2023 Reader Prediction Submissions

Plus ChatGPT's new API, data on 2022 venture rounds, and just how common is corporate securities fraud

Thanks for reading The Split! It's Turner, back again, with a short and sweet piece: I want to know what you think will happen in 2023. I'll highlight the best responses next Tuesday.

I'll explain more below, and keep reading for details on OpenAI's ChatGPT API, data on 2022 venture round sizes, a chart showing the per store sales of your favorite fast food chains, and a wild research paper estimating 10% of large publicly traded companies are committing some form of securities fraud. 🤯

For anyone building or selling software, a quick message from Banana portfolio company Secureframe:

⚡ Close Deals Faster with Secureframe 🔐

Secureframe helps companies achieve fast SOC 2, ISO 27001, PCI, HIPAA, NIST, GDPR and CCPA compliance. With their guided workflows and one-click integrations, Secureframe automates the compliance process so you can focus on your customers, closing deals, and growing revenue.

Secureframe helps organizations respond to RFPs and security questionnaires quickly with AI (and they've been doing it long before AI was cool). Get compliant in weeks, not months. Thousands of companies like Ramp, AngelList, Fabric, Doodle, Dooly, Lob, Slab, and Stream trust Secureframe for automated security and privacy compliance.

Click here to chat with the team. Mention “The Split” during your demo to get 20% off your first year of Secureframe. (Promotion available through January 31st, 2023)

🔮 2023 Reader Predictions

As I mentioned earlier, I want to know what you think will happen this year. The odds are that anyone reading this is 100x more knowledgeable than me on at least one topic (probably more than one), and I want to get on your level.

I know these "next year predictions" posts are cooler to read in December, but I'm doing it in January anyways. I might even do a recap a year from now to see where we all landed...

Will a specific company or individual have a breakout 2023? Is there a product or market no one knows about yet that will be a household name? Anything is up for grabs, but responses I think other readers will be interested in are admittedly more likely to show up in next week's email.

Predictions can be related to something I've previously mentioned in The Split, but I'd actually prefer completely new topics you think will blow my mind. Even better if you or someone else has already published something on the topic I can include for everyone to go deeper on.

It's also OK if predictions aren't confined to just 2023. Any trends or rising stars worth paying attention to over the next few years are fair game. If you put something on our radar that doesn't happen until 2024 or 2025, I'll give proper credit when and where it's due.

(I'm trying out Beehiiv's new Form feature - let me know if you have issues. The text box is a little small and I can't make it bigger. Feel free to just reply to my email if that's easier. And in case the button above doesn't work, click here to share your prediction.)

I'm not including any of my own, so please contribute so this doesn't flop. 🙈🙈😂😅😅

I'll give everyone a few days before sorting through the responses over the weekend. Be on the lookout for a post highlighting the most interesting ones next Tuesday!

🚀 Product Launches

Waitlist for OpenAI's ChatGPT API goes live: Not to be confused with the broader OpenAI API that is already available, I feel confident saying we'll see very cool products built on top of this.

I think startups starting from scratch competing against anything with built-in distribution advantages (Google, Microsoft, Apple, Facebook and startups like Notion, Canva, or Figma) will have to work very hard to navigate those disadvantages. But I think there's a lot of open space to build for customers where AI differentiates both the product AND the go-to-market strategy.

🔗 Links and Charts

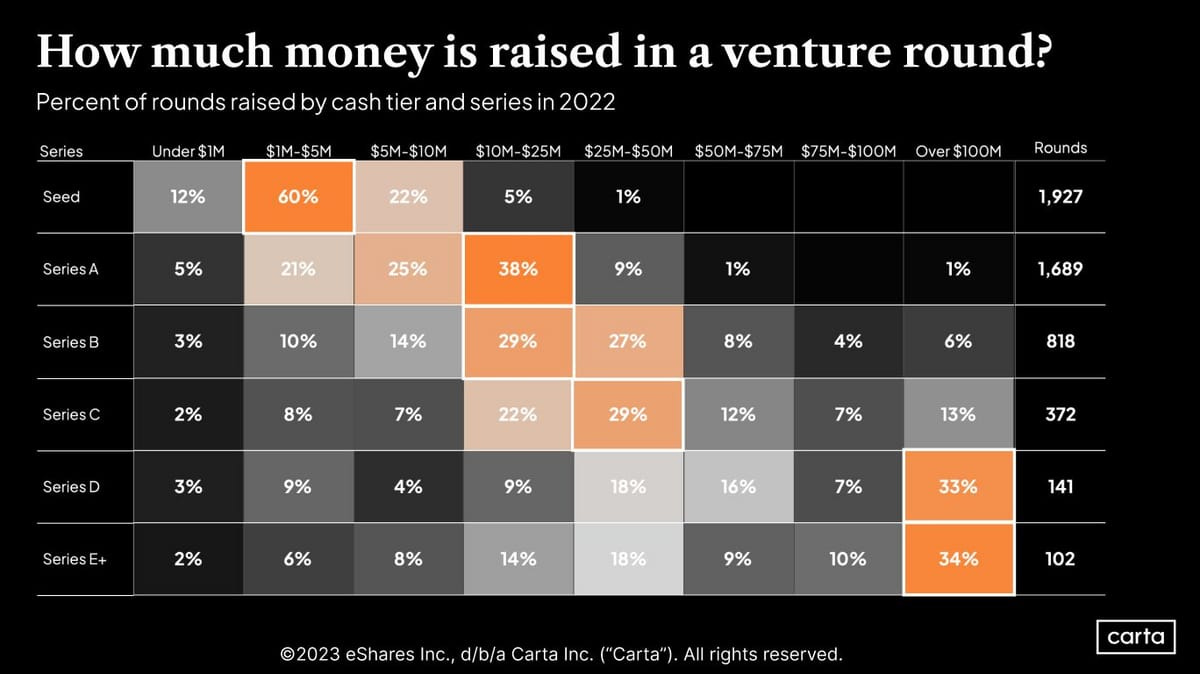

Average sizes of venture rounds in 2022: Carta has been putting out great data on the venture market recently. This chart is one I didn't know I wanted, but found fascinating nonetheless.

I might be stretching in how I'm interpreting this, but it looks like the average Series B round size was particularly close to the average Series C in 2022 (at least closer than I would have expected). There were also ~25 Series B rounds under $1 million last year! You can also see how small some of these D's and E's got last year. I definitely saw a few "raised $50m at $1.2 billion" type of rounds, showing how much leverage founders had last year.

Twitter's feed now defaults to a For You Page, just like TikTok: Previously, you could set this to a reverse-chronological that held up between app opens. Now, while you can still easily swipe between the two, it always defaults to algorithmic by default. Twitter has also recently rolled out a "swipe up for more videos" feature within its video player, which mimics TikTok. It's actually even more similar to Reels, which doesn't go full-screen video by default, but instead jumps into that experience when tapping a video in the feed.

Going all-in on an algorithmic feed will probably annoy a lot of people (they'll get over it), but also opens an opportunity for creators trying to grow on the platform. Twitter just has to figure out what it wants to incentivize - images? threads? video? it's planned in-house newsletter product? - and prioritize that in the algorithm.

Are NFTs coming back? Two things appear to be true: NFT projects launching on Instagram are selling out in seconds and the new Game of Thrones NFTs, which sold out in seven hours, are the "worst thing I've ever seen".

This one from the GoT collection looks like an NPC from Skyrim with a pair of those AI-generated DALL-E hands:

According to this Dune Analytics dashboard from @hildobby (below), while NFT volumes are down horrendously over the past year, the number of unique NFT traders has hasn't fallen by nearly as much. The total number of trades appears to be roughly flat over the past 18 months. And the wash trading that plagued NFTs throughout last year's bubble also appears to be fading, as roughly 85% of trades in January were organic according to this data set.

I think NFTs are an interesting concept, but I still struggle identifying what problems they solve outside of entertainment (gambling), or how they save time or money for a brand or consumer. ¯\_(ツ)_/¯ Now that the hype has faded, I wouldn't be surprised if some real utilities start to emerge.

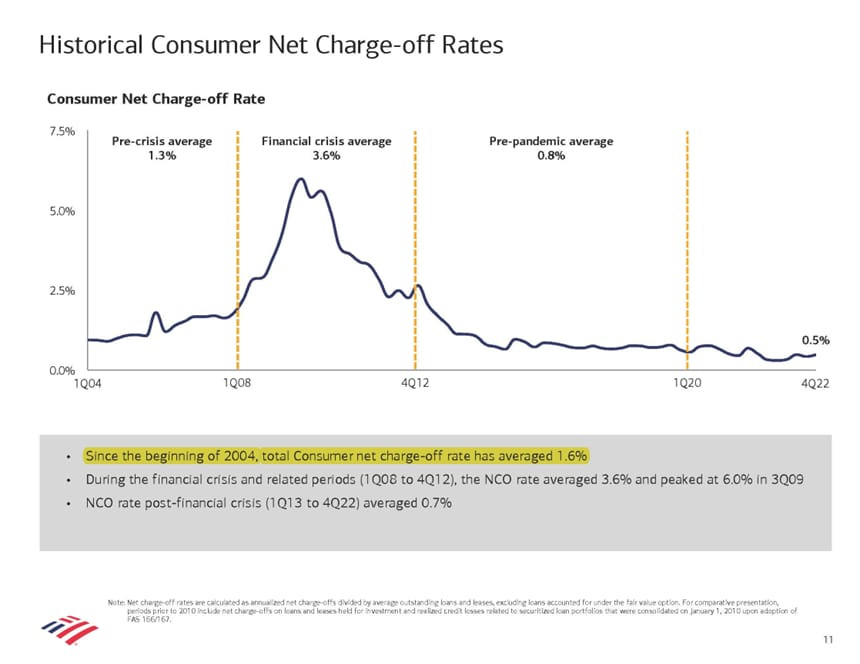

Consumer credit charge-offs (defaults) are still near all-time lows: Per Bank of America's Q4 earnings, this number is hovering around 0.5% compared to an average of 1.6% since 2004. If we're truly entering (or in) a deep recession, this number should probably be higher. h/t @wabuffo

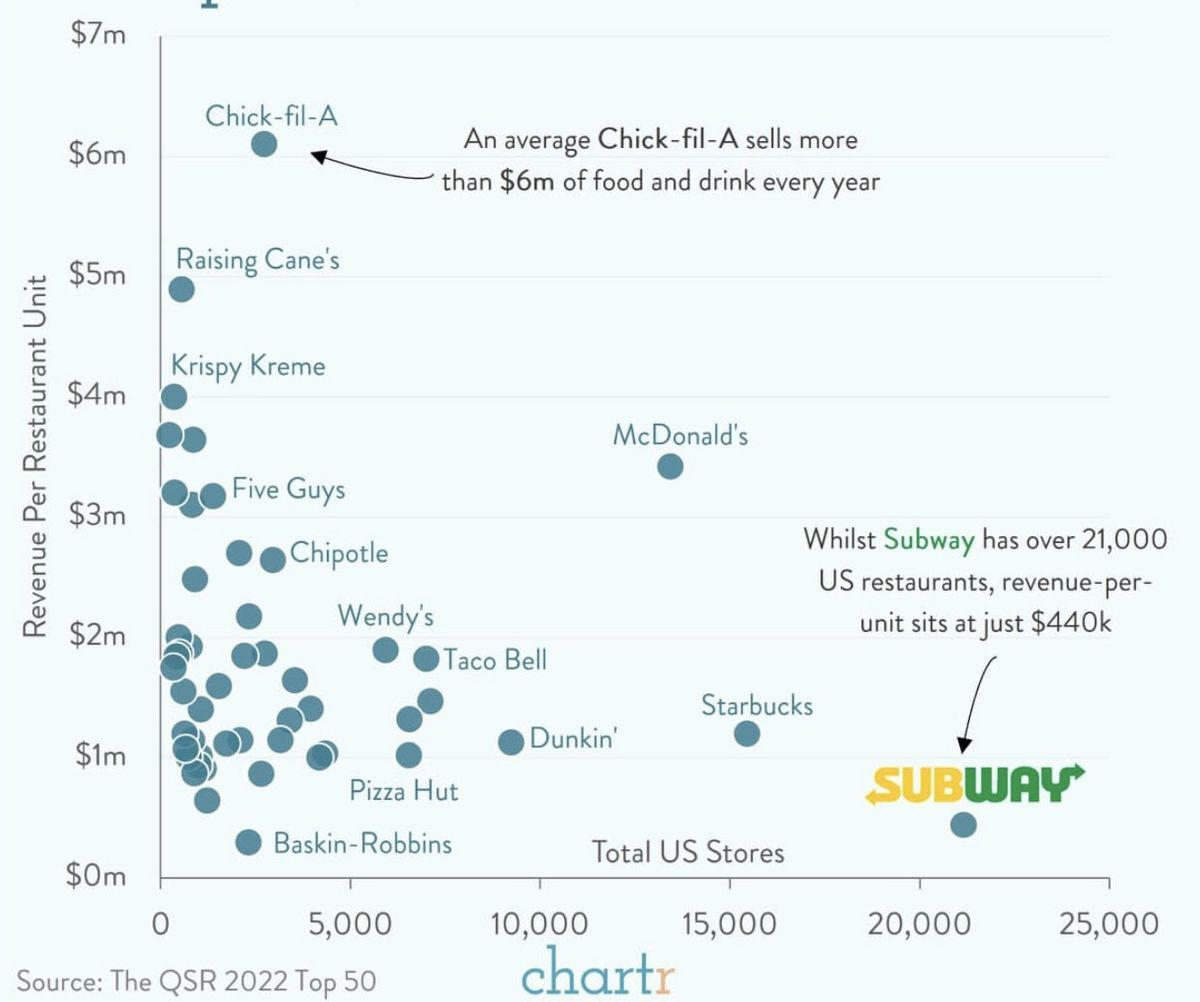

Fast food store count and average revenue per store 🍔🍟: I knew where Chick-fil-A would sit (even more impressive that its closed on Sunday's), but I didn't realize Subway stores were so small. Of all of these, Krispy Kreme's $4 million in revenue per store surprised me the most.

The growing gap between battery and plug-in electric vehicles: h/t Nick at Keep Cool

📚 Long Reads

The BNPL Bubble Is About to Burst: Total "Buy Now Pay Later" loans originated in the US grew from $2 billion to $24.2 billion between 2019 and 2021, more than 10x. The most surprising part? While Gen Z has a negative connotation of credit cards, they appear to make no moral distinction between BNPL and debit, perceiving them as identical products. h/t Casey Lewis for sharing this in After School.

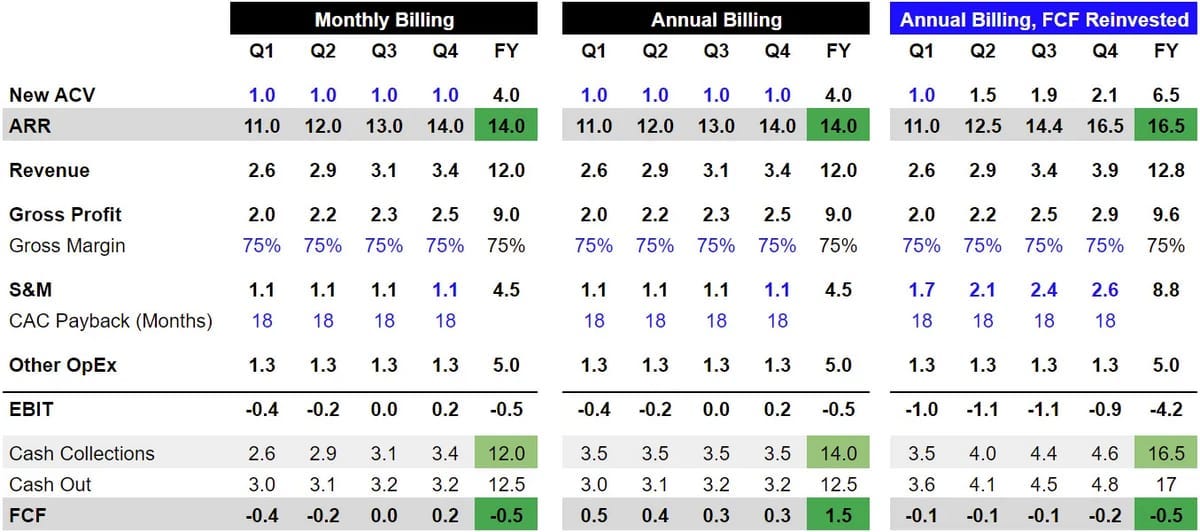

Not All CAC Payback is Created Equal: Great post on how billing customers annually + reinvesting in growth can lead to more ARR / cash flow vs monthly billing in one year alone. There's much more nuance to this, including how it impacts churn, but the math (below) is surprising.

How pervasive is corporate fraud? According to this study, the authors estimate an average of 10% of large publicly traded firms are committing securities fraud every year. This is much higher than I would have guessed. They estimate it destroys 1.6% of equity value each year, equal to $830 billion in 2021.

"Ask an LP" with Beezer from Sapphire Partners: For my fellow emerging venture fund managers, some tactical advice from the other side of the table.

🔊 Podcasts

Creating Magic For Consumers: I really enjoyed this conversation between my friend John and Patrick OShaughnessy. I've been in a group chat with John for a few years now and had no idea he was this smart 😂 He shares everything he's learned on product positioning and brand building from bootstrapping four consumer brands, plus what he learned working for Justin Bieber. John gave us a lot of takeaways, even if you're not directly building products for consumers.

💼 Career Services

We just did Banana Talent Drop #9! The Talent Collective now has almost 200 candidates and just under 50 companies hiring. If you're at a Banana portfolio company, reach out any time for free access.

If you're starting to explore a new role or hiring and want a steady stream of pre-vetted candidates, get started here.

Two other roles on my radar:

Sibill is hiring a Go To Market intern: The only Banana portfolio company based in Italy, this is a unique opportunity working directly with the CEO and Head of Sales helping Italian SMBs solve their cash flow pain points. Candidates must be able to speak Italian as this role will be in the trenches selling software to locals.

Precursor Ventures is hiring MBA interns: There are very few pre-seed funds that offer MBA internships, and working with Charles at Precursor is arguably the best one out there. Application deadline is Weds, Jan 18th at 11:59pm PT.

🍌 Monkey Business

Ask...

And the internet will deliver:

✍️ Reader Reviews

🍌 The Split is brought to you by the team at Banana Capital. Read more about what we're up to and the latest on our Fund 2 here.

🤝 Interested in a sponsor partnership with The Split? Inquire here.