Elon's Twitter

With Elon's acquisition officially closed, here's how I'm thinking about Twitter's future.

Happy Tuesday 👋 Turner back again with The Split! Welcome to all nearly 13,000 subscribers tuning in today.

Last week, Elon Musk officially closed on his acquisition of Twitter. It puts the world's wealthiest person in charge of one of the most influential social media platforms. He probably paid too much - Meta and Snap stock prices are down down 53% and 71%, respectively since his initial offer - but it will still likely end up a good deal for Elon. Here's why.

Elon's Media Company

It’s not new for a billionaire to buy a newspaper, magazine, TV station, or media company. Salesforce CEO Marc Benioff bought Time in 2018, and Jeff Bezos bought the Washington Post in 2013. Twitter is Elon's newspaper. However instead of a newspaper, it’s a social media network.

Elon has historically used Twitter heavily to market his other businesses, practically for free. Its the news platform of choice for most founders, executives, and the journalists who influence the news consumed by people around the world. Owning Twitter ensures that he always controls that distribution to his 112 million followers.

You could argue that Elon controlling Twitter acts as off-balance sheet marketing for Tesla, SpaceX, and every other company he builds. Auto makers typically spend 2-3% of revenue on marketing. Ford, GM, Hyundai, Subaru, Kia, and Ferrari spent a combined $10 billion on advertising in 2021. Mercedes-Benz, Renault (Renault, Nissan), and Stellantis (Fiat, Chrysler, Peugeot) don't break out advertising expenses, but reported $22.8 billion in Selling, General, & Administrative (SG&A) expenses in 2021. As a comp for SpaceX, Boeing paid $2.9 billion in SG&A expenses in 2021, or 4.7% of its revenue. For Tesla, that 2-3% of revenue would come out to $1-2 billion in marketing expenses. That's close to the estimated interest expense due annually on the debt financing the Twitter acquisition.

Every major media company and social network ultimately makes editorial decisions. And influencing a social media product's algorithm isn't novel. It is well documented that TikTok prioritizes certain content and accounts in its algorithm. And platforms like Facebook and Instagram influence what sorts of content (whether video in the feed, stories, reels, etc) show up in each part of the app. Elon is already perhaps the most important person on Twitter. He can ensure that all new users follow him (anyone remember Myspace Tom). And better yet, ensure he and his companies' content get priority in the algorithm.

Twitter, the Consumer Super App

The evolution of other social media products is the biggest opportunity for Elon and Twitter. The platform's core consumer-facing product hasn't changed in a decade, and it appears Elon intends to change this. Within 24 hours, the Verge reported that Twitter already switched the homepage for non-logged in users to show a feed of content instead of the "you must log in" page. If you're familiar with how TikTok works, it similarly opens directly to the content feed, and never actually requires a log in. (Twitter's new user onboarding can also be described as underwhelming, and new members often complain that the platform is hard to figure out.)

One of the biggest changes Twitter has made over the past decade is its timeline algorithm. Originally, Twitter only showed users content from accounts they followed. Starting in 2015, it rolled out broader changes that wove in "recommended" content. Similar to TikTok, Twitter has limited reliance on followers or a friend graph (it's worth noting that TikTok has heavily experimented with building a friend graph over the past year).

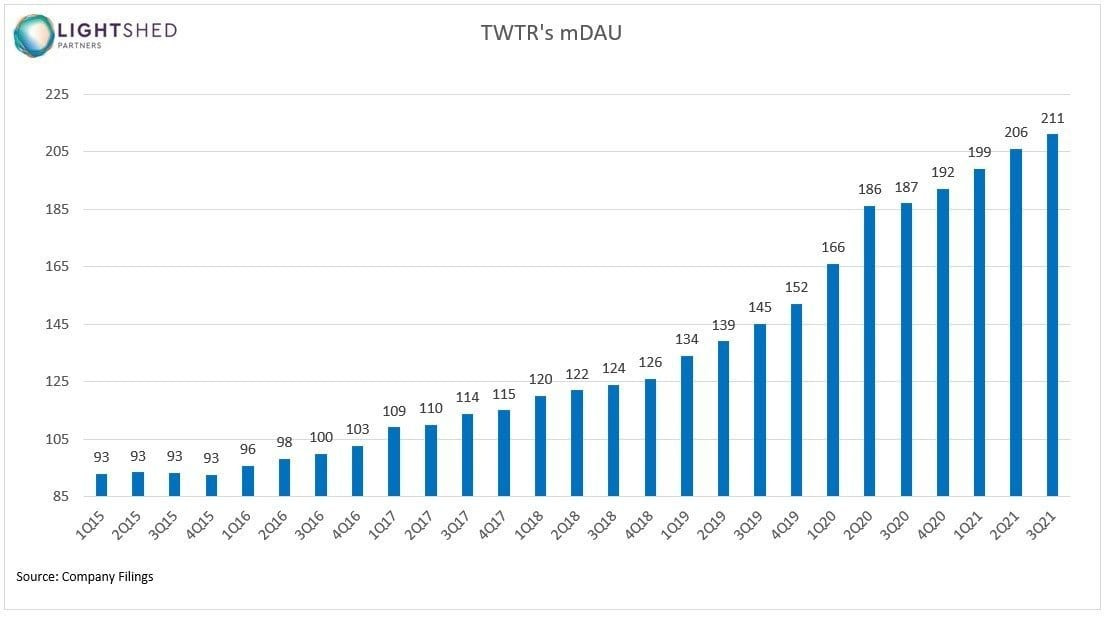

Twitter's timeline algorithm change worked, doubling the number of "Monetizable" Daily Active Users (mDAUs) on the platform over the next five years.

When Elon first made his Twitter offer, my initial assumption was that we'd see more of these changes. Both TikTok and Twitter are interest-based networks, whereas products like Facebook, Instagram, and Snapchat ultimately tie back to some sort of follower or friend graph. Ironically, I believe Twitter is actually the best positioned of any of the large established networks to challenge TikTok. It's not something I'm personally looking forward to as a user, but I expect Twitter to evolve into much more than its text-based roots. We've seen this type of product evolution from Facebook, Instagram, YouTube, and Snapchat over the past decade.

Some view ByteDance's TikTok ownership as a strategic threat to the US. Elon's lived experience with the government on SpaceX projects puts him in an interesting position to challenge TikTok, or even absorb a potential spin-out. Vine, which was basically TikTok before TikTok existed, was acquired by Twitter in 2012 and then shut-down in 2016. Elon already seems to be planting the seeds, tweeting about bringing Vine back. Axios also just confirmed Twitter is already working on a reboot.

You can point to many reasons why Vine didn't work, primarily that Twitter did not invest in making Vine the best place to create content. Content discovery was difficult, and Vine had no easy ways for creators to make money - and it didn't even pay them to post like TikTok did initially to seed its network. The internet poked fun at Elon bringing Tesla autopilot engineers onsite to review Twitter's code, but a powerful AI algorithm driving content discovery is be necessary for Twitter to compete as the product evolves.

To start the transformation, Elon appears to be charging for verification. It seems trivial and won't add much revenue, as the proposed $20 per month on 294,000 verified users is only $70 million per year. I do, however, think this is a step towards fixing Twitter's bot problem, which appeared to be one of the reasons Elon bought it in the first place. As anyone with a meaningful following on Twitter knows, the barrage of spam and bots in both your replies and DM's can make it more difficult and less pleasant to use. I'm not sure if this is true, but this change may be wrapped in to Twitter Blue, Twitter's paid subscription feature, which would increase the price from $5 to $20. This change could impact much more than just verified users.

On the monetization front, I think Twitter ultimately needs 1) a stronger ad product and 2) better monetization tools for creators. Twitter has already been experimenting with creator tools over the past year. These include:

Revue - In-app newsletter

Super Follows - Essentially a subscription to paywalled content from a single-user

Ticketed Spaces - Clubhouse-like audio rooms

Elon is no stranger to social audio. He sent Clubhouse to the top of the app store when he went live in February of 2021.

It also demonstrates that, as one of the most influential social media users in the world, Elon has a strong understanding of what other power users require of the product. He's already building a coalition with one of the other biggest content creators in the world, Mr. Beast.

Finally, especially if Twitter wants to expand its core offering, it must improve its advertising product. Advertisers haven't seen anything new from Twitter in a decade. Elon is already campaigning to them, hinting that better ad targeting is coming. Again, this comes back to building a strong recommendation algorithm.

Private Better Than Public

Twitter is arguably better positioned as a private company. Being publicly traded requires quarterly SEC disclosures and reporting, and also puts potential acquisitions under higher FTC scrutiny. Meta's legal team, which must approve even the smallest of product decisions at Facebook and Instagram to appease regulators, is notorious for being the most powerful at the company. Elon, who already has a long, complicated history with the SEC, will probably want to acquire other businesses, whether for new products or hiring talent. Being private makes it harder for the FTC to intervene, especially considering its other, more important public battles against larger competitors like Meta, Google, and Amazon.

Being private also gives Twitter more flexibility to make changes. We should expect there to be leaks, but as a private company, Twitter can disclose much less than if it were public. And natural short-term fluctuations in the business won't show up daily in the stock price.

Heads He Wins, Tails He Doesn't Lose

Elon stands to benefit whether or not he can actually improve Twitter's underlying business. Owning Twitter ensures marketing benefits to Elon's other businesses. And Twitter's core product is a top of funnel for Elon to build other consumer products over time. Elon may look to China as an example, where the largest social platforms not only keep people in touch with friends and entertain them with videos, but also enable payments, food delivery, travel bookings, and hundreds of billions in ecommerce transactions.

Early product experiments are just the start. Most will probably fail. In the words of Rohit Krishnan on Twitter, "I have a feeling this is gonna be a Masterclass on speedrunning through things other folks have done and figured out for the first few weeks / months, which is both the benefit and drawback of first principles [everything]."

Like what you're reading?

Subscribe to The Split for more every week.

🚗 Carvana Shutting its Third Party Marketplace

In July I wrote about Carvana's big bet on a third party marketplace. This allowed other dealers to list inventory on its site, similar to CarGurus or Cars.com. To me, this seemed like an answer to its margin troubles and sagging stock price, down 96% to $15.64 from a high of $360.98 in August of 2021.

Carvana now appears to be closing this business. The company shared few details, but my guess is that Carvana struggled to monetize quickly and, in the current environment of dropping vehicle prices, needed to prioritize moving its own inventory. I'll continue following and share anything else I learn.

🔗 Links and Charts

Elon Code Review: Print your code for Elon to review 😂 💀 Print, fax, and send it to space. The reviews are incredible. (If you missed it, the day of the acquisition, Elon brought a team of engineers to the Twitter office and required some employees to print out code to be reviewed)

The kids like offices: No idea what the sample size or source is, but h/t Aaron Levie.

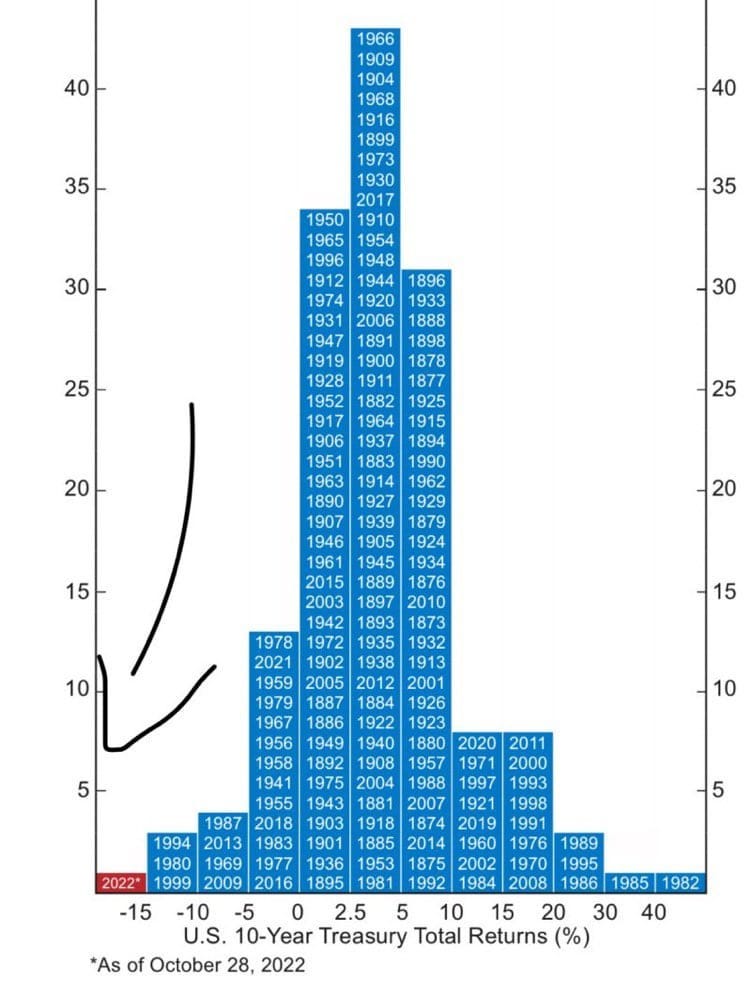

Annual US bond and equity returns since 1870: 2022 has been one of the worst returning years in history. h/t Dario Perkins

Another way to visualize: 2022 has been the worst year for 10-year treasury performance in the past 152 years according to this chart.

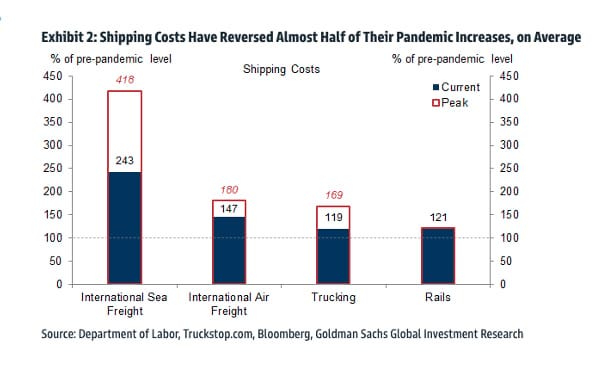

Shanghai to LA shipping rates now below long-term average: The reverse in pricing over the past year reflects weak demand combined with working through supply disruptions. h/t Liz Ann Sonders.

The shipping supply and demand gap continues narrowing: Goldman Sachs expects prices to decline further, but at a slower pace. While it won't have much of an impact on inflation going forward, the normalization helps reverse shortages in various consumer products that caused prices to spike last year. h/t Jeff Richards

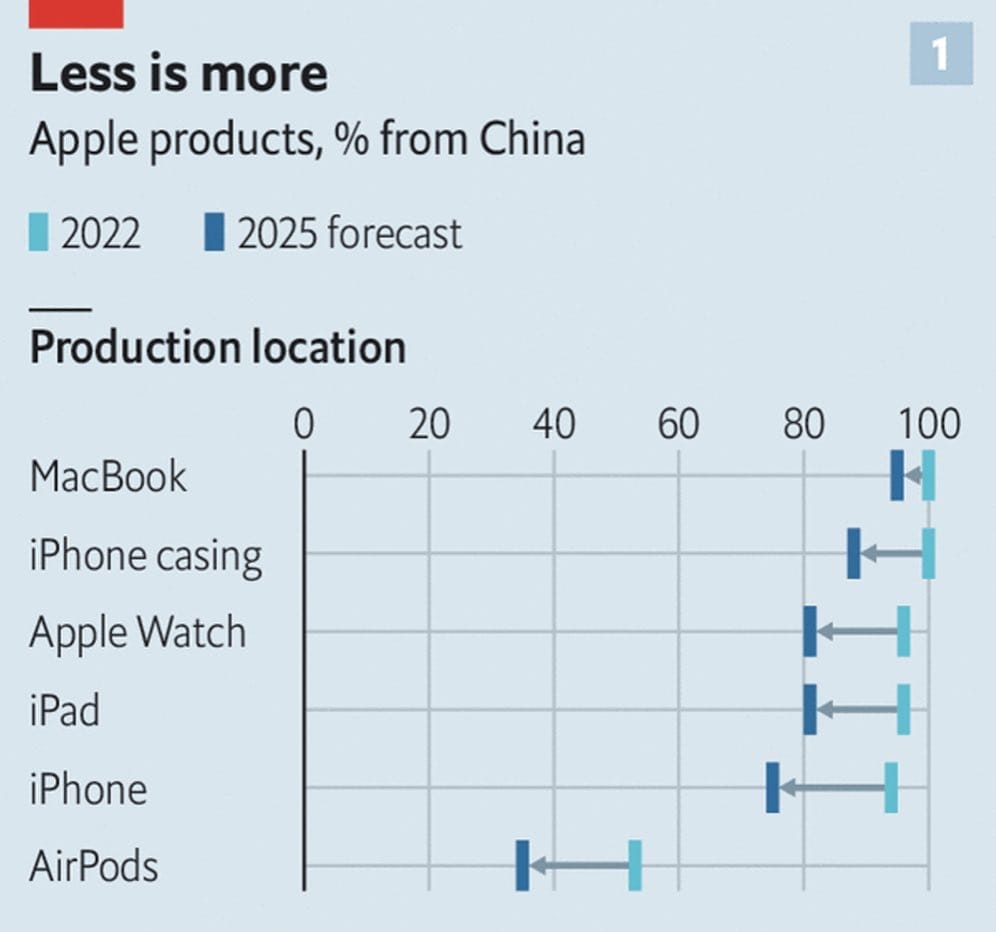

Apple begins shifting production from China: After riding China-based factories to a 70x increase in revenue over the past twenty years, Apple has started decoupling and moving production, specifically to India and Vietnam.

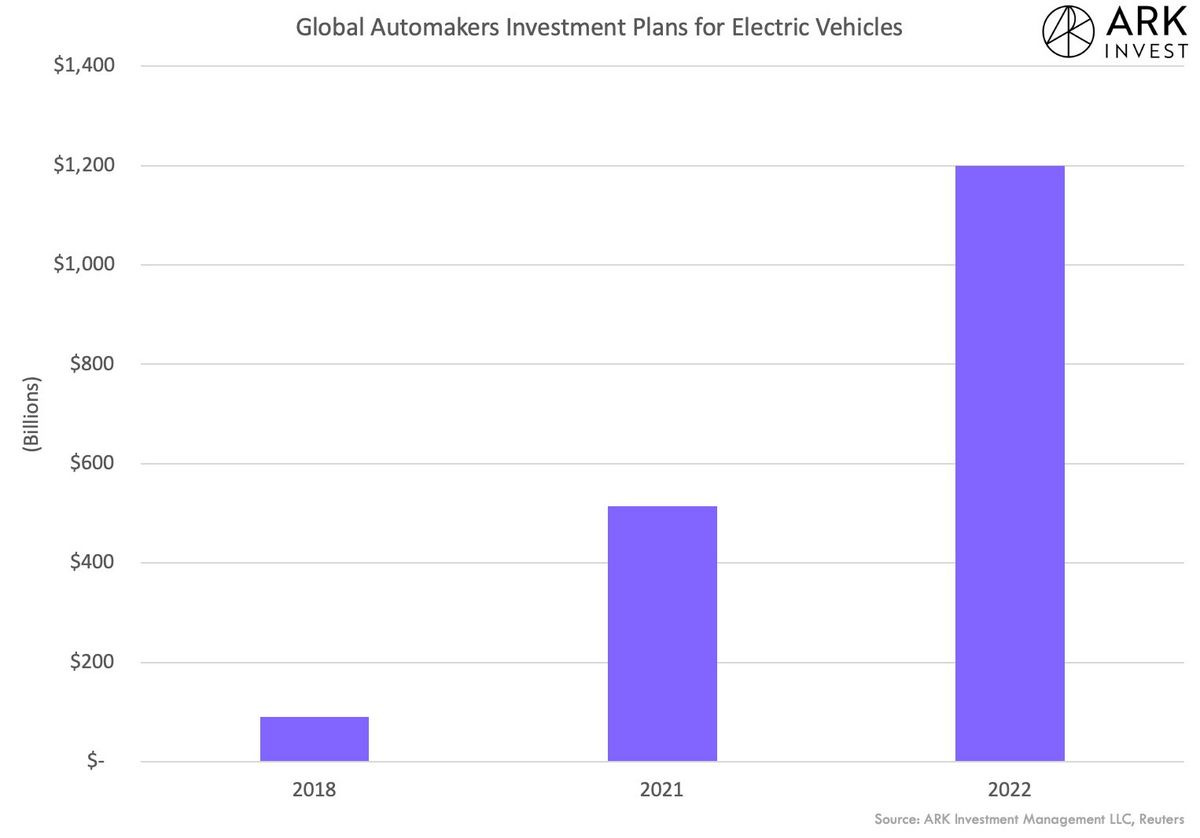

Automakers plan to invest $1.2 trillion in EVs. h/t Sam Korus

💼 Career Services

Don't miss Banana Talent Drop #6 this upcoming Sunday. The Banana Talent Collective has over 125 candidates passively exploring new roles, and over 50 hiring companies taking a look at each new drop (if you're at a Banana portfolio company, reach out for access!).

If you're looking for a job at a startup, apply to the collective here (anonymously if you choose), and sit back for interview requests from startups delivered right to your inbox. If you're hiring and want a stream of pre-vetted candidates in your inbox, sign-up here. The collective includes 100+ employees from all the companies below, plus many startups you've probably heard of.

Could Elon’s use of Twitter for off-balance-sheet marketing give Tesla and SpaceX an unfair competitive advantage compared to companies that spend billions on traditional advertising? https://stickmanhookgame.org