Can Substack Save the Social Network?

Plus new products from Stripe, AngelList, and Epic Games

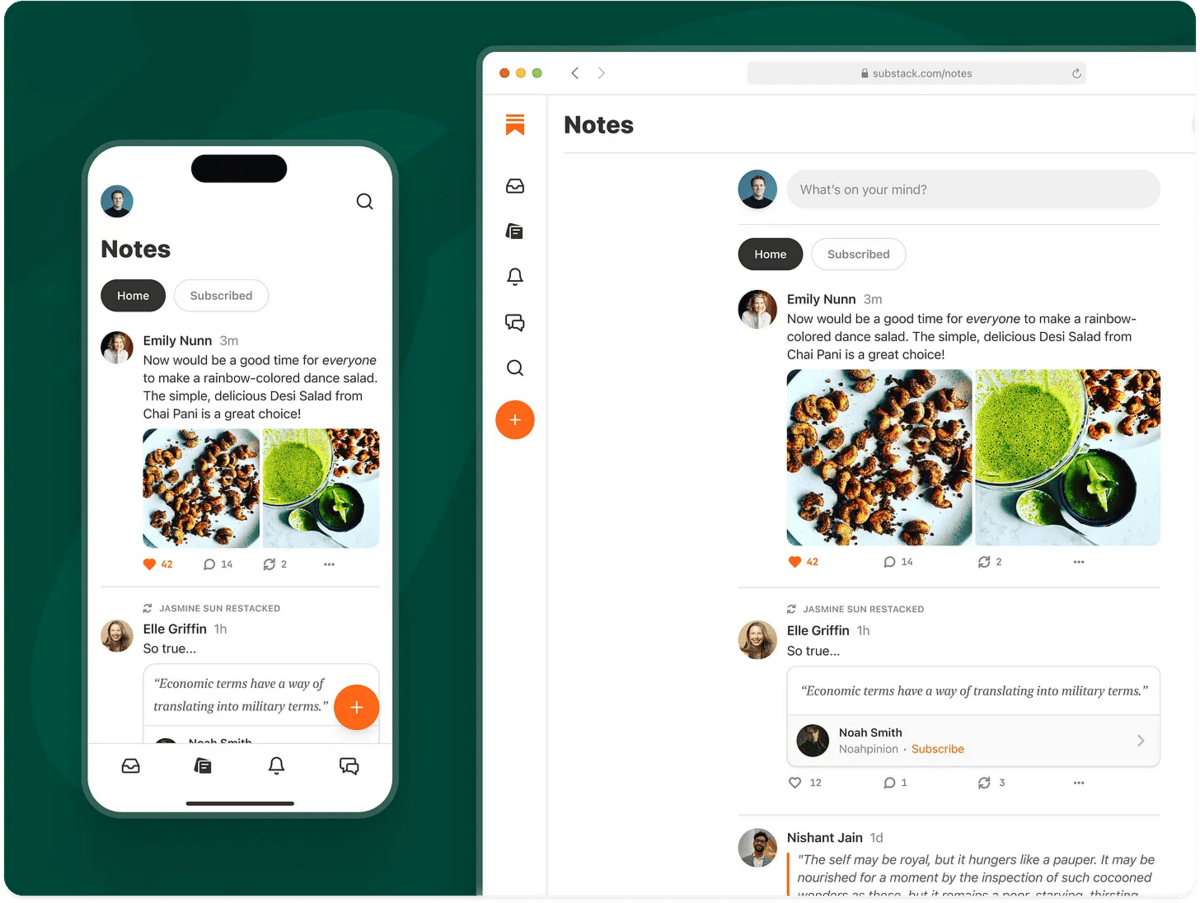

This past week, Substack dropped what may have felt like an insignificant new feature, Notes. But it lined up with something I’ve been thinking about for awhile: is Substack the next big social network?

I’ve had this draft half-written for a few months. It’s admittedly a bit crazy to even propose, and it’s definitely not how Substack describes itself. But a series of features and deliberate product choices over the years (and the fact Twitter recently started aggressively muting any mention of Substack in its feed) lead me to think it has a chance.

A Message From Matt Navarra’s Geekout Newsletter

🤓 The World's Most Useful Newsletter on Social Media

If you like how The Split weaves in and out of the latest in social media, you’ll probably love Matt Navarra’s Geekout Newsletter. He goes deep on everything happening, and over the years I’ve personally saved hundreds of hours from reading his Twitter and newsletter.

If you work in marketing or growth at a startup (or even a larger company), half the battle is just understanding how the game on the field is changing. Matt makes it easy. Once per week, he covers:

✨ New platform features

🤖 Algorithm changes

✅ Expert tips & tricks

🛠️ New tools

Join 26,321 other people and subscribe for free here. He also just launched a premium WhatsApp group with even more coverage that you can join here.

Substack: The Subscription Social Network

Society if everyone paid for at least one Substack subscription

Substack just announced a new feature, Notes. It seems small, as it’s essentially “tweets for Substack”. But it scared Twitter enough to suppress any mentions of Substack in outbound links. In my opinion, this continues Substack’s march towards becoming what most people would call a social network - and possibly something much bigger.

If you’re not familiar with Substack, it started in 2017 as the best tool for writing a blog. It had a simple editor that was easy to use, generated great SEO ranking out of the box, and placed heavy emphasis on email collection and the reader experience.

I’m probably getting the exact order of operations wrong, but Substack then enabled writers to paywall specific content (or maybe it started with this?), giving the tools to run a premium content business. Among many other features, it added things like podcasts and video support, cross-newsletter recommendations, and eventually a mobile app (and chat).

If you’ve followed the Creator Economy over the past three years, it became a graveyard of startups that never quite solved an urgent enough problem. Looking across the landscape of creator-focused products, the first tier (at least in terms of valuation) include YouTube, Instagram, and TikTok. These are each worth north of $100 billion, primarily because they help creators solve their most urgent problem: distribution. We can argue how well they actually solve this problem, but it does make these platforms almost impossible for creators to leave.

Next is the second tier of creator-related businesses, which typically help solve for monetization. This means they have a clear path to generating revenue, and includes companies like Patreon and Kajabi. While they enable creators to run a business, they don’t generally help grow them grow them, which is the most urgent problem for most content creators. If you only read a sentence or two about what Substack does, you’d probably think a tool for publishing a blog ends up in this second tier. But that would be incorrect.

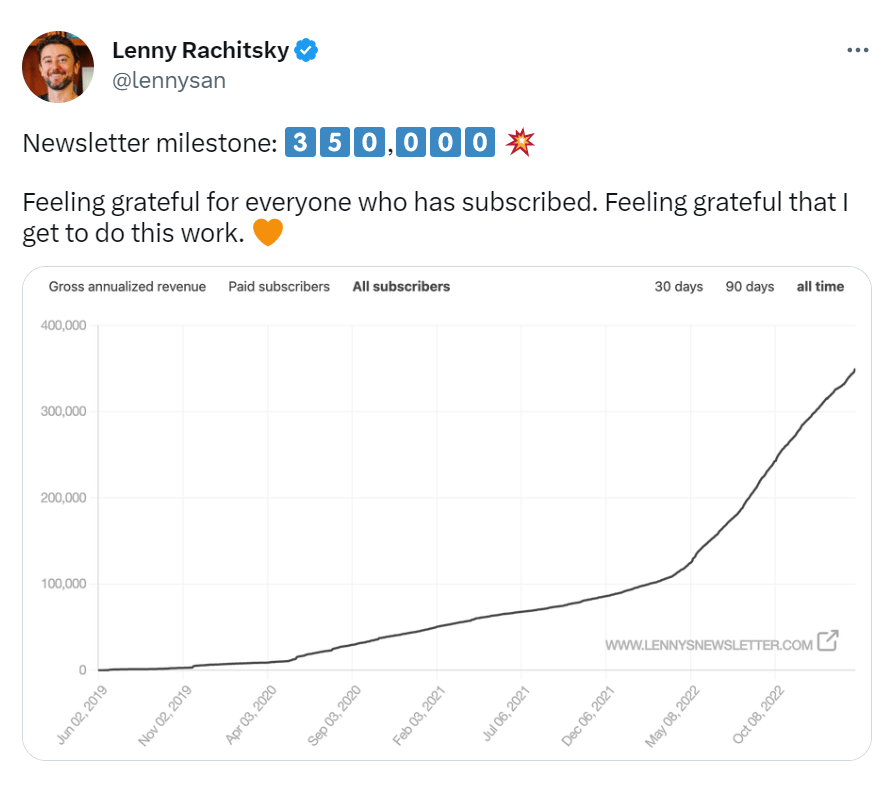

Substack started helping creators with distribution a few years ago. In its early days it had a public leaderboard featuring its top writers, “recommended for you” articles below each post, a feed featuring all of a reader’s subscriptions, and eventually a standalone mobile app. Substack supercharged its distribution when it launched recommendations in 2022. You can tell exactly when this happened based on Lenny’s newsletter growth below.

Lenny is a former startup founder and spent seven years in growth and product roles at Airbnb. Or in other words, the exact person you’d expect to be good at growing a newsletter. He was already growing steadily, and recommendations added rocket fuel.

The boost from recommendations is even more noticeable looking at Newcomer, run by former Bloomberg journalist Eric Newcomer. It’s probably not a stretch to say Substack recommendations changed his life.

When Subtack’s mobile app launched in March of 2022, it added another way to pull someone in. And its news feed gave even more leverage on distribution. Prior, the primary way a reader came to Substack was through an email or inbound traffic from SEO and Twitter. According to Similarweb, over 70% of Substack’s traffic is on mobile, and I’d expect the speed of app adoption to surprise us. An app might also increase mobile conversion rates to paid.

Substack’s new Notes feature isn’t going to immediately solve for distribution. It’s actually launching as a separate side tab outside of the main feed. But it introduces a new content format to Substack: short-form text. Just like short-form video, it breaks text-based content into smaller and more digestible bites. Short-form text gives another reason for readers to open the app, which benefits every publisher.

Over time, a stream of consistently good Notes could build the same habit that drives us to open Twitter, TikTok, Instagram, or any other app with short-form content. The key difference is Substack does not monetize with advertising, and instead generates revenue from writers building deep relationships with their readers. This means its not incentivized to continuously increase time spent on its product, which is exactly what ad-driven social networks are forced to do.

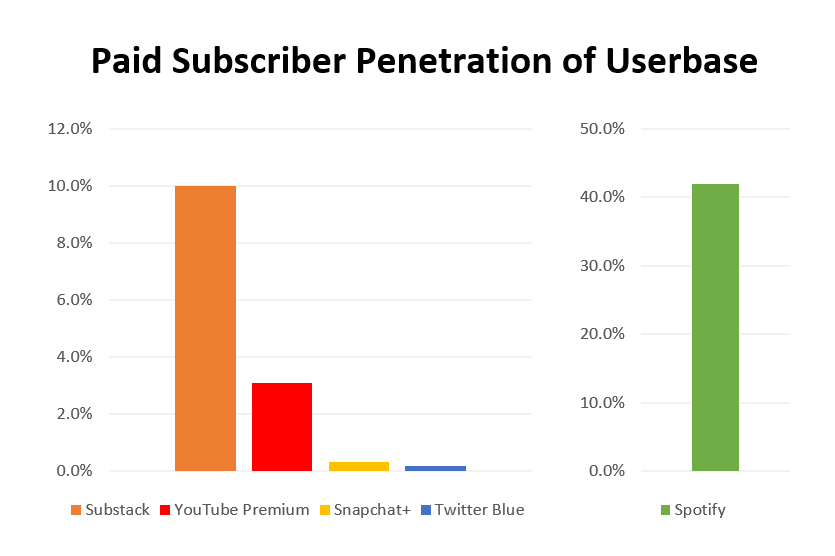

Compared to traditional social media platforms, Substack’s subscription network is showing early signs of success. I’ve written about the convergence of advertising and subscription revenue models. Although Substack is smaller overall, its 2 million paid subscriptions represent a much higher penetration of its total userbase than others. (I’m assuming 20 million monthly unique visitors and that each paid sub is unique, both of which are probably not exactly correct). I don’t have perfect data, but paid subscriptions appear to be 10-50x higher than Twitter.

Source: SEC filings and corporate blog posts

While Twitter charges $8/month per user, since Substack subscriptions support individual publications, it can charge $8/month per subscription per user. I don’t think its crazy to think someone might subscribe to 10+ Substacks, giving it a much clearer path to more revenue per user than other content platforms.

This also gives Substack network effects. For a reader subscribed to 10+ publications, there’s much less friction to add one additional subscription vs the very first one on Twitter (or Facebook, or Instagram, or Snapchat). And they’re less likely to churn. For writers, less friction for readers makes Substack the logical place to host a paid product. This could get even more pronounced as Substack adds more features like live streaming, paid coaching, ecommerce, and more.

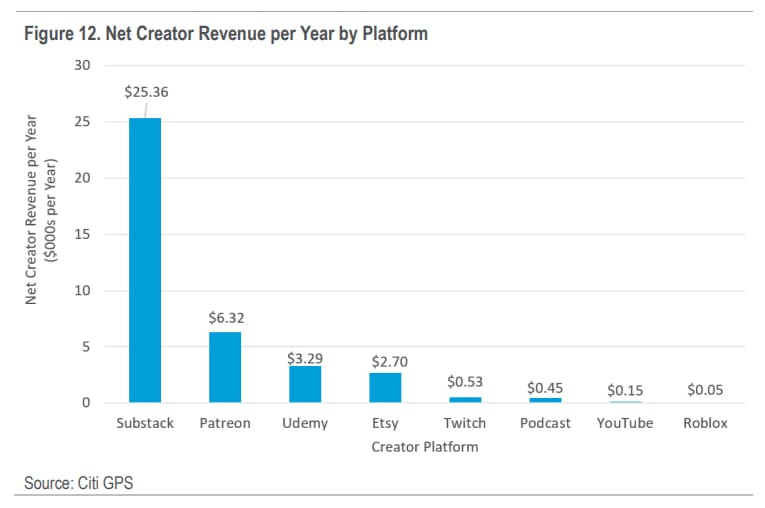

This high monetization means the average Substack writer makes nearly $25,000 per year, per Citi. That might not seem like a big number if you’re aware that some YouTubers make tens of millions per year. But high earners represent a very small % of the total (on an average of $150/year) and reflects that, despite being barely five years old, there’s a path for the long-tail of writers to earn a meaningful income on Substack.

So much so that when Substack had trouble raising a Series C from traditional growth stage investors in 2022, it’s $5 million round raised from its writer community was oversubscribed within 12 hours (more on the public raise here). The rationale from customers speak for itself:

“People sometimes ask me why I’m on Substack instead of a cheaper publishing platform. In the early days, my answer was because I could get Substack on the phone and get their advice. Even though that’s still true, my answer shifted to their recommendation feature once it started powering my free signups growth. But really, I’m on Substack because there’s a sense that there’s always a new feature on the way — that suddenly my business could get better because they had a great idea.”

To be clear, these growth investors are probably correct that Substack is overvalued if looking at its current financial metrics compared to similar companies. It technically had net revenue of negative $5.2 million in 2021 because it lost money on guaranteed minimum payments to writers (my understanding is it no longer does these guarantees ). Based on the implied $590 million post-money valuation of this public round, it’s priced at a 31x multiple on estimated 2022 gross revenue compared to 5-10x for companies like Snapchat, Twitter, Pinterest, Kajabi, and Patreon. But it’s hard to argue with how compelling its product is, as Substack is what every ad-based social network wants to become.

As another adjacent comparison within media, Netflix has 13,612 titles globally (5,087 in the US), which is actually down 35% from 2015. Substack hosts 17,000 writers with paid subscribers, a number that’s increasing exponentially. Expanding beyond writers to other types of creators like podcasters, videomakers, musicians, and scientists (!) means things could just be getting started for Substack.

In a time where public trust in incumbent social networks seems to be at an all-time low, Substack started as a simple tool and evolved into a new type of network. It’s social, but in it’s own way. Its business model is exactly what the incumbents wish they had. And as it continues shifting usage towards its mobile app and builds up even more of its own distribution, it can layer in other forms of media on top of its subscription network. Plus, it can always borrow elements from the incumbent’s advertising models when it makes sense.

Ultimately, Substack is building “an economic engine for culture” (their words, not mine). It’s a business in a box that gives content creators a direct relationship with their audience and customers. And if you take all the features it supports: text, video, audio, etc; it’s essentially social media where paid content is expected by default. Or as Substack likes to call it, a subscription network.

🧠 Would you work for an AI CEO?

Following up on our poll about the AI CEO that outperformed human CEO’s, we asked “would you work for an AI CEO?” The results were split 50 / 50.

Two notable responses:

“No, because I’d expect my role to be automated if the CEO's role is automated.” - Balaji Vijayan

“No, I just think it would be really weird. An AI doesn’t have feelings, it’s not human. And sometimes there are decisions to be made that need a real, functioning frontal lobe.” - Anonymous

🚀 Product Launches

Stripe Atlas Partners with AngelList Stack: When using AngelList to setup your startup, it now passes the actual incorporation process off to Atlas, Stripe’s dedicated product that automates the corporate entity formation and management process. Everything else remains the same - set up your bank account, fundraise, spend money, hire employees, and grant equity all on AngelList’s software.

Epic Launches Unreal Editor: This new change to Unreal Engine essentially makes every game built on its platform moddable. In other words, it brings Roblox capabilities to every game on Unreal Engine. Check out this demo of an anime-styled AI robot boss fight in Fortnite:

🔗 Links and Charts

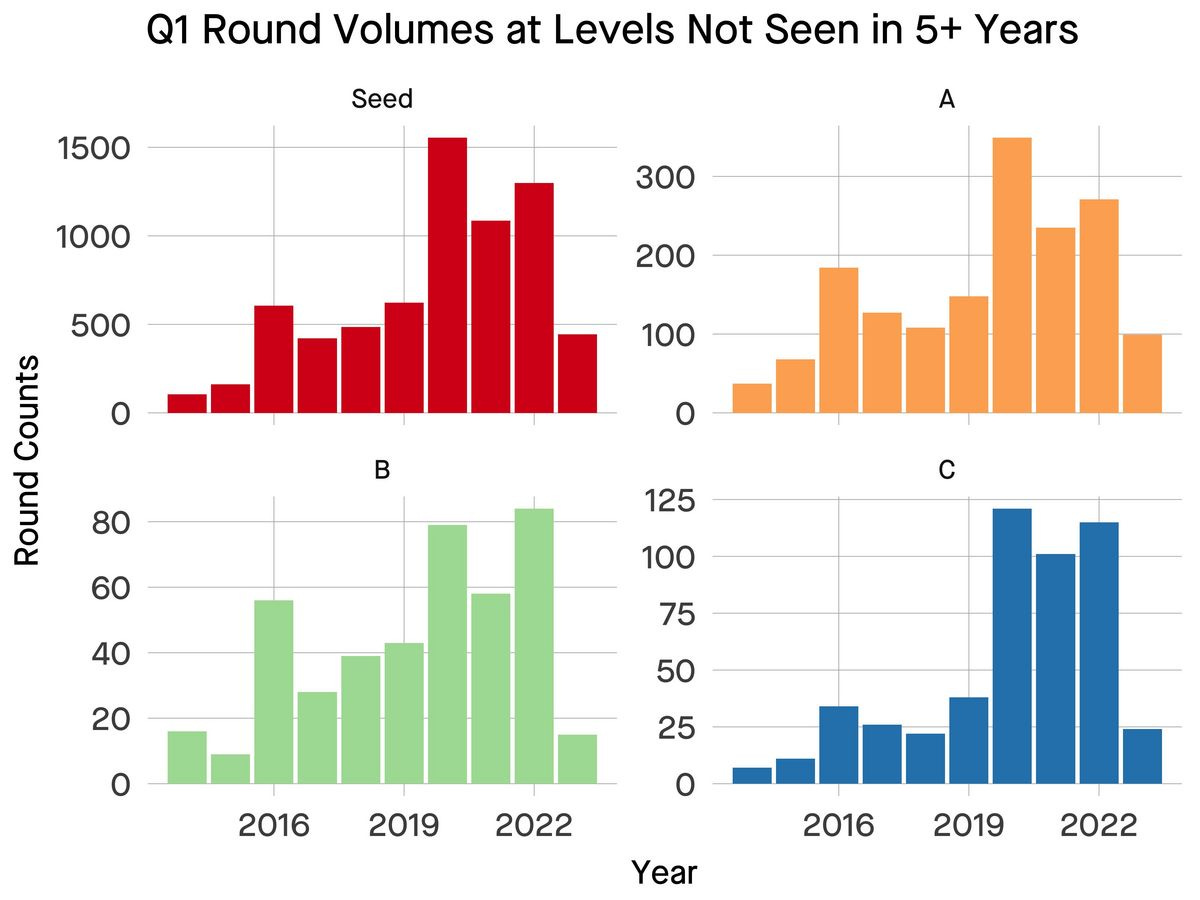

Q1 Round Volumes Down Almost 90%: Not news if you’re a regular reader, but another data point. The volume of Seed, Series A, B, and C rounds are down 64%, 68%, 86%, and 80% from highs in 2020.

This chart also highlights how, despite a slowdown in Seed and A’s, Series B’s and C’s remained elevated in 2022 (and B’s actually increased!). In my opinion, this was due to a rush of loose capital flooding into “venture capital exposure” within the growth equity markets.

This next chart highlights how low the Series A to B conversion rate is right now. Historically, it’s hovered around 30%, and it’s now dipped to all-time lows of 15%.

Important to note in all of this data is the lag between when rounds are priced and when they are closed and/or officially reported in public data sets.

Private market multiples lower than publics for first time in 10 years, per Morgan Stanley. This is still buoyed by SaaS multiples being higher in private markets, so likely a lot of other areas that might be more attractive.

Public High-Growth SaaS vs Series B and C Multiples: On that note, Logan Bartlett from Redpoint shared this chart comparing the fastest growing public and hottest private companies over the last 5 quarters: “‘hottest’ + most competitive deals (arbitrarily defined by us). The ones that everyone was competing to see or do.” Check the full (slightly redacted) report from their annual meeting here.

Startup Job Applicants Double From 2020 Peak: Internal data from recruiting software Dover shows a huge jump in Q1 job applications across its customer base (companies like Scale and Stripe). h/t Dover co-founder and CPO Anvisha Pai for sharing!

US Commercial Bank Deposits Down 5% From April 2022 Highs: This reverses what has essentially been a century-long run (furthest back this chart goes is 1973).

Zooming in on the past 28 months, the US has lost $362 billion since the beginning of March.

CapCut Catches TikTok in Monthly Downloads: Bytedance’s second largest product CapCut had more US downloads than TikTok over the past 4-5 months, per Sensor Tower. h/t Olivia Moore.

ByteDance Generated EBITDA of $25 Billion in 2022: EBITDA grew 79% in 2022 compared to revenue growth of only 30%. This $25 billion passes fellow Chinese tech giants Alibaba and Tencent for the first time ever, and continues to prove ByteDance is growing into a similar margin profile as Facebook.

US West Coast Home Prices Fall While East Coast Booms: Prices fell in all 12 major housing markets west of Texas (plus Austin), while the 37 east of Colorado (ex-Austin) saw gains.

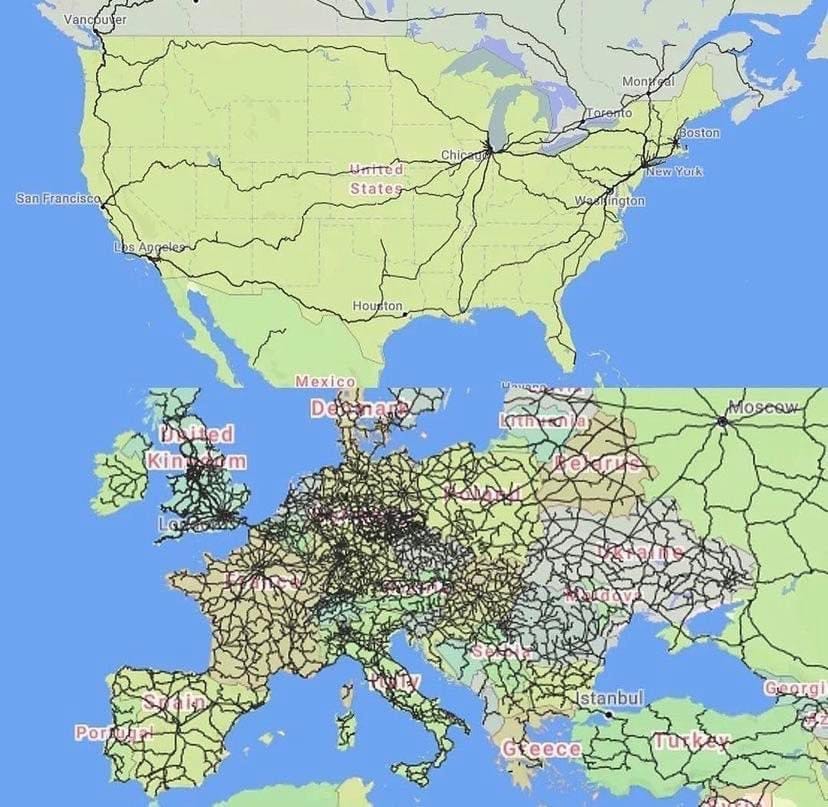

Stark contrast in passenger railways in North America and Europe. Wonder if more commuter rails on the West Coast would have supported housing prices? 😂 h/t Tom Harwood.

The US is Home to 2 Billion Parking Spots: Experts estimate there are 2 billion parking spots in the US, more than six for every registered car in the country. These parking spots take up as much land area as Connecticut and Vermont combined.

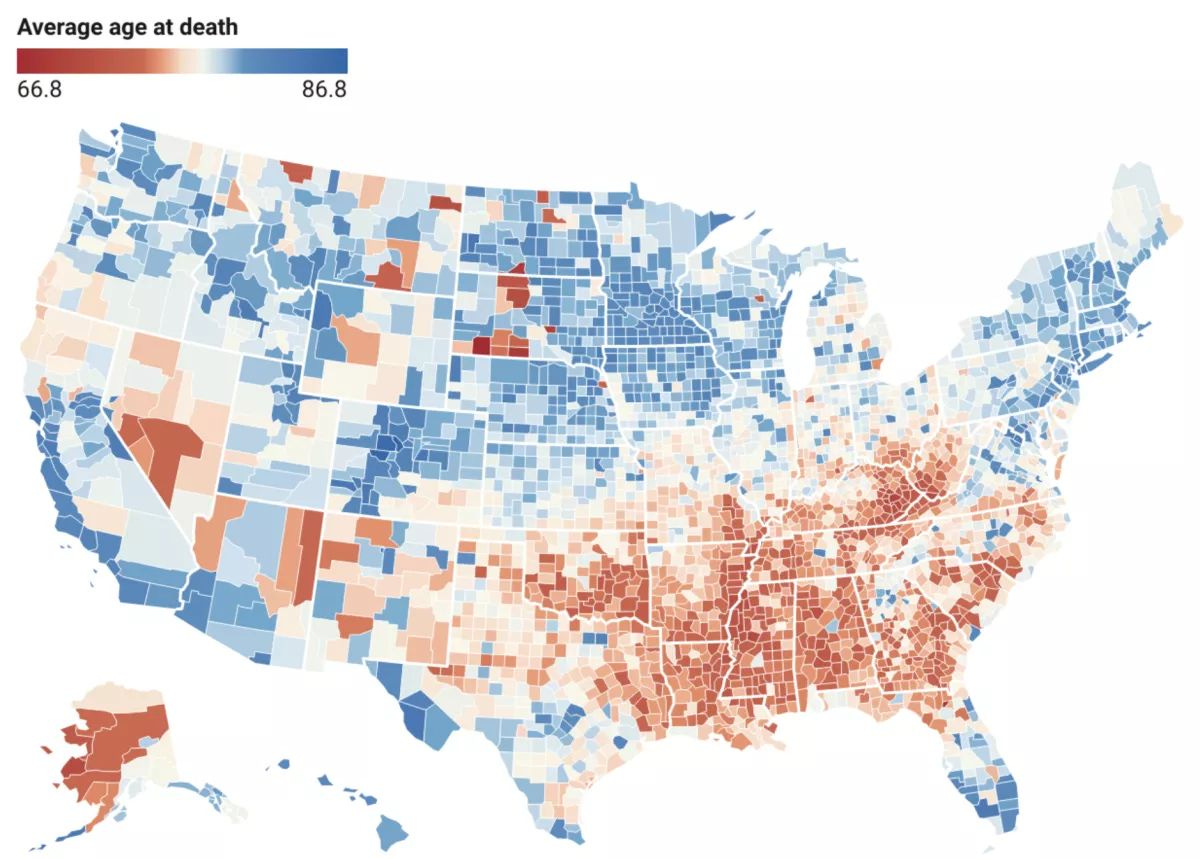

Average Life Expectancy Across the US: An eye-opening chart, the NYT article states: “Americans with the shortest life expectancies ‘tend to have the most poverty, face the most food insecurity, and have less or no access to healthcare’”. It goes on to suggest low life expectancy has a high correlation with states that have not implemented Medicaid expansion under the Affordable Care Act (which is 90% covered by the federal government), which leads to higher rates of uninsured residents and fewer healthcare facilities.

📚 Long Reads

Bet the Company Ideas: Good read from Byre at the Diff. At one pint in the mid-1960’s, IBM was spending roughly 0.6% of US GDP on its new System/360 line of computers.

The Case of Playrix and Why Product-Market Fit is a Moving Target: The story of mobile-game publisher Playrix. First, it ran “fake ads”, showing concepts that weren’t in its games to drive installs. After facing bans, it created mini-games within its games to continue running misleading ads that increased new app installs. Finally, it started molding its product based on the top performing ad creatives, incorporating elements from the best misleading ads into actual gameplay to drive even more installs.

This all ultimately drove down install costs, increased monetization, and improved margins. It’s a case study in how the paid-ad driven world of mobile gaming evolved post-Apple’s ATT changes. h/t Blake Robbins for sharing!

Venture Capital Red Flag Checklist: This isn’t actually that long. But a good reminder from Bill Gurley for founders and investors alike.

💼 Career Services

Banana Talent Drop #13 just went live yesterday. We sent 13 candidates from Instawork, Zuora, Qualcomm, and a long-tail of startups to 68 hiring managers.

The Banana Talent Collective now has 210+ candidates hailing from the companies below + more (if you're at a Banana portfolio company, reach out for access).

If you're hiring and want a feed of pre-vetted candidates, join the collective to get in front of potential hires that are both actively and passively thinking about their next role.

Two open roles worth highlighting:

Goals is hiring Engineers. I’ll share more on what Goals is up to in a few weeks. But in the meantime, its building the best football / soccer game from the ground up. Free to play, cross-platform, and multiplayer-first. The team comes from places like EA, King, Ubisoft, Disney, and Andreas the CEO was the founder of one of the very first professional esports teams, SK Gaming.

In-N-Out: is hiring an Alternative Investment Analyst for its family office in Irvine, CA. The role would manage its fund investments across its hedge fund and private equity, real estate, credit, and venture capital. It does not look like the role provides in-store credits or food vouchers.

🍌 Monkey Business

❤️ Reader Love

We’re getting hate mail now.

🍌 The Split is brought to you by the team at Banana Capital. We invest $250k to $750k in Pre-Seed and Seed rounds globally. Read more about what we're up to and the latest on our Fund 2 here.

🤝 Interested in a sponsor partnership with The Split? Inquire here.

A very enjoyable and thorough read. I sometimes wonder if we haven't incentives to be bullish on substack that biases us. We try our best to be brand ambassadors because we have skin in the game.

You know as well as I do the VC environment for growth. Startups has hit a wall and it's going to be pretty brutal for cash burning teams. Outside of costly substack pro deals that burn cash at a rate that's no longer sustainable, my amateur impression is that substack has no idea how to do sales or marketing or app marketing in particular. Substack has 17,000 paids creators likely 20k by now. But it's literally depending upon their reach to grow its own product.

Medium isn't even profitable with 40 times the daily content. Substack's only getting around 60 million visitors per month. In silicon valley terms, even if you generously give them 40 million active monthly users, That's not great for a 5-year startup that only takes 10% of revenue. How do we justify the valuation of the community around?