🍌 AngelList Thinks Your Venture Investments Probably Aren't Getting Marked Up

How early markups predict venture outcomes, plus Tucker Carlson goes direct while Twitter hires a new CEO, the loneliness epidemic, and Datadog's $65 million customer

Hi everyone 👋 Turner back again with The Split. Welcome to all new subscribers and the 20,000+ people tuning in every week!

AngelList just published a blog post on venture markups that I’ll dig in to below. Twitter’s also hiring a new CEO, which may hint at its future product roadmap. Secureframe just rolled out a new dashboard for managing all your compliance programs, Planet Fitness is letting your teen workout for free all summer, and Gergely at the Pragmatic Engineer dug into a viral tweet I had about Datadog’s mysterious $65 million crypto customer.

A Message From Axios

🥶 Venture Capital in a Cooldown

Funding rounds aren’t stopping, VCs are just getting more selective. In the midst of high inflation, rising interest rates and a global economic pullback, the Axios Pro newsroom is here to provide clarity.

Why it matters: Record amounts of dry powder were raised last year and they’re here to help you understand where it’s going, why it’s going there and what dealmakers are thinking.

Axios Pro reporters are true industry insiders, pairing decades of experience with contacts and connections that other outlets just don’t have.

They’ll give you the insights you need to better understand the current climate, and what to watch moving forward.

Download Axios’ free industry report on what this cooldown means for VC, PE, M&A and the future of your business.

Why Your Venture Investments Aren’t Getting Marked Up

AngelList also just published a report, this one on venture markups. It claims the more time that passes since the last investment, the less likely a startup will ever be marked up again. It’s fairly intuitive, but AL has a lot of data supporting it.

The pace at which AngelList has taken venture fund market share is insane. AL had more SEC filings than every other venture firm in 2021, and has had nearly 2x more in 2022 and 2023.

Based on AngelList’s latest quarterly figures, this graph shows the decreasing chance that a Seed or Series A investment will ever be marked up, given that it hasn’t already been marked up a certain number of months after it was made.

Series A investments that don’t get marked up within 18 months of closing are more likely to never be marked up again than to be ever marked up at all. This happens faster at Seed, with the chances of a future markup dropping below 50% after 12 months. According to AngelList, Pre-Seed has an even higher rate of failure than Seed, and the markups happen even slower.

For founders, the data shows that the longer since you’ve raised your last round, the less likely you’ll ever raise another one (at least at a higher valuation). And of course, markups aren’t everything. Some companies might get to cash flow break even or even get acquried at a huge premium. But generally, a markup (when a company raises at a higher valuation than the last round) reflects that some sort of progress has been made and owning a piece of the company’s equity is still desirable.

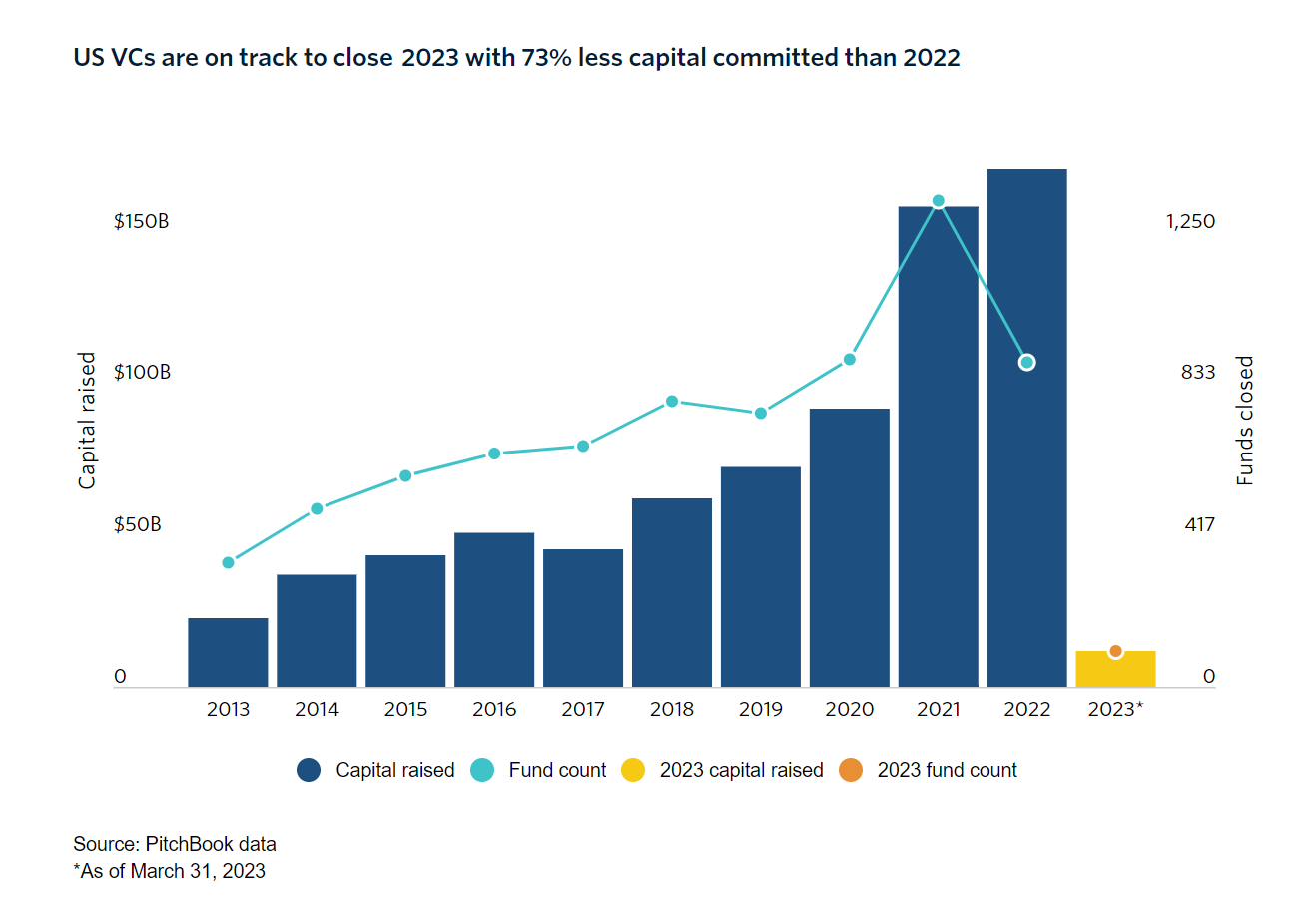

AngelList said that Q1 of 2023 had the lowest ever level of investment activity on its platform. And Pitchbook predicts US VCs are on track to raise 73% less capital in 2023 than in 2022. Its data is also lagged, with many of the announcements made in 2022 and 2023 not all being raised from LP’s during that specific year.

This massive drop-off in new capital being raised hints the amount of dollars flowing into early stage startups is set to drop back to 2015-2017 levels. And with very few financing rounds happening over the past 18 months, AL’s data suggests the majority of startups have less than a 50% chance of ever raising another round.

Of course, each startups fundraising situation is unique. And this historical data is based on a record decade of venture activity. But it hints that the probability of any startup raising a follow-on round or getting marked up will be even lower going forward.

🚀 Product Launches

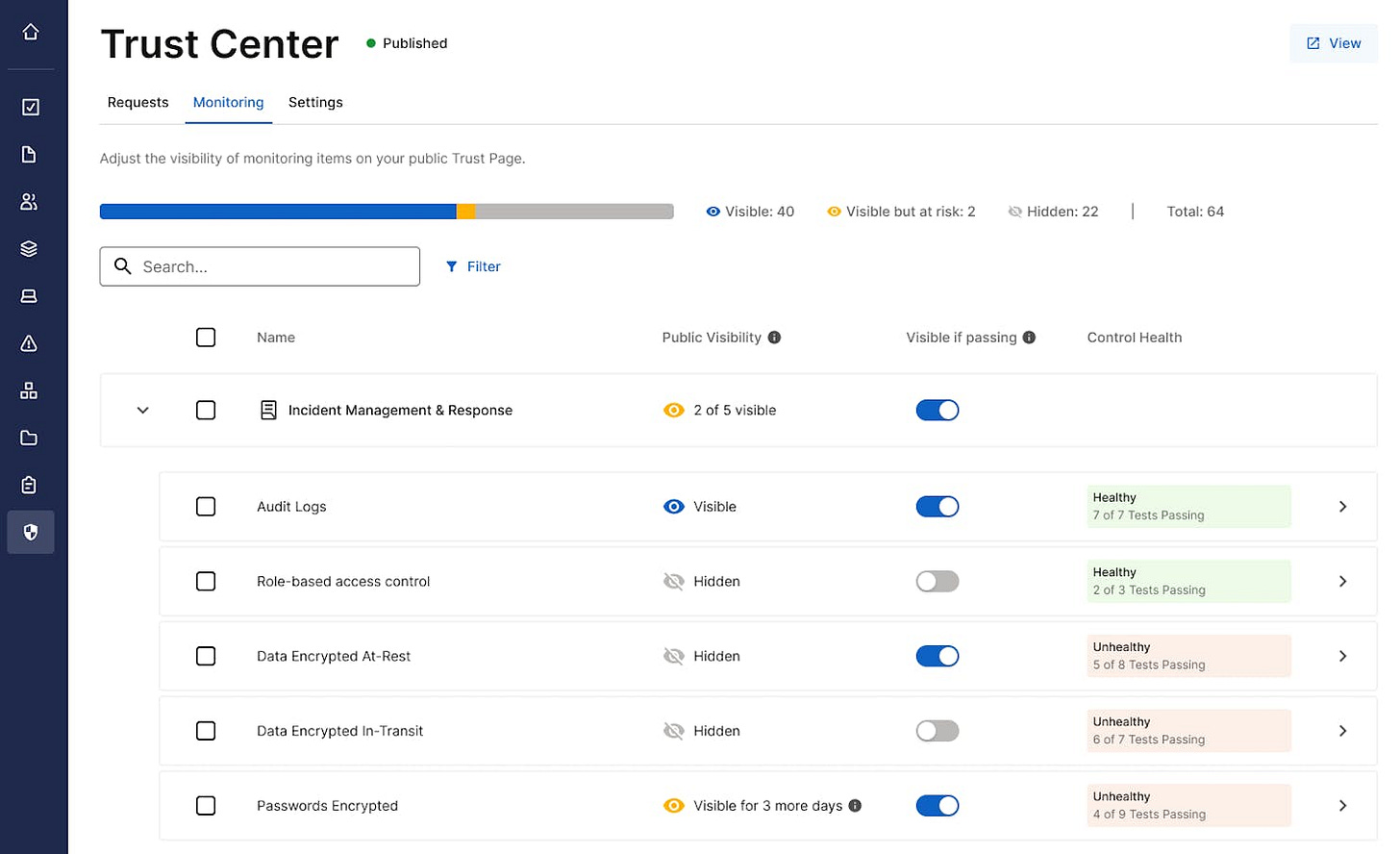

Secureframe Launches Trust: An extension of its compliance platform, Secureframe Trust gives a central source of truth for a company’s security status. It connects with all Secureframe’s other automated systems and questionnaires, and makes it even easier to share security details with existing and potential customers. Whether you’re getting compliance in SOC 2, ISO 27001, HIPAA, GDPR, or something else, it’s become the best way to automate and streamline your compliance practices.

Atom’s Collabs with YouTuber MKBHD on New Shoe: Marques (MKBHD) is arguably the most popular product reviewer on YouTube. And Atoms is a footwear brand popular for being very comfortable, coming in quarter sizes, and even allowing customers to buy a pair in two different sizes. Marques appears to have been very hands-on throughout the two-year design process, and he’s even teased them in prior videos.

I’m not sure if this is a one-off from Atoms or the first of many similar partnerships. Most creators shift from sponsorships deals to owning their own products over time as they grow in influence, but designing, manufacturing, and distributing physical products takes unique expertise that a company like Atoms has. And if done right, working with a creator like MKBHD elevates their brand across the board.

It could be a playbook for other brands and creators to borrow from. You can buy a pair here.

Superhuman AI: Email client Superhuman just released the ability to write messages in your own voice using AI. It can translate languages, expand on a few short lines, and summarize longer drafts. And based on what’s been teased, I’d assume more AI features are coming soon.

Tucker Carlson Goes Direct: Ex-Fox News political commentator and talk show host Tucker Carlson is using Twitter to go direct to his audience. Whether or not you agree with his platform on Fox News (I just learned he used to work at CNN and PBS), Tucker going direct is something to watch.

When Elon bought Twitter, I argued he should prioritize better monetization tools for creators. Twitter is the top of funnel for most of the internet, especially considering its where the media world (and newsletter writers) hang out all day. But it doesn’t capture much of that value. Instead of just treating Twitter as a top of funnel, content creators could start monetizing directly, which would probably be good for both them and Twitter.

Twitter has also changed its algorithm dramatically over the past year. It had been gradually shifting away from a follower model to something more interest-based like TikTok. That change accelerated since Elon acquired it, which made something at the center of a controversial topic like [whatever Tucker Carlson is doing after getting fired from Fox] get 126 million views, or more reach than the Super Bowl. Next, Twitter needs to help creators monetize that reach.

This also confirm my suspicions Twitter is focusing on video. Its reportedly hiring Linda Yaccarino, NBCUniversal’s head of advertising, as its new CEO. It begs the question, can Twitter build a better video monetization platform before Substack can become a social network?

💰 Free Stuff

Free Planet Fitness Membership for Teens: Starting May 15th, 14-19 year old’s can work out for free at Planet Fitness all summer. The only catch is they must download the Planet Fitness app.

🔗 News and Charts

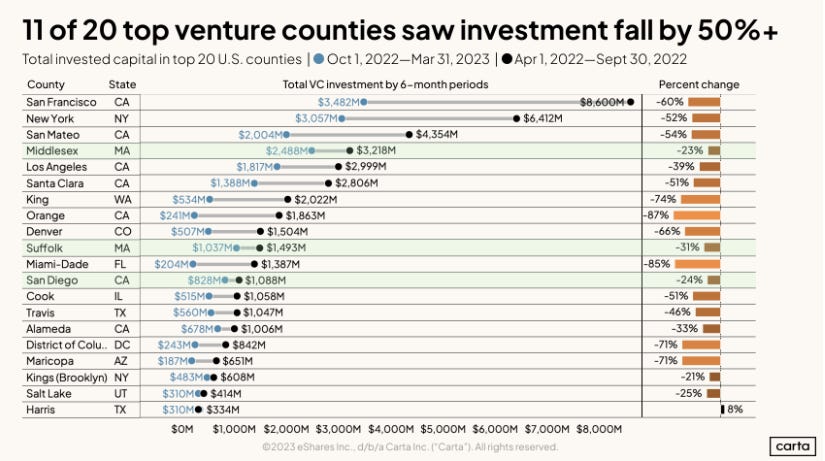

US Startup Funding by Geo: Someone needs to figure out what’s going on in Harris, Texas (which I just Googled and found out is Houston).

Consumer M&A Grinds to a Halt: Not that this is new to anyone paying attention, but M&A across consumer internet companies has been almost non-existent the past 18 months. 95% of transaction volume in 2022 came from the Twitter acquisition.

Looking at the data another way, small transactions that have historically made up nearly half of volume have been very scarce. h/t to Jefferies for this data.

AI’s Emergent Abilities Are a Mirage: A new research paper from Stanford claims Large Language Models will never “accidentally stumble” into Artificial General Intelligence. While they still may get there, it will be very clear and researchers will be able to react accordingly.

Viral TikTok Movie Clips: If you’ve been on TikTok much the past few months, you’ve probably noticed the rise of accounts that simply post 2-minute movie clips, sometimes in up to 20 separate parts. We know TikTok wants to get into longer-form content, and this is an interesting way it could be encouraging content creators to help it tease demand.

US Surgeon General’s Report on the Loneliness Epidemic: Research found that a lack of meaningful social connection has the same effect on a person’s health as smoking 15 cigarettes or consuming 6 alcoholic drinks daily. h/t Sahil Bloom.

Snoop Dogg Wants to Buy the Ottawa Senators: It would be the first black ownership group in the NHL. And part of Snoop’s proposal is to bring more concerts and events to the arena, which doesn’t host any other major league professional sports teams.

Mr. Beast Buys a Neighborhood: Remember creator hype houses? YouTube’s highest profile creator Mr. Beast is building a “hype neighborhood”. He’s reportedly bought an entire cul-de-sac to house members of his now 60-person team. Aside from housing helping to retain employees, the always-on nature of content creation likely benefits from always being close together. In a way, it’s just an evolution on the Company Town that has been popular throughout history.

The Modern Work Crisis: Interesting survey from Almanac of 1,500 American white collar workers, of which 47% were middle management or higher. Respondents report spending only 5% of work time actually working. It doesn’t clarify, but I’d assume this 5% reflects some sort of cut-off around 40 hours of allotted time per week, with excess beyond eight hours per day representing other “actual work” being completed. not reflected in the study.

The Streaming Wars Are Over: And Gaming is probably media’s next act.

Twitter is Freeing up Old Usernames: It’s not clear exactly how this will happen. But if you want weekly updates on any that you’re eyeing (or hourly for $9/month), check out Handle Horse.

GM Hires ex-Apple Exec to Lead Services Business: Mike Abbott was previously the VP of Engineering for Apple’s Cloud Services division. iCloud+ was Apple’s subscription service for extra cloud-based storage across devices.

📚 Long Reads

We Have No Moat, and Neither Does Open AI: This internal report from a Google employee went viral over the weekend. It claims that, while not as powerful, open source models are good enough for the majority of use cases. It proposes Google should immediately open third party integrations, re-think where it adds value, and focus on small models that can be iterated on much faster and cheaper. Most of this open source work is being built on top of Facebook / Meta’s leaked models, which ironically stands to benefit the most.

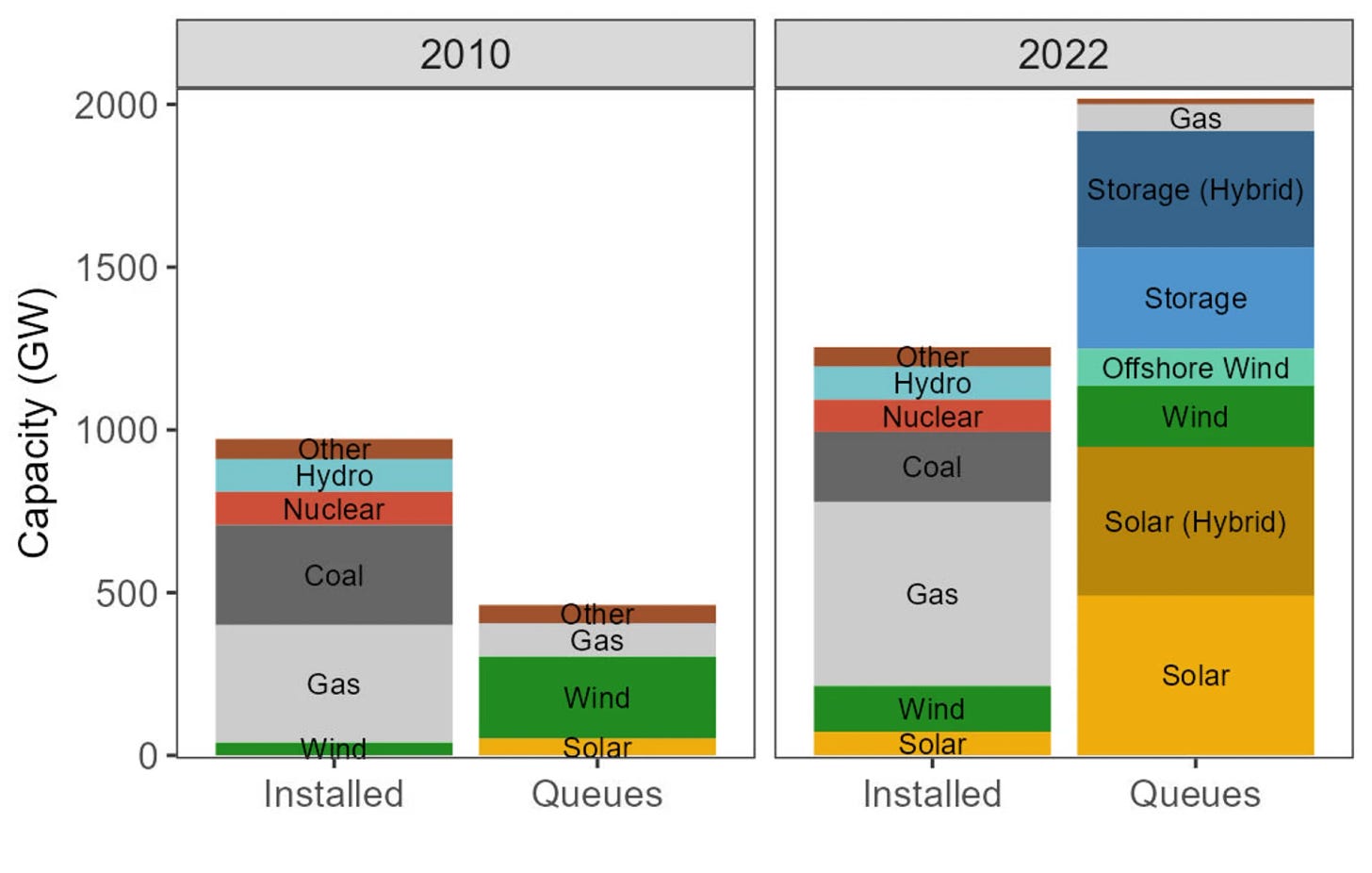

The US Power Grid’s Hidden Hurdles and Fees: This is a pretty wild look at how outdated and archaic utility infrastructure is in the US. There’s almost twice as much electricity capacity waiting to be connected to the grid than is actually live. That’s not good for the IRR’s of climate tech funds.

The Rise of BookTok: A deep dive into how TikTok has led to a resurgence in the sale of physical books. Authors whose books blew up on TikTok are seeing a 43% increase in sales over 2022. “Barnes & Noble is leaning so hard into BookTok right now because, simply put, BookTok sells books. It’s one of the only things that does.”

Datadog’s Mysterious $65 Million Customer: Last week I tweeted about Datadog’s Q1 earnings call casually mentioning a “crypto company” with a $65 million bill that had churned. I speculated this was Coinbase, and Gergely at the Pragmatic Engineer dug in with Coinbase’s engineering team to confirm it was. The story is unsurprisingly more nuanced than you’d expect.

Inside the Drug Use that Fueled Nazi Germany: “Notes show Hitler was injected [almost daily] with various drugs, including amphetamines, barbiturates and opiates… Ohler concluded that at the time of his suicide, Hitler was likely suffering withdrawals as his doctor’s struggled finding drugs in the devastated city.”

How Raising Cane’s Built a Chicken Finger Empire: If you’re familiar with how Chick-fil-A built one of the most profitable restaurants of all-time around chicken sandwiches, Raising Canes has done something very similar with chicken tenders. Founded in 1996, individual stores average nearly $5 million in annual revenue.

And not surprisingly, when founder Todd Graves’ pitched the initial business plan as a college assignment, he got the lowest grade in the class.

Is Los Angeles Underrated?: Despite humans generally preferring warm weather, people who endure cold winters for part of the years experience a euphoria in the summers that inhabitants of warm-only climates do not.

What Does Vercel Do?: If you’ve heard people talk about Vercel but don’t know what it does, this is a great overview from Justin at Technically.

🔊 Video

How to Run a User Interview with Emmett Shear, co-founder of Twitch: This was a great 46 minute interactive presentation.

💼 Career Services

The Banana Talent Collective is dropping another batch of candidates on Monday!

The collective is free to join and gets you in front of 70+ companies actively hiring. Your profile can be either public or anonymous, and you’ll join nearly 230 folks with experience at Microsoft, Github, Tesla, Stripe, LinkedIn, Uber, Twitch, and a host of other companies across nearly every startup job function.

If you're hiring and want a feed of high quality pre-vetted candidates, join the collective to get in front of potential hires that are both actively searching for and passively considering their next role.

Turner, here is the linked to John Stewart eviscerating Tucker and his co-host on CNN's Crossfire. The show was cancelled soon after.

https://youtu.be/aFQFB5YpDZE