games now have 30 million MAU’s, and 30 total Snap Games have been published over past two years.

Games and Minis are built on the same platform and offer developers one engine that works cross-platform across iOS and Android. Snap is also turning on revenue generation via ads, tokens, and commerce.

French-based Voodoo’s Aqua Park has reached 45 million players since launching last fall and is now working on 5 more Snap Games. Snapchat is serving as an additional distribution channel for new app downloads + gives them incremental revenue as they can re-use assets they’ve already built for their own apps. If you’re not familiar with Voodoo, they’re a game publisher with a portfolio of “mini-game”-like apps. Voodoo also has a publishing platform that powers 100’s of other game publishers.

A standout early Snap Mini example is Poshmark. The Mini will feature daily shopping events, viewing Poshmark’s 200+ million secondhand item catalog, sharing with friends, and checkout - all within Snapchat. We’ll likely see similar concepts launch with other early test partners that include Target, Adidas, Ralph Lauren, and Dior. Gifting platform Givingli powered 2 million digital Valentine’s Day cards, and Turbo Vote helped 30 million users register to vote. With products like Bitmoji that can weave through these experiences both in and outside Snap, Minis will likely be a channel that increases revenue, installs, and retention for partners.

A big change coming to Snapchat’s UI is Games and Minis are getting their own home in the app. Swiping down from the camera will access what might look like, if you squint hard enough, the very early days of an Snap App Store.

Snap Map: Bridging Snapchat’s Friend Graph with the Real World

A product that ties together Snapchat’s core camera, messaging, and Minis products is the Snap Map. Its a personalized digital map that shows (and lets you message!) your friends around you. Snap just announced its crossed 250 million MAU’s, up from 200 million in Q2 ‘20, and now features 30 million businesses.

Snap announced a new Layers feature last week, which changes the map based on:

Memories: User photos and videos taken around the world

Explore: Public content from other users around the world

Infatuation: Restaurant reviews

Ticketmaster: Explore concerts and events - and jumps into Ticketmaster’s Mini

We’re in the early days of Snap opening the Map, and we’ll likely see more use cases built on it.

Content, Creators, and Spotlight

Snap shared Spotlight, Snapchat’s TikTok-like vertical video feature, now has 125 million MAU’s (up from 100 million in January). Viewers watching over 10 mins per day grew 70% in Q1, and it will soon roll out globally (Middle East launch was May 17th). Flexing the power of Snapchat’s built-in distribution, this 100 million MAU milestone took less than three months, compared to the 12 and 18 months it took Douyin / TikTok’s to reach 30 million / 100 million, respectfully, when first launched in China in 2016.

Snap initially made waves with Spotlight by paying out $1 million to content creators per day. Since launching at the end of November 2020, 5,400 people have earned over $130 million. In what felt inevitable, Snap recently changed the messaging around this payment to “millions per month”.

Snap also launched story replies allowing creators to insert user responses within new content. This looks similar to TikTok’s comment replies feature. Snap also announced users will be able to gift creators, of which Snap will take a cut, set to roll out later this year. Snap is notably adding web-based PC editing tools for Spotlight. This hints brands will start entering the Spotlight feed, and soon, ads.

More on the editing front, Snap announced Story Studio, a standalone mobile app for editing content that will launch on iOS later this year. It borrows much from TikTok’s editing suite (clipping, browsable sounds, effects) and taps into Snap’s more robust AR ecosystem.

Snap now has a total of 500 premium content partners, and content partner payouts have grown 100% over the past year. Launching less than two years ago, India had 70 million Snap Show viewers in 2020, and reach in the Middle East grew 300%. Not only do these premium shows have ads that bring in revenue to be re-invested in other areas of the product mentioned above, but much of this premium content acts as user acquisition. Content and creators act as a growth flywheel that helps kickstart Snapchat’s messaging network in each market, which then reinforces Discover’s content network.

Conclusion

This year’s Snap Partner Summit reminded us how far Snap has come over the past few years: build anything with Lens Studio, find anything with Scan. Augmented reality and Snap Games will start meshing with Spectacles and the Snap Map, and the advertising network originally seeded by the content business will be a monetization engine that weaves through it all.

Most importantly, its become clear Snap has taken a key lesson from Amazon. Each piece of the Snapchat platform - the Camera, Messaging, the Map, Games, Bitmoji, Stickers, Discover, Snap Ads - has quietly opened itself to developers and third parties through products like Snap Kit, Lens Studio, and Snap Audience Network. Historical cost centers like messaging, which sucked cloud resources and user time spent, are now positioned to drive material revenue for Snap through commerce and advertising in products like Minis, Games, and the Snap Map.

Snap’s business is evolving into a mix of messaging, content, advertising, software, and hardware. What started as an app to send disappearing pictures is starting to look like pieces of WeChat, Disney, Google, and Apple. Time will tell if Snap is ultimately an enduring business, however it appears to be positioning itself to be just that.

Snap still faces the difficulty of making money off of these undeveloped market customers. Over time, things like commerce, premium Discover content, and augmented reality will probably assist with this. https://geometrydash-subzero.io

Snap is placing its entire future on people someday interacting with the environment more visually was one of my main takeaways. Its success will depend heavily on the camera acting as the interface that controls everything. https://eggycar.co