Ramp Flexes its Muscle

Streaming viewership officially passes TV, Cash App issuing 1 million loans per month

Thanks for tuning back in! Its Turner, founder of Banana Capital, back with another edition of The Split.

Ramp continues its impressive product velocity, and I chimed in on its latest launch. I also recently realized Walmart+ is a thing that exists, and am amazed at just how big Cash App's consumer lending product is.

Ramp Launches Flex

Ramp just launched Ramp Flex, which essentially adds a credit solution to its Bill Pay product. Not only does this help Ramp further automate its customers finances, but also captures more of their ACH payment volume.

At face value, Ramp's business seems simple: generate revenue by taking a cut of all corporate charge card transaction volume. The types of things you can pay for with a card are limited, and ACH makes up the majority of B2B transaction volume. Layering what is essentially a modern day line of credit or factoring product (which is how many businesses float their daily transactions) on top of Bill Pay allows Ramp to monetize practically all of a customers expenses.

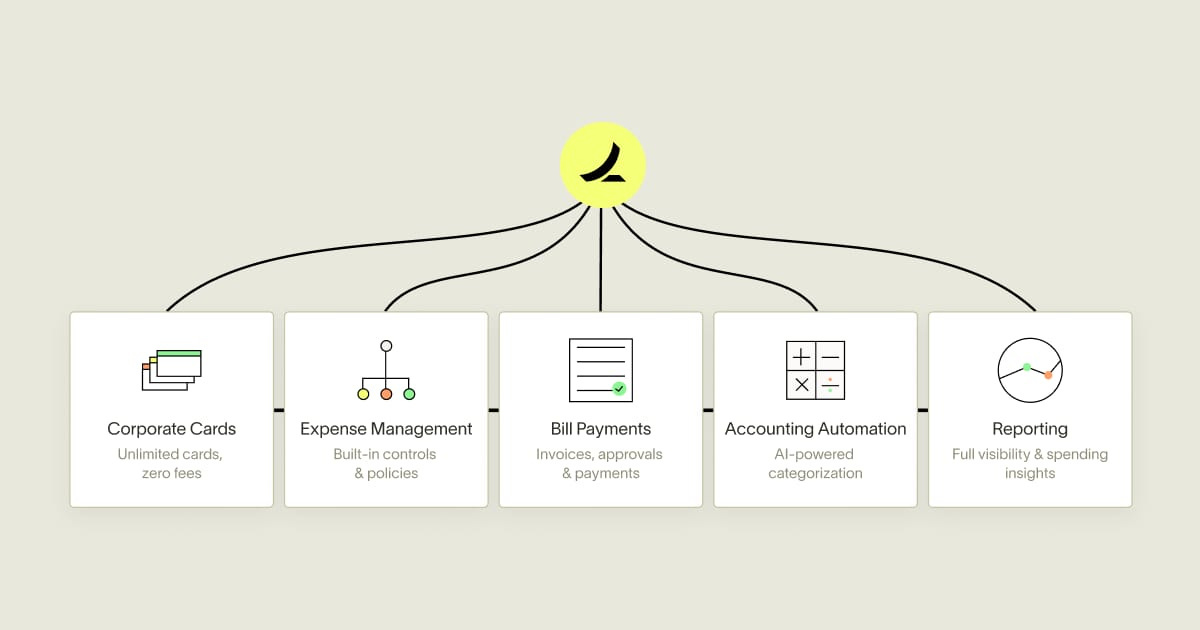

Tieing back to my earlier point, Ramp's mission is to save its customers money and its strategy to do that is to automate their finances with software. Initially this was through better charge cards, expense reports, and invoicing. Over time, this expanded to further serve the entire CFO suite. This image is from a blog post and at least a year old, but hopefully you get the point: Ramp is a suite of software products that saves its customers time and money. It uses a sexy corporate charge card to acquire customers, and then further monetizes customers via financing embedded in the finance teams workflows.

Selling software to finance departments seems like a small opportunity at first glance, but as the typical company spends 70 to 100%+ of its revenue, being positioned to take a small cut of all of a customers expenses lays the groundwork for what could become a very large business. Ramp estimates Accounts Payable teams spend over 520 hours per year on manual tasks, and Ramp says its various tools saves customers an average of 4% on all expenses. And I'm sure automating their spend on its platform makes them more likely to stick around for awhile.

Other Reads

TikTok tests "Nearby" feed that sources local content. This appears next to the algorithmic "For You Page" and "Following" feeds in the app, and coincides with location tags recently added as an option when uploading a video. More from Digital Trends.

TV streaming viewership surpasses cable TV for the first time: A long time coming, streaming represented a 34.8% share of total US TV viewing time in July, per Nielsen. Important to note that this does NOT include mobile, meaning streaming likely passed TV a long time ago. Full story from TechCrunch.

Walmart acquires Delivery Drivers Inc: The gig-labor platform will be rolled into Walmart's Spark Driver (don't worry, its my first time learning this exists as well) and coincides with Walmart ending its partnership with DoorDash. Spark drivers deliver customer orders for Walmart and other retails and is in 600 cities reaching 84% of households. This will likely boost its Amazon Prime-like subscription product, Walmart+: free shipping, fuel discounts, contact-free checkout, in-app deals, free streaming, grocery delivery, and more. More on the DDI acquisition from Grocery Dive.

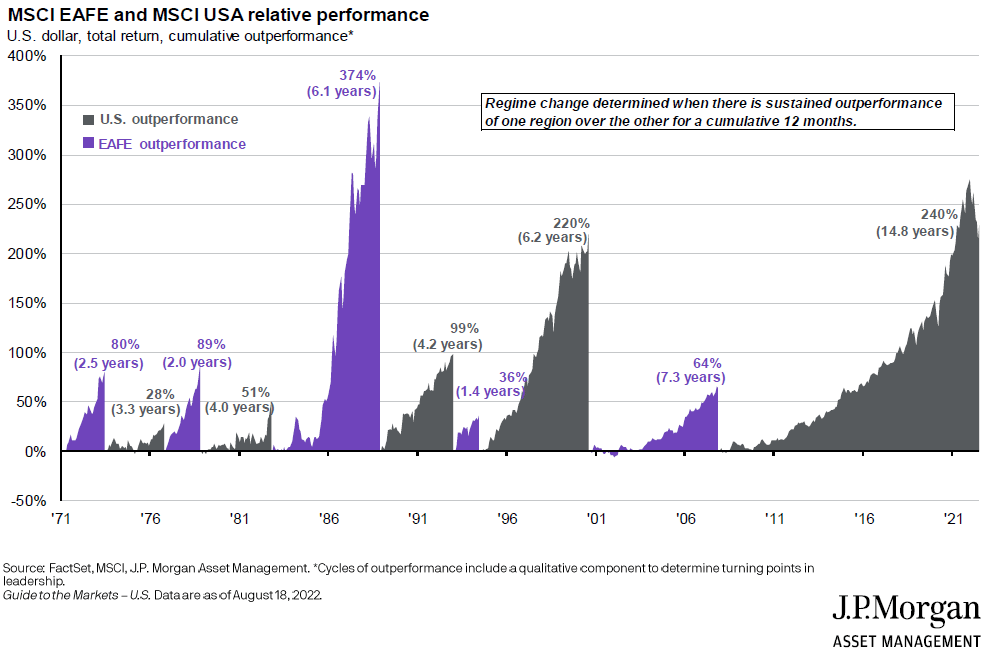

US stocks have now outperformed international stocks for 15+ years: On a relative basis, international stocks saw two 6-7 years of outperformance in the mid-80's and early 00's. Aside from that, US stocks have largely outperformed for the last 30-35 years. h/t Nate Geraci

UK inflation projected to hit 18.6%: Largely due to a recent surge in gas prices. More from FT.

Cash App surpasses 1 million loans underwritten per month: Cash App, which now has 47 million MAUs (Monthly Active Users), significantly grew its lending product in 2022. Playing around with this myself right now, it lets me borrow up to $25 (looks like this increases as you make repayments) for a 5% flat fee paid back in four weekly installments. More from Fintech Business Weekly here.

FTX reports $1.02 billion in 2021 revenue: An increase of over 1,000% from 2020, FTX is projecting revenue of $1.1 billion in 2022. Nearly 2/3rds of 2021 revenue came from "futures trading" and only 16% from spot trading (this what you would call a traditional buy / sell trade on Robinhood, Schwab, etc). Less than 5% of FTX 2021 revenue came from the US. Notably, FTX spent 15% of its 2021 revenue on marketing, however expects to spend over $900 million on advertising "in the coming years" - likely related to growing the US business. More from CNBC.

Reply to this email - how much revenue do you think will FTX do in 2022?

I'll share any interesting responses on Tuesday!

Career Services

I've been slow ramping up the job board due to travel last week, but the Banana Talent Collective is finally in a good spot. The first cohort will go out this weekend. (I still need to sort through the last wave of applications.)

If you're on the fence, remember its free, anonymous, and passive through your inbox. Get started here.

Drivly is hiring a Business Development Leader (Detroit, Miami, or remote)

Secureframe is hiring Senior Software Engineers (React/Ruby, remote)

Walnut is hiring an Engineering Manager / Tech Lead(NYC or remote)

Browse 50+ openings or add your own here.

Monkey Business

And finally, not a meme, just an incredible visual: