JOKR and Personalized Instant Commerce

The inside story behind one of the world's fastest growing and most customer-centric companies

In April of 2021, Ralf Wenzel and his team launched JOKR, a global platform for instant grocery and retail delivery at a hyper local scale. Within six months, the company operated in seven countries and its annualized revenue run-rate surpassed $100 million, showing no signs of slowing down.

I was lucky to invest in JOKR’s Seed and Series A rounds through my investment firm, Banana Capital. Here’s the inside story behind one of the world’s fastest growing and most customer-centric companies.

Spotting Operational Inefficiencies; The Beginning of Ralf’s Ecommerce Journey

Ralf was born in East-Berlin and lived 10 meters from the Berlin Wall. He had family in Cuba and spent part of his childhood there, getting a glimpse of Latin America’s version of communism. Living between both systems as the Berlin Wall came down taught him to spot operational inefficiencies and inspired him to fix them.

He saw the internet coming and studied computer science at the University of Havana in the mid-90’s, betting his career on it. Over the next decade, he worked in engineering at Mercedes Benz, received a Masters in Computer Science at Berlin University of Technology and Economics, started numerous businesses, and even invented a voice-recognition engine.

The first startup Ralf joined was Berlin-based Jamba (Jamster) in 2004. The product distributed news, wallpapers, ringtones, and eventually games on mobile devices (which at the time had tiny black and white screens with text pads). Ralf led Sales and Business Development, expanding Jamba into 45 countries, becoming the world’s largest platform for mobile content. Jamba was acquired by VeriSign and NewsCorp in 2005 and was one of Europe’s first big tech exits, putting Europe’s tech scene on the map. Not only was this Ralf’s first taste of building a company, but it was also where he first met one of JOKR’s co-founders and now-CPTO, Sven Grajetzki.

Two Decades of Company Building

After Jamba, part of the team moved to London to work on Moneybookers together, which later rebranded to Skrill and merged with Paysafe in 2015. Ralf stayed on for five years as COO, working closely with Sven in Product. Skrill, and then Paysafe went on to IPO, becoming one of the biggest payment companies in the world and the largest e-wallet behind PayPal and Alipay at the time. Ralf then launched a Seed-stage venture fund, Tocororo Ventures, to invest in tech and food startups around the world.

By 2013, many of JOKR’s eventual co-founders (Ralf, Sven, + new additions Ben Bauer and Konstantin “Koko” Sorger from Groupon) moved to Singapore to launch and scale foodpanda globally, which was at the time only in South East Asia. The company was initially incubated by Germany’s Rocket Internet and Ralf eventually became foodpanda’s founder and global CEO, with Ben (CCO), Sven (CPO), and Koko (CMO) all taking progressive roles as the company scaled. This was around the time Ralf met JOKR’s now-COO Aspa Lekka. Originally from Greece, she spent seven years playing professional handball across Europe. Ralf convinced her to join foodpanda for four years and then return after her MBA. foodpanda went on to launch ghost kitchens, new brands in each market, make over 12 acquisitions, and capture high market share in over 40 countries across South East Asia, MENA, Eastern Europe, Russia, and LatAm.

Over this time, Ralf became friends with Niklas Oestberg who co-founded Delivery Hero in 2011. Similar to foodpanda, Delivery Hero had captured high market share throughout Western Europe. Initially competitors and both based in Berlin, they combined forces in 2016, citing complementary geographic coverage and a shared investor (Rocket Internet, who had been buying up stakes in numerous on-demand companies around the world at that time). Niklas would focus on all operations as CEO, Ralf on M&A as Chief Strategy Officer, with other future members of JOKR’s founding team taking roles across the globe.

The Delivery Hero / foodpanda merger closed on December 31st, 2016 and the company IPO’d six month later in June 2017. Today, the public markets value Delivery Hero at ~$27 billion. foodpanda’s original markets make up the majority of Delivery Hero’s orders (2.5 billion run rate as of Q2 2021), and over half of its GMV ($33.43 billion) and revenue ($5.78 billion). Delivery Hero continued acquiring companies, making over 26 acquisitions and 22 outside investments that included Rappi in Latin America, Zomato in India, Deliveroo in Europe, and Woowa Bros in Korea (acquired).

Then, Softbank called.

SoftBank, WeWork, and Lockdowns

In 2019, SoftBank recruited Ralf as a Managing Partner to lead its Latin American Tech Hub, an incubator for startups, joint ventures, and strategic initiatives across the region. Fascinated by the opportunity to launch 50 businesses in five years and work alongside SoftBank’s new $5 billion Latin America Fund, the team moved to Latin America.

Part of the role involved managing operations at numerous SoftBank portfolio companies. Market historians will remind us that 2019 and 2020 were challenging years for some SoftBank-backed companies. Spending most of their time on WeWork and Oyo, the SoftBank tech Hub was never realized. Then in March 2020, COVID hit.

Locked down around the world, Ralf reconnected with all the best operators he’d worked with over the past 20 years. As they ordered everything online (meals, groceries, kitchen supplies, furniture) they realized every purchase in each market all had an inconsistent customer experience. Poor product discovery, slow delivery, inadequate customer service, and even the wrong products being delivered all together. Over time, the team that had been building on-demand businesses since 2011 realized there was still a huge gap between customer expectations and what the market was delivering.

The Massive, Outdated Grocery Market

This market they were entering admittedly seems crowded at first glance. It consists of four major categories: Brick & Mortar, Supermarket Delivery, Marketplaces, and Instant Commerce. A non-exhaustive overview:

JOKR specifically operates in the instant commerce space, broadly defined as a service that delivers to customers in 15-minute or less. Within that, JOKR launched with a low-SKU collection of grocery products. Grocery retail is one of the largest categories globally at $9.8 trillion, or roughly ~10% of global GDP, however less than 3% (~$260 billion) of that is currently online.

There are many reasons for groceries' low online penetration, and the simplest answer is that existing offline solutions have generally been good enough for consumers. Things like agriculture and roads first built in the ancient era, food processing and global supply chains established during the industrial revolution, and densely trafficked roads and city plans that evolved around automobiles, all shaped how the global food and retail infrastructure evolved into multiple layers of distributors, consumer packaged goods (CPG) conglomerates, and national chains of physical brick & mortar stores by the 1990’s.

Many of these brick & mortar stores still exist, however are structurally unprofitable selling online as-is and were generally un-incentivized to figure out how to do so until 2020. They built businesses centered around daily two-way commutes from their customers. Their operations, business models, and cost structures are optimized for that in-person, in-store experience. Trips to the grocery store are generally not enjoyable and can take a total of 45 to 90 minute for some consumers. The inconveniences associated with traditional grocery shopping has encouraged users to take fewer trips (once a week on average). This has forced consumers to attempt to plan meals far in advance and make large orders to stock their fridge for weeks in advance, leading to significant time spent on meal planning and high food waste.

Most grocery stores have now begun to offer some form of their own in-house delivery, some of which are profitable. These profitable models generally have higher minimum order requirements, markups on items, non-flexible delivery windows (often multiple deliveries are pooled into one driver trip to save costs), and an unclear view into what products are actually in-stock due to outdated software stacks.

With the rise of mobile phones, a second major category emerged: three-sided marketplaces connecting couriers, local stores, and consumers. Customers order from a local store on the platform, and typically schedule a drop off time anywhere from 2-hours to one week in advance. The platforms dispatch a courier (non-salaried, on-demand worker) who drives to the retailer, walks around the store to locate each item in the order, works through the checkout line, delivers it to the customer, and repeats this multiple times at multiple stores spread around a city until they choose to stop. These marketplaces represented the first wave of mass-market online grocery adoption as they connected consumers with excess capacity at existing retail locations. Their asset-light models allowed them to scale very quickly, and their on-demand nature made them attractive for couriers in a competitive labor market as fast adoption of smartphones made it easy to earn an income.

As these marketplace models scaled, it became clear that a middle, software-layer taking an additional cut between the demand and an already complex supply side was inefficient. Brick & mortar stores traditionally have slim profit margins, as well as outdated software systems that make it difficult to connect their inventory with the marketplaces, providing an inconsistent customer experience (below). The marketplaces also saw limitations relying on existing infrastructure that was built around commuters, which led to longer delivery times and higher prices.

The item replacement process is core to most marketplace products

Long delivery times and high prices were exacerbated in 2020 by the COVID-19 pandemic, giving rise to the latest category in grocery: instant commerce. First proven out by goPuff in the US and Getir in Turkey, this model delivers groceries and other products to consumers in 10-15 minutes from micro fulfillment warehouses. These 2.5k-5k square foot hubs are not seen by the end-customer despite being located within minutes of them. The hubs have floor plans, shelves, packing, and logistics areas optimized for delivery. They pay rent, employ full-time workers, and carry their own inventory - the last of which can have compounding advantages at scale.

When the internet first hit in the 1990’s, companies like Webvan and Kozmo attempted to bring groceries and 15-minute delivery online. Both failed, ultimately due to poor pricing and customer segmentation, unnecessarily complex infrastructure, and simply expanding too fast without discipline around profitability. You could also argue a lack of smartphones for the delivery fleet was working against them. Most investors have since abandoned the category assuming the model doesn’t work, forgetting that Kozmo was profitable in four cities (and ironically raised money from Amazon in March 2000). Pink Dot, founded in 1987, has also operated profitably for over 30 years in Los Angeles, the first two decades operating mostly via phone orders and cash payments.

goPuff has since publicly disclosed its been EBITDA positive since day 1, with 40% gross margins and double-digit contribution margins. Its new markets are profitable within 18 months, and at scale its drivers deliver within 20 minutes and complete an average of 4 orders per hour (often via batching). goPuff also proved the model worked in US college towns, not just dense urban areas, which many believers in the instant commerce model even doubted was possible.

Variations of the model have taken China by storm, as nearly every large Chinese internet platform has at least attempted some form of entry into the market over the past two years. Samokat in Russia was acquired by Russian social network and internet platform mail.ru (assume operating margins similar to Facebook) in 2020, and is now launching in the US under its Buyk brand. Russian search-engine turned internet platform Yandex (reports EBITDA margins north of 40%) has also been investing heavily in its meal delivery and quick commerce brand, Lavka. In its public investor materials Yandex states the Total Addressable Market (TAM) of its Ecommerce and Egrocery business will 3x over the next three years, making it 10x larger than the opportunity it sees in digital advertising and 5x larger than in shared transportation and meal delivery. It recently started to expand beyond Russia.

Finally, public disclosures in Delivery Hero’s investor relations materials also hint the model is more profitable than its marketplace business.

Delivery Hero operates what is likely the largest business in this instant commerce space. Their public investor materials estimate the category will represent 25% of all online groceries and 5% of all other commerce globally by 2030. JOKR has already begun expanding outside groceries and into adjacent product categories to reach the broader $26.6 trillion global retail market, of which ~15% is currently online.

JOKR: Instant Commerce, Powered by Vertical Integration

To differentiate in what some consider a crowded market, the product behind JOKR is an end-to-end experience that takes control of every step of the ecommerce value chain. It combines speed, personalization, local assortment, and sustainability to provide an unparalleled customer experience and give back the one thing every consumer wants more of: time.

Consumers gravitate towards on-demand products because, if done correctly, they get what they need faster than it would take them to travel to it themselves (let alone locate, checkout, and travel back home). The best on-demand experiences drive customer affinity, and there is generally a correlation between delivery speed and customer retention. JOKR’s early metrics show exactly this as it retains customers at twice the rate of the scaled marketplace models.

This superior customer experience is why vertically integrated models will win over the long-term. Vertical integration generally has higher fixed costs and lower per unit costs at scale. In JOKR’s case, these cost savings can fall to the bottom line, be reinvested, passed to consumers in the form of lower prices and fees, or a combination of the above.

JOKR co-founder and CEO Ralf Wenzel at one of JOKR’s early hubs in Mexico

Where JOKR excels in speed of delivery, grocery marketplaces are constrained due to supply constraints (stores, restaurants, etc), which leads to a poor customer experience. The existence of these marketplaces made sense within the context of the market's evolution as they provided immediate scale and product variety, however the initial creation and placement of its supply side throughout cities pre-dated the existence of the internet.

The historical location of the supply that makes up most marketplaces is not aligned with the actual demand of an internet-first economy. JOKR’s smaller micro fulfillment centers (or hubs) strategically positioned and built for its delivery-first model, not in-person, brings that supply closer to the demand, allowing for even faster delivery and a better customer experience.

The team running one of JOKR’s Manhattan hubs

Vertically integrated models ultimately have the opportunity to rebuild the convoluted global supply chains that power much of the retail industry. Existing supply chains are very wasteful and a focus on local products not only removes layers of middleman to increase profits for suppliers, retailers, and consumers; it also provides a better customer experience (speed and quality) and a drastically more sustainable option for consumers (JOKR aims to be carbon neutral by 2022). Local products also lead to faster sourcing and inventory turnover. As JOKR scales its global platform, it will better leverage all its fixed costs and investment in building the underlying technology. And one day, it may have the opportunity to open up this more efficient supply chain to other market participants.

Data Science and Personalization; Taking Verticalization to the 21st Century

To execute this vertically integrated model, JOKR has to be very good at predicting exactly what consumers want. The team refers to this as the singular customer journey. Predicting what each individual customer needs in the morning, afternoon, and evening; on Monday, Thursday, and Saturday; in January, April, and November. JOKR needs to know the exact profile of each customer, in each location, which gets more granular and powerful at scale.

Some of JOKR’s NYC team

To accomplish this, JOKR uses a robust inventory procurement and city management system. It maps each city into 300x300 meter sections. Customers are then segmented by these neighborhoods to predict demand, which has historically been done at an aggregate, high-level globally by suppliers. JOKR predicts what inventory will be needed months, weeks, days, and even hours in advance to optimize the limited space in each hub. Instead of a retail model where suppliers say “what can we produce?”, it becomes JOKR saying “what will we sell?”.

JOKR builds hubs in each neighborhood, supported by a central warehouse in each region. It aims to capture the highest market square within each region, allowing each hub to be profitable on a neighborhood level. Its on-demand riders not only deliver to customers, they also rotate inventory between hubs multiple times per day as JOKR predicts a product may be out of stock in a particular location. This means JOKR only procures the products it needs, increases inventory turnover, maximizes operating leverage, and ensures the best customer experience. Most importantly, it's near impossible for legacy players to replicate within their existing operating models.

As JOKR scaled, it started expanding its share of wallet beyond grocery into adjacent categories like personal care, pharmacy, household goods, pets, apparel, and electronics. Soon a customer will be able to buy any product imaginable on JOKR and have it delivered within 15 minutes. This runs counter to what is possible within the existing infrastructure of incumbent players built for 2-hour and 2-day delivery.

The results of JOKR’s product expansion into 100,000+ SKU’s are already playing out. In September, the total basket size of the first cohort of customers in April was twice as large as that first month. This cohort is also placing nearly 50% more orders per month. Considering that like any new platform there has naturally been some churn, it shows how quickly JOKR’s product has become a habit for its customers.

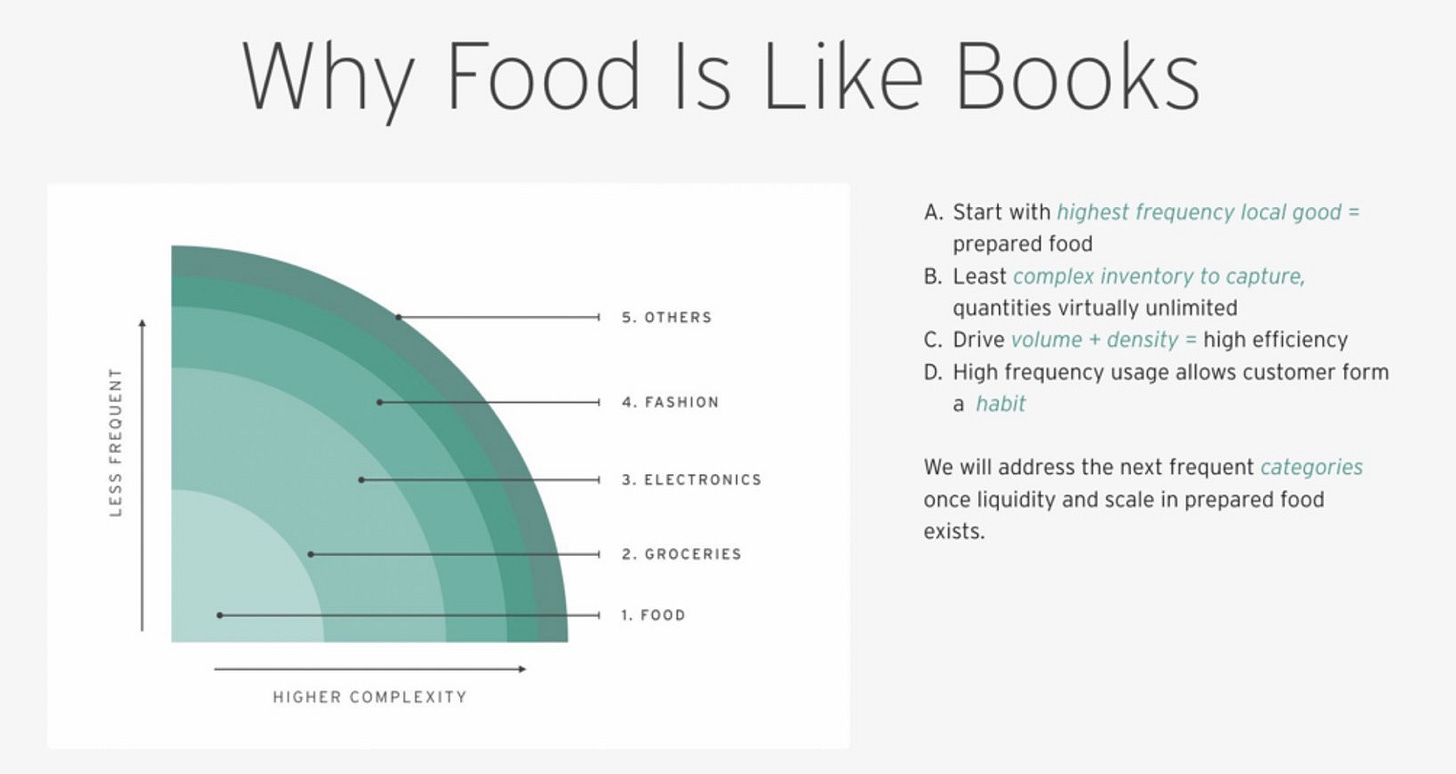

If companies like Coupang in Korea and Sea Limited in South East Asia are any example, there are other opportunities beyond ecommerce for a platform like JOKR to expand into over time. Capturing a repetitive consumer behavior like ordering groceries allows them to layer on other products over time. This could include, but not be limited to, everything from consumer payments, meal delivery, travel, streaming, healthcare, gaming, financial services, and products for their merchants and suppliers. This expansion into other product lines is generally the holy grail of any consumer internet platform as highlighted in Postmates Series B deck.

Data science and personalization also builds the foundation for a very effective advertising product at scale. Profit margins in legacy grocery average 2-3%. One of the industry’s worst kept secrets is that trade spend, the amount CPG companies pay to promote their products with special placement at retailers, is 5-25% of the average supplier's revenue, representing up to $500 billion globally. This form of offline advertising makes up over 100% of profits in the traditional grocery industry. Historically, this channel has been incredibly inefficient relative to digital advertising due to lack of targeting and measurement capabilities. It is estimated that over $104 billion of trade spend dollars go to waste and up to 75% of offline promotions from CPG brands fail to break-even.

As the industry shifts online, advertising will do for grocery what Facebook did to the ad industry. Suppliers will have self-serve tools to pay for guaranteed demand. This will shift the industry from being supply-driven (“how do we sell what we produced?”) to being demand-driven (“what do we need to produce?”). With up to 35% wastage in a $10 trillion industry, this could cut excess production and trillions of dollars of food waste (and eventually other products) across the globe by only producing what will be consumed, while also being very profitable for JOKR.

A data-driven approach also sets JOKR up to launch higher margin private label products, a common strategy in retail. This combination of private label, high-margin ads, personalization, adjacent product categories, and vertical integration positions JOKR to become a very valuable business over time. Its already playing out: the first hubs launched in LatAm have positive contribution margins despite much lower basket sizes than its European and US markets launched later in 2021.

The Early Innings of Instant Commerce

JOKR is building a personalized, instant commerce platform for consumers across the world. Capturing consumer demand at the point of purchase positions them favorably in the value chain, and capturing repetitive grocery orders positions them to add adjacent products and capabilities over time.

JOKR’s founding team has scaled multiple global companies together and is firing on all cylinders, building one of the fastest growing consumer businesses of all-time. They are still early in their journey and hiring across all roles (here) for anyone ambitious enough to help bring 15 minute delivery to consumers across the world.

If you liked this deep dive on JOKR, please subscribe above for more writings on companies and trends I’m following and investing in. I’m also on Twitter at @TurnerNovak.

Thank you to Armin at Greycroft for help on market research and the team at JOKR for letting me be a part of the journey.

Due to the potential inaccuracy and translation errors in some foreign publications, I cannot personally verify every piece of information shared here. I have linked to all sources wherever possible. My thoughts shared above are not investment advice and I am an investor in JOKR through my investment firm, Banana Capital.

how do you comp JOKR to Rappi in LatAm?

Keep on writing, Turner! I know life get in the way, but your articles are missed, just know that