Hi everyone 👋 Turner back again with The Split.

A few years ago, Chinese ecommerce upstart Pinduoduo was adamant it would never expand outside the country. Only a few years later, it now has more active buyers in China than Alibaba and its new US ecommerce platform Temu launched last week. I'll walk through what I'm seeing so far below.

Yesterday we did Banana Talent Drop #2. It features 29 folks open to exploring new roles. If you're looking to make your next move or adding to your team, check the details below. I also got a ton of new subscribers from Instagram last week - I would love it if anyone who came from Instagram can share where you found us from!

I have a family wedding this week, so don't expect an email from me on Thursday. See you next Tuesday!

Pinduoduo's Temu Launches in the US

Last week, Pinduoduo launched Temu, its new US ecommerce platform. My initial reaction: it feels like someone combined SHEIN and Wish into one.

I first wrote about the yet-to-be-named Temu a few weeks ago and Pinduoduo more broadly in August 2020 (check out both for more context). I thought we'd see Temu leverage PDD's base of Chinese merchants, which it seems to be doing. I also thought it may emulate SHEIN's clothing / beauty catalog, which its doing as well. One thing I did not predict was the product assortment matching the random electronics and household goods (and I mean truly random) you'd find on Wish, but maybe that's just my fault for not knowing PDD's merchant base well.

Temu is currently offering 30%-off sitewide, which compares to SHEIN's 10% to 20% depending on order sizes (up to $169). There's 30 to 75 "free" $0.01 items that appear to rotate daily, which you can't view unless you create an account or share your phone number. Currently, Temu offers 10 to 12 day shipping and a "full refund, keep the item" guarantee if an order arrives late. It also includes carbon offsets on every delivery, though its unclear exactly how.

The early App Store and product reviews are clearly fake. Baby toys have "outfit fits great" comments, and many of the day one App Store reviews commented on the fast shipping, despite it having just launched. As of today, no one I know who purchased on launch day has received an order yet.

On mobile web, Temu heavily emphasizes downloading the app (download it yourself here). No matter how many times you close it, the top of each mobile web page has a "Get the App" bar. That said, the app is designed very well. The app's core product is a endless feed of shoppable pictures, contrasted to SHEIN whose homepage focuses more on broad product categories to be tapped on to browse products. If Temu is borrowing from Pinduoduo, the feed algorithm will become more personalized over time. Quickly expanding its merchant base will be key for this.

My first time viewing the home page on desktop offered an opportunity to join the "Temu chat room" on WhatsApp, which I of course joined immediately. The app's tagline is "Team Up, Price Down" (aka Temu) but there don't seem to be any "group" or "team" purchase options that Pinduoduo is known for yet. Right now, its mostly Chinese merchants asking how to sell on the site in broken English. I'm assuming being in "Temu Group 1" will give me a front row seat if these features ever launch. Temu's emphasis on app downloads and phone number collection hints at how important push notifications may be to its business model.

Temu's product assortment feels very random. $3.72 running shoes. $0.59 for a roll of Halloween stickers. And a "car trash can" for $1.49. There's also apparently 1,000's of new products added daily. To its credit, the product pages and picture quality do feel like a step-up from Wish, but I'm sure similar to SHEIN, each one is flirting dangerously close to lead / chemical levels legally allowed in the US.

Temu also does do a great job making the site feel active. I can't find any customers mentioning Temu on Instagram, TikTok, Reddit, or Twitter, so it looks like the customer base is still small. They show # of units sold next to each product on the search pages, but who knows if these numbers are real. And though clearly fake, the reviews are likely believable to the average shopper.

My two highest level takeaways are:

Temu seems to be leveraging Pinduoduo's merchant base

An endless feed sets up for an ad-based business model, again similar to PDD

Wish has a similar product catalog, but it's business model that was built almost entirely on top of Facebook's ad platform collapsed after Apple's ATT changes last summer. It feels like there's an opportunity to fill that gap in the market. As I mentioned two weeks ago, Pinduoduo increasing its existing merchants volumes by helping them expanding outside China all on one back-end platform could allow Temu to offer sustainably lower prices to consumers over time. This existing merchant base would also help it quickly scale its supply to match consumer demand if Temu grows fast.

Temu's free returns may help offset product quality concerns, as Wish was notorious for having very low long-term repurchase rates, often due to products not even arriving. Repurchase rates may be why Temu chose to focus on fashion and apparel, as SHEIN had a 30% repurchase rate (in 2018) and sees roughly 60% of the app install base open the app monthly (per App Annie). Pinduoduo's "Consumer to Manufacturer" model could be compared to the "data-driven manufacturing" approach SHEIN is known for. And if I had to guess, the Temu app is built with the intention of layering on more product categories over time and monetizing the feed with an ad product like Pinduoduo in China.

My biggest outstanding questions are around Temu's go-to-market strategy. There's early indications of leveraging messaging for customer acquisition like Pinduoduo. Personally, I'm not sure how well this will work outside of China. There's also no hints yet around what a Temu influencer marketing strategy could look like, which I think makes even more sense in the current environment after Apple's ATT changes. Its also possible giving things away for one cent is all Temu needs to do to go viral. ¯\_(ツ)_/¯

This is a purposefully vague question, do you think Temu will be successful in the US?

Other Reads

TikTok has 11x more total time spent than Reels: Instagram users spend a total of 17.6 million hours per day watching Reels, compared to TikTok's 197.8 million hours. Reels engagement fell 13.6% in August, and it makes up only 20% of total time spent on Instagram. Only 20% of Meta's 11 million US creators are posting Reels, and 33% of Reels videos are created on another platform, usually TikTok.

This might be the first time we've ever gotten a public content creation rate from Instagram. Instagram's ad product reached 154 million users in July 2022 (slide 172), which would mean only 7% of US Instagram users create content on any given day (and only 1.4% create Reels). Reels now reportedly makes up 50%+ of all content shared in private messages. More from WSJ.

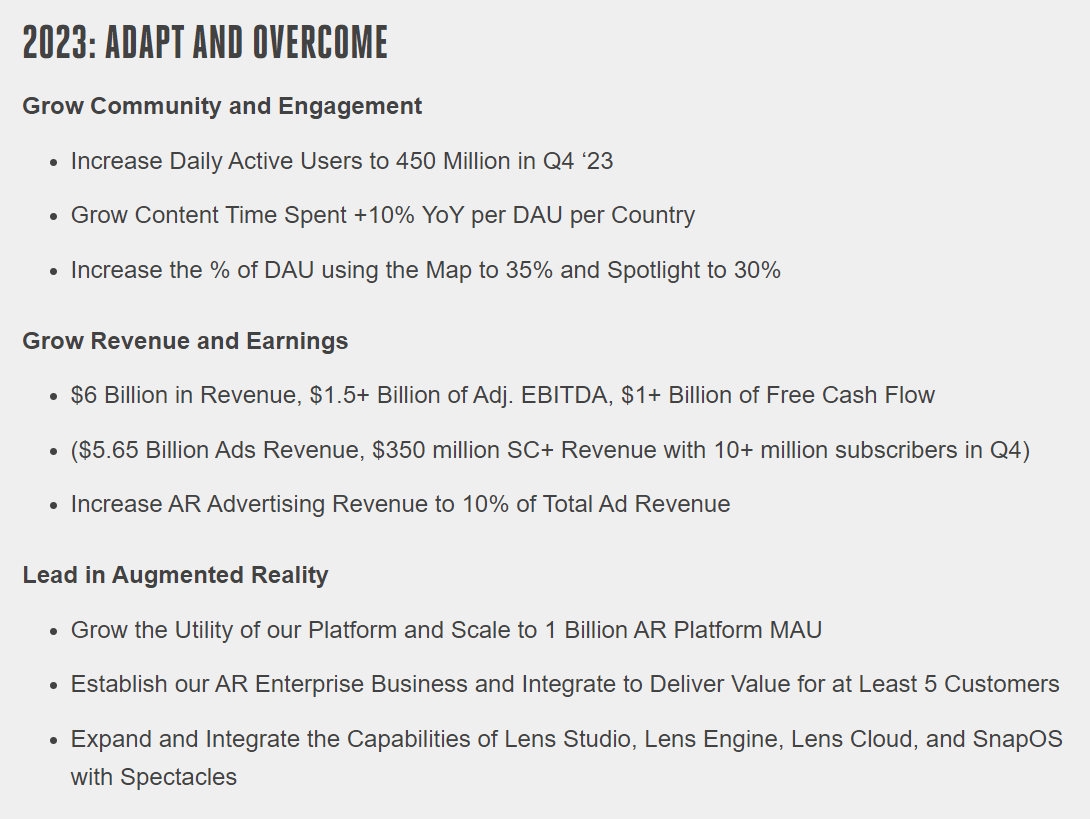

Leaked Snap memo hints at 2023 plans: Most notably, Snap thinks it can reach 1 billion Monthly Active Users (MAUs) by the end of 2024 and 10 million Snapchat+ subscribers by the end of 2023. My admittedly ridiculous 100 million by 2027 prediction is looking a little less insane 😅. More from the Verge.

Starbucks launches Odyssey, its NFT / web3 rewards program: A good indicator of how quickly Starbucks product team moves. I'm now slightly more bullish on Blank Street and About Time. More from Starbucks.

Shanghai to LA freight rates dropped 14% last week: Nearing 2021 levels. h/t Conor Sen

LA-Long Beach container ship backlog hits record low: Savannah, the fourth-largest US port, is still seeing congestion related to earlier than usual back to school orders from retailers. More from the WSJ.

Netflix switching from binge model to weekly releases: This would keep subscribers engaged for a longer period of time, and likely reduce churn. Combined with crackdowns on password sharing, ads, and games, would this be enough to re-ignite subscriber growth? More from Screen Rant.

Sea Limited scales back in LatAm: Shopee, with roots in South East Asia and one of the top downloaded shopping apps globally over the past three years, will exit Argentina completely and switch to a cross-border model in Chile, Colombia, and Mexico. Sea also laid off ~15% of employees in its gaming division, Garena. This comes after shutting down its India and France operations in March. More from Reuters.

Career Services

This morning we did Banana Talent Drop #2. It features 29 candidates and 25 companies. The talent includes junior + senior spanning engineers, PMs, growth, finance, data scientists, and developer relations. The latest batch contains multiple employees from Snap, as well as engineers with experience at Amazon, Microsoft, and Meta.

Applications are already rolling in for Drop #2. If you want to passively get in front of talent and hiring managers at companies across the broader Banana Cap portfolio and network join the next drop as a candidate or hiring manager here. Note that joining as a hiring manager today gets you in front of Drops 1 and 2.

One job to highlight this week: Banana portfolio company Arrive is hiring for a VP of Partnerships role. I'll write more about Arrive soon, but they power a fully managed logistics and customer service experience for a retailers returns, recommerce, and rental programs. The VP of Partnerships role will be in charge of helping brands and retailers unlock this new revenue stream, from first contact to close. More info and application here.

Monkey Business

Pleased to announce our new product line, the Big Banana Restaurant & Bar: